"METHANE" is the hottest term in the Bitcoin ecosystem recently. As the first fairly minted token of the new Bitcoin ecosystem protocol Alkanes, "METHANE"

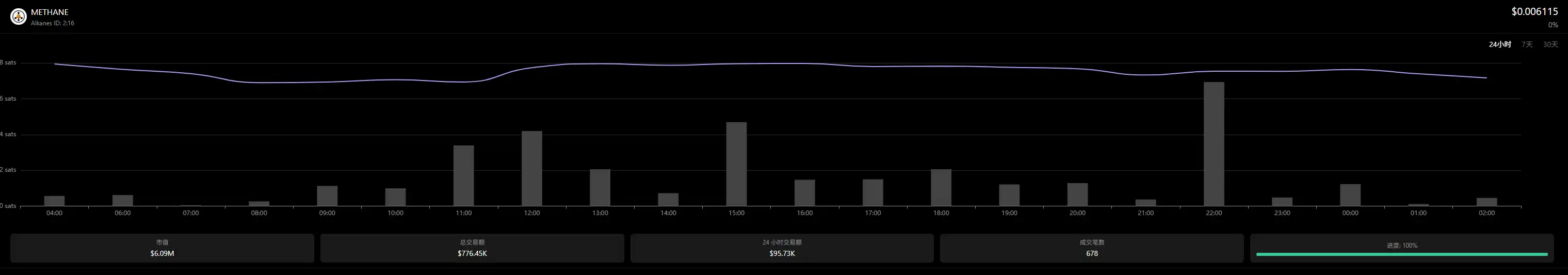

METHANE's market capitalization has exceeded 6 million dollars, which means each METHANE is over 60 dollars. I asked some Bitcoin ecosystem players who participated in the minting, and the cost of minting varies significantly. Taking a minting cost of 5 dollars per token as a benchmark, the profit from minting METHANE has already exceeded 10 times.

In the long-standing quiet of the Bitcoin ecosystem, how did this new asset protocol Alkanes emerge?

Protocol Background

The predecessor of the Alkanes protocol was called Protorunes, which means "programmable runes," and the founder is the same. This concept briefly attracted attention in the Bitcoin ecosystem around mid-last year when runes were still quite popular.

The protocol founder @judoflexchop is the Chief Technology Officer of the Bitcoin wallet Oyl Wallet. The number of users for this wallet in the Bitcoin ecosystem may not be very high, but its recognition is still significant. Just look at its funding situation to understand why:

On March 8, 2024, the Bitcoin infrastructure company Oyl completed a 3 million dollar Pre-Seed round of financing, led by Arca, with participation from Foresight Ventures, Arthur Hayes' family office Maelstrom, Domo, UTXO Management, Taproot Wizards CEO Udi Werthheimer, Kanosei, and FlamingoDAO.

Due to Arthur Hayes' involvement, this wallet quickly gained recognition in the Bitcoin ecosystem. In mid-last year, Oyl launched a Bitcoin NFT project called "Airheads," which sparked controversy due to its relatively high minting price. From the price performance of the NFTs, it was a "failed" project, but recently it has surged nearly 3 times due to the popularity of the Alkanes protocol.

Although they all focus on wallets, in the Bitcoin ecosystem, major wallets are not purely wallet providers. Companies like OKX, UniSat, Magic Eden, and the main character of this article, Oyl, have many other Bitcoin ecosystem businesses outside of wallets, while Xverse has a more "focused" business scope. Back to Oyl, in addition to the wallet, they also developed a Bitcoin RPC called "Sandshrew" and the Alkanes protocol.

Now Oyl is fully promoting this protocol, and their official Twitter account has also included Alkanes in its name:

Reasons for Popularity

Alkanes is a new Bitcoin asset protocol. Overall, it draws from the "Runestone" structure of the rune protocol but offers greater scalability and supports smart contracts. As mentioned earlier, the predecessor of this protocol is Protorunes. From the name, Protorunes seems like a "modified version of runes," but it is not. Simply put, the rune protocol and the "Runestone" structure are like a closed iOS, while Protorunes and Alkanes are like open-source Android.

Protorunes is equivalent to the "Runestone" of the rune protocol. Here, "Runestone" is not the early NFT with a strong wealth effect but rather a "transaction data encapsulation" of runes. In simple terms, it is a piece of information embedded in Bitcoin transactions, serving as the basis for indexing and determining whether there are rune operations in a transaction.

If the indexer finds the "RUNES" identifier while scanning the OP_RETURN of each transaction, it will parse the data following the identifier, such as etching, minting, transferring, etc. "Runestone" acts like an operation manual, and the indexer derives indexing results based on this manual.

"Runestone" is a limited operation manual for the rune protocol, and it corresponds linearly with the rune protocol, while Protorunes is different. To put it directly, we cannot directly instruct the rune protocol's indexer to perform such an action, "I am a sub-asset protocol based on Runestone, please index me together," but Protorunes can. Anyone can customize their own new asset protocol according to Protorunes' data format, and these protocols will be assigned a "Protocol ID." The indexer will read the "Protocol ID" to determine which protocol's specifications to follow for parsing.

There are some modular chains like Ethereum that simplify things. For developers, they can use the tools provided by Oyl without needing to create their own indexer.

As for the implementation of smart contracts, before the revival of OP_CAT, it was basically limited to storing contract data in transactions and off-chain index execution, which did not deviate much.

Beyond the technical aspects, there are two main reasons why this protocol is gaining traction. First, it has received strong support from the Chinese inscription player community. Undoubtedly, the most capable consumers in the Bitcoin ecosystem right now are the Chinese inscription players. This group is quite special; the PvP aspect of Solana meme coins is redundant in the Bitcoin ecosystem, but gaining recognition from the Chinese inscription player community is not easy. Once inscriptions gain momentum, their spread within WeChat groups can be very rapid and influential.

When searching for the keyword "Alkanes" on Twitter, you'll find that most of the promotional content comes from Chinese users, and the protocol founder has also posted in Chinese to thank the Chinese community for their support. The early minting tool in the Bitcoin ecosystem, iDclub, created a trading market for the Alkanes protocol, also developed by Chinese hands.

The second reason is that the project team behind this protocol has a notable background, and according to their disclosed plans, they are not just launching an asset protocol to "drive traffic" to their wallet. They also plan to develop AMM, BTC staking, stablecoins, MEV tools, and a trustless ZK bridge, essentially creating a BTCFi ecosystem around this protocol.

The entire narrative logic makes sense: an asset protocol that supports smart contracts, with applications built around this asset protocol. If a project team without a background were to present this narrative, it would be hard to convince people. After all, in the Bitcoin ecosystem, players still feel some pain from the decline of Atomicals, and having a mature team handle significant matters reduces uncertainty.

Protocol Leaders

METHANE, the first fairly minted token of the Alkanes protocol, currently has a market capitalization of about 6 million dollars. The Chinese meaning of Alkanes itself is "alkanes," and the Chinese meaning of METHANE is "methane," so BUTANE and HEXANE have also been mentioned by players, although these two tokens currently only have a market capitalization of around 250,000 dollars.

DIESEL, from the official team, is also the first deployed token of the Alkanes protocol, currently valued at about 12.6 million dollars. This token has a unique mechanism, with a total supply of only 1,562,500 tokens, 28% reserved for the team, and 72% produced block by block with each Bitcoin block, following Bitcoin's halving schedule. In each block, the DIESEL minting transaction with the highest miner fee will ultimately receive the DIESEL output for that block. In summary, DIESEL is issued once per block, and only one person (the one who pays the highest miner fee for the minting transaction) can mine DIESEL in each block. Ordinary players can hardly mint it anymore, as scientists will automatically monitor the miner fee situation and keep increasing it.

Because METHANE is fairly minted, the holder community/chip distribution is definitely healthier compared to DIESEL, and it is fully circulating. Therefore, currently on social platforms, METHANE's volume is far greater than DIESEL's. If you look purely at volume without considering market capitalization, it may seem that METHANE is the leader. The official team has not disclosed more information about what future empowerment DIESEL may have. Thus, METHANE excels in community aspects, while DIESEL benefits from its official background and potential future empowerment expectations.

Conclusion

This protocol is still in its early stages, and the support for this protocol's assets from various wallets has not yet caught up, so it is best to use Oyl Wallet for asset interactions within this protocol to ensure asset security.

The success of this protocol essentially brings together the key elements for the success of a new asset protocol in the Bitcoin ecosystem—"mainnet assets," "fair minting," and "support from the Chinese community," along with "smart contracts" and an ecological narrative, allowing it to break through in a long-quiet Bitcoin ecosystem. I hope the ecosystem can be built up and continue to thrive.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。