🧐The Inevitable Path for Bitcoin to Reach One Million Per Coin|The Next Bull Market is Not Just a Price Bull Market, but a Structural Revaluation——

I have been repeatedly pondering what the biggest opportunity for Bitcoin in the next round will be:

Currently, Bitcoin has made a significant mark in history:

The U.S. recognition of Bitcoin's spot ETF,

Acceptance by mainstream assets and listed companies,

The construction of faith and the global spread of awareness,

The reserve construction of sovereign funds and century-old funds,

Walking on the path of U.S. national reserves;

Where will the next round be?

At a moment of structural change in global asset re-anchoring, can Bitcoin turn into a truly global high beta, borderless asset?

Is it possible to become an asset that is unaffected by tariffs, not reliant on geopolitics, and can capture marginal changes in global risk appetite!?

Before that, Bitcoin needs to decouple from U.S. stocks and even detach from the dollar peg;

But can Bitcoin really decouple from U.S. stocks?

This is something I have been thinking about recently.

I happened to see @fejau_inc's post:

https://x.com/fejau_inc/status/1912576594083971147

There are several interesting points in it:

Once the global deleveraging process stabilizes, Bitcoin will become the best trading opportunity: not only because it has global liquidity exposure, but also because it no longer needs to be tied to the "chariot" of U.S. stocks.

This may be the first time since Bitcoin's inception that it encounters a structural change in the global liquidity-dominated pattern.

If you understand this, you will know:

The real big opportunity is approaching.

🧵Here is my analysis:

1/

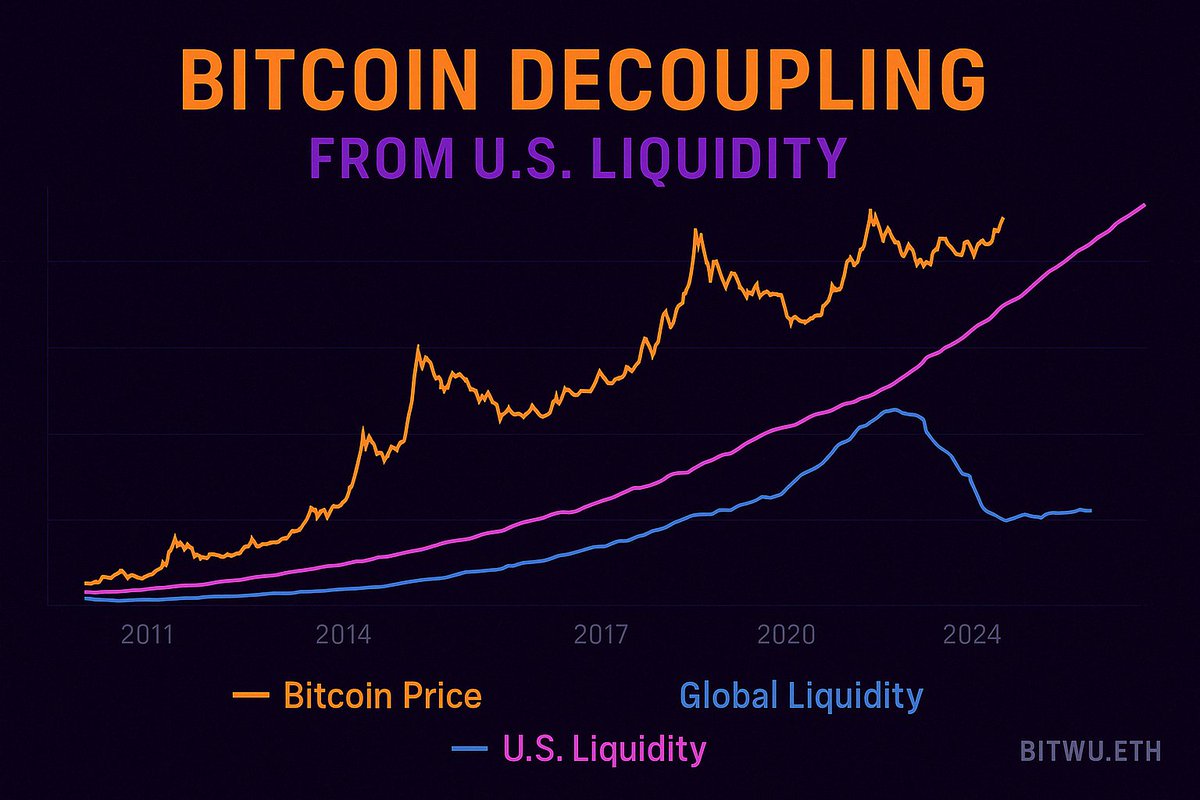

Many people tie Bitcoin's price movements to U.S. stocks, but this is actually a statistical "false correlation."

Bitcoin ≠ U.S. stocks.

The apparent correlation is because both are driven by "global liquidity." The true core variable has always been global liquidity.

2/

Michael Howell has verified through Granger causality tests:

Global liquidity → Bitcoin price

Not:

U.S. stocks → Bitcoin price

It's like when the sea level rises, all boats will float. Bitcoin and U.S. stocks just happen to be on the same boat.

3/

In the past decade, the U.S. has dominated global liquidity because it has the largest fiscal deficit.

This has made dollar assets (U.S. stocks, tech stocks) the preferred choice for global funds, even pushing up Bitcoin.

But now, this pattern is changing.

4/

What Trump aims to do is simple yet profound:

Narrow the trade deficit

Promote a weaker dollar

Force other countries to expand their fiscal policies

Compel global capital to "de-dollarize"

This signifies an important shift:

Global liquidity will transition from "U.S. dominated" → "multi-centered driven"

5/

Once this switch occurs, funds will withdraw from U.S. Treasuries and U.S. stocks, flowing into other countries.

In this process of de-dollarization + deleveraging, gold has already begun to take off.

But a more agile, more "borderless" asset—Bitcoin—has not truly started yet.

6/

Bitcoin cannot be taxed, has no borders, and does not need to worry about which country's central bank is implementing policies.

It is a purely global asset and a configuration tool born for the next phase of liquidity reconstruction.

Gold is the currency of the past,

Bitcoin is the future anchor of liquidity.

7/

Currently, Bitcoin's correlation with gold is increasing, while its correlation with U.S. stocks is about to break.

This market trend could become the first battle for BTC to decouple from U.S. stocks.

And when this decoupling is recognized by the market, it will mark the beginning of its acceleration.

8/

So what I am focusing on now is not "price," but structural opportunities.

Once the dust settles on global deleveraging, Bitcoin will be the first to start running and accelerating.

This is one of the biggest asymmetric trading opportunities I see.

Conclusion——

Can Bitcoin really decouple from U.S. stocks?

I believe—the direction is correct, but the path will not be simple, and the time will not be short.

However, it is the biggest opportunity of the next decade and the inevitable path for Bitcoin to reach one million per coin;

This is more like a structural evolution rather than a short-term trading logic.

But to achieve true decoupling of BTC, there are two prerequisites:

① The dominance of global liquidity shifts from the U.S. to a multi-centered distribution

→ More funding sources will no longer rely on dollar printing but will come from China, India, the Middle East, and even Web3 natives.

② BTC transforms from a speculative asset to a configuration asset

→ When sovereign wealth funds, pension funds, and multinational corporations treat BTC as "digital gold," it will have the intrinsic support of independent liquidity.

So, I believe this trend will happen, but it will not be linear.

The future of Bitcoin is not "de-tech stock," but "globalization."

It does not belong to the U.S. or any single country;

It is the only neutral high beta asset in the next generation of capital structure.

And this structural repricing is the real big opportunity worth waiting for.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。