Original Title: Trump’s newest grift: Building a cryptocurrency empire while destroying its regulators

Original Author: Molly White

Translation by: Daisy, ChainCatcher

In the context of Trump's return to power, the cryptocurrency industry is experiencing unprecedented regulatory loosening. Seizing this opportunity, the Trump family has rapidly laid out plans in the related industries, creating a cryptocurrency empire worth billions, encompassing platform construction, token issuance, infrastructure control, and even market manipulation, with power and capital closely intertwined.

This process not only brings enormous profits but also raises serious questions about conflicts of interest and abuse of power. From platform holdings to policy interventions, from meme coin speculation to potential insider trading, the Trump family is transforming the national regulatory system into a tool for their own profit.

This article will outline the operational path of the family's cryptocurrency business, revealing how they profit in a regulatory vacuum, and explore the systemic risks triggered by this "expansion of the cryptocurrency empire."

Financial Backers and Loosening Rules: How Cryptocurrency Capital Quickly Opens Political and Business Channels

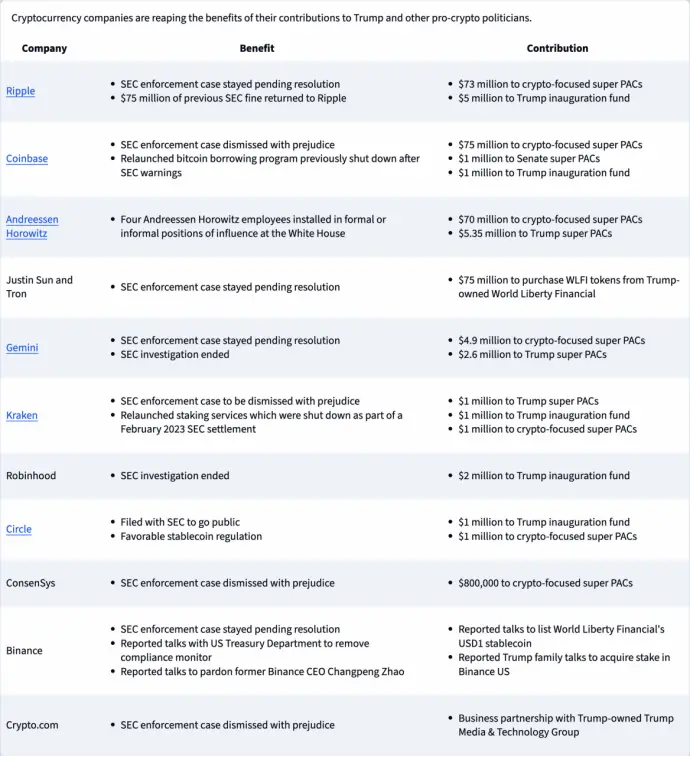

After Trump regained power, he quickly received at least $20 million in political donations from cryptocurrency industry backers. Among them, Ripple and Andreessen Horowitz each contributed $5 million, while giants like Coinbase, Gemini, Kraken, and Circle also provided millions in support.

These backers soon received policy returns: at least eight enforcement cases by the U.S. Securities and Exchange Commission (SEC) against cryptocurrency companies were withdrawn or postponed. Many companies were also included in the new regulatory drafting process, seizing the opportunity to tailor market rules for themselves in an environment lacking regulation, with low compliance requirements and weak consumer protection.

The loosening of policies not only allowed donating companies to reap substantial profits but also cleared institutional barriers for the Trump family's cryptocurrency expansion, laying the groundwork for the entire business operation.

Source: Follow the Crypto

World Liberty Financial: The Core Asset of Trump’s Cryptocurrency Empire

In August 2024, Trump and his partners founded the cryptocurrency company World Liberty Financial. The project's co-founder, Zach Witkoff, is the son of Steven Witkoff, a long-time ally of Trump, who currently serves as a special representative for Middle Eastern issues and was recently appointed as his personal envoy for a visit to Putin, playing a key role in facilitating the project's connections.

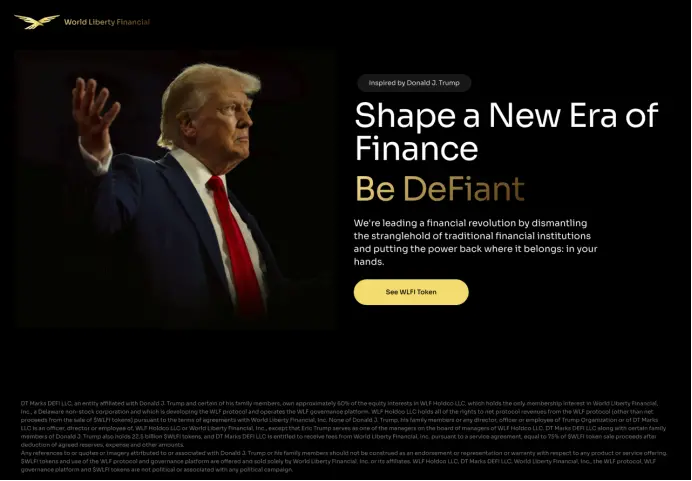

Although the platform's promotion and positioning almost entirely revolve around Trump himself, with the official website listing his son as a "DeFi visionary" and "Web3 ambassador," promising that 75% of the protocol's profits would belong to him, the family initially tried to create a "keep distance" posture. It wasn't until Trump took office again that he officially held 60% of the shares, becoming the actual controller.

Source: World Liberty Financial Homepage

Despite not having launched any trading platform, World Liberty has raised as much as $550 million, and based on the profit-sharing ratio, Trump personally stands to gain nearly $400 million. The company claims it will create a "financial democratization" platform and issue a stablecoin USD1, which sharply contrasts with Trump's past stance of labeling stablecoins as "government-controlled financial tools."

Notably, $75 million of the project comes from Sun Yuchen—a foreign cryptocurrency entrepreneur under investigation by the SEC and the Department of Justice for fraud, who cannot donate directly to Trump. Subsequently, Sun was appointed as an advisor to World Liberty, and after Trump took office, the SEC's lawsuit against him was shelved.

The $WLFI token issued by World Liberty is defined as a "governance token," theoretically granting holders voting rights, but the platform team unilaterally advanced significant matters, including the issuance of stablecoins, without any voting. The token also includes several regulatory evasion clauses, limiting purchases to non-U.S. citizens or "qualified investors," and is currently non-tradable. Some investors bet that once SEC regulations are further weakened, these restrictions will be lifted, allowing the token to enter the secondary market for returns.

Meanwhile, the project has also faced widespread scrutiny for potential insider trading. Media reports revealed that World Liberty purchased tokens from Movement Labs for about $2 million, coinciding with rumors that the latter was negotiating blockchain cooperation with the "Department of Government Efficiency" led by Musk. Both parties denied the claims, but the market reacted strongly.

On April 8, 2025, a memorandum released by Deputy Attorney General Todd Blanch revealed that the Department of Justice officially disbanded the cryptocurrency investigation team based on an executive order signed by Trump, terminating all related enforcement actions. This move nearly severed the federal investigation path into the Trump family's cryptocurrency business.

The timing of the USD1 stablecoin announcement also drew attention: on March 25, World Liberty announced it would issue the stablecoin, and just ten days later, the SEC stated that "certain types" of stablecoins are not under its regulatory purview, allowing companies to issue them without registration. Meanwhile, Congress is pushing related legislation to loosen regulatory restrictions on stablecoins, backed by over $130 million in lobbying funds from the cryptocurrency industry during the previous election cycle.

Additionally, World Liberty is negotiating with Binance to list USD1 on its platform. If successful, the project will tap into the user base of the world's largest cryptocurrency exchange, presenting enormous profit potential. At this time, Binance is negotiating compliance matters with the U.S. Treasury, attempting to lift the regulatory agreement established due to previous anti-money laundering violations, which stemmed from a judicial settlement after paying over $4 billion in fines.

Truth Social and Truth.Fi: Social Platforms Turning to Cryptocurrency Investment

Trump's "Trump Media & Technology Group" (TMTG), the parent company of Truth Social, has also begun to venture into the cryptocurrency field in recent years. The company has gone public, with an estimated valuation of about $2 billion, and Trump holds approximately 53% of the shares. Recently, TMTG applied for permission for a trust fund controlled by Donald Trump Jr. to sell its shares.

In January 2024, TMTG announced its entry into the fintech sector under the brand "Truth.Fi," launching so-called "America First" investment products. On March 24, the company announced a partnership with Singapore's Crypto.com exchange. Notably, this platform was previously under investigation by the SEC and received a "Wells Notice" in August of the same year, indicating impending enforcement action. However, just three days later, Crypto.com announced that the SEC had terminated its investigation.

Meanwhile, TMTG stated it would use up to $250 million in cash reserves to invest in cryptocurrencies like Bitcoin. Through this move, the company—essentially Trump himself—hopes to profit directly from market movements driven by his own statements and actions. Policies he proposed, such as establishing a Bitcoin strategic reserve and promoting government purchases of Bitcoin, could have substantial impacts on the market.

Blockchain Gaming Plans and Regulatory Loosening: From "Monopoly" to Real-World Arbitrage

According to Fortune magazine, Trump is preparing to launch a blockchain-based real estate-themed game, similar to "Monopoly," but built on a cryptocurrency system, emphasizing "Play-to-Earn" to attract players to earn real profits through gameplay.

Such games have faced criticism in the past, primarily due to imbalances in economic structure and moral hazards. Wealthy players can "pay to win," while those with poorer economic conditions may find it difficult to participate, as the system heavily relies on new player influx to maintain token value, risking collapse if growth slows.

The 2021 sensation Axie Infinity sparked the "digital sharecropping" model: wealthy individuals rented game assets to players from low-income countries, promising them earnings above local wages through gameplay. This model ultimately led to widespread ethical controversies, involving mechanisms akin to gambling for minors and players losing real money after investing. In March 2022, the game was also attacked by North Korean hackers, resulting in losses of about $625 million, and the token price has yet to recover.

In recent years, U.S. regulatory agencies have begun to strengthen scrutiny of such projects. The SEC, in suing Coinbase and Binance, accused them of listing unregistered securities, including game tokens like Axie Infinity's $AXS, The Sandbox's $SAND, and Decentraland's $MANA. Meanwhile, the Consumer Financial Protection Bureau (CFPB) has also focused on exploitative practices in the monetization of game tokens, especially concerning underage players.

However, after Trump's return to power, these regulatory barriers are being rapidly dismantled. He is pushing to loosen restrictions on cryptocurrency companies, including eliminating registration, compliance, accountability, and gambling mechanism regulations. The SEC has recently "accelerated" the withdrawal of multiple enforcement actions against Binance, Coinbase, and related game tokens, announcing that most cryptocurrency assets are no longer under its regulatory purview, while inviting industry executives to participate in drafting new regulations.

The Trump administration is also advocating for the complete closure of the CFPB, a proposal that has received public support from senior executives in the cryptocurrency industry. Congress is also cooperating, with both the House and Senate passing measures to repeal the CFPB's regulatory rules established for cryptocurrency games, originally intended to strengthen protections for underage users and non-gaming cryptocurrency investors.

This repeal shows a clear partisan divide: Democrats and independent lawmakers unanimously oppose it, while all but one symbolic Republican senator support it. The bill is currently awaiting Trump's signature. Once signed, it will not only completely end regulatory barriers to related activities but also bring direct benefits to him and the cryptocurrency projects he is involved in.

Trump Family Ventures into Bitcoin Mining, Renewed Questions of Interest Transfer

At the end of March 2025, Trump's two sons—Eric Trump and Donald Trump Jr.—announced their investment in the Bitcoin mining company American Bitcoin, with Eric serving as Chief Strategy Officer.

The company was established with the assistance of mining firm Hut8, which transferred "almost all" of its mining equipment to the new company, raising industry concerns. VanEck analyst Matthew Sigel commented, "I really can't understand why they would exchange 61,000 mining machines for just 80% of the remaining shares of a previously 100% owned subsidiary." Many observers believe this resembles a "political stock swap"—Hut8 relinquishing 20% of its equity to the Trump family in exchange for policy conveniences and potential returns.

Eric Trump stated that the company plans to go public in the future and will collaborate with World Liberty Financial. He also revealed that they will retain some of the mined Bitcoin, betting that Trump will once again drive up Bitcoin prices to gain asset appreciation profits.

Massive Launch of Meme Coins, Trump Family Cashes Out Hundreds of Millions

Just before Trump took office again, he launched a meme coin named $TRUMP, shocking some supporters in the crypto community. Industry insiders bluntly described his actions as "blatant money-grabbing" and criticized it as "absurd to the extreme, setting a new low for stupidity."

Shortly after, the family launched the $MELANIA meme coin, further igniting controversy. The Financial Times estimated that by early March, Trump's team had cashed out at least $350 million through these two tokens. On April 15, a wallet address controlled by Trump allegedly cashed out another $4.6 million.

Meanwhile, the $MELANIA team reportedly sold about $4.5 million worth of tokens from late March to early April. On April 7, the on-chain analysis platform Bubblemaps revealed that insiders from the project transferred approximately $30 million worth of tokens from a wallet labeled "community distribution" and sold them on a large scale. More concerningly, the team had previously been accused of manipulating the $LIBRA token related to Argentine President Milei and engaging in insider trading of several Solana-based meme coins.

In the initial distribution of the $TRUMP token, Trump and his affiliates held up to 80% control, with a three-year linear unlocking mechanism. The first round of unlocking is about to start, allowing Trump to sell up to 40 million tokens, valued at approximately $310 million at current prices. Meanwhile, many early investors have been severely impacted, with the token price plummeting from a peak of $75 to less than $5.

Despite these trading activities being suspected of market manipulation or insider trading, regulatory oversight is almost absent. On February 27, the SEC explicitly stated that meme coins are not within its regulatory scope. Typically, such potential criminal activities should be addressed by the Department of Justice, but that department has been instructed to prioritize resources for areas like "immigration and government procurement fraud," leaving the crypto market sidelined.

In other words, the Trump family is leveraging the regulatory vacuum to exchange low risk for high returns in the meme coin market.

NFT Operations Take Another Turn: From Self-Purchasing "Obscure Works" to Selling "Suspect Cards"

In addition to cryptocurrencies and meme coins, the Trump family is also actively involved in the NFT (non-fungible token) market. As early as December 2021, Melania Trump launched her first NFT series, but the market response was tepid. A piece with a starting price of about $250,000 received no bids and was ultimately purchased by her for around $170,000.

In July 2023, she launched a second series, which again sparked controversy. This project used NASA images, allegedly violating its prohibition on commercial use. The series also saw poor sales, with only 55 pieces sold in a week, generating less than $5,000 in revenue.

In contrast, Trump's own performance in the NFT project has been more commercially rewarding. In December 2022, he launched the first batch of "digital trading cards" (Trump Cards), intentionally downplaying the "NFT" label. This set of cards portrays an idealized image—muscular, young, and handsome, dressed in superhero or cowboy attire, with an exaggerated and unrealistic style.

One of Trump's "digital trading cards" (from OpenSea)

Subsequent series took it a step further, directly themed around Trump's suspect booking photo, and set up an "upgrade reward" mechanism for buyers, including pieces of the suit worn in the booking photo and even the opportunity to dine with him during his criminal trial in New York.

Unclear Holdings, Linked Actions: Concerns Arise Over Trump Family's Cryptocurrency Assets

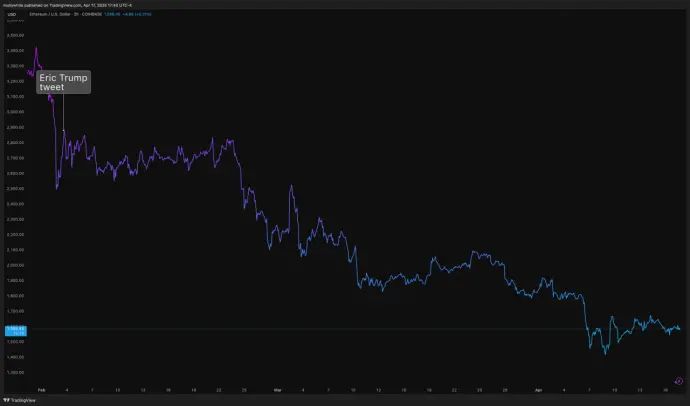

Although the Trump family's cryptocurrency asset holdings remain opaque, public financial disclosures and on-chain records provide some clues. In August 2024, Trump reported holding Ethereum (ETH) valued between $1 million and $5 million, which roughly matches the approximately $2.28 million balance in his wallet at the time. Since December of that year, this wallet has begun to sell ETH on a large scale, having now offloaded most of its holdings.

The holdings of other family members have not been disclosed, but they clearly have opportunities to profit directly from market fluctuations influenced by policy. Some even actively "influence the market." For example, Eric Trump tweeted in February this year, "Now is a good time to increase your $ETH holdings, remember to thank me later." Almost simultaneously, World Liberty Financial, led by the Trump family, made a large transfer of ETH to Coinbase, raising external suspicions of "pump and dump" behavior.

More concerning is the potential insider trading risk among Trump's inner circle. They are well aware of Trump's style of operation and may possess non-public information, while Trump’s sudden policy decisions have repeatedly caused severe market shocks.

A recent example is particularly telling: after Trump announced the "Liberation Day" tariff policy, leading to a significant stock market drop, there were signs that some insiders bought in at low prices, profiting from the market rebound after the policy was paused. Similar operations could also occur in the crypto market. With the prices of assets like Bitcoin fluctuating wildly, having advance knowledge of policy directions could easily yield substantial profits through information asymmetry.

The Ultimate Form of Power Monetization: From Regulatory Collapse to Systemic Risk

The conflicts of interest for the Trump family in the cryptocurrency field have long surpassed the "compensation clause" controversies of his first term. By laying out multiple projects, Trump has constructed a complete path for profit from power: directly profiting from tokens and companies, promoting regulatory policies favorable to his investments, engaging in suspected insider trading, and providing external forces with a channel to gain political influence through "investment"—if converted into campaign donations, these actions would be illegal.

Meanwhile, the regulatory system is being systematically dismantled. Trump continues to weaken constraints on the crypto market, exposing ordinary investors to fraud and manipulation risks, while he and his backers face almost no substantive scrutiny.

Despite increasingly obvious signs of power abuse, the current checks and balances remain largely ineffective. Some Democratic lawmakers have already written to the SEC Inspector General, senior officials in the Department of Justice, and several state attorneys general, calling for investigations into Trump and his team's conflicts of interest, but to date, there has been no substantial public progress.

Even more alarming is that the ongoing collapse of regulation is leading to a high degree of overlap between the personal financial interests of the president and the power of national policy, with the crypto market gradually becoming a playground for the elite to profit: high-risk lending projects disguised as "financial democratization," fraudulent behaviors packaged as technological innovation, and meme coins evolving into tools for "pump and dump."

In this process, ordinary investors are marginalized, with no recourse for their rights. The risks of this deregulatory experiment are beginning to spread to the traditional financial system. As banks expand their exposure and pension and retirement funds get involved, society as a whole is quietly bearing the systemic costs that may be profited by a very few, but paid for by everyone. Once the bubble bursts, the victims will not only be speculators but also those ordinary people who have never participated.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。