No Federal Reserve Chair has ever been dismissed by a president.

Written by: Nik Popli

Translated and organized by: BitpushNews

The Federal Reserve has long prided itself on its independence. However, as U.S. President Donald Trump escalates his attacks on Federal Reserve Chair Jerome Powell for refusing to cut interest rates, this tradition of "independence" is facing new pressures.

On Thursday, Trump told reporters in the Oval Office, "If I wanted him gone, believe me, he would be gone quickly."

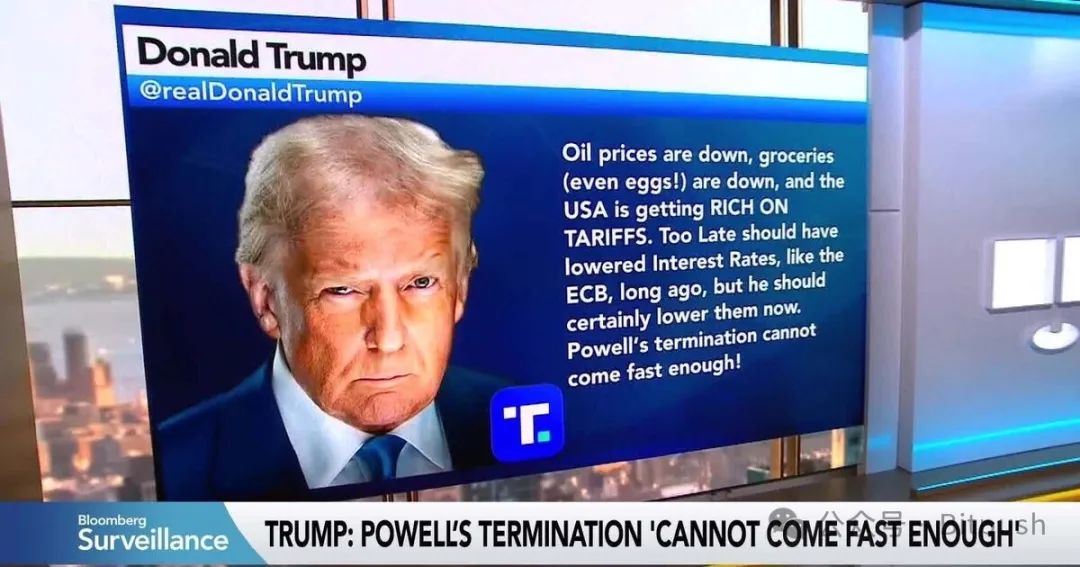

On his social media platform Truth Social, Trump reiterated, "Get Powell out, it can't happen fast enough!"

Image source: Bloomberg

These remarks are among Trump's sharpest actions to undermine the political independence of the Federal Reserve—a key institution traditionally independent of the White House, responsible for maintaining economic stability.

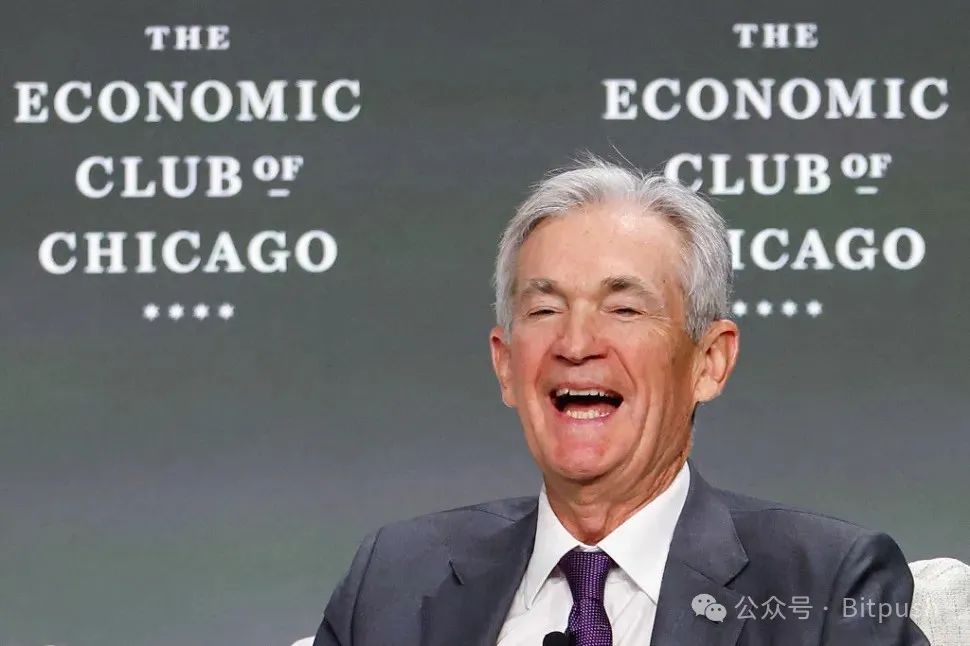

The day before, during a speech at the Chicago Economic Club, Powell rebutted political interference, stating that the Federal Reserve would make decisions solely based on what is best for the American people.

Powell said in his speech, "That is the only thing we will do… We will never be influenced by any political pressure… Our independence is a legal issue."

Powell added that Federal Reserve governors "cannot be dismissed without cause" and that "our terms are long, seemingly endless."

Nevertheless, this has not stopped Trump from attempting to fire the Federal Reserve Chair. "I don't think he's doing a good job," the president said on Thursday, claiming that Powell's interest rate cuts came "too late."

Powell was initially nominated to lead the Federal Reserve by Trump in 2017 and was re-nominated by Joe Biden in 2022. His current term as Chair will last until May 2026.

While previous presidents have expressed dissatisfaction with the Federal Reserve's interest rate decisions conflicting with their policy goals, Trump's remarks have raised new concerns about political interference in monetary policy, a development that could spook markets and damage the central bank's credibility.

Trump's aggressive stance has even raised concerns among some of Powell's critics, including senior Democratic Senator Elizabeth Warren, who earlier warned that undermining the Federal Reserve's independence could spell disaster for U.S. markets.

Sarah Binder, a senior fellow at the Brookings Institution and Federal Reserve expert, said, "The Federal Reserve needs public confidence." "But if the president tries to push Powell out, that will only increase the uncertainty that markets do not want to see."

Here is what you need to know about the limitations of presidential power over the Federal Reserve and what it means for the economy.

Can Trump fire Powell?

Legally, the answer is complex and untested. No Federal Reserve Chair has ever been dismissed by a president.

The Federal Reserve Act allows for the removal of board members, including the Chair, "for cause." However, this has historically been interpreted as misconduct or incapacity, rather than policy disagreements. Sarah Binder said, "Courts typically do not view disagreements over interest rate setting as 'misconduct.'"

Although Trump and his allies have raised the possibility of firing Powell since his first term, they have not done so, likely due to the unclear legal prospects and potential negative repercussions.

Powell himself has also made it clear that he would not resign voluntarily. When asked last November if he would resign if Trump asked him to, he simply replied, "No."

Nonetheless, the Trump administration appears to be preparing for a potential confrontation. Treasury Secretary Scott Bessent recently told Bloomberg that he expects to begin interviewing potential replacements for Powell in the fall.

As Trump pushes to remove Powell, the U.S. Supreme Court is currently hearing a case involving the president's power to dismiss senior officials of independent agencies.

While the case involves the National Labor Relations Board and the Merit Systems Protection Board, its implications could be broader. If the court sides with the Trump administration, it could be interpreted as a signal of how it will resolve the legal conflict surrounding Trump's desire to remove Powell, although the Federal Reserve has stated it does not believe the challenge applies to it.

At the heart of this debate is a nearly century-old legal precedent: the 1935 Supreme Court ruling in "Humphrey’s Executor v. United States," which limited the president's power to dismiss leaders of independent agencies without cause. This ruling has long protected the Federal Reserve Chair from political dismissal, but it may soon be tested by a conservative Supreme Court.

The stakes for the economy

Trump has accused Powell of failing to take sufficiently aggressive action to support economic growth, claiming that the Federal Reserve Chair is "playing politics" by keeping interest rates unchanged.

However, U.S. central bank officials—and many economists—hold the opposite view: an independent Federal Reserve is crucial for managing inflation and guiding the economy, and yielding to political demands could undermine the economy and global trust in U.S. institutions.

Powell insists that the Federal Reserve's decisions are "entirely based on what is best for all Americans."

In his speech on Wednesday, he warned that Trump's sweeping tariffs could push the U.S. economy into a "challenging situation," characterized by rising inflation and slowing growth—conditions that complicate the Federal Reserve's dual mandate of stabilizing prices and maximizing employment. Trump's tariffs have increased the costs of many imported goods, squeezing household budgets and raising concerns about a policy-induced economic slowdown while inflation remains above the Federal Reserve's 2% target.

Meanwhile, Trump is calling for immediate interest rate cuts, pointing out that the European Central Bank cut rates on Thursday.

Yale University's Budget Lab estimates that the inflationary effects of Trump's tariffs amount to an additional real tax burden of $4,900 per U.S. household. At the same time, long-term interest rates have surged, raising borrowing costs for homebuyers, businesses, and consumers.

Jerome Powell's experience

At 71 years old, Powell is currently serving his second term as Chair of the Federal Reserve, the most powerful economic decision-making body in the U.S. As a Republican and former investment banker, he was initially appointed to the Federal Reserve Board by Obama in 2012 and was elevated to Chair by Trump in 2017. Biden later re-nominated him, indicating broad bipartisan trust in his ability to lead the central bank.

During Powell's tenure, the Federal Reserve has responded to a series of economic shocks, from the recession triggered by the pandemic to the most severe inflation surge in 40 years. Under his leadership, the central bank lowered interest rates to near zero in 2020 to stabilize the economy during COVID-19, then began raising rates in 2022 to curb inflation that had surged above 9%.

Although inflation cooled in March to a six-month low, the process has been bumpy, with Powell facing criticism from both sides for whether the Federal Reserve's actions were too slow or too aggressive.

Binder said, "The level of support for Powell may have dropped significantly compared to (Trump's) first term when the economy was indeed performing very well. Many might argue that the Federal Reserve's efforts to curb inflation in 22-23 came too late, committing a significant policy error. So the question now is, who will stand up to support the Federal Reserve in this situation?"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。