Original Title: Why Your Mindset Matters More Than Finding Perfect Trades?

Original Author: @YashasEdu, Crypto Researcher

Original Translator: Rhythm Little Deep

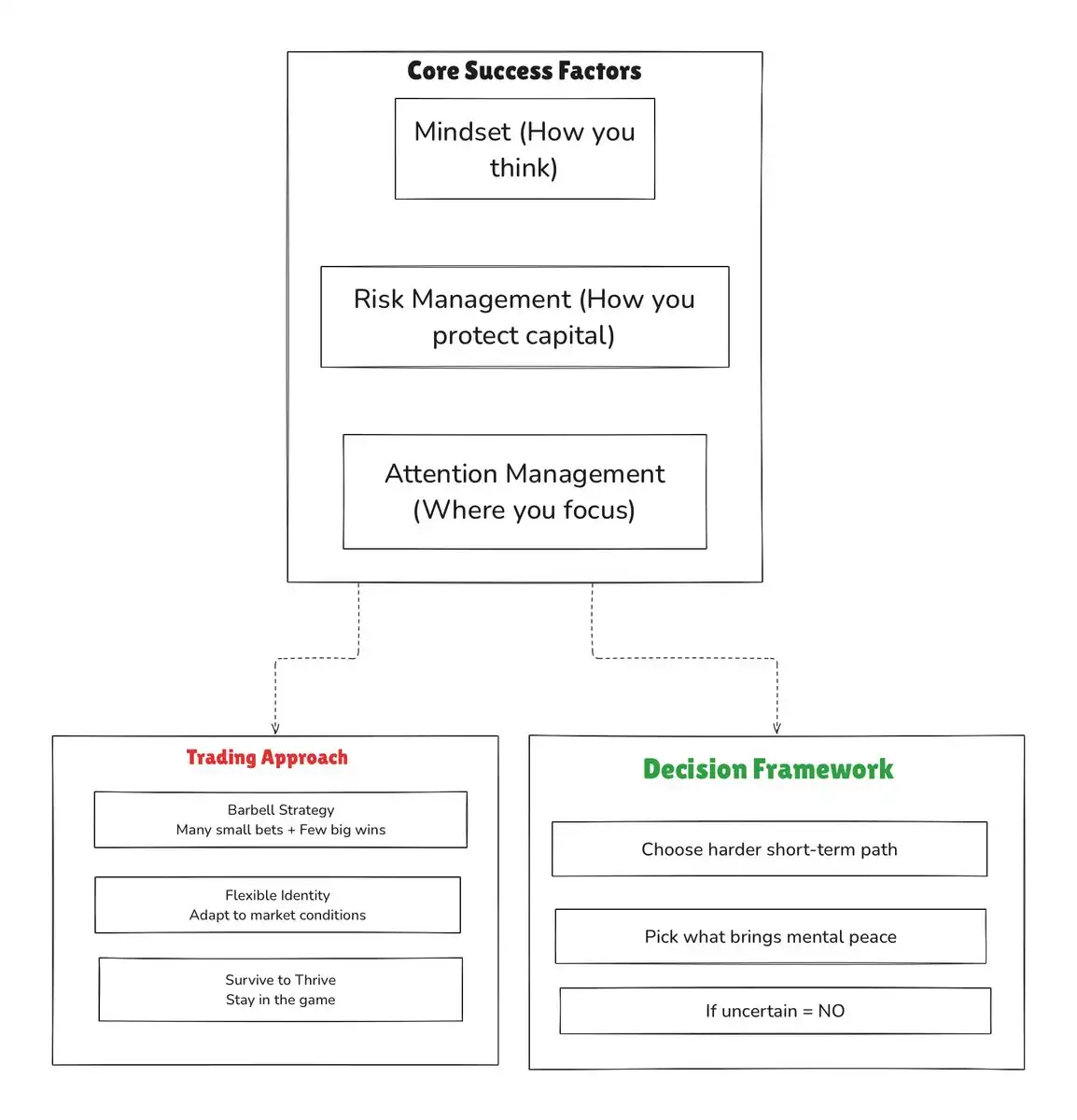

Editor's Note: The author believes that the key to trading success lies not in finding perfect trading opportunities, but in cultivating the right mindset and risk management skills. The market rewards traders who can adapt to changes, protect their capital, and maintain discipline at critical moments. By focusing on probabilities rather than predictions, staying flexible, protecting attention, and following a clear process, traders can survive in the market and seize life-changing opportunities.

The following is the original content (reorganized for better readability):

Most traders focus on the wrong things. They spend all their time looking for perfect chart patterns and hot market news. But even those who are proficient in technical analysis often lose money. What truly determines success or failure? It’s how you view risk and how you respond to mistakes.

Perfect Analysis Won't Save You

You can find perfect trading opportunities, identify the clearest chart patterns, and catch the hottest market trends at the best times, but you can still lose money.

Why?

Because even if you correctly judge the market trend, poor risk management will ultimately eat away at all your profits. Trading isn’t about always guessing right. (The key is how you handle being wrong.)

The market does not reward those who can predict the future. It rewards those who can adapt and protect their capital amidst changes.

Smart Ways to Handle Risk

In trading, you can lose only the capital you invest, but when you are right, the rewards can be substantial. This creates a unique opportunity: you can try multiple times, fail often, but once you succeed, you can make a significant profit.

Great traders think this way:

- They carefully review each trade, knowing that most trades won’t succeed.

- They stay positive, believing that big opportunities will eventually arise.

- They accept small losses, knowing that one big win can compensate for multiple small losses.

This means trying various trades with small amounts of capital and then putting more money into the trades that perform well.

Don’t Label Yourself

One of the biggest mistakes traders make is labeling themselves: "I only go long," "I only go short," "I only trade Bitcoin."

These labels can make it difficult for you to adjust when the market changes. The market is always changing, and you need to change with it. Clinging to rigid labels can trap you in ineffective patterns.

Successful traders remain flexible. They can switch from going long to going short based on market conditions, from aggressive to cautious. (Instead of being driven by self-awareness.)

Your Attention is Your Most Valuable Asset

We often think about how to manage money and time, but the most valuable resource in trading is your attention. Your focus determines your results more than any indicator or system.

Many traders waste their attention on:

- Staring at price charts every minute.

- Reading too much financial news.

- Ruminating on past losses.

- Paying attention to too many markets without a clear plan.

This scattered attention leads to emotional decisions and missed opportunities. Disciplined traders carefully protect their attention, focusing only on what truly enhances their results.

How to Make Better Trading Decisions?

When you are uncertain about a trade, follow these simple guidelines:

If You Can’t Decide, the Answer is to Do Nothing

If you hesitate about a trade, that’s your intuition telling you something is off. Skip those trades that lack certainty.

Choose the Harder Option in the Short Term

The brain amplifies short-term pain. Those trades that make you uncomfortable now—like taking profits, cutting losses, or reducing leverage—often lead to better long-term results.

Choose Decisions That Let You Sleep Peacefully

The right decision shouldn’t make you anxious. If you find yourself constantly checking your phone or losing sleep over a trade, you might be over-leveraged. (No matter how good the trading opportunity looks.)

Three Key Factors for Trading Success

Your Environment

- Who do you learn from?

- What information do you read?

- Who inspires you?

Your trading environment shapes your possibilities more than most people realize.

Your Process

- What are your strengths?

- How do you look for opportunities?

- How do you manage positions?

A clear and consistent process is the foundation of lasting success.

Your Mindset

- How do you handle losses?

- Can you let profitable trades run?

- Do you trade from abundance or fear?

Your mindset determines whether you can stick to your process at critical moments.

Most traders focus almost exclusively on the process while neglecting the environment and mindset. But without the right environment and mindset, even the best process can crumble under pressure.

Success is Not About Perfect Opportunities

The path to trading success is not about finding more perfect trading opportunities, but about cultivating the discipline to manage risk regardless of the opportunities presented.

This means:

- Never risk more than you can afford to lose on a single trade.

- Increase your investment when you are more confident and market conditions are better.

- Let profitable trades run while quickly exiting losing trades.

- Choose trade sizes that keep you clear-headed.

- Completely exit the market when conditions are poor.

By focusing on risk management rather than the pursuit of correctness, you transform trading from a guessing game into a probability game—a game that allows you to last long enough to seize rare life-changing opportunities.

The market does not reward those who guess correctly the most. It rewards those who can endure long enough in the game to seize the biggest opportunities.

Ultimately, survival is the only important trading strategy. Because if your account is wiped out, you’re out of the game, and no perfect trading opportunity can save you.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。