Author: Airdrop Insulator Scof, ChainCatcher

Editor: TB, ChainCatcher

Event Summary

On the evening of April 15, the ZKsync token ZK experienced an abnormal drop, falling over 14% within 24 hours, with the price briefly dropping below $0.04. Following the incident, exchanges such as Bithumb suspended ZK's deposit and withdrawal services.

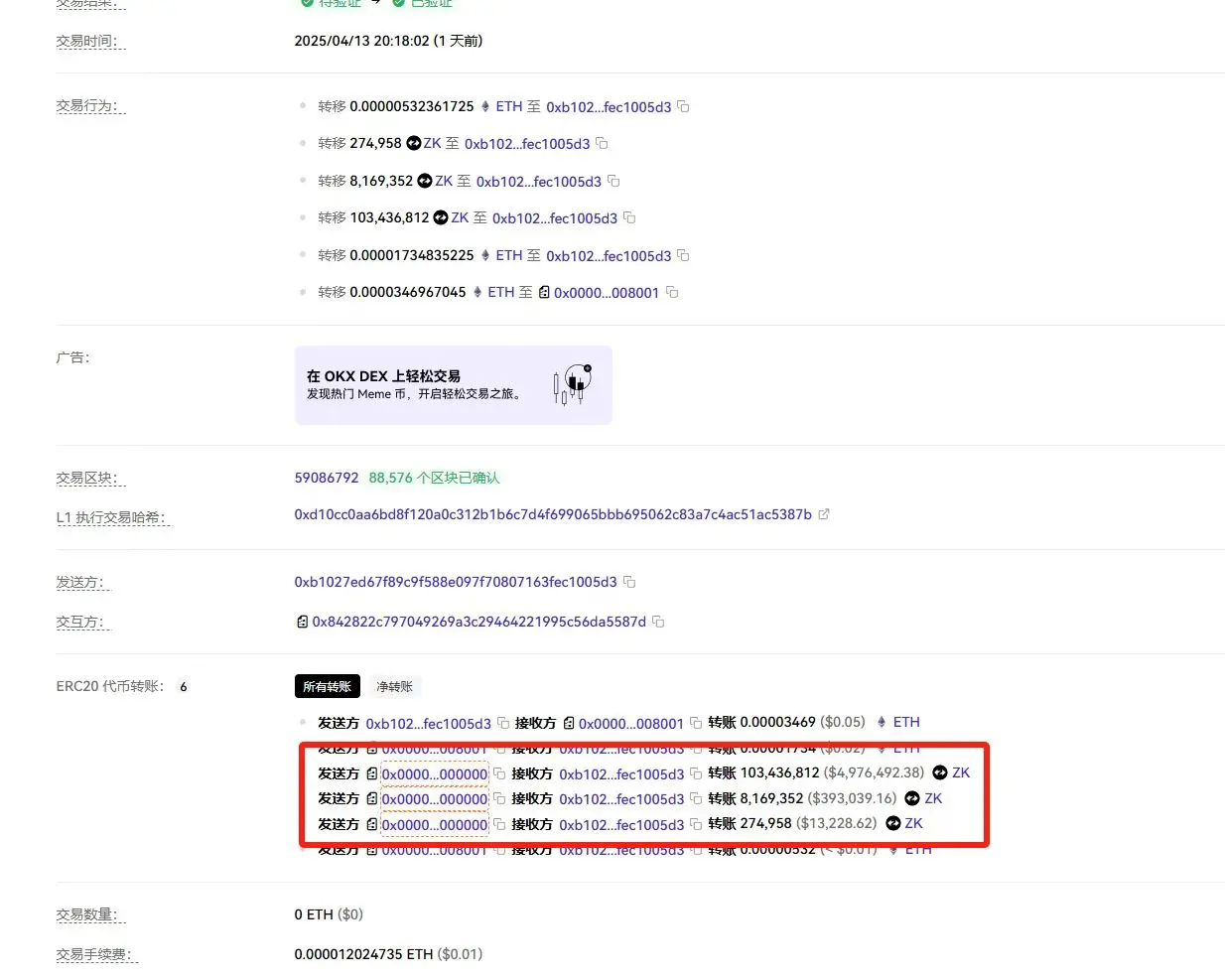

According to on-chain data, the actual attack occurred on the evening of April 13 at 8 PM (UTC+8). The attacker, using an administrator account of an airdrop distribution contract, called the sweepUnclaimed() function within the contract, minting approximately 111 million unclaimed airdrop tokens. Subsequently, the attacker sold about 66 million of these tokens and conducted cross-chain transfers. By the time the incident was exposed on April 15, approximately 44.68 million tokens remained in the attacker's address.

At 9 PM on April 15, the community first disclosed this abnormal behavior of token issuance and selling on social media. The ZKsync official team responded shortly after, confirming that this was due to the leakage of the administrator keys for three airdrop distribution contracts, leading to abnormal minting behavior. The official statement indicated that this incident only involved the airdrop contract and did not affect the ZKsync protocol itself, the main ZK token contract, governance contract, or other token distribution plans. The token circulation increased by approximately 0.45%, with a total value of about $5 million.

The ZKsync team coordinated with exchanges on the night of the incident to attempt to freeze the relevant funds and called on the attacker to return the tokens to avoid legal consequences. The official emphasized that this attack vector can no longer be exploited, and the rest of the current system remains unaffected.

After the incident, the price of the ZK token briefly rebounded but has not returned to pre-incident levels. As of now, the investigation is still ongoing, and the project team has stated that further details will be released.

From Former Kings to "Heaven's Fall"?

Once regarded as the "Four Kings" of Ethereum Layer 2—ZKsync, Arbitrum, Optimism, and Starknet—their trajectories have now diverged significantly. It is worth mentioning that many of my peers began their on-chain operations by engaging with the airdrops of these projects, learning about wallets, interactions, and basic concepts like Gas fees. These projects not only embody the technical practices of Ethereum's scalability but have also become the entry point for many into the crypto world.

ZKsync and Starknet both follow the ZK Rollup route and were seen as representatives of the technical faction, emphasizing higher security and data validity. ZKsync promotes its zkEVM, compatible with EVM, aiming to reuse Ethereum ecosystem tools to lower development barriers, while Starknet insists on its self-developed Cairo language system, achieving higher performance potential but limiting its ecosystem expansion. In contrast, Arbitrum and Optimism adopted the earlier OP Rollup solution, relying on optimistic proofs for transaction settlement, allowing for quicker market entry in terms of development tools and compatibility.

In terms of ecosystem development, Arbitrum is undoubtedly the strongest performer, with native DeFi projects like GMX firmly established and a richer overall application layer distribution. Optimism's focus is more on governance and architectural expansion, launching OP Stack and collaborating with Coinbase to launch the Base mainnet, which has initially constructed a "modular alliance chain" framework. Meanwhile, ZKsync's ecosystem activity has largely stagnated around the time of the airdrop, with several projects running away after the airdrop, severely damaging user and developer confidence. Starknet has maintained a slow development pace, with relatively lagging ecosystem expansion.

In terms of user activity, Arbitrum has long been in the lead, with both on-chain active addresses and transaction volumes far exceeding the others, followed closely by Optimism. ZKsync peaked during the airdrop but saw a rapid decline in activity, with current daily active users dropping to low levels. Starknet's data has remained stable over the long term but lacks growth, consistently struggling to break through.

The on-chain locked value also visually reflects the differences between projects. According to DefiLlama data, Arbitrum firmly holds the top position in L2 TVL with $2.1 billion, demonstrating a certain degree of economic self-circulation capability; Optimism maintains high expectations due to the expansion potential of OP Stack; ZKsync's revenue has long been sluggish, with TVL only fluctuating at a few event nodes, lacking long-term growth momentum; Starknet similarly faces issues of insufficient scale, with both revenue and locked value being small.

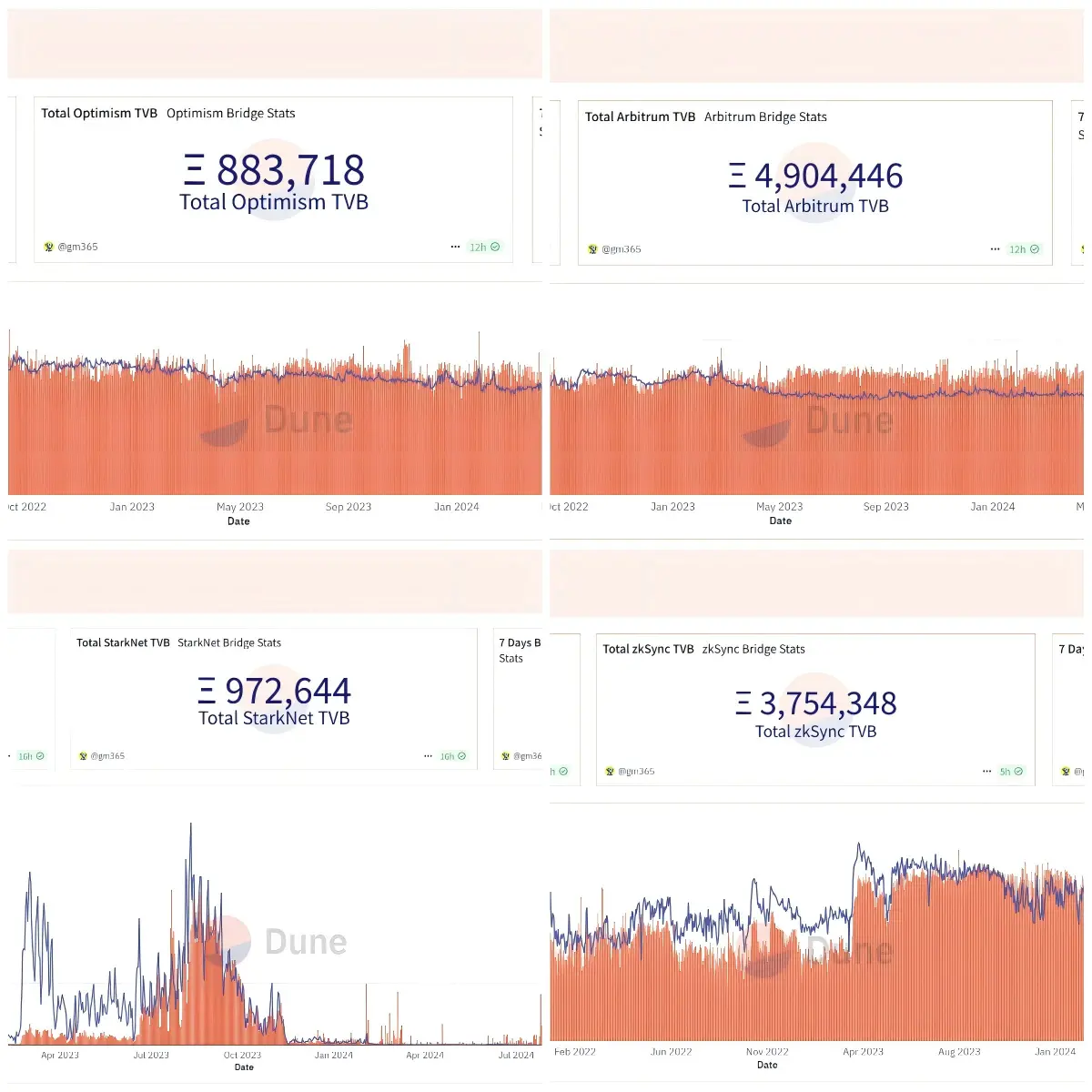

From the perspective of cross-chain bridging data, the differences in ecosystem activity among projects are also very evident. According to Dune data, Arbitrum's official cross-chain bridge has accumulated over 4 million ETH bridged, firmly ranking first among all Layer 2 projects; ZKsync follows closely with approximately 3.7 million ETH bridged, which appears substantial on the surface, but activity has clearly declined. In the past 7 days, only 14 users utilized the ZKsync official bridge, with a total bridging amount of just 5 ETH, nearly at a standstill. In contrast, Optimism and Starknet's total bridging amounts have not been high, failing to exceed 1 million ETH.

However, it is noteworthy that despite Arbitrum's robust performance in the on-chain ecosystem, with sustained user activity and project implementation, its token price trajectory has not been ideal. Since its peak of about $2.4 last year, the ARB price has retraced over 88%, yet its current market capitalization remains above $1.3 billion. This disparity may be closely related to its continuously released circulation. Since the token's launch, Arbitrum has experienced multiple large unlocks, leading to persistent market selling pressure and price pressure.

Once the "Four Kings" of Layer 2, representing the future direction of Ethereum's scalability and serving as the first stop for countless users, have now faced a series of challenges including technical implementation, airdrop competition, security incidents, and project differentiation. Today, the Layer 2 landscape is no longer marked by its former glory.

The once-repeated emphasis on "high performance, low cost, strong security" now seems to be losing its appeal. How long can the narratives that use Layer 2 as an entry point sustain? In the current environment of capital and attention flowing out, is Layer 2 truly a bridge to large-scale applications, or merely a transitional solution? Will the projects that were once highly anticipated ultimately stall in the midst of technological evolution?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。