Industry Overview

At the beginning of 2025, the cryptocurrency market opened amidst a complex mix of optimism and uncertainty. The industry had multiple expectations for the new year: the potential benefits of a shift in the Federal Reserve's monetary policy, a second wave of the AI technology revolution, and the new U.S. government's commitment to a "crypto-friendly" regulatory framework were all seen as catalysts for breakthroughs in the industry. However, as the dust settled in the first quarter, the market presented a stark picture of "strong macro narratives with significant volatility, and deep-seated micro innovations."

The global macroeconomic environment became the core variable driving market rhythms. The Federal Reserve struggled to balance between recurring inflation and recession risks. The unexpected hype around recession rate cut expectations in March briefly boosted risk appetite but failed to offset the liquidity panic triggered by the bursting of the U.S. stock market valuation bubble. Meanwhile, the Trump administration fulfilled its campaign promises, promoting Bitcoin as a national strategic reserve and digital asset strategic reserve, as well as implementing the "Digital Asset Regulatory Clarity Act," which released structural benefits for the industry. However, the parallel between policy dividends and the SEC's lenient enforcement also intensified market debates over the "cost of compliance transformation." After Bitcoin broke through the historical high of $100,000 again in January, it faced a 30% deep correction, exposing the market's capital to phase-based profit-taking on the "halving narrative." The overall performance of the altcoin market was lackluster, but the birth and delivery of products related to RWA and user entry, which brought in capital and user increments, still injected underlying innovative momentum into the industry. Notably, centralized exchanges (CEX) like Binance accelerated their layout of decentralized exchange (DEX) ecosystems, promoting seamless user access to DeFi and other dApp scenarios through on-chain liquidity aggregation and account abstraction technology. For the first time, CEX users were allowed to trade DEX assets directly within their accounts. This paradigm shift of "integration of centralization and decentralization" may become a key pivot for growth and breakthroughs in the next cycle.

Macroeconomic Environment and Impact

In the first quarter of 2025, the U.S. macroeconomic environment had a profound and complex impact on the cryptocurrency market. For the cryptocurrency market, the correlation between the entire crypto market and U.S. stocks has increasingly strengthened since ETFs began trading BTC spot. The performance of the Nasdaq to some extent directly determined the direction of the cryptocurrency market. Although BTC was dubbed "digital gold" in its early years, cryptocurrencies are currently more inclined towards risk assets rather than safe-haven assets, being more affected by market liquidity. ArkStream will continue to monitor macroeconomic trends in the future. The core of the macroeconomy lies in balancing inflation and economic strength; the market trades on expectations for the future: if inflation is too high or the economy is too strong, the Federal Reserve will tend to delay rate cuts, which is unfavorable for capital markets. Conversely, if the economy performs too weakly, it may trigger recession risks, which is also detrimental to market confidence and capital flow. Therefore, the macroeconomy needs to find a delicate balance between strength and weakness to provide a favorable environment for capital markets. The DOGE sector's large-scale layoffs of government agency staff directly caused an increase in the unemployment rate. Meanwhile, Trump's tariff policy exacerbated inflationary pressures by directly raising the prices of affected goods and the costs of related service industries, increasing the likelihood of a recession in the U.S. economy.

This series of policies has increased market instability, leading to greater volatility in capital markets. Considering the high gains brought by the 2024 Q4 election market and the potential for significant short-term market fluctuations causing retracement risks, ArkStream Capital reduced its investment plans in Q1 2025, focusing more time and energy on exploring OTC strategies and channel expansion. However, considering that such policies may not merely be economic control measures but rather a means for the Trump administration to increase leverage in political negotiations with other countries, or to deliberately create chaos to achieve specific political and economic objectives—such as forcing the Federal Reserve to quickly implement emergency defensive rate cuts by creating signs of economic recession to alleviate the U.S. national debt issue while stimulating economic growth and capital market performance—we remain optimistic about the subsequent performance of the cryptocurrency market.

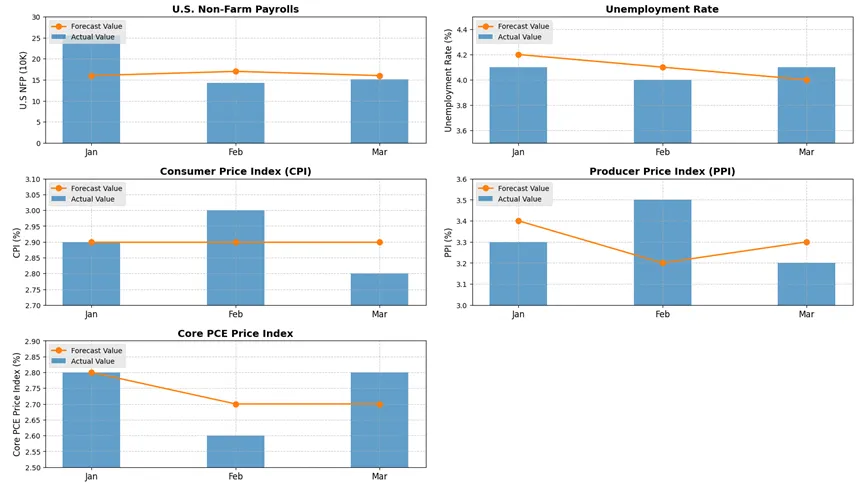

In the first quarter, the cryptocurrency market's response to macroeconomic data demonstrated a high degree of sensitivity. Below is a month-by-month analysis of market performance in January, February, and March.

In January, U.S. macroeconomic data was overall strong, but the market reacted relatively calmly. On January 10, the seasonally adjusted non-farm payroll data for December was released, with an expected value of 160,000 and an actual value of 256,000, significantly exceeding market predictions. The unemployment rate for December, released on the same day, was 4.1%, lower than the expected 4.2%, further confirming the strong economic performance. On January 14, the year-on-year PPI for December was announced at 3.3%, slightly below the expected 3.4%, seen as a sign of short-term easing of inflationary pressures. However, on January 15, the unadjusted CPI year-on-year for December was 2.9%, in line with expectations but up 0.2% from the previous month, beginning to raise market concerns about rising inflation and delayed rate cuts. On January 31, the core PCE data for December was 2.8%, in line with expectations, and did not significantly disturb market expectations. Overall, January's data did not cause noticeable volatility in the cryptocurrency market, as the strong employment market and stable inflation data kept the prices of assets like BTC relatively stable.

Entering February, the cryptocurrency market experienced sharp fluctuations due to deviations between macroeconomic data and expectations. On February 7, the seasonally adjusted non-farm payroll data for January was released at 143,000, below the expected 170,000. The unemployment rate for January, released on the same day, was 4.0%, lower than the expected 4.1%, indicating uncertainty in the employment market and exacerbating market uncertainty in the short term. On February 12, the unadjusted CPI year-on-year for January was announced at 3.0%, higher than the expected 2.9%, with inflation continuing to rise and exceeding expectations, leading to a collapse in market confidence regarding rate cuts. Traders generally bet that rate cuts might only occur once in December this year, which had a huge negative impact on market sentiment, causing BTC to drop 2,500 points within 15 minutes after the data was released, a decline of 2.66%. The next day, the year-on-year PPI for January was announced at 3.5%, higher than the expected 3.2%, further intensifying concerns about downward adjustments in rate cut expectations. This was seen as a trigger for weakened buying power, and in the following half month, BTC fell by about 20%, with a decline of 20,000 points. It wasn't until February 28, when the core PCE price index for January was announced at 2.6%, below expectations, that the market stabilized and formed a bottom. Notably, the weak performance of the financial and medical services sectors in the PPI data had already provided early signals for the PCE's decline.

In March, the overall improvement in macroeconomic data led to a slight recovery in market sentiment, but the core PCE's better-than-expected performance again triggered volatility. On March 7, the seasonally adjusted non-farm payroll data for February was released at 151,000, slightly below the expected 160,000. The unemployment rate for February, released on the same day, was 4.1%, higher than the expected 4.0%, indicating slight weakness in the employment market. On March 12, the unadjusted CPI year-on-year for February was announced at 2.8%, below the expected 2.9%; on March 13, the year-on-year PPI for February was announced at 3.2%, slightly below the expected 3.3%. This series of data indicated that the economy was operating on a solid foundation, with inflationary pressures easing, and the rate cut process expected to accelerate. As a result, the cryptocurrency market experienced a brief rebound in the following 10 days. However, on March 28, the year-on-year PCE price index for February was announced at 2.5%, in line with expectations, but the core PCE year-on-year was 2.8%, higher than the expected 2.7%. In the 10 hours before the data release, the market experienced a noticeable drop due to concerns over the core PCE exceeding expectations, demonstrating ongoing sensitivity to inflation data.

In summary, in the first quarter of 2025, U.S. macroeconomic data had a significant and variable impact on the cryptocurrency market. January's strong economy saw a muted market response, February's inflation exceeding expectations led to a sharp drop in rate cut expectations and a significant decline in BTC, while March's improvement in economic data spurred a brief rebound, but the core PCE exceeding expectations again triggered a pullback. Trump's tariff policy, by exacerbating inflationary pressures, increased market uncertainty and may become a crucial factor in pressuring the Federal Reserve to adjust its policies. Looking ahead, the trajectory of the cryptocurrency market will remain highly dependent on macroeconomic data and the Federal Reserve's policy direction, and investors need to closely monitor the dynamics of inflation and employment data to accurately grasp market trends.

Trump Administration's Cryptocurrency Policy and Impact

In March 2025, Trump signed an executive order requiring the establishment of a strategic Bitcoin reserve, primarily funded by approximately 200,000 Bitcoins (valued at about $18 billion) seized from criminal or civil forfeitures, and prohibited the government from selling Bitcoins in the reserve. This move aims to elevate Bitcoin as a "sovereign reserve asset," enhancing its legitimacy and liquidity while promoting the U.S. leadership in the digital asset space. Although Bitcoin's price surged over 8% in the short term, boosting market confidence, the market soon believed that the reserve relied solely on forfeited assets without any new purchase plans, leading to a rapid price decline. In the long run, this move may prompt other countries to follow suit, pushing Bitcoin to become an international reserve asset. Additionally, a series of non-Bitcoin digital assets may also be included in the digital asset reserve. This marks a transition of cryptocurrencies from marginalized assets to national strategic tools. Despite short-term market reactions being hindered, its long-term impact may reshape the global financial system: on one hand, promoting Bitcoin to become a mainstream reserve asset, and on the other hand, intensifying competition among sovereign nations in the digital finance sector.

In terms of regulation, after taking office, Trump pushed to dismiss SEC Chairman Gary Gensler and established a cryptocurrency asset working group to clarify the classification standards between securities and non-securities tokens, terminating lawsuits against companies like Coinbase. Additionally, the controversial accounting standard SAB 121 was abolished, reducing the financial burden on companies. The regulatory environment has significantly loosened, accelerating the entry of institutional investors; traditional financial institutions like banks have been authorized to conduct crypto custody business, promoting the industry's compliance process. This series of regulatory policies has changed the ecology of the U.S. cryptocurrency and financial industry through deregulation, restructuring frameworks, and promoting legislation. In the short term, policy dividends may accelerate technological innovation and capital inflow; however, in the long term, systemic risks and the complexity of global regulatory competition must be monitored. The effectiveness of policy implementation in the future will depend on multiple variables, including judicial challenges, economic cycles, and political negotiations.

Regarding the development of stablecoins, the Trump administration established a federal regulatory framework for stablecoins, allowing stablecoin issuers to access the Federal Reserve's payment system and explicitly prohibiting the Federal Reserve from issuing central bank digital currency (CBDC) to maintain the innovative space for private cryptocurrencies. The application of stablecoins in cross-border payments has accelerated, expanding the path for the internationalization of the dollar; the market share of private stablecoins has increased, deepening integration with the traditional financial system.

In terms of tariff policy, in February 2025, Trump signed the "Reciprocal Trade and Tariff Memorandum," requiring U.S. trading partners to align their tariff rates with those of the U.S. and imposing tariffs on countries implementing value-added tax systems. This memorandum serves as a framework document for adjusting U.S. trade policy, aiming to reduce the U.S. trade deficit and address issues of trade inequality and imbalance. Subsequently, Canada, Mexico, the European Union, and others quickly took countermeasures, leading to a spiral increase in global tariff barriers for the first time. On April 2, 2025, Trump signed an executive order on reciprocal tariffs, further detailing and implementing the policy direction outlined in the February memorandum. This order aims to reduce the U.S. trade deficit, promote the return of manufacturing, and protect the U.S. economy and national security by requiring higher reciprocal tariffs on countries with the largest trade deficits with the U.S. This move triggered rapid countermeasures from the major affected countries, particularly China, which took corresponding countermeasures immediately, leading to a serious divergence and friction in the economic and trade relations between the two sides.

Under the influence of such tariff policies, global trade costs are bound to increase, and the scale of international trade may shrink. Production costs have risen sharply, supply chain restructuring has accelerated, and corporate investment willingness has declined. Most critically, the U.S. will have to face the pressure of imported inflation. The Federal Reserve's monetary policy is caught in a dilemma, with expectations for rate cuts being postponed. The tariff policy has also forced companies to shift production to Latin American countries like Mexico, but the lack of infrastructure and labor shortages in the U.S. hinder the return of manufacturing. Industries reliant on global supply chains, such as automotive and electronics, have been severely impacted, increasing profit pressures on multinational corporations, leading to a pullback in the stock prices of U.S. tech giants. Emerging markets face challenges in accommodating the transfer of industrial chains and are unlikely to fully compensate for the demand gap from the U.S. in the short term. The trade war has also weakened trust in the dollar as an international trade settlement currency, resulting in a decline in the prices of ten-year Treasury bonds and a corresponding rise in yields. Behind this is the Trump administration's plan to reduce debt expenditures and borrowing costs, prompting some countries to explore paths to de-dollarization. In the financial markets, global financial markets, including U.S. stocks, A-shares, and the Nikkei, have generally seen significant declines, with market liquidity facing immense pressure.

Trump's cryptocurrency policy, through regulatory easing and strategic reserves, has temporarily boosted market confidence and attracted capital inflows, but in the long term, it is necessary to be wary of the risks of centralized computing power and policy reversals. While the tariff policy is framed under the banner of "America First," it has led to the fragmentation of the global trade system, driving up inflation and exacerbating expectations of economic recession, forcing capital to flow from risk assets to safe-haven assets like gold. These two major policies highlight the contradictions and gamesmanship of the U.S. in the transformation of the digital economy and the real economy.

Since its launch in 2024, the DeFi project World Liberty Financial (WLFI), supported by the Trump family, has had a multidimensional impact on the cryptocurrency industry due to its political background and capital operations. WLFI is seen as a "barometer" of the Trump administration's crypto-friendly policies, with its asset allocation and strategic partnerships interpreted by the market as a "presidential selected portfolio," attracting investors to follow suit. In the short term, this may exacerbate the market's reliance on "political narratives," driving price fluctuations of specific tokens, while in the long term, it is necessary to be wary of the risks of policy reversals. Additionally, WLFI launched the USD1 stablecoin in March 2025, emphasizing compliance and institutional-grade custody. If it successfully penetrates cross-border payment and DeFi scenarios, it may weaken the market share of existing stablecoins while promoting the digitalization of the dollar, consolidating the U.S.'s dominant position in the global financial system.

Furthermore, WLFI's operations benefit from the Trump administration's policy adjustments, providing a compliance template for similar projects, lowering industry compliance thresholds, and attracting traditional financial institutions to participate in crypto business, but it may lead to market bubbles due to regulatory arbitrage.

In terms of long-term strategic value, WLFI heavily invests in various cryptocurrencies, such as BTC, ETH, AAVE, ONDO, and ENA, thereby resonating with the "strategic crypto reserve" policy promoted by the Trump administration. This layout may guide more capital to focus on cryptocurrency assets, thereby promoting digital asset reserves to become the core narrative of the next cycle. At the same time, WLFI's operational model provides a reference case for other projects in "government-business interaction," and more crypto projects relying on political forces may emerge in the future, but it is necessary to balance compliance with decentralization principles.

In summary, WLFI's impact on the cryptocurrency industry has a double-edged sword effect. On one hand, it accelerates the compliance process through political empowerment, promotes the integration of DeFi and institutional capital, and explores the global application of the dollar stablecoin; on the other hand, reliance on policy dividends may lead to market bubbles, and opaque profit distribution may trigger a trust crisis, while poor project execution could become a negative case for the industry. In the future, it is essential to focus on the progress of WLFI's product implementation, the market acceptance of USD1, and the supporting role of the Trump administration's policy coherence.

Integration of CEX and DEX

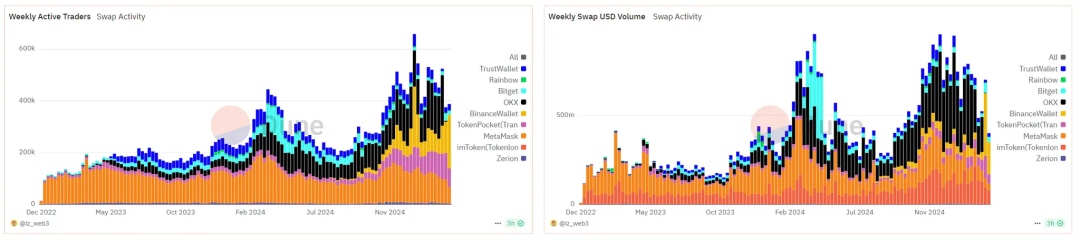

Exchanges and Web3 wallets serve as important entry points into the crypto world. Users often first use fiat currency on mainstream exchanges to recharge assets and engage in cryptocurrency trading, lending, and wealth management, or interact with various dApps through Web3 wallets on different public chains. In the past, the boundaries between the two were clear. Due to the high threshold and educational costs of using Web3 wallets, ordinary users typically began their Web3 journey through exchanges, which retained users by providing more mature and liquid services compared to decentralized dApps. Especially entering 2025, exchange businesses have become more mature compared to the previous cycle, with Binance announcing in 2024 that its user base reached 200 million, doubling from the previous cycle. In contrast, the number of native on-chain users in Web3, constrained by various factors, is only about 10% of that of centralized exchanges.

Since 2023, exchanges have leveraged their accumulated experience in managing exchange wallet assets to enter the Web3 wallet product market. Among them, OKX Wallet has attracted numerous users at the product level, successfully garnering a large user base due to its excellent product experience in asset management, on-chain interaction, and trading optimization. CEX has utilized its advantages in the exchange wallet module, such as building different public chain RPCs, to create more comprehensive and superior wallet products, achieving user attraction and retention. However, OKX Wallet is essentially not significantly different from traditional Web3 wallets; it is merely a higher quality, more convenient multi-chain wallet that does not break the usage threshold of native Web3 wallets.

The Binance Web3 Wallet is closely tied to exchange accounts, initially supporting rapid receiving and sending of assets between on-site assets and Web3 wallets, reducing users' security concerns when using Web3 wallets and providing guarantees from the exchange level. At the same time, Binance Web3 has launched multiple IDOs aimed at ordinary users in collaboration with mainstream DEXs within its ecosystem, attracting more on-site users to participate and learn about on-chain knowledge. Additionally, its latest wallet feature allows on-site users to directly purchase Alpha series on-chain assets, achieving the functionality of purchasing on-chain assets directly from within the CEX, completely breaking the traditional boundaries between CEX and DEX.

Data Source: Dune, https://dune.com/lz_web3/wallet-war

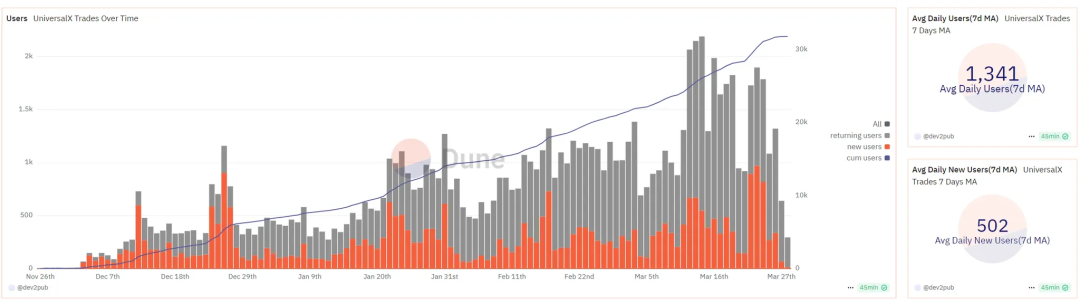

Unlike the mainstream CEX-dominated Web3 wallets, native crypto projects can focus on the actual and urgent needs of on-chain users in the wallet field. Particle Network, leveraging its years of experience in MPC and account abstraction technology, has seized the unified account demand arising from multi-chain transactions and launched UniversalX. This product integrates wallets and trading platforms, effectively solving the challenges of transferring and trading assets across different chains, helping users achieve convenient asset management and efficient trading in a multi-chain environment. With this innovative product, Particle Network has gained a good reputation and widespread recognition in the market.

Data Source: Dune

The integration of CEX and DEX is not only a technological innovation but also a milestone in the cryptocurrency market's transition from "opposition and fragmentation" to "collaborative coexistence." This transformation, while enhancing efficiency and inclusivity, also gives rise to new challenges in regulation, security, and governance. In the future, whoever can better balance centralized efficiency with the security and autonomy of decentralized assets will be able to dominate the evolution direction of the next generation of financial infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。