On April 17, 2025, Federal Reserve Chairman Jerome Powell delivered a highly anticipated speech at the Chicago Economic Club. Although the crypto market did not receive clear benefits such as interest rate cuts, Powell explicitly stated that there is "room for relaxation" in cryptocurrency regulatory policies for banking institutions. He affirmed the trend of mainstreaming cryptocurrencies in recent years and particularly emphasized the need to establish a clear regulatory framework for stablecoins, sending a positive signal in support of innovation and development in the crypto industry.

Shift in Banking Regulation

Powell pointed out that there is "room for relaxation" in the current cryptocurrency regulatory policies for banking institutions. While affirming the trend of mainstreaming cryptocurrencies, he particularly emphasized the need to establish a clear regulatory framework for stablecoins. This statement, while stressing the importance of maintaining financial security and stability, released a policy signal supporting industry innovation and development. He acknowledged that regulatory agencies had previously taken a cautious stance due to "successive incidents of failures and fraud" in the cryptocurrency sector, but noted that the current market environment has fundamentally changed.

On March 7 of this year, coinciding with the first-ever White House cryptocurrency summit, the Office of the Comptroller of the Currency (OCC) released a series of explanatory documents, marking a substantial shift in the U.S. regulatory attitude towards digital assets.

For many years, the U.S. banking system has maintained a rejectionist attitude towards cryptocurrencies, often completely refusing to provide services to blockchain companies, even earning the nickname "Chokehold Action 2.0." Now, the latest guidance issued by the OCC removes key barriers, allowing national banks to conduct digital asset business more freely while maintaining a strict risk management framework.

OCC Eases Crypto Regulation, Embraces Financial Innovation

As an independent agency under the U.S. Department of the Treasury, the OCC is primarily responsible for regulating national banks to ensure their safe and sound operation. Historically, the OCC has taken a cautious stance on banks participating in cryptocurrency-related activities, requiring additional approvals and implementing strict reviews. However, under the leadership of Acting Comptroller Hood, who took office in early 2025, the OCC has adopted a more supportive attitude towards innovation, aligning with the overall effort to integrate digital assets into the mainstream economy.

On March 7, 2025, the OCC officially announced that banks can now offer services such as cryptocurrency custody, stablecoin reserves, and participation in blockchain nodes without special approval. This overturned the restrictive guidance from the Biden administration that required banks to consult regulatory agencies before engaging in crypto business.

The OCC's new position essentially views crypto services as part of traditional banking operations, eliminating the additional regulatory barriers that previously hindered financial institutions from entering the field. "Digital assets should and must become a part of the U.S. economy," Acting Comptroller Hood stated, "I am committed to developing a regulatory framework for digital assets that promotes innovation while maintaining the safety, soundness, and fairness of the federal banking system."

The new explanatory documents revoke the 2021 Interpretive Letter No. 1179, which had set strict regulatory requirements for banks participating in cryptocurrency activities. Under the revised policy, national banks can now offer cryptocurrency custody services to clients, ensuring the secure storage and management of private keys; banks are also permitted to hold reserves of stablecoins pegged 1:1 to the U.S. dollar; additionally, banks can participate as nodes in blockchain networks to validate transactions, thereby enhancing their support for decentralized financial services. These changes signify a significant adjustment in the regulatory framework, providing banks with more flexible operational space to deeply integrate into the digital asset sector.

Accelerating the Integration of Banking and Blockchain in the U.S.

The OCC's actions indicate increased confidence in banks' ability to manage crypto risks and resonate with the overall trend of integrating blockchain technology into the financial system. Given the industry's growing maturity and the improvement of risk management practices, the agency believes that previous strict reviews are no longer necessary.

This regulatory shift coincides with President Trump's reaffirmation of his commitment to abolishing the "exclusion of crypto companies from banking services" policy. He stated at the White House cryptocurrency summit: "Last year, I promised to make the U.S. the world's Bitcoin superpower and the global capital of crypto, and today we are taking historic action to fulfill that promise."

Although the OCC's move is a significant boon for the digital asset industry, challenges remain. The Federal Reserve and the Federal Deposit Insurance Corporation have yet to clarify their positions on crypto banking operations, and federal agencies may still impose restrictions through other regulatory channels. However, the OCC's latest guidance undoubtedly marks a turning point—the U.S. financial system is finally opening its doors to digital assets. By streamlining approval processes and recognizing the legitimate financial instrument status of digital assets, the OCC has laid the groundwork for broader adoption of cryptocurrencies. The banking industry now has clear regulatory guidance to utilize blockchain technology to meet the new demands of modern economic development.

The banking sector may worry that stablecoins could siphon off bank deposits, weakening lending capacity. However, at the same time, clearer regulations may attract new participants to the market. Bank of America CEO Brian Moynihan has already indicated that they will issue their own stablecoin once legislation is enacted.

Progress in Stablecoin Legislation Accelerates

Regarding the highly anticipated stablecoins, Powell commented: "Cryptocurrencies are gradually becoming mainstream, and establishing a legal framework for stablecoins is a good idea. Stablecoins may have broad appeal and should have consumer protection measures in place." He positively evaluated Congress's efforts to advance stablecoin legislation, and Trump has also expressed a desire to accelerate the progress of this bill.

Clarifying the Compliance System for Stablecoins

Under the push of the Trump administration, the specific process of regulatory legislation surrounding stablecoins in the U.S. is accelerating. On April 3, the U.S. House Financial Services Committee passed the "Stablecoin Transparency and Accountability Act" (STABLE Act) with 32 votes in favor and 17 against, which will move to the full House for consideration. The bill was co-drafted by Republican representatives French Hill and Bryan Steil. During the committee hearing on the 9th, Chairman Hill stated regarding the bill's approval: "We have a responsibility to build on this momentum and continue to construct a comprehensive regulatory framework that establishes clear rules for the digital asset market."

The approved bill aims to introduce a new compliance system that clarifies the issuance and usage standards for dollar-backed digital assets. The bill particularly emphasizes the positioning of stablecoins as "payment tools" while prohibiting the provision of interest earnings to users.

In the Senate, the Banking, Housing, and Urban Affairs Committee overwhelmingly passed the "U.S. Stablecoin National Innovation Leadership and Establishment Act" (GENIUS Act) with a vote of 18 to 6 on March 13. Committee Chairman Tim Scott remarked: "This is a significant bipartisan advancement in protecting consumers and national security while ensuring the industry can achieve innovative development domestically."

The bill requires stablecoin issuers to maintain 1:1 reserves and comply with anti-money laundering regulations, with the ultimate goal of establishing "common-sense rules" that protect U.S. consumers while enhancing the global status of the dollar. Notably, stablecoin issuers that provide yields are not covered by this bill's regulatory scope. The GENIUS Act has now been submitted for consideration by the full Senate, but passage requires 60 votes, making the Democratic stance crucial. Chairman Scott aims to complete the legislation before President Trump's first 100 days in office (April 30, 2025).

On April 5, the SEC released new regulations clarifying that certain stablecoins do not fall under the category of securities and may be exempt from trading reporting obligations. Some analysts believe that the stablecoins covered by the SEC's new regulations may not include those issued by industry giant Tether, as the SEC pointed out that acceptable reserves for stablecoins do not include precious metals or other crypto assets, both of which are included in Tether's reserves. Additionally, the SEC requires that any token must be redeemable for U.S. dollars at any time, but Tether's terms of service suggest there may be minimum redemption amounts or delays in redemption.

Related Reading: "Full Text of U.S. SEC Stablecoin Regulation: What Kind of Stablecoin is Not a Security?"

Discrepancies Between the House and Senate; Trump's WLFI Stablecoin May Affect Legislative Progress

The stablecoin bills in the House and Senate maintain a consistent basic framework but still have discrepancies regarding the regulation of algorithmic stablecoins and the division of regulatory authority between state and federal levels. Industry predictions suggest that if the GENIUS Act and the STABLE Act are coordinated and merged, legislation could be completed before Congress's August recess. Ron Hammond, Director of Government Affairs at the U.S. Blockchain Association, predicts: "In the next 2-3 months, we will be prepared to vote on the merged 'STABLE GENIUS Act.'"

Trump clearly expressed his strong support for advancing stablecoin legislation during the March White House cryptocurrency summit and indicated that he would sign the bill before August. Treasury Secretary Scott Bescent simultaneously hinted at "consolidating the dollar's status as the global reserve currency through the stablecoin system." On April 9, at the American Bankers Association (ABA) conference, Bescent reiterated that the Treasury is "carefully assessing the regulatory barriers surrounding blockchain, stablecoins, and new payment systems," and stated, "We are considering implementing reforms that unleash the tremendous potential of U.S. capital markets."

Under the strong push from the Trump administration, industry insiders predict that "2025 will be the year of comprehensive stablecoin adoption." However, some Democratic lawmakers have raised concerns that the bill may involve conflicts of interest related to Trump family's virtual currency DeFi project "World Liberty Financial (WLFI)." Five Democratic senators wrote a letter to the Federal Reserve and the OCC, questioning the "unprecedented risks" posed by the USD1 stablecoin launched by WLFI, which is supported by the Trump family. The letter pointed out that Trump weakened regulatory independence through a February executive order and holds a 60% stake in WLFI, constituting a significant conflict of interest. Since its establishment in September 2024, WLFI has raised $550 million through two token sales and launched USD1 on the BNB Chain and Ethereum on March 24. This coincides with Congress's review of the GENIUS Act, potentially granting the OCC and the Federal Reserve regulatory authority, raising concerns about the stability of the financial system.

Related Reading: "Is the Trump Family Entering the Stablecoin Race? Understanding the 'Presidential Stablecoin' USD1 on BSC"

The Impact of Tariffs is Complex and Far-Reaching

Regarding the recent tariff policies that have frequently triggered significant market fluctuations, Powell stated, "The impact of tariffs on the economy may be greater than expected," and "Tariff levels have exceeded the Federal Reserve's optimistic expectations." He added, "Currently, higher-than-expected tariffs may imply higher inflation and slower growth."

Although the original intention of cryptocurrency was to serve as a financial tool independent of government control, prices and market performance are still significantly influenced by macroeconomic policies. After the U.S. announced new global tariff policies on April 2, despite a general decline in global asset prices, Bitcoin's drop was relatively small, only down 10%, while the S&P 500 index fell much more sharply (if calculated with a 1:1 correlation, Bitcoin should have dropped 36%). This indicates that even during deep market pullbacks, holding Bitcoin as part of an investment portfolio can still provide significant diversification benefits, highlighting its relative stability.

Tariffs increase the cost of cross-border transactions, which may weaken global economic liquidity and capital inflows, reducing demand for speculative assets such as cryptocurrencies. Additionally, tariffs on technology products, especially semiconductor chips and mining hardware, will significantly increase the mining costs of proof-of-work (PoW) cryptocurrencies like Bitcoin, particularly in regions reliant on Chinese-manufactured ASIC miners and GPUs. This may force miners to shift to lower-cost regions or reduce their operational scale, thereby affecting network security and market confidence.

Related Reading: "Mining Equipment Prices Rise 24%, Trump's Tariff Policy is Impacting the U.S. Bitcoin Mining Industry"

Tariffs may also indirectly affect the crypto market through exchange rate fluctuations. Historically, Bitcoin has shown an inverse relationship with the U.S. dollar; when tariffs temporarily boost the dollar's exchange rate, cryptocurrency prices often come under pressure. However, if tariffs trigger a trade war and lead to currency devaluation in certain countries, residents may turn to Bitcoin or stablecoins to preserve value, as seen in Argentina and Turkey during periods of economic turmoil when crypto adoption surged.

Moreover, the rise in import prices due to tariffs may trigger inflation, prompting central banks to raise interest rates, thereby reducing the flow of funds into the crypto market. However, if inflation spirals out of control or trust in fiat currency collapses, Bitcoin may be viewed as a safe-haven asset similar to gold, attracting investors seeking to hedge against inflation and currency devaluation.

Trade tensions may also intensify regulatory scrutiny, with investors concerned that the government may take the opportunity to strengthen control over crypto assets, further exacerbating market volatility. Different cryptocurrencies are affected by tariffs in various ways: Bitcoin may decline in the short term due to market risk aversion, but in the long term, it may benefit from its "digital gold" attributes; stablecoins, due to their stability, may become the preferred choice for traders seeking to hedge during trade disputes; utility tokens reliant on specific blockchain use cases are more directly influenced by their related industries. Tariffs targeting countries with concentrated mining activities (such as Canada, which accounted for 6.5% of Bitcoin mining electricity consumption in 2022) may directly disrupt the geographical distribution of mining, affecting market structure.

Related Reading: "History is Repeating Itself: Grayscale Report Reveals New Safe-Haven Logic Amid Tariff Storm"

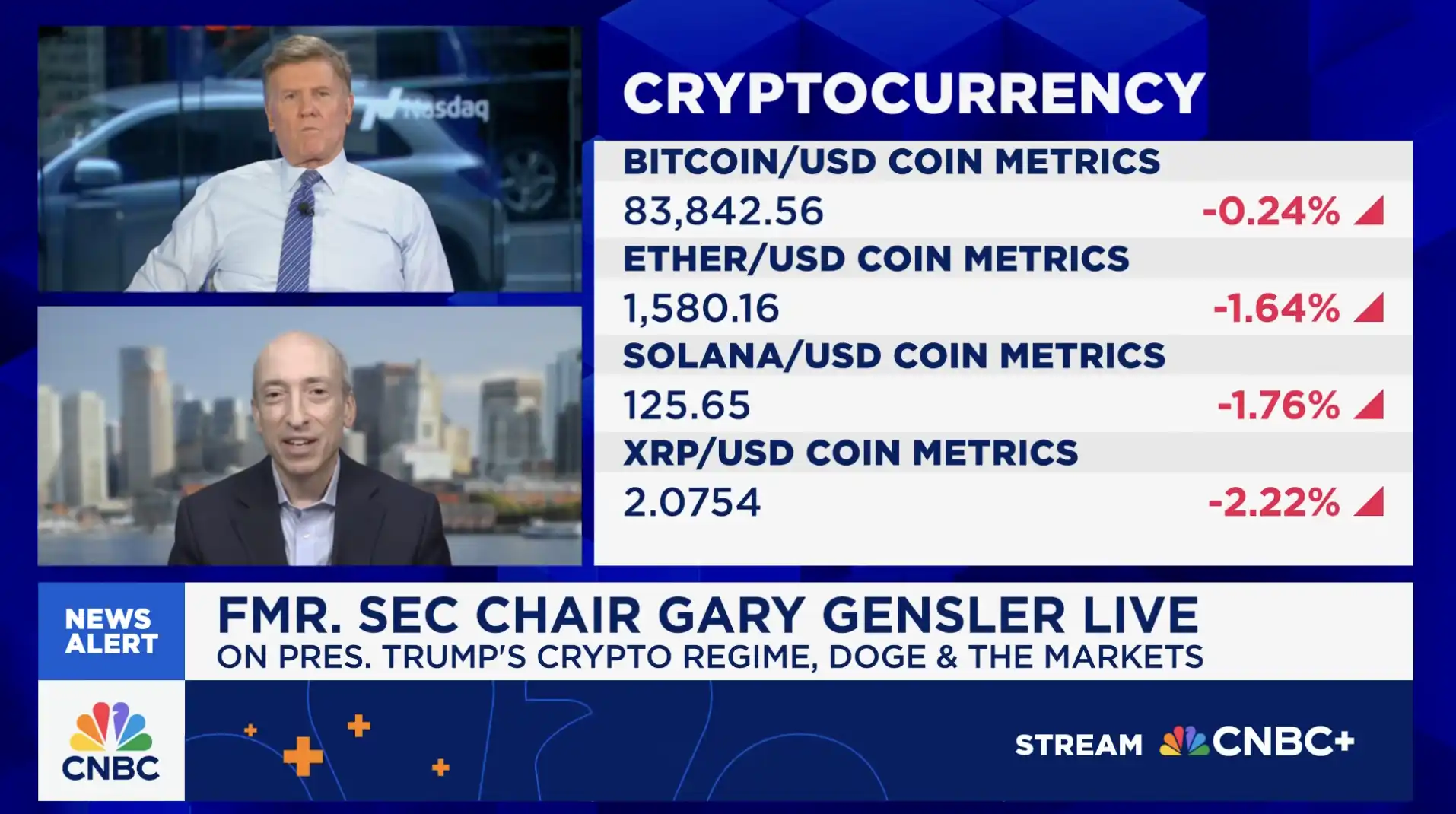

"Risk Warning" from Gary Gensler

Former SEC Chairman Gary Gensler appeared on CNBC's "Squawk Box" on the 16th, expressing his belief that Bitcoin and certain other cryptocurrencies may have long-term survival potential, and that crypto assets as investment targets will undergo a selection process.

Gary Gensler stated that a few cryptocurrencies like Bitcoin have attracted widespread attention globally, "Bitcoin may continue to exist for a long time because 7 billion people around the world have shown strong interest in it."

During this interview, Gensler mentioned cryptocurrencies while discussing topics such as Trump's tariffs and the U.S.-China trade war. The topic arose from the host's question: "After you left office, the SEC under the Trump administration seems to be withdrawing lawsuits against cryptocurrency companies. What are your thoughts on this?" He simply responded that he is "stepping back from specific lawsuits." He further stated, "Cryptocurrency is just a small part of the financial market, but since everyone is interested, I will talk about it." He then elaborated on the aforementioned views.

Gensler also pointed out, "The trading of financial assets is based on fundamental value and market sentiment, but about 99% of cryptocurrency trading is purely driven by sentiment." He added, "Tokens driven by sentiment, such as meme coins, numbering between 10,000 to 15,000, will lose their appeal to most people in the long run."

In the future, as the regulatory framework continues to improve and the market environment gradually matures, cryptocurrencies and stablecoins may play a more important role in the global financial system.

Institutions and investors need to closely monitor policy dynamics and market trends to seize historic opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。