Editor’s Note: The HyperEVM ecosystem attracts miners due to HYPE's high-quality token economics and value accumulation. This article interprets strategies around protocols such as @upshift_fi, @stakedhype, @HyperSwapX, @hyperlendx, @HypurrFi, and @felixprotocol, covering staking, LP, and lending strategies. Returns include APY, points, and potential airdrops, but the ecosystem is still in its early stages, and cautious investment is necessary to avoid risks from unverified protocols.

The following is the original content (reorganized for better readability):

Why Choose HyperEVM?

My intuition tells me it will be very profitable, and HYPE is one of the few altcoins with value accumulation, product-market fit (PMF), and good token economics.

A high-quality DeFi ecosystem forms around quality collateral.

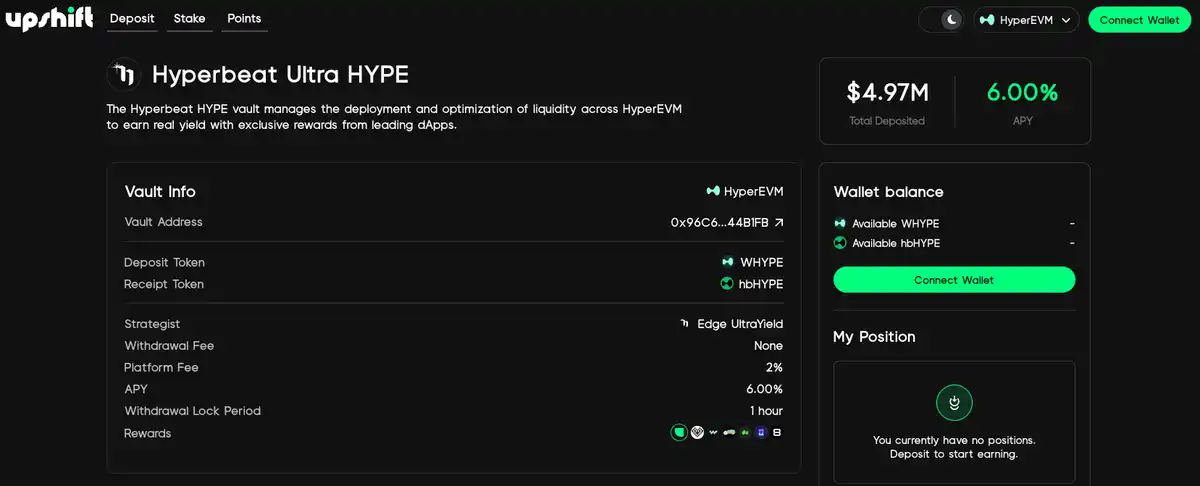

@upshift_fi and @0xHyperBeat Vault

This is the simplest "set it and forget it" mining strategy.

The hbHYPE vault dynamically allocates deposits to HyperEVM's DeFi protocols. It employs various methods such as delta-neutral strategies and capital arbitrage to maximize returns.

Depositing WHYPE earns a 6.0% annual percentage yield (APY) + ecosystem points (5x Upshift, Hyperbeat, @hyperlendx, @hyperpurrfi, @HyperSwapX, @TimeswapLabs, and @silhouette_ex).

Upshift is supported by @dragonfly_xyz, with $235 million in deposit assets on the platform.

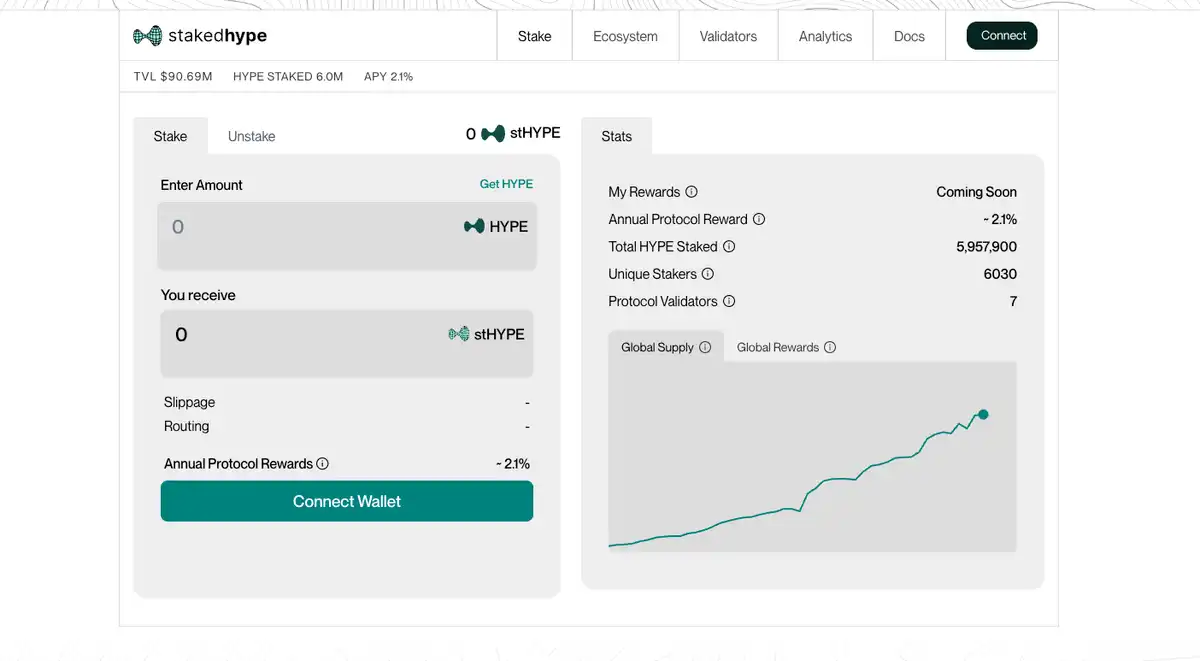

@stakedhype Staking HYPE

HYPE's main liquid staking token (LST) can be used in DeFi to earn more returns.

This is built by @thunderheadxyz. I am not sure if there will be a protocol token, but I can be fairly certain that stHYPE holders will receive rewards through Jeff's HYPE airdrop in the future.

@HyperSwapX Exchange and LP

Use HyperSwapX to wrap your stHYPE and provide liquidity on different trading pairs (such as HYPE/stHYPE, etc.).

Earn returns + HyperSwapX points.

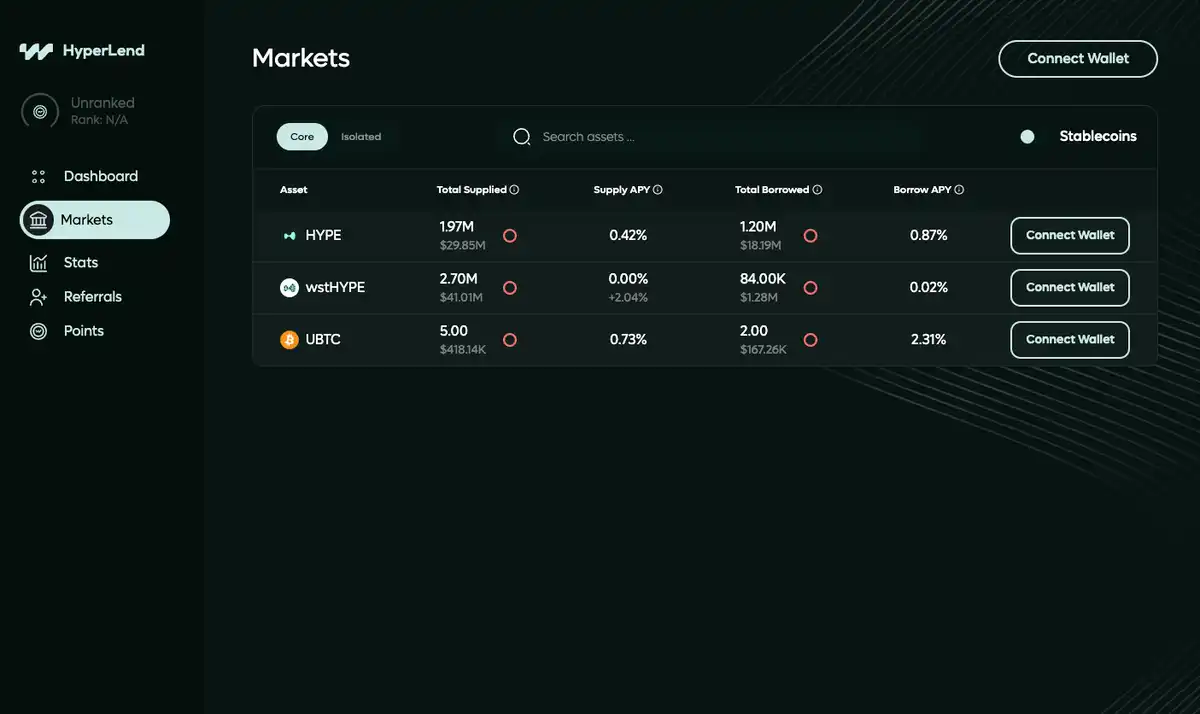

@hyperlendx

Lend HYPE, wstHYPE, or UBTC (using @hyperunit) to earn returns + HyperLend points.

Currently, the liquidity pool is full, so keep an eye out for any openings or increases in limits.

HyperLend has been officially recognized as a friendly fork by AAVE DAO and will share revenue and tokens with AAVE.

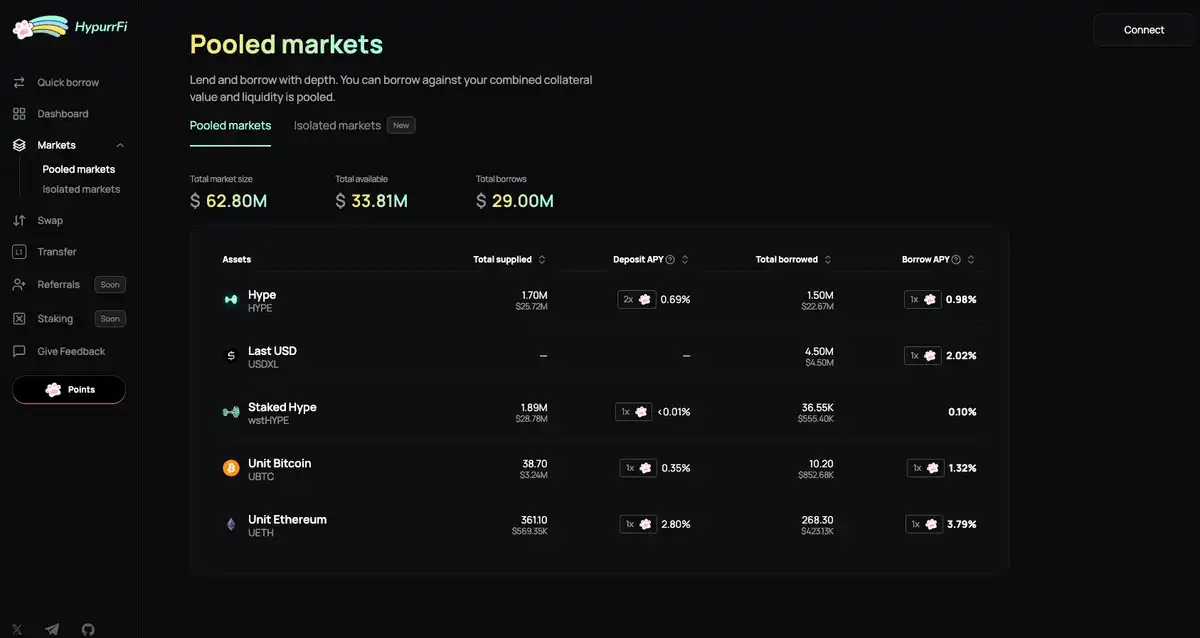

@HypurrFi

Use wstHYPE as collateral to borrow USDXL.

You can also use @hyperunit, supplying BTC and ETH as collateral to borrow USDXL. Earn HypurrFi points.

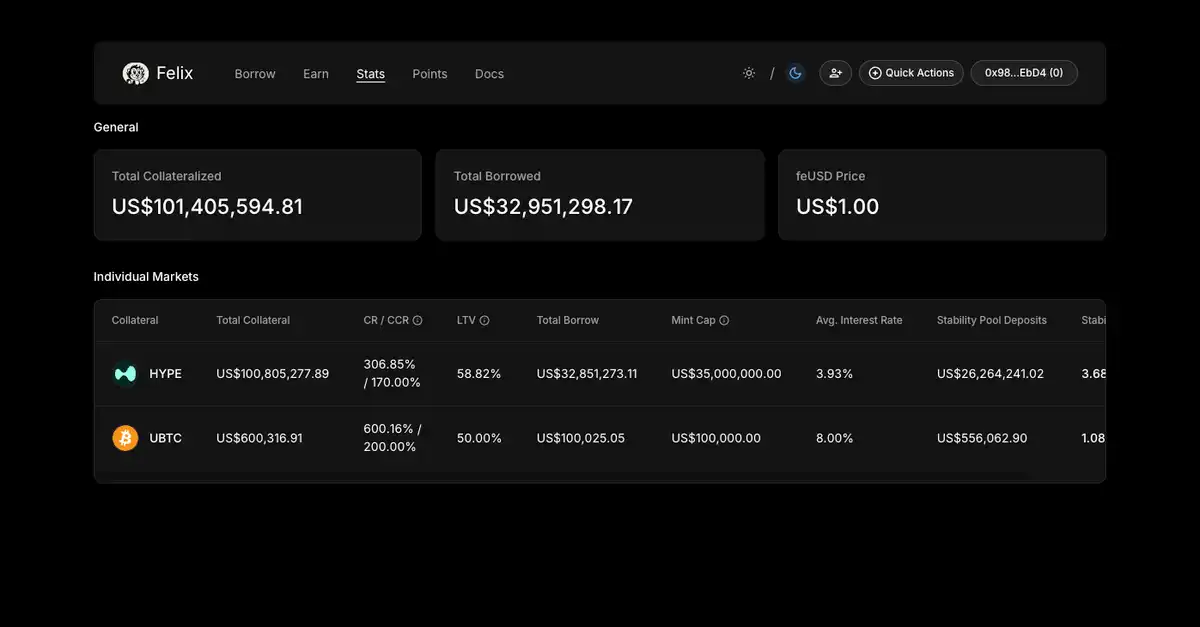

@felixprotocol

Exchange USDXL for feUSD and deposit it into the Felix protocol.

Currently, the yield from the HYPE pool is higher than the borrowing cost of USDXL + you can also earn Felix points.

Felix currently has a considerable TVL and borrowing volume.

There are more applications to explore, but this is my current summary (not an expert, still exploring).

I focus on audited protocols with high TVL (though there are still risks). There will definitely be more high-risk, high-reward opportunities.

We know Hyperliquid will allocate incentives for HyperEVM users, so I think it can be assumed that returns will be enhanced through retrospective HYPE.

But be aware that the HyperEVM ecosystem is still in a very early stage. I will not risk investing more than I am willing to lose. Don’t do anything foolish by putting too much money into protocols that have not been tested in the long run.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。