Author: Stacy Muur

Compiled by: Tim, PANews

In the past 15 months, the liquidity landscape of DeFi has been reshaped across various chains. Projects driven by speculative hype have gradually exited the stage, and liquidity has quietly concentrated in places with strong fundamentals rather than market speculation.

Key Insights

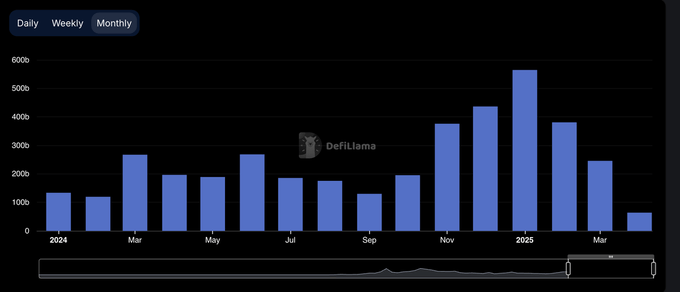

- DEX trading volume reached a historic high of $380 billion in January 2025, followed by a 35% drop in the next two months, suggesting that January may have formed a short-term peak.

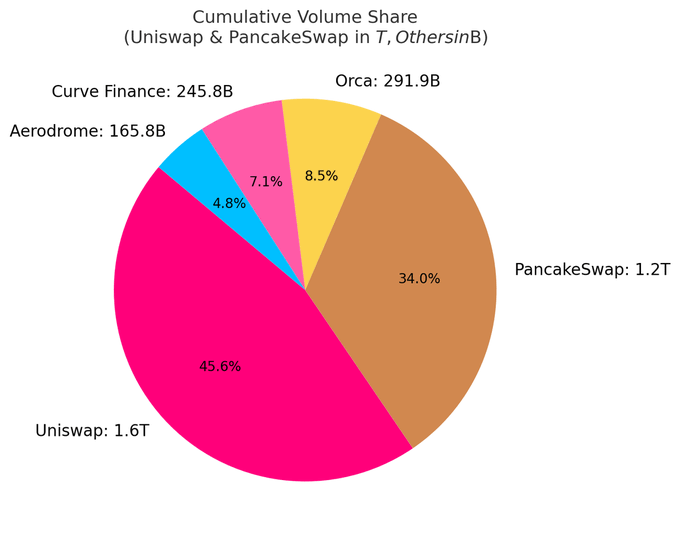

- Currently, the top ten DEXs account for nearly 80% of total trading volume; Uniswap and PancakeSwap alone account for about 40% of the share.

- Solana-based DEXs have quietly dominated the rankings, occupying 5 out of the top 10, with their market share growth primarily driven by the trading volume brought by the Meme coin craze.

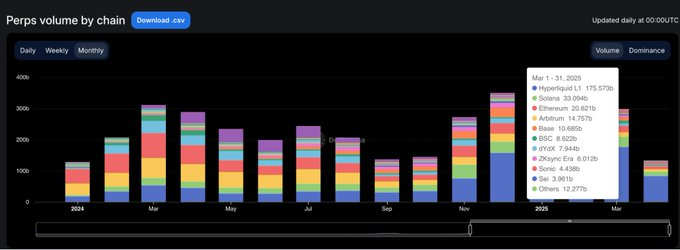

- Hyperliquid has completely transformed the perpetual contract landscape, rising from an industry newcomer to capturing over 60% of the market share by March 2025.

All insights in this article are based on publicly available data. Special thanks to DefiLlama for continuously providing high-quality statistical data.

A Cycle Defined by Surge and Slowdown

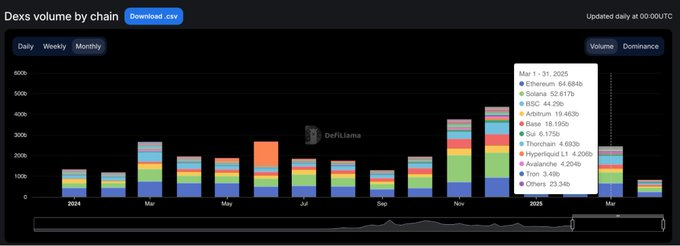

At the beginning of 2024, DEX trading volume performed strongly in March and May, then gradually slowed down before mid-year.

The situation changed dramatically in the fourth quarter, with trading volume surging in November and December, continuing into January 2025, reaching an explosive peak of $380 billion.

However, this rebound was short-lived. By February, market trading volume had plummeted to $245 billion, marking a 35% cliff drop that concluded three months of vertical surges. This retreat set the tone for a more cautious second quarter.

DEX Dominance: Leading Protocols Hold Power

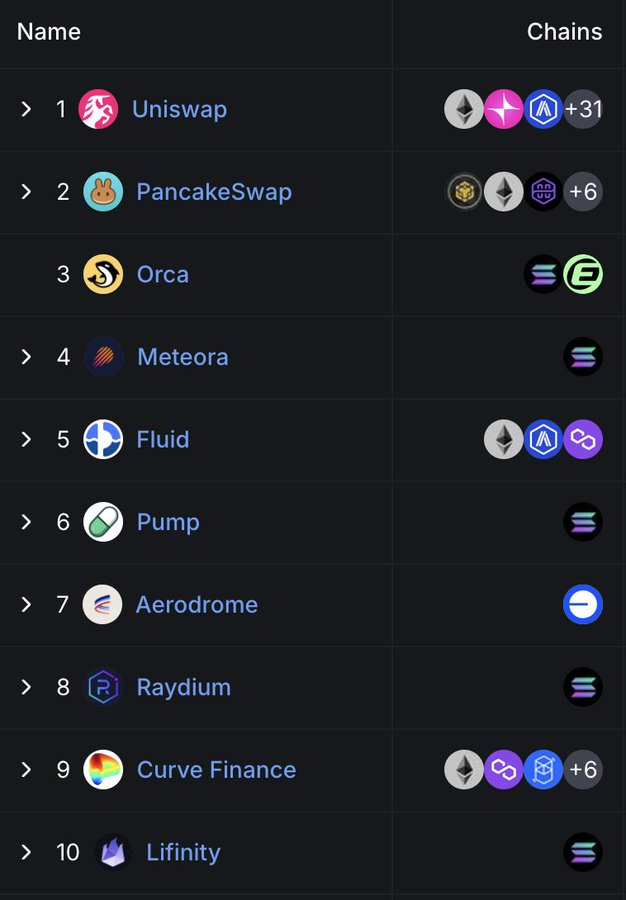

The market landscape of DEXs remains highly concentrated. Currently, the top ten protocols account for 79.5% of daily trading volume, with the top five alone accounting for 59.1%.

Uniswap and PancakeSwap together account for about 40% of DEX trading volume, being the only two platforms to surpass a cumulative trading volume of $1 trillion. Their leading position stems from first-mover advantage, extensive support for multi-chain ecosystems, and deep liquidity.

Uniswap Labs has also launched Unichain, an Ethereum Layer 2 network built on the Optimism Superchain. This chain aims to achieve fast, low-cost transactions through native multi-chain interoperability.

The Quiet Rise of Solana

Notably, Solana's position in the DEX space is becoming increasingly prominent. Currently, five of the top ten DEXs, including Orca, Meteora, Raydium, Lifinity, and Pump.fun, are natively developed on Solana.

Orca (8.02%) and Meteora (6.70%) alone account for about 15% of global decentralized exchange activity.

This growth is attributed to low GAS fees, fast block times, and the Solana Meme coin craze. Pump.fun's rise to the top ten is a testament to this fervor.

Emerging Protocols: Fluid and Aerodrome

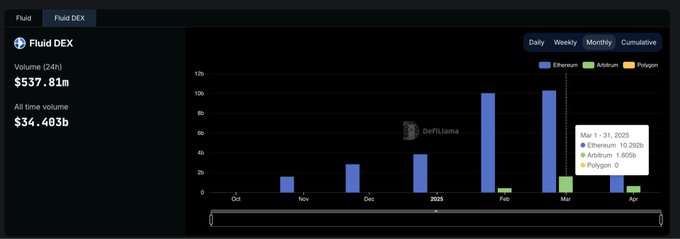

Fluid (7.09%) is the most capital-efficient platform among the top five DEXs. The protocol is active on Ethereum, with monthly settlement amounts exceeding $10 billion. Its performance has been particularly impressive since launching in the Arbitrum ecosystem: trading volume surged from $426 million in February to $1.6 billion in March, indicating its adoption speed far exceeds the industry average.

Aerodrome, as a native project of Base, showcases the continued growth of liquidity on Base L2.

Although Hyperliquid does not rank high in the spot market, it dominates the perpetual contract market, with a market share exceeding 60%.

DEX Market Share Across Chains: Easy to Grow, Hard to Retain

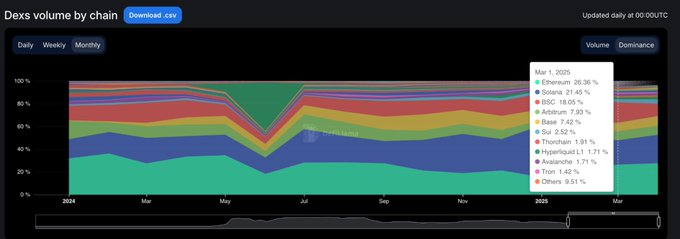

The past 15 months have clearly demonstrated a phenomenon: most blockchain projects can attract attention, but only a few can maintain their appeal. From January 2024 to March 2025, the market share of chain-level decentralized exchanges changed rapidly, with only a handful of projects truly exhibiting user stickiness.

Solana achieved the most significant breakthrough. It steadily climbed in 2024, driven by the TRUMP and MELANIA Meme coin craze, reaching a market share peak of 45.8% in January 2025. However, by March, its market share was halved to 21.5%, yet it still maintained the top position among all public chains with an average share of 25.1%.

Ethereum, on the other hand, had a completely opposite trajectory. Starting with about 32% in early 2024, it fell to 15.3% in January 2025, then rebounded to 26.4% in March. Even though Ethereum lost growth momentum, its ecological resilience remains intact.

Base is the most robust contender, growing steadily from 3% in March 2024 to 12.4% in December, then dropping to 7.4% in March 2025, maintaining an average share of 6.6% during this period. Without speculative support, it has shown slow but sticky growth.

BNB Chain maintains stability with an average share of 14.7%. There have been no dramatic surges or drops, consistently sustaining stable retail capital flow.

Arbitrum started strong (16% share) but faltered, dropping to 4.8% by January 2025, overtaken by both Base and Solana.

Blast peaked at a market share of 42.3% in June 2024 but disappeared the following month. This is a clear case of incentive-driven trading volume with zero user retention.

In summary, the DEX dominance of various public chains exhibits strong volatility. Solana once surged, Ethereum achieved value recovery, and Base gradually expanded its ecosystem, while the market speculation cycle showed significant ups and downs. Ultimately, the public chain that occupies the dominant position is not the one with the loudest voice, but the one with the highest actual usage rate.

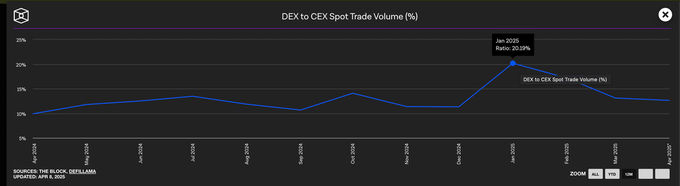

Centralized Exchanges Still Dominate Spot Trading Volume

Despite the explosive growth of DEXs in early 2025, centralized exchanges still dominate the spot market. Even in January, when DEX trading volume peaked, CEXs accounted for nearly 80% of total trading volume.

Although the dominance of centralized exchanges dropped from 90% in early 2024 to a low of 79%, the broader trend is evident: while DEXs continue to grow, CEXs remain the default choice for most traders.

Perpetual Protocol Market Share

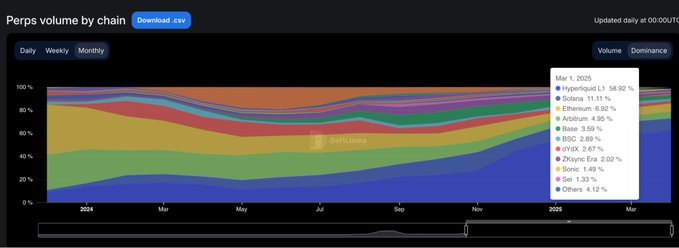

The landscape of on-chain perpetual contracts underwent a fundamental shift in 2024.

After dYdX held the top position in perpetual contract trading for over two years, Hyperliquid emerged, redefining what dominance means. The platform first topped the rankings in February but was briefly surpassed by SynFutures mid-year, reclaiming the top spot in August and then pulling ahead decisively. As of March 2025, Hyperliquid captured nearly 59% of the total trading volume in perpetual contracts, solidifying its position as the preferred platform for professional traders.

This rise has attracted significant market attention, with its product experience being closer to centralized exchanges than any previous decentralized exchange. In contrast, dYdX's market share has rapidly declined, dropping from 13.2% at the beginning of 2024 to just 2.7% by March 2025, as users flocked to faster, more streamlined, and modern alternative platforms.

Jupiter's perpetual contracts took a different approach, leveraging Solana's native liquidity and the traffic from its spot DEX, rising to second place with an 8.8% market share. Although it rose quickly, it lacked staying power and ultimately fell behind Hyperliquid. Other projects like SynFutures, Vertex Protocol, and Paradex also briefly emerged.

Perpetual Contract Chains: Execution Layer Reconstructed Within a Cycle

The most significant change in the perpetual contract infrastructure over the past year has not been which protocols users prefer, but rather which chains they trust to execute trades.

By March 2025, the trading volume share of perpetual contracts on Ethereum and Arbitrum had plummeted to 11.8%, starkly contrasting with their combined market dominance of over 65% in January 2024, as newer, faster execution layers have now fully taken over.

The driving force behind this transformation is the blockchain independently developed by Hyperliquid. During the same period, it significantly increased its market share from 13.6% to 58.9%, replacing various Layer 1 and Layer 2 solutions that had defined industry standards in less than a year, becoming the default execution environment for perpetual contract trading. Its advantages are not only reflected in faster transaction speeds but, more importantly, it provides the reliability and low-latency guarantees demanded by professional traders.

Solana also experienced a strong surge, driven by the Jupiter and Phoenix projects at the end of 2024, with its market share climbing to nearly 16%. However, it ultimately stabilized in the 10-11% range, failing to maintain its breakthrough growth momentum. Meanwhile, the Base and ZKsync ecosystems showed vitality (with market share peaks reaching 6-7%) but never managed to break into the ranks of top public chains.

At the same time, Blast became a cautionary tale: this fleeting project reached an 18.8% market share in June 2024 but vanished just as quickly. In a field driven by product quality and user retention, mere speculation cannot last long. The new industry execution standard has become clear: performance-centric public chains have redefined the competitive benchmark, and traditional infrastructure no longer holds a default advantage.

The future of DeFi lies not in multi-chain expansion but in those protocols that can transform industry narratives into user habits.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。