Original Title: "What Happened to $AERGO After a 10-Fold Surge in a Week and an 80% Plunge in a Day?"

Original Author: Oliver, Mars Finance

In mid-April 2025, $AERGO stirred up a storm in the crypto market. Within a week, its price skyrocketed from $0.05 to $0.5, a staggering increase of 10 times; but just a day later, the price plummeted by 80%, dropping to around $0.1. This rollercoaster market led investor sentiment to shift from euphoria to anger, and Binance's data issues further escalated the turmoil. What exactly drove the insane rise of $AERGO, and what caused the crash and the community's strong backlash? Let’s unravel the truth behind this incident.

Binance's "Operational Fog": From Delisting to Futures Frenzy

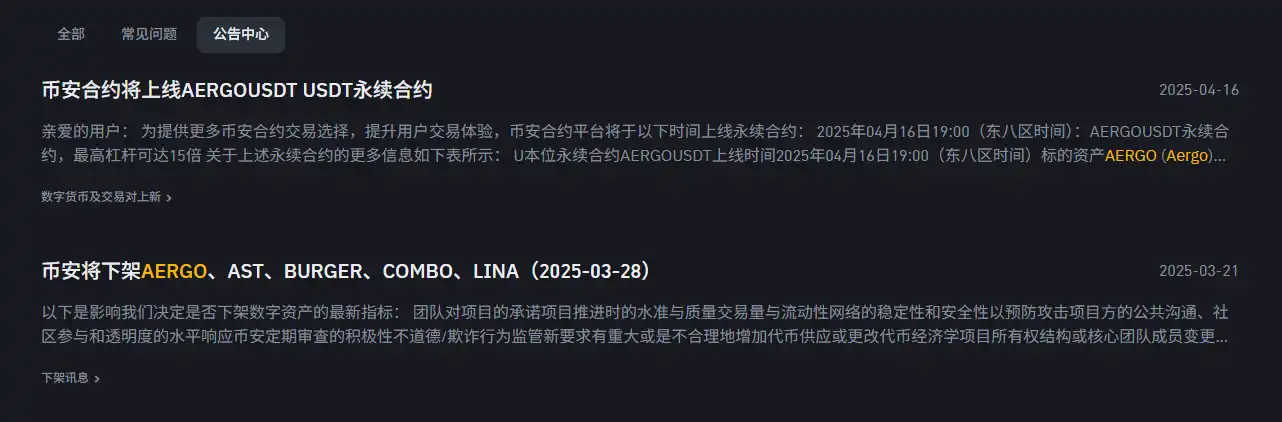

The story of $AERGO began with Binance's dramatic decision. Aergo is a hybrid blockchain project developed by the South Korean company Blocko, which had long remained under the radar. On March 28, 2025, Binance announced the delisting of $AERGO's spot trading pairs, citing "insufficient liquidity." This decision disappointed the community, causing the price to drop to a low of $0.04, with investors generally pessimistic about its prospects.

However, the plot took a sharp turn on April 16: Binance suddenly announced the launch of $AERGO/USDT perpetual contracts, supporting up to 15x leverage. As soon as the news broke, speculative funds rushed in, and the price of $AERGO soared from $0.2 to $0.4995 within hours, setting a new all-time high.

This surge was supported by multiple factors. On April 15, the DigiFinex trading platform launched the $AERGO/USDT trading pair, enhancing the token's liquidity. The Aergo team also announced an AMA on Telegram for April 16 to discuss decentralized AI and potential new projects, igniting community enthusiasm. Market sentiment peaked, with technical indicators showing an RSI (Relative Strength Index) as high as 93, indicating severe overbought conditions and reaching the height of speculative fervor.

The Trigger for the Crash: Leverage Traps and Data Discrepancies

Just as investors celebrated the 10-fold increase, the launch of Binance futures on the afternoon of April 16 marked the beginning of the disaster. The price of $AERGO plummeted from $0.5, crashing to $0.1 within 12 hours, a drop of 80%. Anger quickly spread through the community, with the blame directed at Binance's data transparency issues. Investors discovered that Binance reported $AERGO's circulating market cap as $30 million, while the actual market cap, based on a circulating supply of 477 million, showed a significant discrepancy. For instance, at a price of $0.4, the market cap should have been $0.4 × 477 million = $190.8 million; even if the price dropped to $0.22419 (April 17 data), the market cap should have been $0.22419 × 477 million ≈ $107 million, yet Binance still displayed it as $30.0869 million. This discrepancy led investors to question whether Binance intentionally underreported the market cap, misleading retail investors into thinking the token was "undervalued" and encouraging them to buy at high prices.

Funding rate data exacerbated the market chaos. During the surge, $AERGO's funding rate was around 0.1%, attracting a large number of leveraged long positions. However, after the price crash, Bybit data showed the funding rate plummeting to -3.000%, with shorts dominating the market and long positions being forcibly liquidated. On-chain data further indicated that the open contract volumes on Bybit, Gate.io, and MEXC dropped by 53%, 50%, and 71%, respectively, reflecting traders' panic exit. High concentration also became a hidden danger: about 50% of the tokens were held by the team and early investors, making them susceptible to large sell-offs.

Community Outrage: Data Fabrication or Simple Mistake?

The issue of Binance's market cap discrepancy became the focal point of community controversy. After calculations, investors found that Binance's market cap data was far lower than the actual value. Some sarcastically remarked, "Does Binance even know how to do basic math? 477 million circulating supply at $0.4, how could the market cap possibly be $30 million?" Even more puzzling was that the market cap data from other trading platforms like OKX, Bybit, and BG matched the actual circulating supply, while only Binance's data was anomalous, leading to speculation of "data fabrication." One investor in the community complained, "I thought the market cap was only $30 million, bought some, and then it crashed hard. Upon closer inspection, the market cap was completely wrong!" Another investor stated that they suffered significant losses after mistakenly believing Binance's data and buying at high prices, only to see the price halve repeatedly.

The consequences of this data discrepancy were catastrophic. Investors widely believed that Binance's underreporting of the market cap might mislead retail investors into thinking $AERGO was "undervalued," prompting them to buy in, while large holders took the opportunity to sell for profit. The community began calling for rights protection, with some asking, "After two price halving events, can those who lost money on long positions seek recourse from Binance? It was clearly their misleading data that misled retail investors!" The Aergo team issued a statement on April 17, acknowledging the abnormal price fluctuations but emphasizing that they had not been informed in advance of Binance's futures launch plan and called for the restoration of spot trading to stabilize the market. However, the official website became temporarily unavailable due to a surge in traffic and DDoS attacks, further undermining community confidence.

The dramatic rise and fall of $AERGO reflect the complexities of the crypto market. Community sentiment oscillated between optimism and anger: supporters looked forward to the community vote on April 26 to bring new direction to the project; critics warned that high concentration and the opaque operations of trading platforms could lead to more volatility. Technical analysis indicated that $AERGO was stabilizing in the $0.1-$0.2 range, with Bollinger Bands suggesting that volatility was narrowing, potentially entering a consolidation phase in the short term. However, the ongoing negative funding rates and low open contract volumes reflected a still pessimistic market sentiment, and investors needed to be wary of further downside risks.

Conclusion: Market Lessons in the Fog of Data

A 10-fold surge in a week and an 80% plunge in a day, the rollercoaster market of $AERGO is a microcosm of speculative fervor and market risks. Binance's dramatic operations, from delisting spot trading to launching futures, ignited speculative enthusiasm but also triggered a crisis of trust due to data discrepancies. The severe errors in market cap reporting not only caused significant losses for retail investors but also exposed transparency issues on trading platforms. For investors, the story of $AERGO serves as a reminder: amidst the fervor and traps of the crypto market, the authenticity of data may be the key to determining profits and losses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。