Source: Cointelegraph Original: "{title}"

Fartcoin, a meme token based on Solana, has surged over 370% since its launch in October 2024, bouncing back from a yearly low. Its performance has outpaced Bitcoin (BTC) even amid global trade tensions affecting broader risk assets.

Let’s delve into the five core drivers behind FARTCOIN's outperformance against mainstream cryptocurrencies.

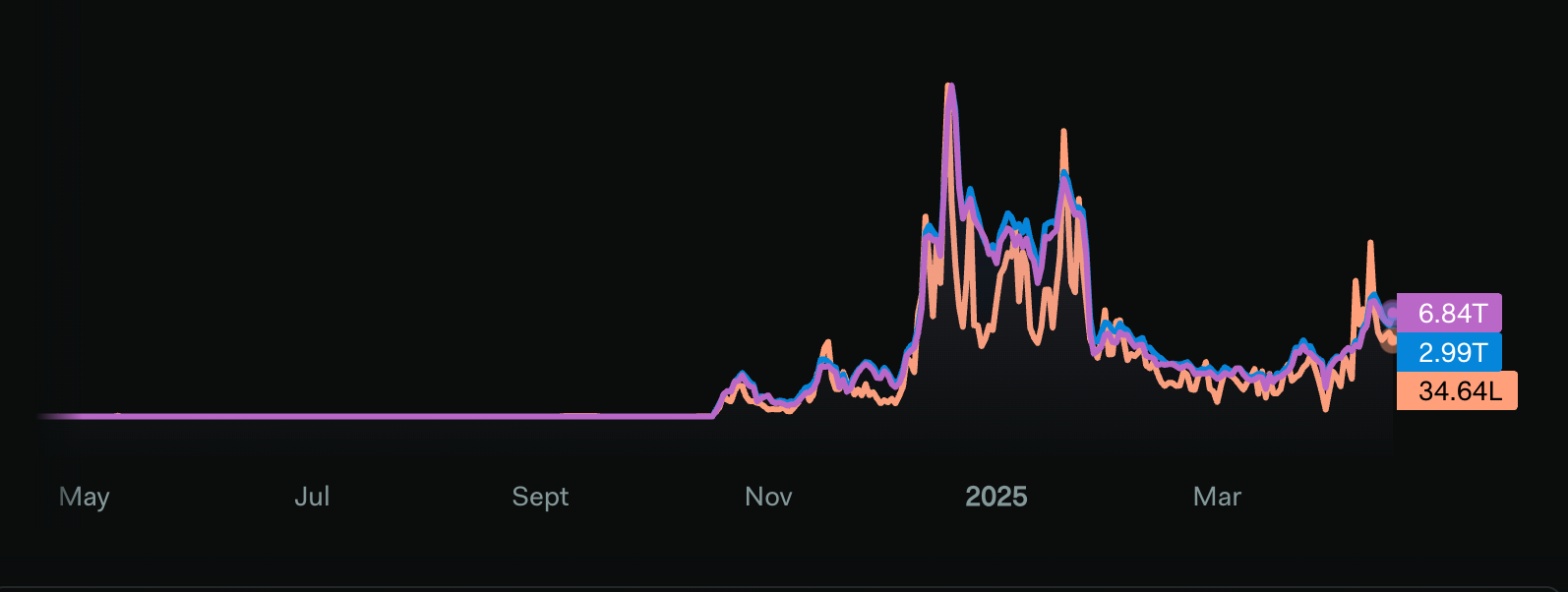

Comparison of FARTCOIN/USDT and BTC/USD 30-day price charts Source: TradingView

FARTCOIN draws on the successful model of PEPE to drive market enthusiasm

FARTCOIN's recent rapid growth trajectory is remarkably similar to the early explosive phase of Pepe (PEPE).

According to weekly data for PEPE/WETH, the market cap of PEPE skyrocketed to $1.8 billion in 2023 before retreating to $255 million.

After hitting a bottom and stabilizing, the token experienced a stronger second wave of growth, with its market cap surpassing $4 billion.

PEPE/WETH weekly performance chart Source: DEX Screener/MacroCRG

This pattern of sharp increases, deep corrections, and quiet accumulation aligns closely with FARTCOIN's current market performance.

Earlier this year, this meme token in the Solana ecosystem had a market cap close to $2.4 billion, followed by a significant adjustment. Its market cap dipped to around $365 million, forming a typical rounded bottom pattern.

FARTCOIN/SOL weekly price chart Source: DEX Screener/MarcoCRG

Since then, FARTCOIN has steadily rebounded, with its market cap recovering to about $949 million this week. This shows a remarkable similarity to the accumulation phase exhibited by PEPE after the 2023 hype.

Market analyst MacroCRG stated, “I believe Fartcoin is likely to replicate PEPE's successful path, achieving significant gains from its current position,” citing the similar development pattern of the PEPE meme coin.

Fartcoin's social media buzz surges by 500%

FARTCOIN appears to be capitalizing on a new wave of speculative enthusiasm, as social media data shows a significant increase in its online activity.

According to LunarCrush data, FARTCOIN's social volume (orange line) skyrocketed nearly 500% in early April, leading to a price increase of over 100% that month.

As of April 17, although participation has slightly declined, it remains at 177% above the baseline.

FARTCOIN social volume, dominance, and contributors 30-day chart Source: LunarCrush

Both social dominance (purple) and the number of social contributors (blue) are on the rise, increasing by 162% and 136%, respectively.

In the crypto market, increased social media activity is often closely related to heightened speculative interest, particularly evident in meme-driven assets.

While this does not guarantee future price movements, the surge in social metrics reflects increased community engagement and exposure, which align closely with FARTCOIN's current volatility.

Fartcoin's open interest in futures contracts surges over 500%

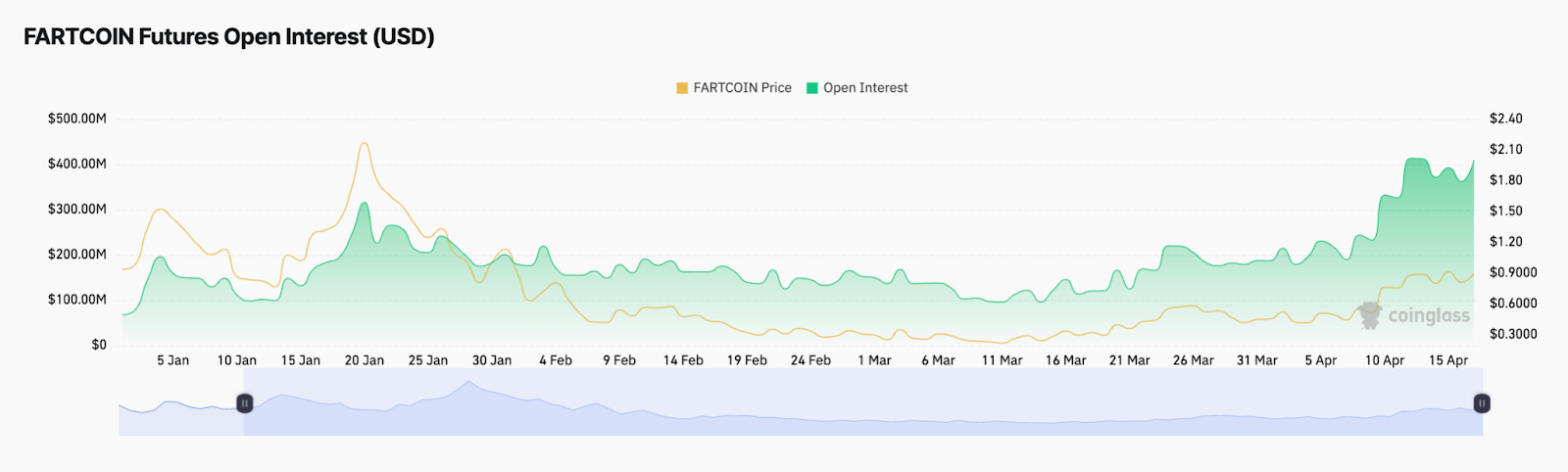

According to CoinGlass data, open interest (OI) in the Fartcoin futures market has surged approximately 504% since 2025. The significant increase in open interest indicates a notable rise in trading capital and market attention.

FARTCOIN futures open interest Source: CoinGlass

In contrast, Bitcoin's open interest has decreased by 10.5% during the same period, reflecting a waning speculative interest in mainstream crypto assets.

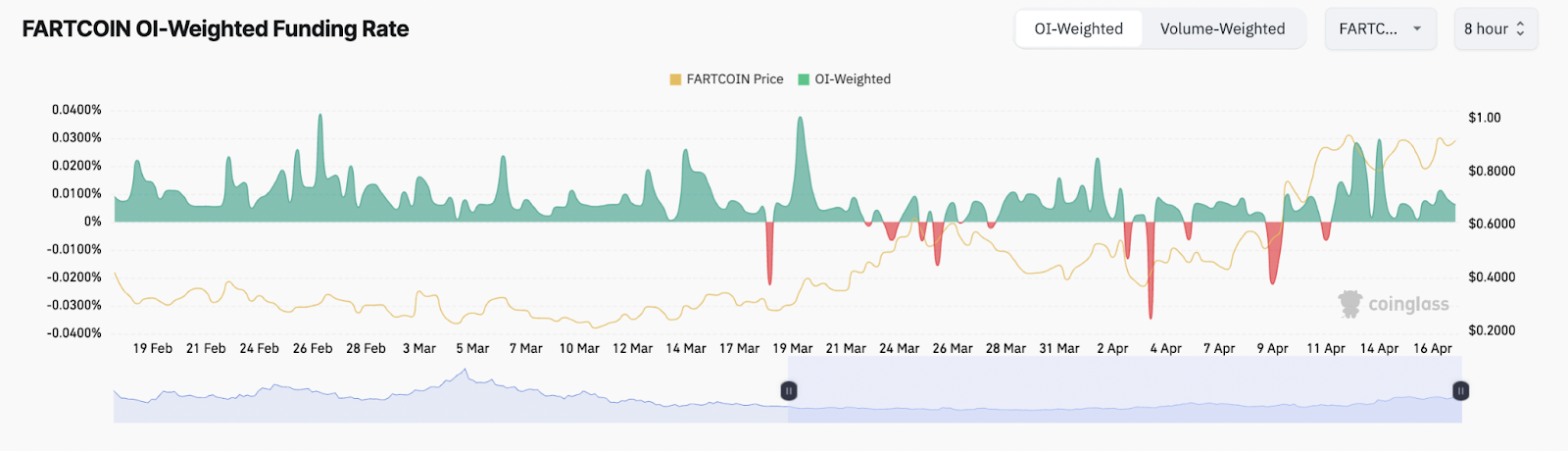

Further supporting the bullish sentiment, FARTCOIN's funding rate has remained positive throughout April, indicating that more traders are betting on price increases rather than declines.

FARTCOIN funding rate (8 hours) Source: CoinGlass

Periods of negative funding rates in the FARTCOIN futures market are often accompanied by large-scale short liquidations, highlighting the risks of shorting this popular meme coin.

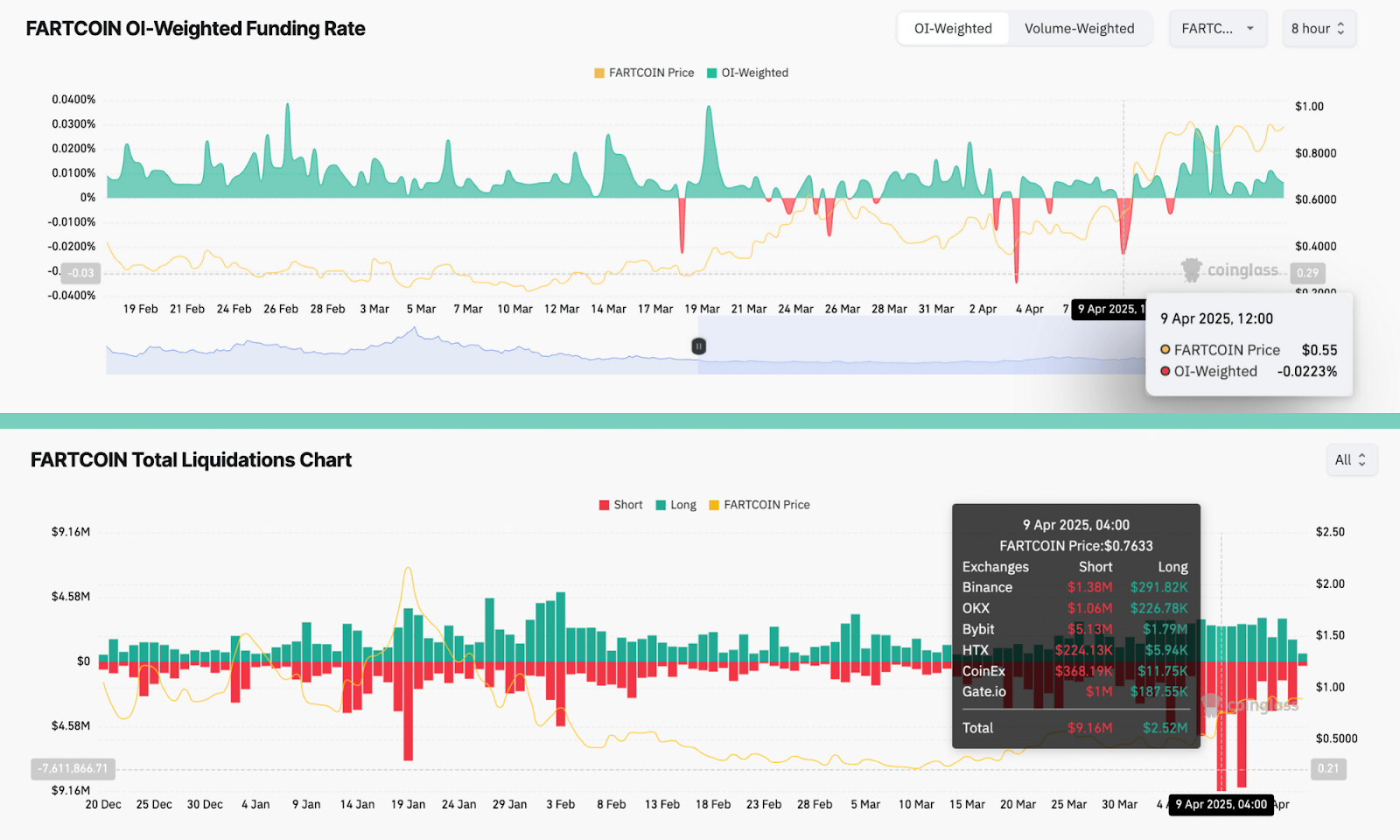

A typical case occurred on April 9, when FARTCOIN's 8-hour funding rate plummeted to -0.023%, indicating that traders were taking an aggressive short position on the token.

FARTCOIN funding rate and liquidation chart Source: CoinGlass

However, in a typical short squeeze scenario, FARTCOIN surged nearly 50% that day, leading to $9.16 million in short positions being liquidated, compared to only $2.52 million in long liquidations.

This clear imbalance highlights a persistent market characteristic: when too many traders hold bearish positions, FARTCOIN often experiences sharp reversals.

As a result, short sellers seem to be becoming more cautious, as excessive pessimism has repeatedly backfired, turning negative funding rates into triggers for explosive price increases.

Fartcoin's decentralized origins

The rise of Fartcoin is not solely due to meme-driven hype—it is built on a unique narrative that cleverly blends AI innovation with internet subculture.

New Zealand AI researcher Andy Ayrey developed an AI agent called "Truth Terminal," which conceptualizes Fartcoin as part of an experiment merging AI and blockchain humor.

Source: X

This unique origin story has attracted traders looking to profit at the intersection of AI and cryptocurrency, elevating Fartcoin beyond the typical meme coin positioning.

Analyst Ben noted in December 2024: "Unlike most AI projects, it avoids the execution risks and technical complexities of infrastructure tokens, while also shedding the fatigue and noise surrounding tokenized agents."

"This combination of simplicity and absurdity creates a perfect feedback loop: price increase = absurdity increase = attention increase = further price increase." The Fartcoin team continues to build its brand around viral internet culture, planning to release a film inspired by Goatse to further enhance engagement.

By incorporating digital sound effects into its "Gas Fee" system, it transforms transaction costs into deliberate humorous elements, further reinforcing its meme-first characteristics.

Source: X

In this way, Fartcoin attracts speculative capital through novelty and narrative without relying on traditional roadmaps, founding teams, or utility value.

This strategy may explain why it continues to gain market momentum while other tokens stagnate.

Fartcoin's technical indicators suggest a potential 100% upside

The price increase of FARTCOIN is also strongly supported by technical factors.

The FARTCOIN/USDT four-hour chart shows an inverted head and shoulders pattern, a classic bullish reversal signal that typically indicates the end of a downtrend and the beginning of a sustained uptrend.

This pattern includes the left shoulder formed in early February, the head's low point in mid-March, and the right shoulder in early April, all centered around a neckline at the $0.63 level.

FARTCOIN/USDT four-hour price chart. Source: TradingView

The pattern was confirmed on April 10, when FARTCOIN broke through the neckline with strong trading volume. After the breakout, the price continued to operate above key moving averages—the 50-day and 200-day moving averages—while consolidating below the $0.90 level.

Based on the distance from the head to the neckline, the target price points to nearly $1.96, representing over 100% upside from the current price level.

This breakout adds technical confirmation to the ongoing uptrend, supporting the view that FARTCOIN's momentum is driven by market narrative and bolstered by bullish chart patterns.

Related articles: Bitcoin reaches an "inflection point" of $85,000 as U.S. unemployment claims suggest market stability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。