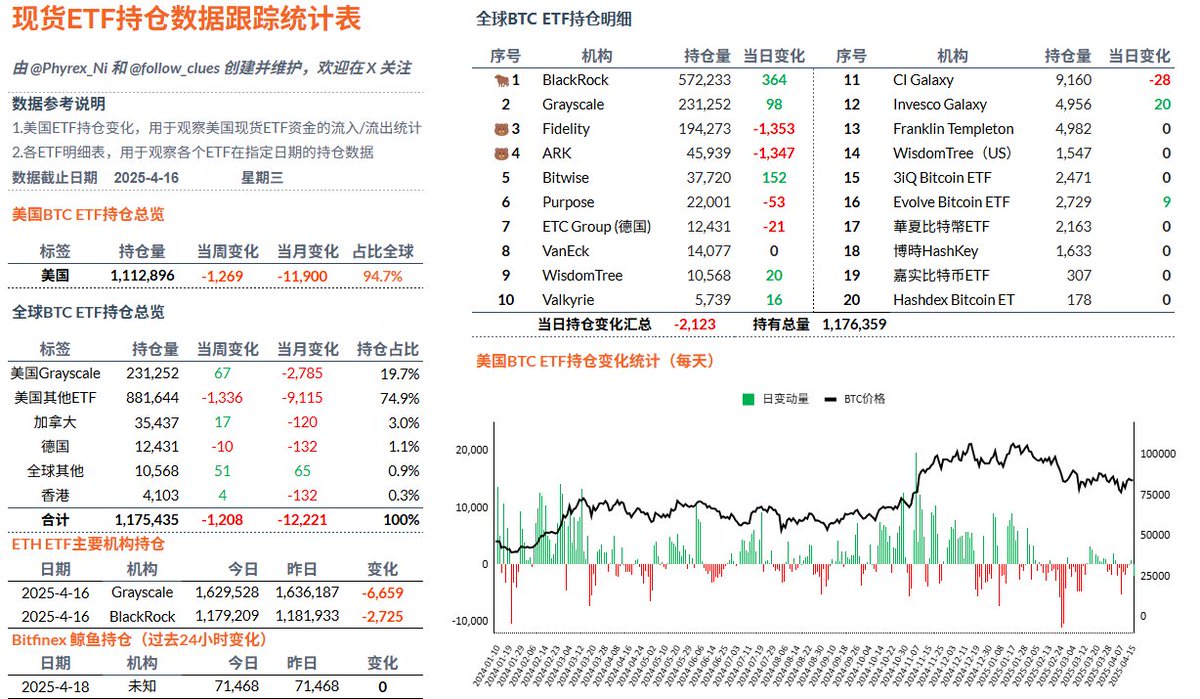

On Wednesday, the data for Bitcoin spot ETFs turned to net outflows again, mainly due to Fidelity and ARK each selling over 1,000 $BTC. Meanwhile, BlackRock's investors saw net inflows for the third consecutive working day, although it was still only a three-digit inflow. Currently, investor sentiment has not fundamentally changed, remaining cautious about the market.

Today is the last trading day, and the next three days will be a holiday. Before the holiday, news emerged that the U.S. and China are about to reach a "very good" tariff agreement, which has somewhat helped investor sentiment. However, the GDP data at the end of the month remains an important basis for the short-term market.

The trading difficulty in April has indeed been quite high, primarily due to various uncertainties. However, as we move into May, the trend may gradually become clearer. As long as there are no unexpected issues with tariffs, their impact on the market will gradually decrease, with more pressure coming from the economy.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。