1. Market Observation

Keywords: sUSD, ETH, BTC

Due to Good Friday and Easter holidays, US, Hong Kong, European, and Australian stock markets are closed today, with Hong Kong, European, and Australian markets set to remain closed until next Monday. Meanwhile, gold prices soared to a historic high of $3,357 per ounce yesterday, sparking speculation about whether Bitcoin will follow suit. Historically, whenever gold rises, Bitcoin tends to break its historical high a few months later. Joe Consorti, head of growth at Theya, pointed out that Bitcoin typically lags behind gold by 100-150 days, and it is expected that Bitcoin could reach new historical highs between Q3 and Q4. However, a recent report from JPMorgan indicates that, in the context of the global trade war initiated by Trump, investors are more inclined to invest in gold rather than Bitcoin.

Notably, according to Santiment data, transaction costs on the Ethereum network have dropped to their lowest level in five years, currently around $0.168 per transaction. Santiment's marketing director, Brian Quinlivan, explained that as fees decrease, the number of people sending ETH and interacting with smart contracts has also declined, which is essentially a supply and demand system. When network activity decreases, users do not need to bid high fees to expedite transaction confirmations, leading to a drop in average fees. From a trading perspective, low fees may hinder price rebounds, but traders seem to be patiently waiting for global economic uncertainty to pass before increasing the frequency of Ethereum and altcoin trading. Additionally, crypto analyst Ali Martinez noted that the TD Sequential indicator has issued a buy signal on Bitcoin's weekly chart. If Bitcoin's price continues to stay above $86,000, it could drive its price further up to $90,000 or even $95,000.

In terms of regulation, Slovenia plans to impose a 25% tax on individual cryptocurrency profits starting January 1, 2026, with the proposal currently awaiting public feedback and parliamentary approval. The new rules will apply to profits made from converting cryptocurrencies into fiat currency or using them to purchase goods and services, while exchanges between cryptocurrencies will remain tax-free. Meanwhile, Panama City Mayor Mayer Mizrachi Matalon announced that the city government has approved the use of Bitcoin, Ethereum, USDC, and USDT for paying taxes, fees, fines, and licenses, converting cryptocurrencies into US dollars at the time of payment through partnerships with cooperating banks. At the same time, Powell himself stated at the Chicago Economic Club that future regulations related to banks and cryptocurrencies may be "relaxed," despite a wave of failures and frauds in the cryptocurrency sector over the years, the field is becoming increasingly mainstream.

On the macro front, The Wall Street Journal reported that Trump is considering firing Federal Reserve Chairman Powell, but former Fed governor Warsh and Treasury Secretary Basant oppose this move. Morgan Stanley's chief US economist, Michael Gapen, pointed out that monitoring the monthly non-farm payroll report is a reliable indicator of economic health, particularly whether the pace of new job creation in the US labor market is sufficient to keep wage growth above inflation. Although Trump's tariffs and immigration policies may drag down the economy this year, Gapen believes the economy will still grow, albeit at a slower pace. Notably, Trump indicated on Thursday that tariff increases between the US and China may soon come to an end, suggesting a possible move to lower tariff levels, which boosted international oil and copper prices, leading to a general rise in Asia-Pacific stock markets.

2. Key Data (as of April 18, 12:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

Bitcoin: $84,600.27 (Year-to-date -9.56%), Daily spot trading volume $18.584 billion

Ethereum: $1,579.14 (Year-to-date -52.59%), Daily spot trading volume $9.99 billion

Fear and Greed Index: 33 (Fear)

Average GAS: BTC 1.5 sat/vB, ETH 0.37 Gwei

Market share: BTC 63.1%, ETH 7.2%

Upbit 24-hour trading volume ranking: AERGO, XRP, IQ, STRAX, ARDR

24-hour BTC long-short ratio: 1.0358

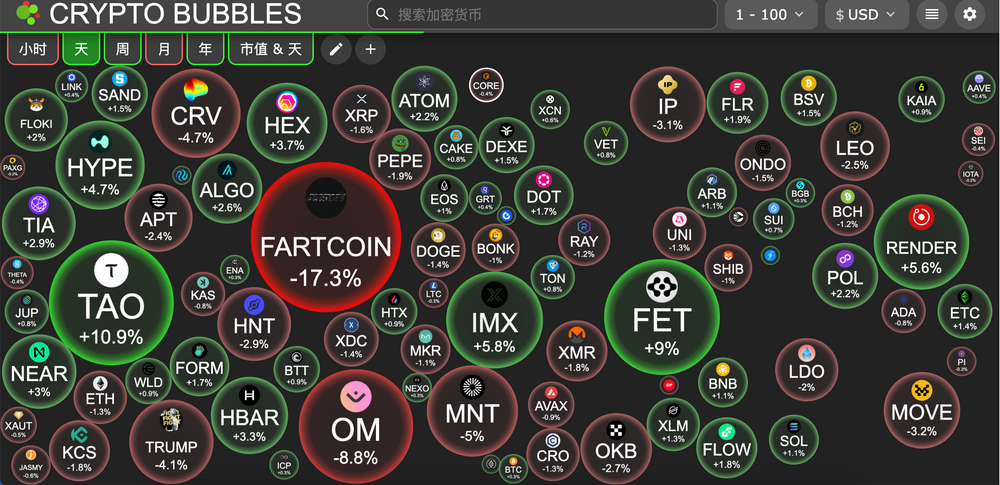

Sector performance: AI sector up 4.12%, GameFi sector up 2.98%

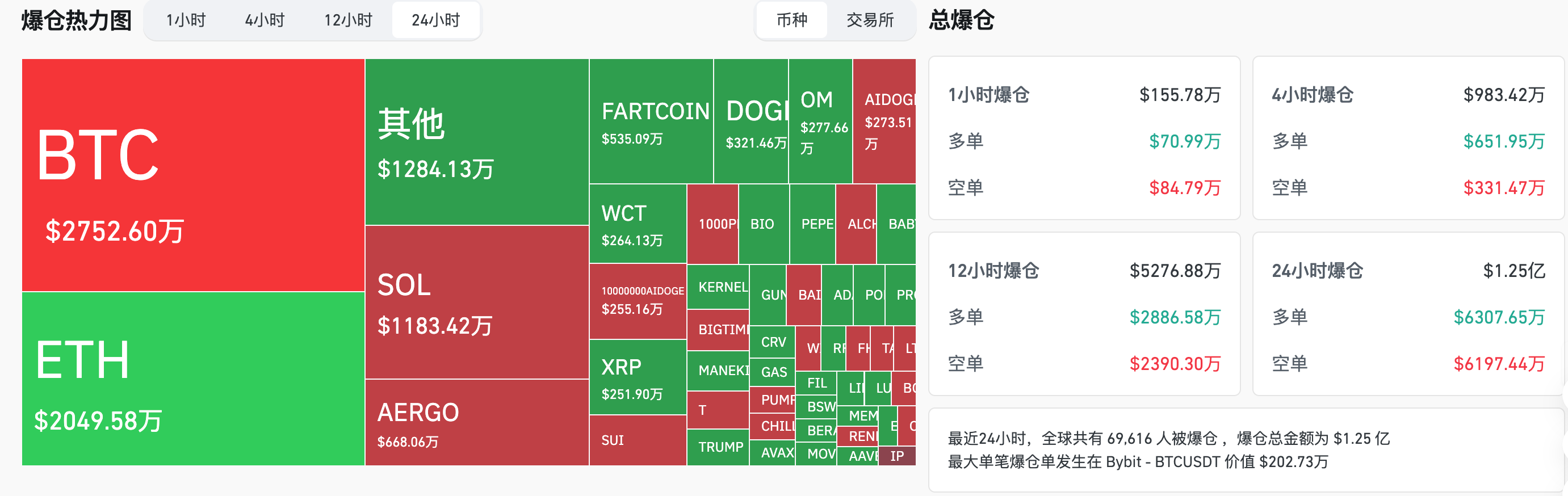

24-hour liquidation data: A total of 69,616 people were liquidated globally, with a total liquidation amount of $125 million, including $27.52 million in BTC, $20.49 million in ETH, and $11.83 million in SOL.

BTC medium to long-term trend channel: Upper channel line ($84,121.77), lower channel line ($82,456.00)

ETH medium to long-term trend channel: Upper channel line ($1,647.69), lower channel line ($1,615.06)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of April 17 EST)

Bitcoin ETF: $108 million

Ethereum ETF: $0 million

4. Today's Outlook

TRUMP will unlock 4% of the total supply tokens on April 18, worth approximately $321 million

Immutable (IMX) will unlock approximately 24.52 million tokens at 8 AM on April 18, accounting for 1.37% of the current circulating supply, worth about $1,060;

Melania Meme (MELANIA) will unlock approximately 26.25 million tokens at 8 AM on April 18, accounting for 17.5% of the current circulating supply, worth about $1,310;

QuantixAI (QAI) will unlock approximately 566,000 tokens at 8 AM on April 18, accounting for 3960.24% of the current circulating supply, worth about $49.9 million;

Fasttoken (FTN) will unlock approximately 20 million tokens on April 18, accounting for 4.65% of the current circulating supply, worth about $81 million.

Polyhedra Network (ZKJ) will unlock approximately 15.53 million tokens at 8 AM on April 19, accounting for 25.72% of the current circulating supply, worth about $35.25 million;

Today's top gainers among the top 500 by market capitalization: KEEP up 67.41%, AERGO up 62.53%, T up 52.24%, STIK up 34.52%, ZENT up 26.05%.

5. Hot News

Arizona's Cryptocurrency Reserve Bill Passed in House Committee, Enters Third Reading Stage

Binance Wallet to Host Lorenzo Protocol (BANK) Token Generation Event

sUSD Depegging Intensifies to $0.6825, 24-Hour Decline of 16.5%

A Giant Whale Invests Nearly $8 Million in $HYPE in Five Days, Profiting $266,000

GOMBLE (GM) to Launch on Binance Alpha and Initiate Airdrop Event

Family Offices Allocate Nearly Five Times the Share of Spot Ethereum ETP Compared to Bitcoin

Abraxas Capital-Linked Wallet Withdraws 1,107 BTC from Exchange Again, Worth $93.47 Million

US SEC to Hold Third Crypto Policy Roundtable on April 25, Focusing on Custody Issues

Powell: Future Banking Regulations Related to Cryptocurrency May Be "Relaxed"

Raydium Launches Token Issuance Platform LaunchLab, 25% of Fees Used for RAY Buyback

DWF Labs Establishes Office in the US and Invests $25 Million in WLFI Tokens

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。