Imagine this: when your company is facing a crisis of bankruptcy, you can easily defeat the annoying short sellers by simply issuing more shares to buy in, or just by announcing that you will use Bitcoin as an asset reserve, bringing you back to the center of market attention from the brink of liquidation. If this were true, would you do it?

After $MSTR became a hot topic in the investment circle again, Bitcoin is rapidly occupying the balance sheets of global enterprises. In this new capital game surrounding Bitcoin, some are chasing trends, some are poorly imitating, and others are discovering new business opportunities, transforming into the behind-the-scenes players creating "price miracles."

MSTR Flows to the World

In 2024, MSTR's stock price soared by 477%, ranking second among technology companies in the U.S. stock market with a market value exceeding $5 billion, second only to AppLovin. Bitcoin investments also brought the company up to $13.14 billion in book profits, pushing its market value to briefly exceed $100 billion, making it a star enterprise in the U.S. stock market.

As of April 2025, the company holds a total of 528,185 BTC, with a holding cost of approximately $33.14 billion and an average purchase price of $66,385. Based on Bitcoin's current price of about $81,400, the total market value is approximately $43 billion, accounting for over 2.5% of the global circulation.

Related Reading: “The strategy of ‘issuing bonds to buy coins’ hasn’t changed, why has MSTR’s premium suddenly soared?”

As early as August 2020, when the crypto market was at the end of a bear market, MicroStrategy purchased 21,454 BTC in the $10,000 range for the first time, initiating the "Bitcoin treasury strategy," becoming the first publicly traded company to invest corporate funds in Bitcoin on a large scale.

Since then, the company has continued to increase its holdings during the downturn from 2020 to 2022 and steadily increased its position in 2023. After Bitcoin entered a bull market from 2024 to 2025, MicroStrategy further accelerated its accumulation, forming a clear operational path of "building a base in a bear market, speeding up in a bull market." The frenzy of stock prices is like a stone thrown into a pond, creating ripples. Companies began to ask themselves: if we can't outrun Bitcoin, why not just buy it?

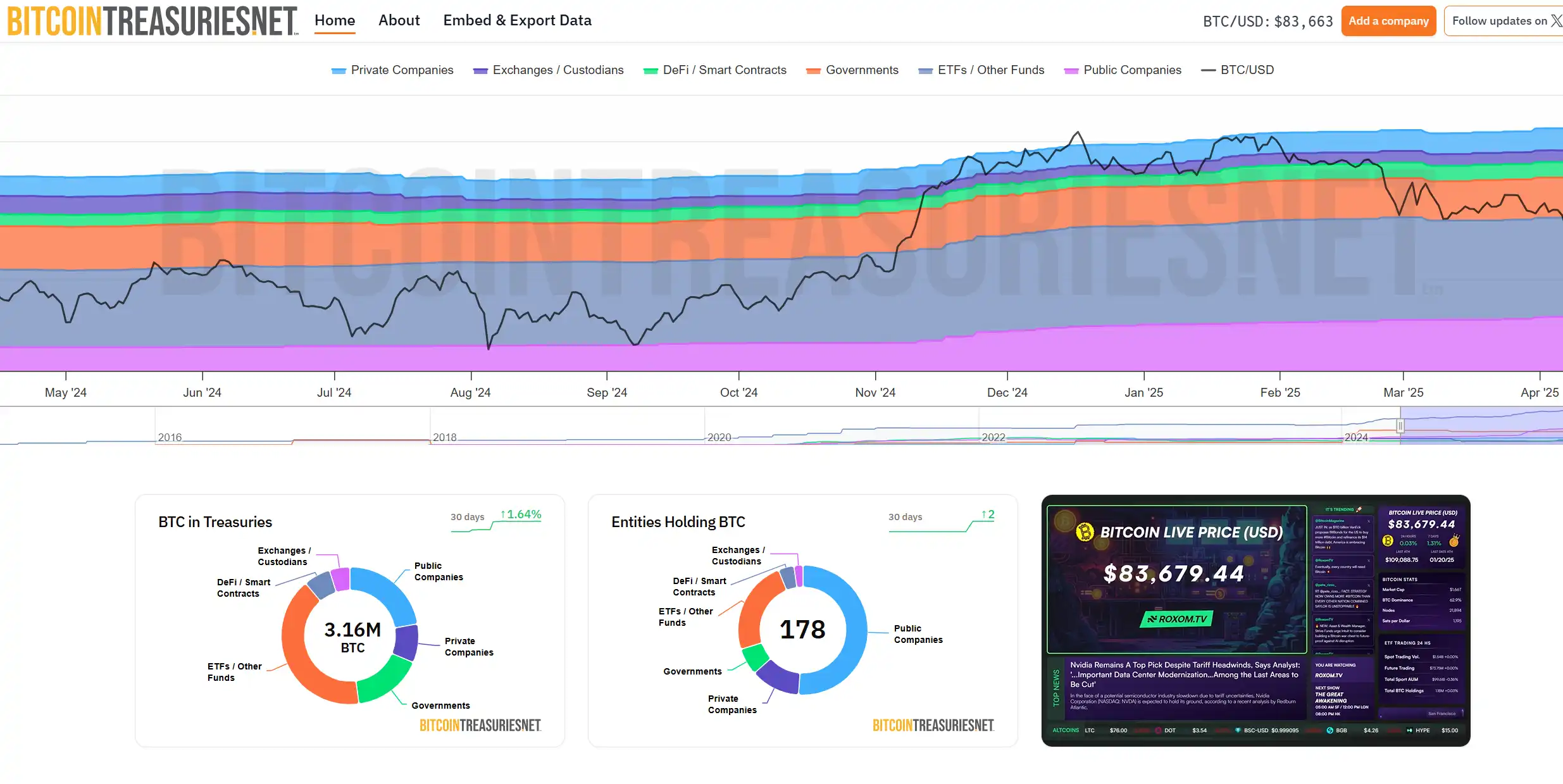

According to data from Bitcointreasuries, as of April 16, 2025, a total of 178 entities hold more than 3.16 million BTC, with publicly traded companies holding about 665,636 BTC, and this number is rapidly increasing. This "MicroStrategy" trend is sweeping the globe, involving 26 U.S. listed companies, 22 Canadian listed companies, and 8 Chinese (including Hong Kong) listed companies, including some originally low-profile, rarely noticed marginal enterprises.

Image Source: bitcointreauries.net

Represented by Hong Kong Asia Holdings, a group of traditional companies that were originally on the margins are reconstructing their business narratives through Bitcoin allocation.

This was originally a low-profile marginal enterprise primarily engaged in the wholesale and retail of prepaid products (such as SIM cards and value-added vouchers). In February 2025, the company spent $96,150 to purchase 1 Bitcoin for the first time, and upon the news, the company's stock price surged by 93%.

After tasting the sweetness, Hong Kong Asia continued to increase its holdings for three consecutive days, becoming the first publicly traded company in Greater China to officially write Bitcoin into its balance sheet.

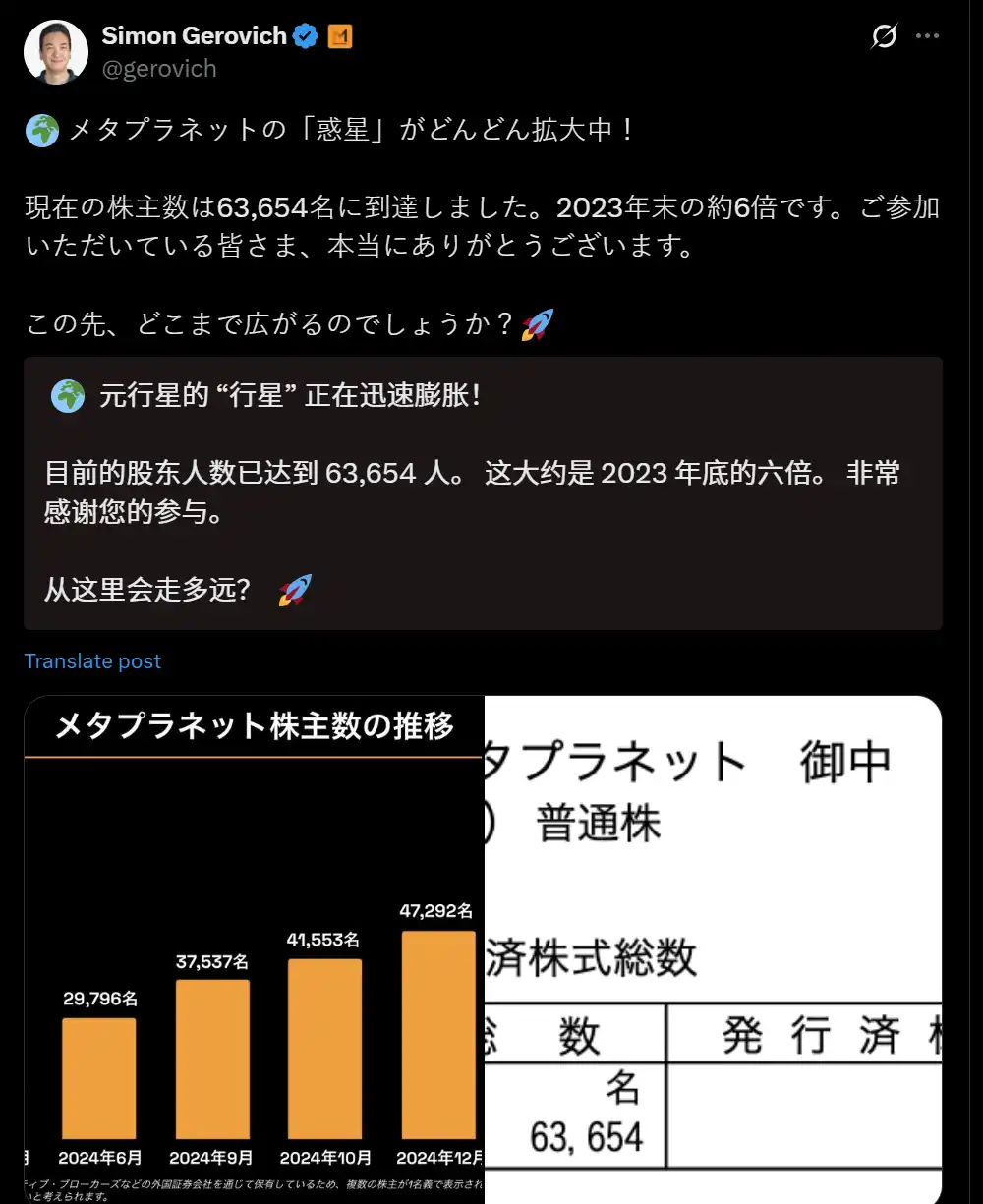

GameStop, the retailer that became famous during the "retail investor battle" in 2021, announced on March 27, 2025, that it would issue $1.3 billion in zero-coupon convertible bonds to purchase Bitcoin, causing its stock price to rise over 18% in pre-market trading due to related rumors. Japan's Metaplanet is also not to be outdone; since it imitated MicroStrategy to purchase Bitcoin in April 2024, its stock price has soared by about 4000%, with a target of 10,000 Bitcoins by 2025.

In addition to high-profile companies like GameStop, Hong Kong Asia Holdings, and Metaplanet, an increasing number of publicly traded companies worldwide, originally unrelated to the crypto field, are quietly replicating the MicroStrategy model, making a bold bet on Bitcoin as a hedge against inflation and a gamble on the future.

For example, Eric Semler, CEO of the U.S. medical company Semler Scientific, stated, "Not holding Bitcoin is irresponsible to shareholders." The board of India's Jerking company has also decided to significantly increase its Bitcoin holdings. KULR Technology has directly allocated 90% of its cash reserves to buy Bitcoin in batches, while Canada's cannabis company LEEF Brands issued $5 million in bonds to support Bitcoin, and Hong Kong's Boyaa converted $50 million worth of Ethereum into Bitcoin.

Related Reading: “Public companies ‘flocking’ to buy BTC: Top 15 profit rankings revealed, who grew nearly 30 times?”

From healthcare to cannabis, from North America to Asia, companies in different industries seem to be swept up by the same wave, diving into a field they may have been completely unfamiliar with. Since then, Bitcoin is becoming the "new protagonist" on the balance sheets of more and more companies.

The "Golden Finger" Behind the Price Miracle: Speculators, White Gloves, and Eric Trump

When capital meets political leverage, many "price miracles" are often staged. The trend represented by MicroStrategy is far from being as simple as it appears. Everything began to heat up dramatically with the market frenzy sparked by the potential re-election of "crypto president" Trump.

With the Trump administration promoting the implementation of a Bitcoin strategic reserve plan and the SEC repeatedly loosening crypto regulations, these policies acted like a favorable wind, pushing Bitcoin prices to approach the historical high of $110,000. When the crypto industry and politicians profit from each other, the undercurrents often go unnoticed.

In this global capital feast, where the stock market's undercurrents intertwine with the crypto market's frenzy, UTXO Management and Sora Ventures seized the opportunity, transforming into the "speculators" of the capital market, pushing a series of "meme stocks" to the forefront.

Amplification Effect

If you have been paying attention to the Hong Kong or Japanese stock markets recently, you may be puzzled by the sudden surge in several strange companies.

A cheap hotel operator, a game manufacturer relying on Texas Hold'em, and an old telecom company selling data cards, all of which have no significant business highlights, yet their stock prices have skyrocketed several times or even thousands of percentage points in a short period. What kind of magic pill have these previously struggling "sick stocks" consumed?

Let's take the most typical case, Metaplanet. This company was originally called Red Planet and was a cheap hotel operator. In 2024, CEO Simon, who graduated from Harvard and previously worked as a senior executive at Goldman Sachs in Tokyo, renamed the company to Metaplanet after selling most of its hotel business. This CEO also serves as the chairman of Red Planet Hotels and the head of a real estate company in Thailand.

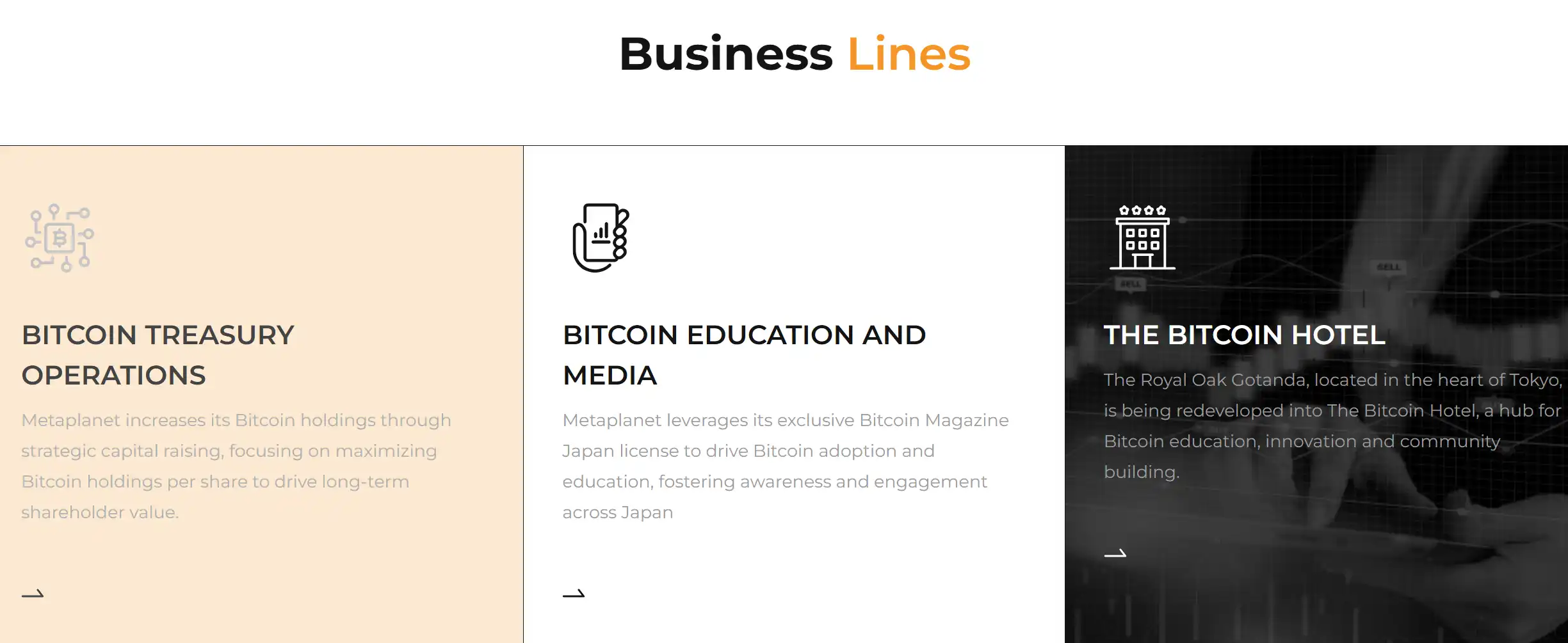

In addition to its core BTC strategy, Metaplanet is redeveloping its remaining hotel into "The Bitcoin Hotel," which is set to open in the third quarter of 2025, attempting to provide a one-stop service for the company from treasury management, operations to Bitcoin education.

Metaplanet's business scope (holding BTC, BTC education, BTC-themed hotel), Image Source: Metaplanet

Through this series of capital operations, Metaplanet has become "Japan's first publicly traded company holding Bitcoin," accumulating approximately 3,050 BTC in a short time and issuing 2 billion yen in bonds in 2024 to continue building its position. Its stock price has also skyrocketed from a long-term low of below 50 yen to over 4000%.

In April 2024, Jason Fang, founder of Sora Ventures, wrote on his personal Twitter account: Metaplanet is "Asia's first MicroStrategy," and through cooperation with UTXO Management, Mark Yusko, and others, helped Metaplanet incorporate Bitcoin into its balance sheet, becoming Japan's first publicly traded company holding Bitcoin.

This was Jason Fang's first appearance as a director of Metaplanet, bringing Sora Ventures to the forefront. In fact, Sora has been very aggressive on the path of "replicating MicroStrategy."

Similar operations seem to have occurred in the same year with the Hong Kong gaming company Boyaa Interactive.

Founded in 2004, Boyaa focuses on poker and other card games. Founder Zhang Wei graduated from Shenzhen University and once leveraged the enthusiasm of Chinese players to drive the stock price from HKD 5.35 to HKD 15.16. However, as the heat faded, the company quickly fell to the bottom, hovering below HKD 1 for many years. On November 14, 2023, Boyaa announced an investment of $100 million to enter the cryptocurrency space, focusing on Bitcoin and Ethereum.

In November 2024, the company suddenly announced that it would exchange 14,200 ETH on its balance sheet for 515 BTC, causing its total holdings to surge to 3,183 BTC, surpassing Japan's Metaplanet, with its stock price skyrocketing ninefold within a year. Subsequently, in December, Sora Venture announced the establishment of a $150 million fund specifically aimed at promoting the adoption of Bitcoin treasury strategies among Asian listed companies, with Boyaa Interactive being its first pilot.

Another noteworthy detail is that in July 2024, Boyaa publicly announced a $1 million investment in UTXO Management's Bitcoin ecosystem fund (UTXO Bitcoin Ecosystem Fund), hoping to enhance Boyaa's transformation exposure through resources from BTC Inc. (such as Bitcoin Magazine).

Sora Venture is not the only one on the "replication path"; in the two cases mentioned above, we can also see the shadow of another "helpful hand"—UTXO Management.

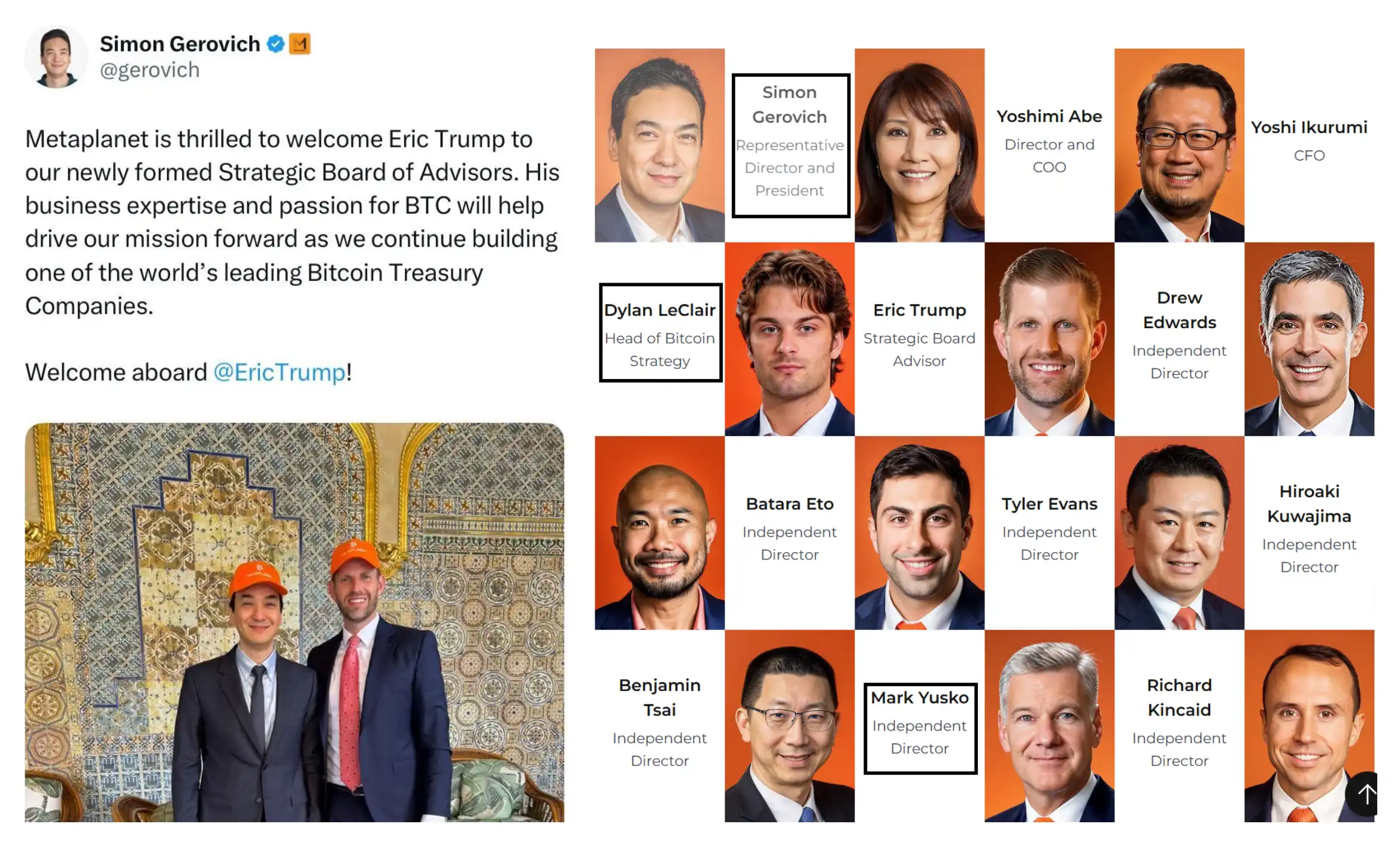

Behind the push for Metaplanet to adopt a Bitcoin strategy, UTXO Management played a key role, with partner Dylan LeClair serving as Metaplanet's Bitcoin Strategy Director and Tyler Evans as an independent director of Metaplanet. UTXO is also the main investment institution for Metaplanet.

This year, the two institutions joined forces again to operate another "price miracle" in the Hong Kong stock market.

At the beginning of 2025, Sora Ventures and UTXO Management jointly invested approximately HKD 126 million to acquire over 70% of Hong Kong Asia Holdings, officially taking control.

Hong Kong Asia Holdings was originally a company that relied on selling data cards and traditional distribution, with very low profits, and had long been classified as a "penny stock" in the Hong Kong stock market (with a stock price below HKD 1). After the acquisition, the company was renamed Moon Inc., undergoing a complete "crypto transformation" from the board to the management, and quickly established a treasury strategy centered on Bitcoin.

Image Source: http://1723.HK

However, as of the time of writing, the company only holds 28.88 BTC, and Hong Kong financial commentator Li Ming bluntly stated, "This level of holding doesn't even count as a test." Nevertheless, after the company announced its first purchase of 1 BTC, its stock price quickly rose from HKD 0.29 to HKD 0.38, an increase of about 31%. As of April 17, 2025, it closed at HKD 4.84, down 32.5% from its 52-week high, but still up about 1669% from the beginning of the year at HKD 0.29.

Sick companies are often low-cost, high-return targets for transformation. Companies like Metaplanet and Hong Kong Asia Holdings, which were "junk shell companies," had long-term depressed stock prices before implementing Bitcoin strategies. Sora and UTXO were never focused on these companies' businesses but rather on their cheap shell resources and potential capital amplification effects.

The "Bitcoin Operators" of the Trump Family

In the global stock market of 2024, Sora Ventures and UTXO Management acted like two skilled chess players, frequently making strategic moves.

In 2024, Sora Ventures, in collaboration with UTXO Management, launched the $2 million Sora TTP Fund, betting on the TTP ecosystem under the Ordinals protocol, becoming the world's first decentralized index fund based on Ordinals, attracting participation from founders of BTSE and Origin Protocol. With the promotion from UTXO and Bitcoin Magazine, the $PIPE token surged 150% within a month.

The story of Sora Ventures began in Hong Kong in 2017, where founder Jason Fang accumulated rich experience at the exchange BTSE and established this investment institution focused on the Bitcoin ecosystem. Initially, Sora primarily focused on early Web3 investments, managing over $100 million. By 2024, the company's ambitions gradually became apparent: to vigorously promote the adoption of Bitcoin as a core treasury strategy among Asian listed companies.

Sora's expansion has also benefited from close collaboration with UTXO. In the Metaplanet case, UTXO brought in Eric Trump, the second son of Trump, as an advisor. For some time, this crypto enthusiast has been paving the way for the Trump family's crypto landscape through World Liberty Financial.

Left: A photo of Eric and Simon; Right: Core members of Metaplanet; Image Source: X, Metaplanet

So what is UTXO's background?

The story of UTXO Management begins in Tennessee, USA, as the investment arm of BTC Inc. (the organizer of Bitcoin Magazine and the Bitcoin conference). They initially focused on allocating Bitcoin assets for high-net-worth clients and had already invested in over 60 mining and early-stage project companies as early as 2013.

With the approval of Bitcoin ETFs in 2024 (BlackRock recommended a 5% allocation, signaling traditional capital's willingness to invest in Bitcoin), UTXO immediately sensed the opportunity for institutional capital and began its transformation. UTXO's hedge fund, 210k Capital, became a rising star in this transformation, achieving an annual return of 164% by heavily investing in Bitcoin treasury stocks like Strategy and Metaplanet, ranking among the top five in HFR.

Its Chief Investment Officer, Tyler Evans, proudly stated, "80% of our investment portfolio is concentrated in Bitcoin-related stocks, with Metaplanet and Strategy being the main sources of returns." These companies have provided the most comfortable entry point for institutional investors (such as the Wisconsin Teachers Retirement Fund and the Abu Dhabi Sovereign Wealth Fund) to enter Bitcoin through "securitizing Bitcoin."

Meanwhile, The Smarter Web Company, in which UTXO Management invested, plans to IPO on the UK Aquis Exchange and is referred to as the "UK version of Metaplanet," with its Bitcoin treasury model penetrating the European market. UTXO's series of layouts are all backed by the resource-rich parent company BTC Inc., not to mention the implicit support from the political resources of the Trump family.

The relationship between BTC Inc. and the Trump family goes far beyond mere cooperation; it is deeply rooted in the intertwining of business interests and political resources.

As the organizer of Bitcoin Magazine and the world's largest Bitcoin conference, BTC Inc. provides a platform for the Trump family to control public opinion through its strong industry influence, while also supporting the Trump family through a series of business collaborations.

The origins of this relationship can be traced back to Trump's 2024 campaign, during which he publicly supported the crypto industry for the first time as a presidential candidate at the Bitcoin 2024 conference organized by BTC Inc. BTC Inc. CEO David Bailey personally organized a high-profile fundraising dinner, with ticket prices reaching $846,000 per person, raising $25 million for the campaign.

Trump repeatedly mentioned BTC Inc.'s support in his speech, praising it as "a pillar of the Bitcoin community." During the campaign, BTC Inc. continuously reported on Trump's crypto policy stance through Bitcoin Magazine, garnering significant support from crypto industry voters.

After the successful campaign, BTC Inc. continued to provide a platform for the Trump family's crypto policies through the conferences it organized. From December 9 to 10, 2024, at the Abu Dhabi Bitcoin MENA conference, Trump's son Eric Trump served as a keynote speaker, predicting that Bitcoin would reach $1 million and emphasizing that his father would become "the most supportive president of crypto in history."

The relationship between BTC Inc. and the Trump family centers on the mutually beneficial exchange of public opinion control and political resources. BTC Inc.'s Bitcoin Magazine continues to endorse the Trump family's crypto projects, such as reporting on the establishment of American Bitcoin and the progress of World Liberty Financial.

From financial support during the campaign to policy promotion at conferences and commercial layouts in mining enterprises, the two have been inseparable. This "duet" inevitably raises many associations regarding the political influence and business ambitions behind it.

"There will be more and more MicroStrategy-like companies in the U.S. stock market"

As Michael Saylor said, more and more "MicroStrategy" companies are emerging in the U.S. stock market. A closer examination of these "MicroStrategy" companies reveals that their underlying motivations are not the same. Not every company is as deeply tied to Sora and UTXO as Metaplanet; some companies are more like "borrowing coins," optimizing their balance sheets by holding Bitcoin or considering market capitalization management.

Why are U.S. companies buying Bitcoin?

In the growing ranks of U.S. companies buying Bitcoin, GameStop may be a typical representative. This once-dominant offline game retail giant is attempting to extend its life through a "hold coin transformation," using Bitcoin to hedge against inflationary pressures and the unattractive data on its financial statements, driven more by a desire to "want to buy" rather than "have to buy."

The announcement of purchasing Bitcoin through $1.5 billion in convertible bonds and CEO Ryan Cohen's $10.7 million stock buyback both stimulated a short-term rise in stock prices, but the stock quickly fell back afterward. While the $1.5 billion investment is substantial, it pales in comparison to GameStop's reported losses of over $100 million in 2024, making it seem like a drop in the bucket.

GameStop's series of actions appears more like an attempt to recreate the glory of the 2021 meme stock craze through the Bitcoin boom, with a strategy leaning more towards capital market operations rather than business transformation.

Cohen's stock buyback is more of a short-term stimulus. Based on his experience selling the pet e-commerce platform Chewy for $3.2 billion, Ryan Cohen's style has always been heavily influenced by e-commerce marketing.

According to media reports, although GameStop has total assets of $5.875 billion, nearly 81% of that is cash reserves, while cash flow from operating activities is only $146 million, clearly indicating its struggles to profit from its core business. The decision to allocate a quarter of its assets to Bitcoin highlights GameStop's reliance on speculative strategies without addressing its core business issues.

Another company with stagnant stock prices and ample cash is Semler Scientific. Chairman Eric Semler joined the board two years ago, self-identifying as a "radical on the board." He described Semler at that time as a "zombie company making money but not receiving market recognition," with an asset structure very similar to MicroStrategy in 2020: high cash, low growth, and low valuation.

Semler chose not to pursue mergers or drastic business reforms but instead pushed the company to incorporate Bitcoin into its treasury strategy, becoming the second U.S. publicly listed company to do so after MicroStrategy. This move triggered a market re-evaluation of its value and brought much-needed attention to its previously overlooked business.

However, not all companies blindly follow the "MicroStrategy-style" Bitcoin treasury operations. In October 2024, Microsoft seriously discussed whether to include Bitcoin on its balance sheet at a shareholder meeting, ultimately rejecting the proposal by an overwhelming vote. The main concern centered on Bitcoin's high volatility potentially disrupting the company's financial stability. Microsoft CFO Amy Hood also made it clear: "Our capital allocation is more focused on core growth areas like AI and cloud computing, rather than venturing into speculative assets."

Can anyone be like MicroStrategy?

Comparing these companies, it is not difficult to see that MicroStrategy deeply binds Bitcoin to its financial structure, going all-in for the long term. In contrast, other companies are either trying to save themselves with Bitcoin (Hong Kong Asia Holdings), using it as a financial hedge (Metaplanet), or perhaps just hoping to gamble for some alpha (GameStop).

It would be inaccurate to label them all as "poor students" imitating the top achievers; a more precise description is that they all want to do something with Bitcoin, but their directions differ.

Currently, MicroStrategy's holdings are 27,987 times that of Hong Kong Asia Holdings, 125 times that of Metaplanet, and 30 times that of GameStop, with a series of other smaller companies also holding very little. The disparity in holdings between MicroStrategy and these companies is significant, as small-scale investments cannot form a true hedging effect.

The more critical distinction lies in the overwhelming financing capabilities. MicroStrategy operates as if it has unlimited ammunition; when funds are insufficient, it can issue bonds, and it benefits from ultra-low borrowing rates, resulting in a lower average cost for Bitcoin.

Since 2020, it has raised over $10 billion through bond issuance and stock increases, with a $1 billion stock issuance in 2024 to continue accumulating, and in the first quarter of 2025, it raised a total of $7.69 billion, with $4.4 billion allocated for Bitcoin purchases. This continuous financing capability allows MicroStrategy to keep accumulating Bitcoin amid price fluctuations.

In contrast, Hong Kong Asia Holdings' funds for Bitcoin purchases only came from the acquisition by Sora Ventures and UTXO Management (costing HKD 126 million), with almost zero subsequent financing capability. Although Metaplanet raised funds through issuing zero-coupon bonds, its total investment was only about $250 million, far less than MicroStrategy's scale. GameStop issued $1.5 billion in convertible bonds, but after the announcement, its stock price plummeted by 22.1%, clearly indicating a lack of market confidence in its financing.

From a stock market perspective, the U.S. stock market has strong liquidity, and Saylor's operations often quickly reflect in stock prices. In contrast, Hong Kong Asia Holdings is limited by the low liquidity of the Hong Kong stock market, where small-cap stocks are easily manipulated, and price movements are more driven by retail investor sentiment. Metaplanet is also constrained by the inherent ceiling of the Japanese market, limiting its growth potential.

From the perspective of company equity, Metaplanet, Hong Kong Asia Holdings, and GameStop exhibit a highly dispersed ownership structure, with a significant number of small and medium investors in the shareholder composition, rather than being dominated by a single or a few large shareholders. For instance, about 40% of GameStop's shares are held by retail investors, and a single post on Reddit or Twitter can cause its stock price to jump by several percentage points, with sentiment rising and falling rapidly.

For secondary market investors, these companies may resemble leveraged BTC concept stocks.

Illustration: The number of shareholders in Metaplanet continues to soar.

In contrast, MicroStrategy is backed by stable large asset management companies like BlackRock and Vanguard, and founder Saylor holds 20% of his company's shares, providing much greater overall stability. One operates like a speculative trading group, while the other resembles a government bond fund; it's not about which is better, but rather whether you want to chase a trend or place a bet.

In terms of market attention and importance, MicroStrategy was included in the Nasdaq 100 index in 2024, with institutional holdings rising to 60%. Defiance and T-REX subsequently launched leveraged ETFs for MicroStrategy, allowing for 2x long and short positions (such as MSTX, SMST, MSTU). As of now, MicroStrategy is held by 216 ETFs, with VanEck having the most significant allocation, and the ETF halo is comparable to that of the "seven giants" of the U.S. stock market.

In contrast, other "trend-following entrants" like GameStop, Metaplanet, and Hong Kong Asia Holdings do not have any exclusive ETF products and have not been significantly included in mainstream ETFs. In this elite club, lacking the backing of an index like Nasdaq makes it challenging to gain the "golden protection" of the capital market.

"Fentanyl Addiction": The Risk of Systemic Collapse in the Stock Market

As of April 7, 2025, the global market experienced severe turbulence due to Trump's announcement of increased tariffs, causing Bitcoin prices to drop like a cold wind, with the stock prices of Hong Kong stock 1723 (Hong Kong Asia Holdings), GameStop, Metaplanet, and MicroStrategy all falling in response.

The high correlation between these companies' stock prices and Bitcoin prices exposes a clear risk: they are like the same type of tree planted on the same mountain, and once a storm hits, they are likely to fall collectively. This "copycat" Bitcoin strategy may seem to bring short-term prosperity, but it also buries the potential for systemic collapse.

By betting their fate on a single asset, Bitcoin, these companies lack diversified support. If market sentiment towards Bitcoin shifts or regulations tighten, a chain reaction of funding chain breaks, debt pressures, and market confidence collapse could occur.

While MicroStrategy appears somewhat stable due to its scale and first-mover advantage, its holding of over 440,000 BTC is backed by high-leverage financing, and the risk of debt default cannot be ignored. In contrast, Hong Kong stock 1723, GameStop, and Metaplanet have much smaller capital sizes, making their risk resistance almost negligible. The essence of this strategy is to amplify speculation to the extreme without building a moat around their core businesses.

Related Reading: "If MicroStrategy is forced to sell BTC, how much selling pressure will it bring to the market?"

A deeper issue is that most of these companies are not engaged in "substantial activities." Hong Kong Asia Holdings' SIM card business has no growth prospects, GameStop's physical retail is dwindling, Metaplanet's Web3 transformation is largely superficial, and even MicroStrategy's software business has long been marginalized.

They choose Bitcoin not because it synergizes with their core business but because they see it as a "lifeline" in the capital market. If companies in the stock market abandon real industries in favor of chasing speculative trends like Bitcoin, it is hard to imagine the entire economic ecosystem could become unbalanced.

Imagine if giants like Microsoft and Apple also abandoned technological innovation to hoard Bitcoin; what would be left of the global industry's foundation? The real economy is the backbone of the economy, creating value and solving needs, rather than merely relying on financial leverage to build bubbles.

In summary, as the impact of tariffs causes a slowdown and the tide recedes, those companies without solid business support are destined to be exposed. The capital market should reward those who are grounded and create long-term value, rather than blindly chasing speculative stories. After all, a healthy forest requires a diversity of tree species, not just a single speculative tree.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。