Author: Lawrence

In April 2025, the price of Bitcoin fluctuated between $83,000 and $85,200, failing to break through the key resistance level of $86,000. This price movement is closely related to subtle changes in macroeconomic data.

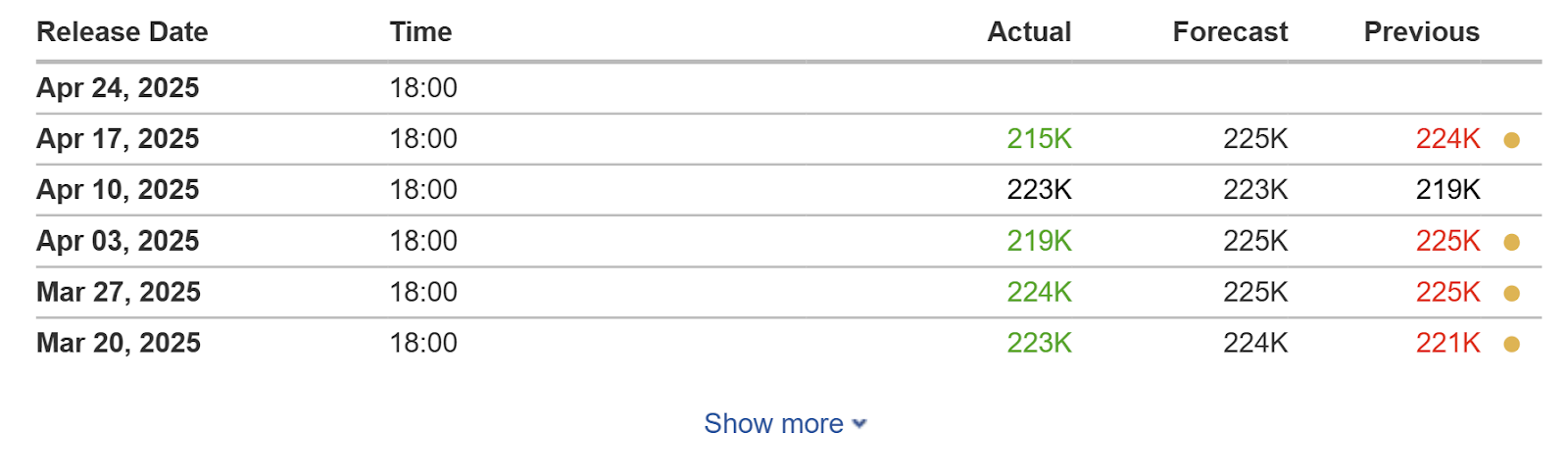

Data on initial unemployment claims in the United States.

On April 17, the U.S. Department of Labor reported that the number of initial unemployment claims was 215,000, lower than the market expectation of 225,000, indicating that the labor market remains resilient. This data is seen as an important signal of the stability of the U.S. economy, but it also reduced market expectations for a rate cut by the Federal Reserve, thereby suppressing short-term speculative sentiment in risk assets.

Federal Reserve Chairman Jerome Powell emphasized in a speech on April 16 that the recent "reciprocal tariff" policy implemented by the U.S. has exceeded expectations, potentially leading to dual pressures of rising inflation and slowing economic growth.

Meanwhile, Trump mentioned at a press conference: "I think he (Powell) is terrible, but I can't complain," pointing out that the economy during his first term was very strong. Trump continued to criticize Powell, claiming he believes the Fed chairman is "playing politics" and stated that Powell is "someone I have never really liked."

Trump then stated: I believe Powell will cut rates sooner or later; the only thing Powell is good at is cutting rates.

Although the Federal Reserve has made it clear that it will not intervene in the market or implement rate cuts, the European Central Bank has already taken the lead in lowering interest rates from 2.50% to 2.25%, a new low since the end of 2022, in an attempt to mitigate the impact of tariff policies on the economy. This divergence in global monetary policy has further exacerbated market uncertainty, prompting investors to reassess the safe-haven properties of assets like Bitcoin.

From a technical perspective, Bitcoin is at a critical "turning point." An anonymous trader, Titan of Crypto, pointed out that the BTC price is continuously contracting within a triangular formation, with the RSI indicator above 50 and attempting to break through resistance, suggesting that a directional breakout is imminent. Order flow analyst Magus believes that if Bitcoin cannot break through $85,000 soon, the long-term chart may turn bearish. The battle for this price range is not only about the short-term trend but may also determine whether Bitcoin can continue the bullish pattern that has persisted since 2024.

Historical Correlation: The Lagging Effect of Bitcoin After Gold Reaches New Highs

On April 17, the price of gold soared to a historic high of $3,357 per ounce, triggering widespread attention in the market regarding Bitcoin's subsequent movements.

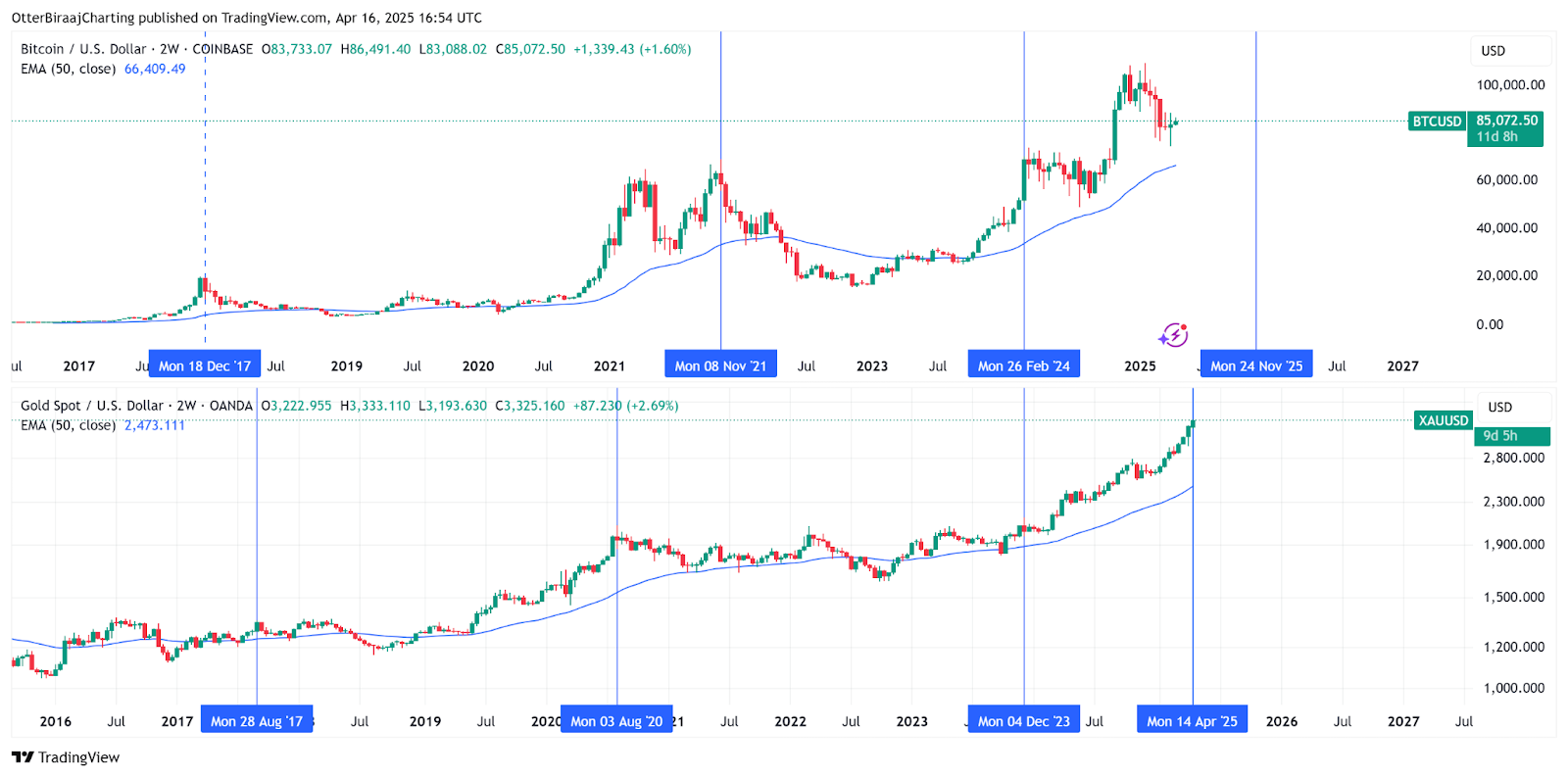

A historical comparison of Bitcoin and gold's price movements.

Historical data shows a significant lagging correlation between gold and Bitcoin: whenever gold reaches a new high, Bitcoin typically follows suit and breaks its previous high within 100-150 days.

For example, after gold rose 30% in 2017, Bitcoin reached a historic peak of $19,120 in December of the same year; after gold broke $2,075 in 2020, Bitcoin rose to $69,000 in November 2021.

This correlation stems from their complementary roles during periods of economic uncertainty. Gold, as a traditional safe-haven asset, usually reflects inflation expectations and signals of monetary easing first; while Bitcoin, due to its rigid supply and decentralized nature, has become a latecomer force under the "digital gold" narrative.

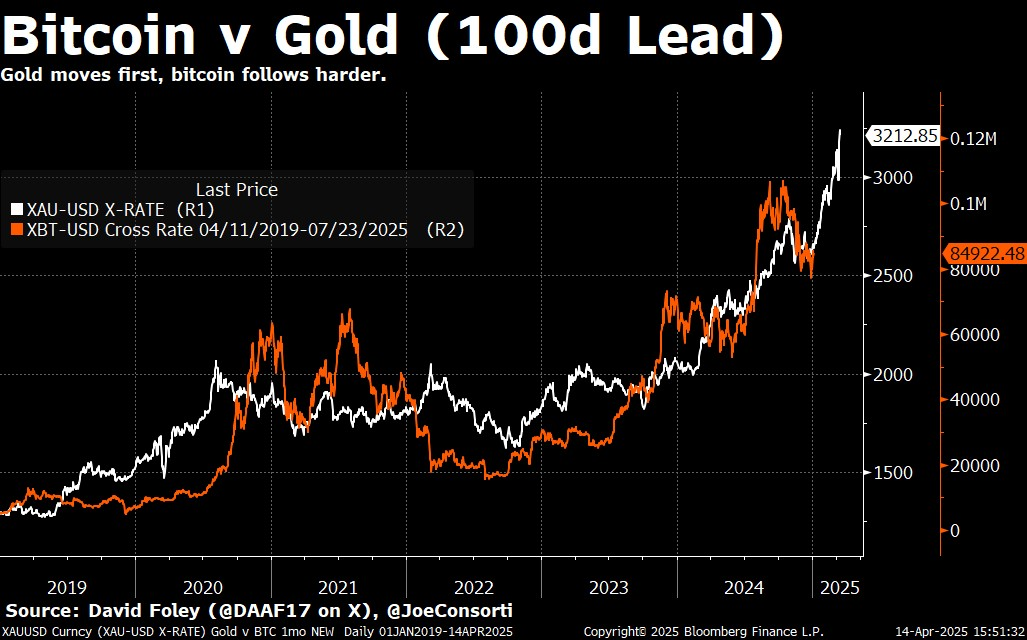

The correlation between Bitcoin and gold price movements.

Joe Consorti, Growth Director at Theya, pointed out that Bitcoin's lagging response to gold trends is related to its market maturity—institutional investors require more time to complete the transition from traditional assets to crypto assets.

Currently, the surge in gold prices resonates with the uncertainty surrounding Federal Reserve policies.

Mike Novogratz, CEO of Galaxy Digital, referred to this phase as the "Minsky moment" for the U.S. economy, a critical point where debt becomes unsustainable and market confidence collapses. He believes that the simultaneous strengthening of Bitcoin and gold reflects investors' concerns about a weakening dollar and the $35 trillion national debt, while tariff policies exacerbate the turmoil in the global economic order.

Cycle Models and Long-Term Predictions: Bitcoin's "Power Law Curve" and $400,000 Target

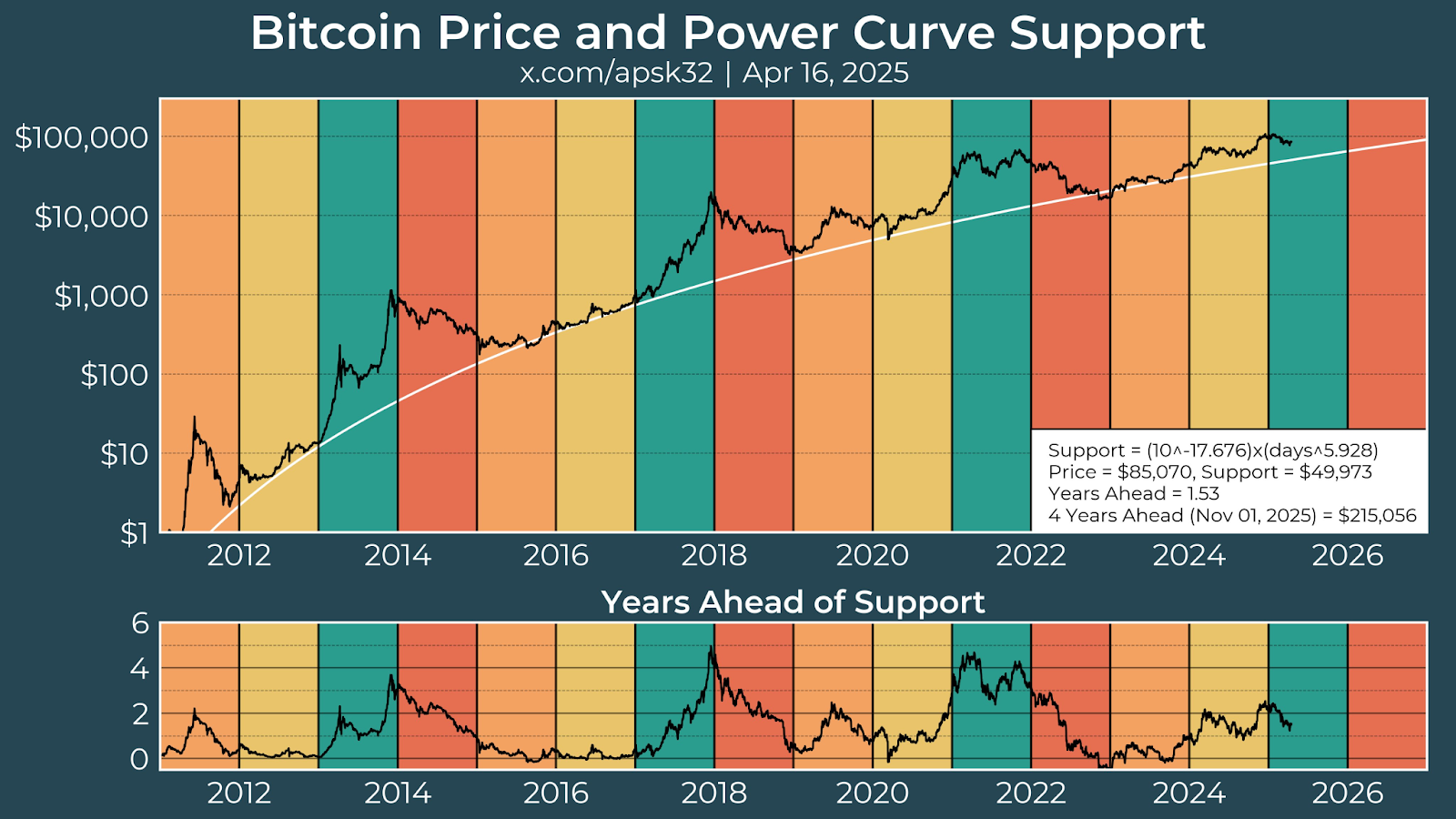

Despite facing volatility in the short term, analysts remain optimistic about Bitcoin's long-term prospects. An anonymous analyst, apsk32, predicts based on the "power law curve time profile" model that Bitcoin will enter a parabolic growth phase in the second half of 2025, with a target price potentially reaching $400,000.

This model standardizes Bitcoin's market value against gold's market value and measures Bitcoin's value in terms of gold ounces, revealing its potential valuation logic as "digital gold."

Bitcoin price and hash rate curve chart.

Historical cyclical patterns also support this prediction. The halving effect of Bitcoin (which occurs every four years) typically triggers a bull market within 12-18 months afterward, and the halving event in April 2024 may show its power in the third to fourth quarter of 2025.

Meanwhile, institutional investors continue to increase their holdings of Bitcoin through compliant tools like ETFs. As of February 2025, the total net asset value of BTC ETFs has reached $93.6 billion, further solidifying its position as a mainstream asset.

However, the market must also be wary of the risk of "expectation exhaustion." The current bull market is primarily driven by institutional hoarding and ETF funds, while retail participation remains low, with exchange BTC balances dropping to their lowest levels since 2018, increasing the risk of liquidity traps. If Bitcoin fails to expand its application scenarios (such as payments and smart contracts), its valuation may face downward pressure.

Policy Variables: Tariffs, Liquidity Crisis, and Market Restructuring

In April 2025, U.S. tariffs on Chinese goods soared to 104%, and countries like Japan and Canada also faced high tariff impacts. This policy not only raised global inflation expectations but also reshaped capital flow patterns. Bloomberg data shows that tariffs have led to a roughly 2.5% increase in U.S. prices, with average annual household spending rising by nearly $4,000. In response to economic pressure, the Federal Reserve may be forced to restart quantitative easing, and excessive money supply will further strengthen Bitcoin's anti-inflation narrative.

Tariff policies also highlight Bitcoin's decentralized advantages. In the context of traditional cross-border payments being obstructed, stablecoins (like USDT) have become tools for emerging markets to evade capital controls due to their low cost and instant settlement features. For example, the stablecoin premium rates in countries like Argentina and Turkey have long maintained at 5%-8%, reflecting urgent demand under the credit crisis of fiat currencies.

However, the short-term market turbulence triggered by tariffs cannot be ignored. On April 9, Bitcoin's price briefly fell to $80,000, with a daily drop of 7%, and over $1 billion in liquidations occurred in the derivatives market in a single day. This volatility indicates that Bitcoin has not completely shed its "high-risk asset" label, and its price remains sharply influenced by macro sentiment and leveraged liquidations.

Conclusion: Asset Allocation Logic Under the New Economic Paradigm

The core contradiction in the current market lies in the mismatch between policy expectation exhaustion and endogenous momentum. The long-term value of Bitcoin depends on the dual tests of regulatory frameworks and technological bottlenecks.

Investors need to be clear that 2025-2026 may be Bitcoin's "last hurrah."

In this changing landscape, the complementarity between gold and Bitcoin becomes increasingly significant. Gold, with its historical consensus and liquidity advantages, remains the ultimate safe-haven choice in times of crisis; while Bitcoin, through "de-correlation," has validated its "digital gold 2.0" attributes, becoming a core target in diversified investment portfolios.

For ordinary investors, a combination of physical gold and mainstream cryptocurrencies, along with attention to "mispriced opportunities" in emerging market bonds, may be the best strategy to withstand turmoil.

History does not simply repeat itself, but it always rhymes. Whether it is Bitcoin's $85,000 turning point or gold's $3,357 new high, these numbers reflect the restructuring of the global economic order. Only by maintaining rationality and foresight can new opportunities be captured amid uncertainty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。