Axiom is a recently emerged dark horse trading tool that integrates various core functions such as Meme coin scanning, information monitoring, spot trading, perpetual contracts (Perp), and even mining (Yield).

This article will start from Axiom's core advantages and guide you step by step on how to complete a full trading loop operation.

1/7

⭐️ 1. Registration and Usage

https://axiom.trade/@biteye

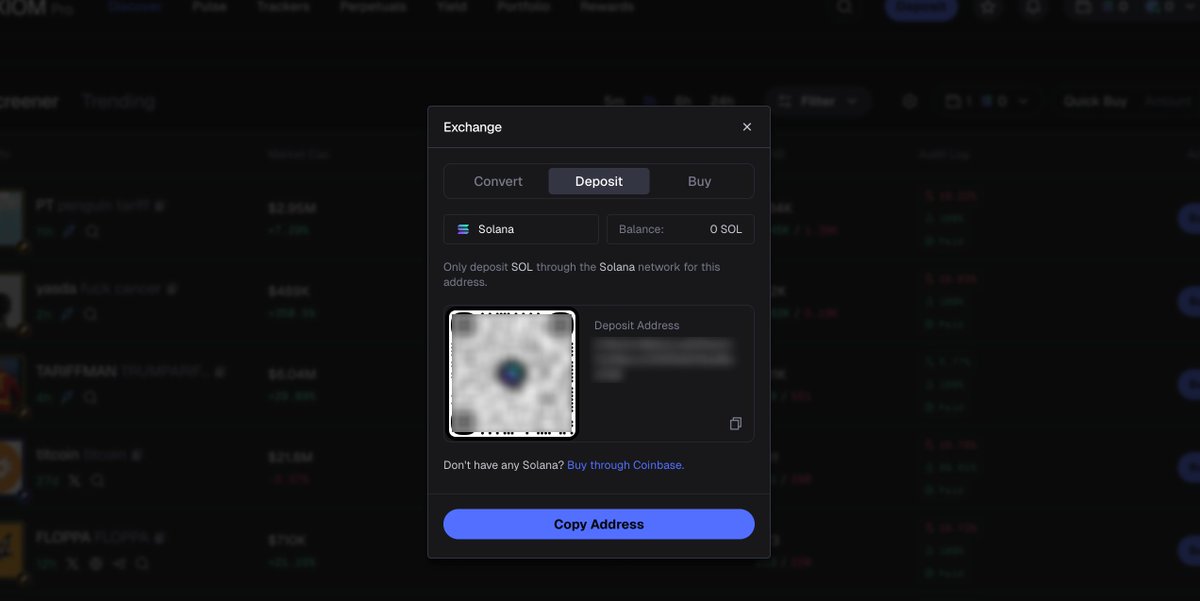

Open the official website above, and you can register using your email, Google, or Phantom wallet. Feel free to use Biteye's invitation code for an additional 10% discount.

After registration, you will be provided with a wallet mnemonic phrase, remember to save it, and then you can deposit money into it to start trading.

Next, let's take a look at Axiom's interface layout.

In high-intensity, fast-paced on-chain trading, an intuitive and efficient user interface is crucial. A chaotic or complex interface increases the risk of operational errors and delays trading opportunities. You can find almost all the functions of bots on Axiom, and many features are directly integrated from other projects, making it a comprehensive platform. Experienced users of other bots should find it very easy to get started with Axiom.

⭐️ 2. How to Discover New Projects?

2.1 Discover Module

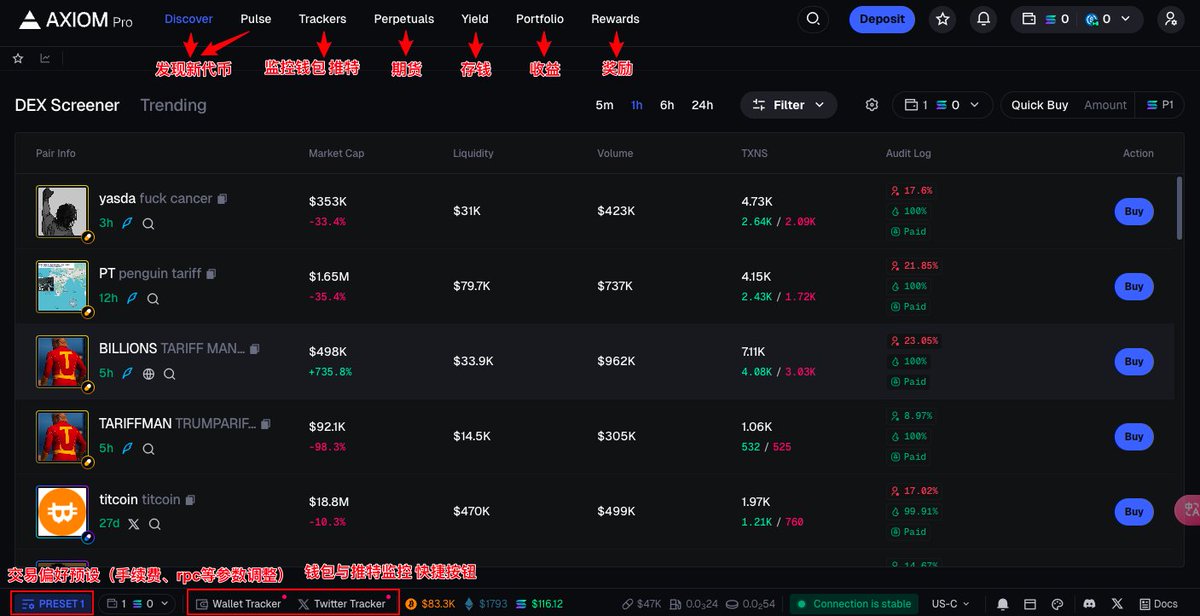

Unlike the Pulse module, which focuses on "latest listings," the Discover module is more focused on helping users filter tokens that are currently "Trending." The projects displayed are some popular tokens that have been released for a while. The Pulse module shows some internal projects that are in very early stages, catering to different user needs.

The Trending view automatically pushes market hot tokens to users, saving them time in the initial filtering among a vast number of tokens. The Filter function allows users to preset their Meme coin filtering criteria (e.g., market cap below $1M, liquidity above $20K, etc.). Additionally, the interface provides warnings about honeypot risks and integrates preliminary security audit results, offering users a quick initial risk assessment.

2.2 Pulse Module

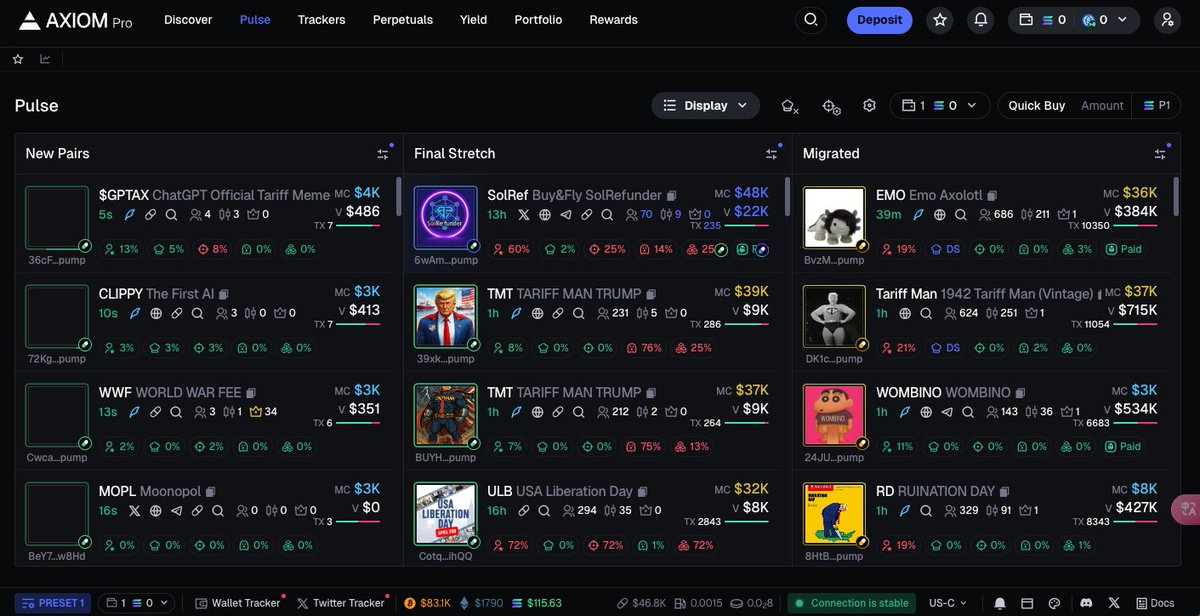

The Axiom Pulse module can be understood as a highly integrated real-time new coin/hot coin discovery and quick trading dashboard. Its core design philosophy is to provide users with an environment that allows for instant monitoring, rapid assessment, and swift execution of trades, especially for Meme coins that require quick reactions. It aims to shorten the time delay from "discovery" to "trading."

- New Pairs: This is one of the most important monitoring areas, displaying the latest tokens detected by the Axiom system or newly launched tokens with liquidity.

- Final Stretch: Represents tokens that have undergone preliminary screening and are close to meeting the conditions to enter Raydium.

- Migrated: This column displays tokens whose liquidity has already migrated to Raydium, considered to be more "mature" under Axiom's standards. The risks and opportunities of these three types of tokens gradually decrease.

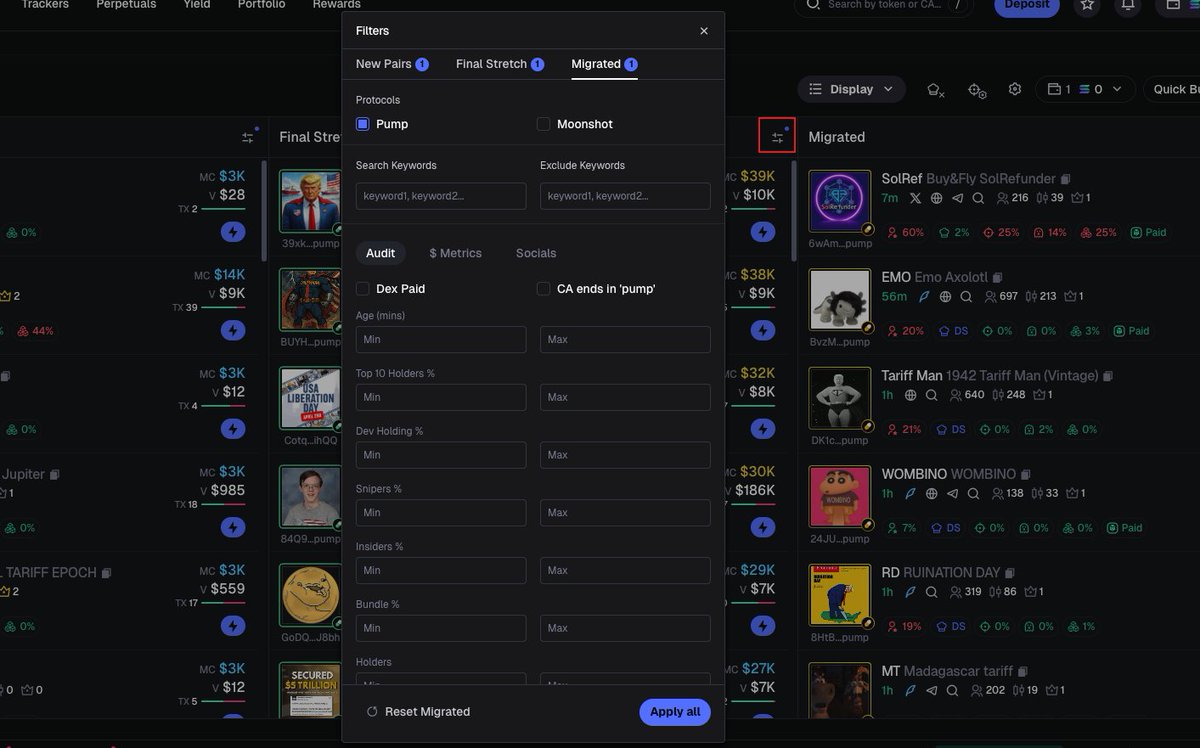

Users can even filter the displayed tokens according to their preferences, such as choosing between pumpfun or moonshot protocols, adding or excluding keywords, token creation duration, TOP 10 ratio, developer holding ratio, sniper ratio, etc. Explanations of the filtering criteria are shown in the image:

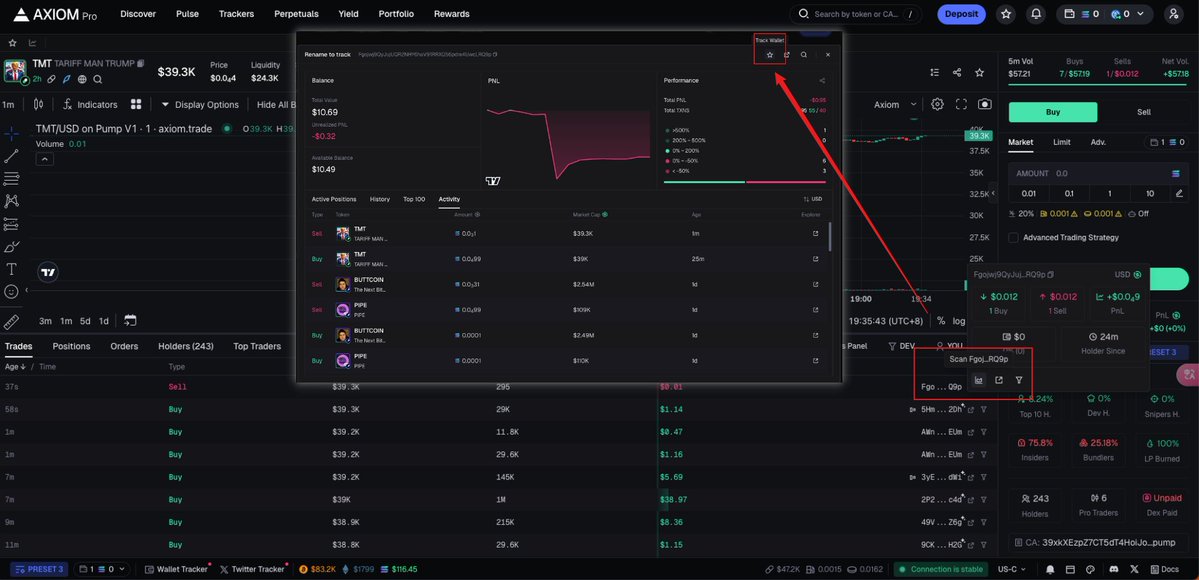

Some noteworthy designs to improve efficiency: First, the bottom of the interface integrates real-time monitoring of Twitter and wallets, which is a common feature in GMGN. Secondly, the Quick Buy Amount (top right corner quick buy amount) allows users to preset the amount for each quick buy. When users see a desirable token and complete a quick assessment, they can directly click the Buy button next to the token, using the preset amount to execute the buy operation. In theory, this can achieve "one-click buying," greatly simplifying the trading process and maximizing the seamless connection and speed from monitoring to execution.

⭐️ 3. Trading Functions

3.1 Order Types

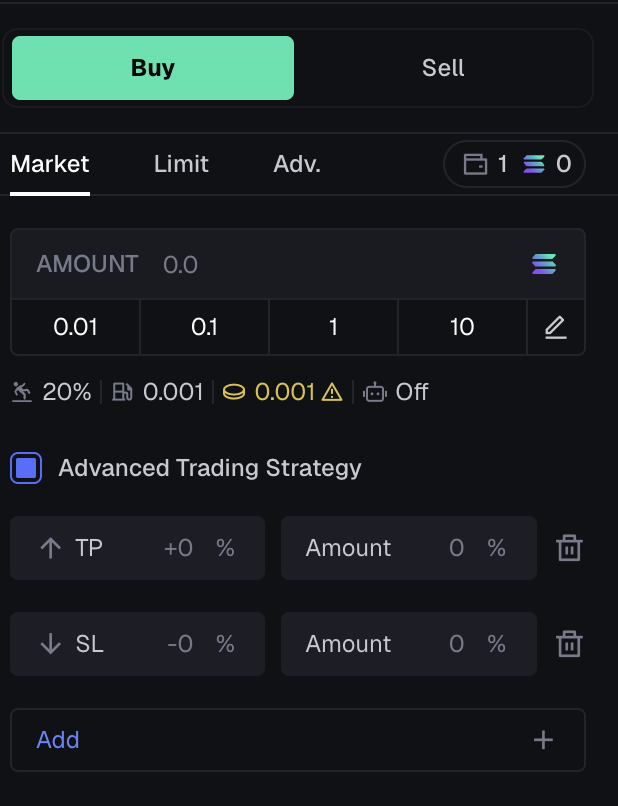

To meet the needs of different trading strategies and risk management, Axiom supports not only basic order types but also provides take-profit and stop-loss options, increasing trading flexibility. Market Orders and Limit Orders are quite basic, but Axiom's highlight is the ability to set Take-Profit/Stop-Loss (TPSL) orders. In the highly volatile Meme coin market, setting TPSL reasonably is an important means to protect funds and avoid emotional trading. Refer to the image below:

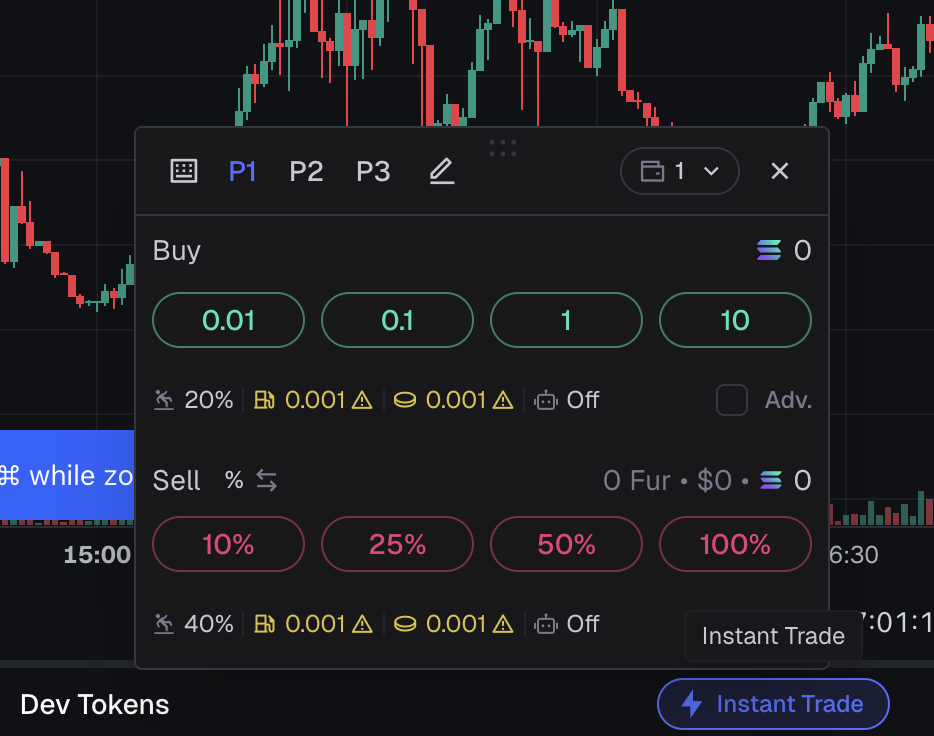

3.2 Instant Buy

When you discover a newly launched coin that is gaining volume in the scanning module, what you need is not to "compare pools" or "calculate slippage," but to place an order quickly. Axiom's Instant Trade module is designed for such scenarios. This feature will pop up a window next to the token chart, allowing you to buy and sell with just one click. It is suitable for short-term trades and getting in on hot tokens at the first opportunity.

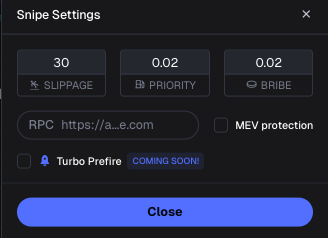

3.3 Built-in Sniping Tool

This is suitable for when a new token has just "migrated" (for example, from pump.fun to a public market like Raydium), and you need to buy in as quickly as possible to get ahead of others. Or when you buy a token and quickly realize it may be fake, a copy, or has other serious issues, you need to sell it as quickly as possible to minimize potential losses.

⭐️ 4. Monitoring Functions

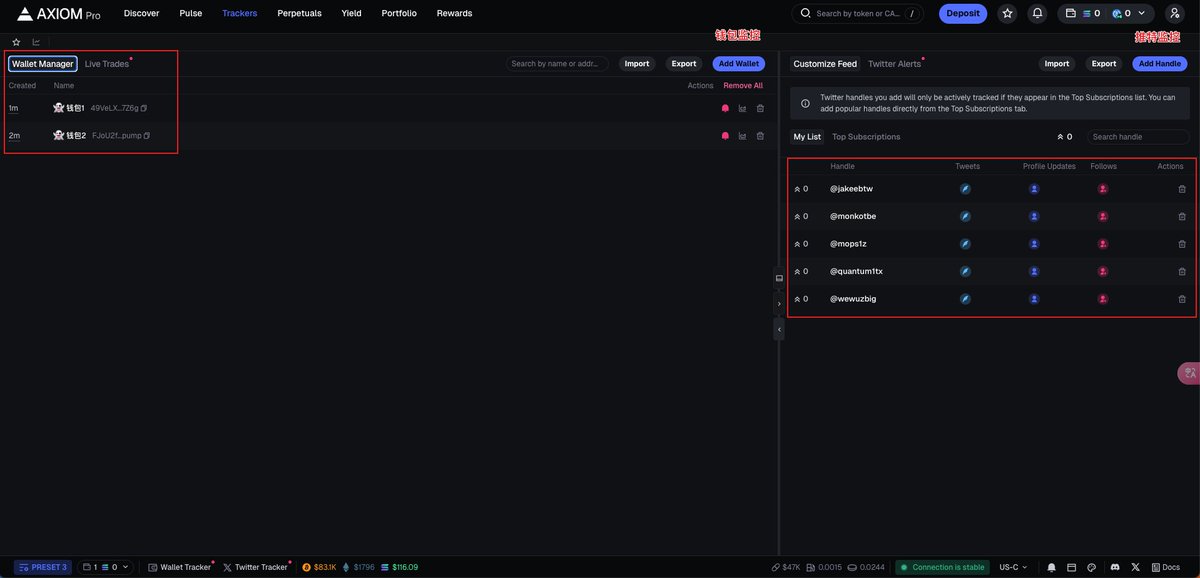

The Trackers module not only tracks wallet addresses but also allows users to track specified X accounts, enabling a customizable watchlist. In many products, this is a paid feature, but Axiom offers it for free to all users.

The most unique design of Axiom's monitoring tool is its floating window feature. At the bottom of the Trackers page, there are two small buttons that can summon floating windows for wallet monitoring and X monitoring, respectively. These windows can be freely dragged, allowing users to monitor key information sources in real-time while performing trading operations (such as chart analysis and placing orders) without switching screens or applications. This greatly assists traders in multitasking between information monitoring and quick execution.

4.1 Wallet Monitoring

You can directly click "add wallet" to add the wallet addresses you need.

If you have multiple wallets, you can also import them all at once using the "import" button, with the import format as follows:

[

"trackedWalletAddress": "Enter wallet address here",

"name": "Enter wallet name here",

"emoji": "Enter wallet emoji here",

"alertsOn": Enter true or false, indicating whether to enable alerts

},

{

"trackedWalletAddress": "FJoU2fDRGxUvrv9**********xxAwo2DNKzkisBpump",

"name": "Wallet 2",

"emoji": "?",

"alertsOn": true

}

]

All data should be placed inside [], with each wallet link inside {}. Each wallet requires four items to be filled out, and none can be omitted. To add more wallets, simply add more {}. The format can be converted with the help of GPT.

In addition to importing your own, you can also monitor the trading dynamics of tokens by directly adding the addresses of traders, holders, or developers to the monitoring list.

Just hover over the corresponding address, click the “scan” button, and then click the favorite button to add this address to the monitoring list.

4.2 Twitter Monitoring

Twitter monitoring, like wallet monitoring, can also manually add IDs or import in bulk. The format for bulk import is as follows:

[{"h":"Twitter ID","t":true or false, whether to monitor tweets,"a":true or false, whether to monitor user homepage,"f":true or false, whether to monitor followers},{"h":"we***ig","t":true,"a":true,"f":true}]

All data must be placed inside [], with each individual user inside {}. Each {} should be separated by a comma. To monitor multiple Twitter users, just add more {}.

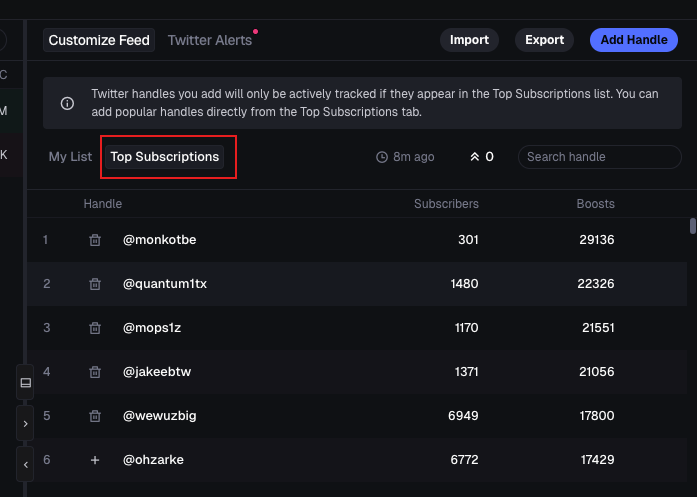

Note that currently, only the top 1500 users' Twitter accounts can be monitored. For other users, such as the official NBA account, it cannot be monitored because the NBA is not a trader.

If you don't know which users to monitor, simply click “subscriptions” to view the current leaderboard.

⭐️ 5. Futures and Savings

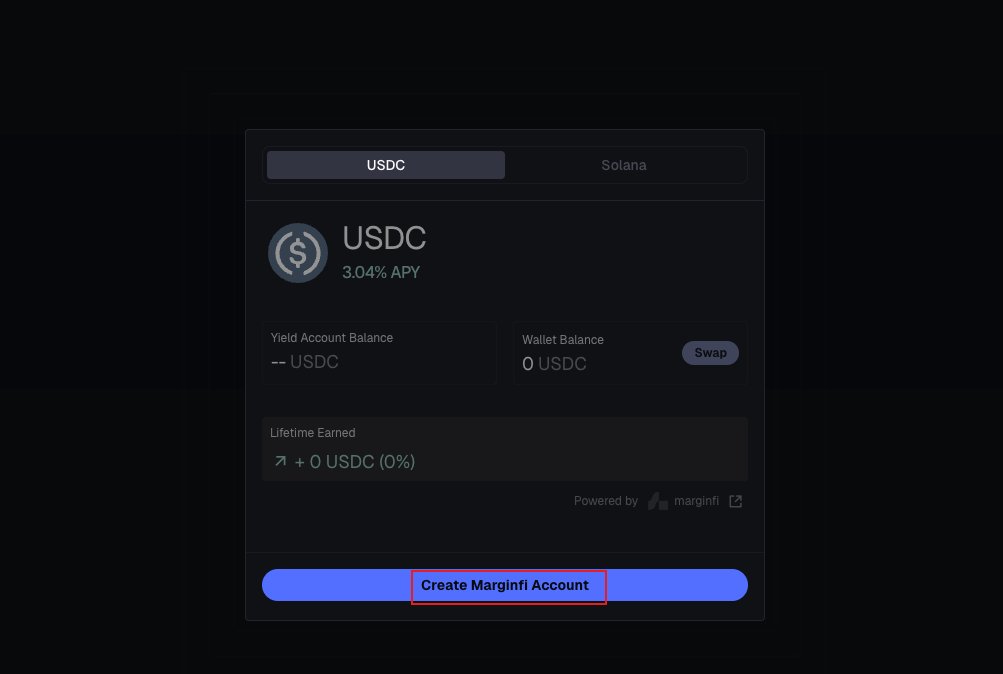

Axiom's futures are directly integrated with Hyperliquid's services, while savings use Marginfi's services.

Futures operations are relatively simple, and users familiar with exchange futures should find it easy to navigate. Currently, savings support USDC and SOL on the Solana chain, with an APY of 3.04%, which is slightly higher than the 1.5% offered by most exchanges.

However, please note that since it uses Marginfi's services, you will need to pay around 0.017 SOL as an account opening fee, which is about $2.

⭐️ 6. Earnings and Rewards

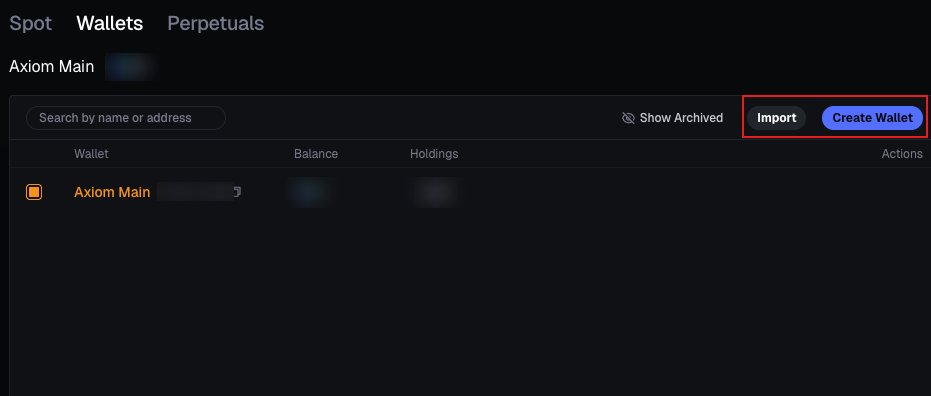

Users can view their spot and futures trading earnings in the earnings section and manage their wallets. For example, creating a new wallet or importing their private key wallet.

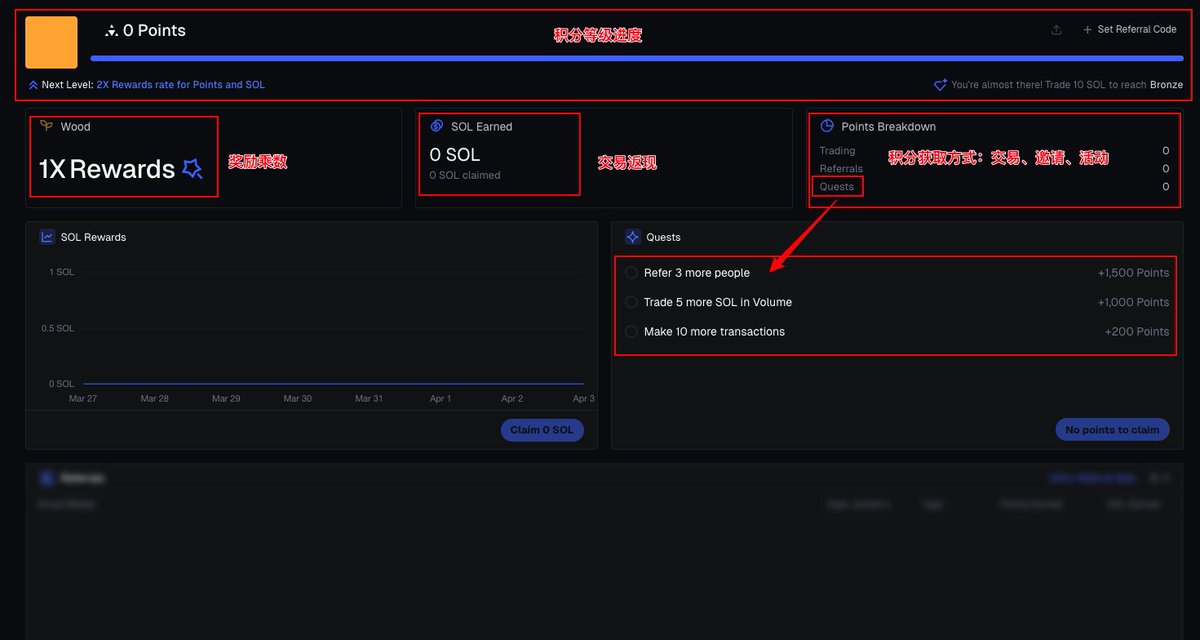

Rewards here include cashback, points, and invitations.

For every transaction on Axiom, users will receive cashback in SOL, and the more you trade, the higher your multiplier, resulting in more cashback.

The multipliers are categorized into six levels: Wood, Bronze, Gold, Platinum, Diamond, and Champion. The higher the level, the more cashback you receive, effectively lowering your transaction fees.

Currently, most BOTs charge a fee of 1%. If you registered for Axiom using someone else's invitation code, you will start at the Bronze level with a fee of 0.9%. The highest Champion level has a fee of 0.75%.

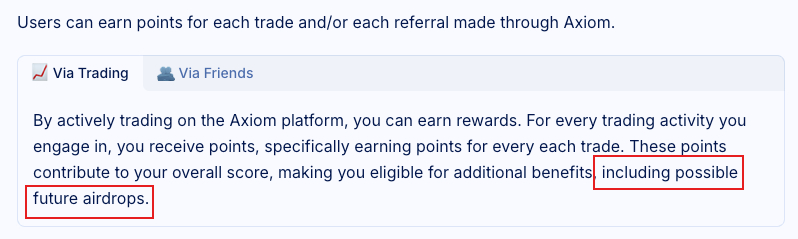

In addition to cashback, Axiom's points system may also lead to potential airdrops, as clearly stated in the official documentation, making this another attractive feature for users.

Overall, Axiom, as a real-name and endorsed BOT project, not only has the advantage of low fees but also brings the anticipation of airdrops, making it quite appealing to users. From scanning, following trades to contract trading, it seems poised to become the next on-chain Binance.

Although the current Meme market has not yet warmed up, experiencing new products in advance is undoubtedly a proactive measure, allowing users to seize opportunities when the market recovers. For users keen on airdrops, earning points through invitations and trading not only provides cashback rewards but also offers the chance to enjoy additional airdrop benefits, making it a good strategic move.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。