Source: Cointelegraph Original: "{title}"

VanEck's research director proposed a new type of U.S. Treasury bond partially backed by Bitcoin, aimed at helping the U.S. refinance $14 trillion in debt.

On April 15, at the 2025 Strategic Bitcoin Reserve Summit, VanEck's research director Matthew Sigel introduced the concept of "Bitcoin Bonds" (BitBonds) — a U.S. Treasury bond linked to Bitcoin (BTC).

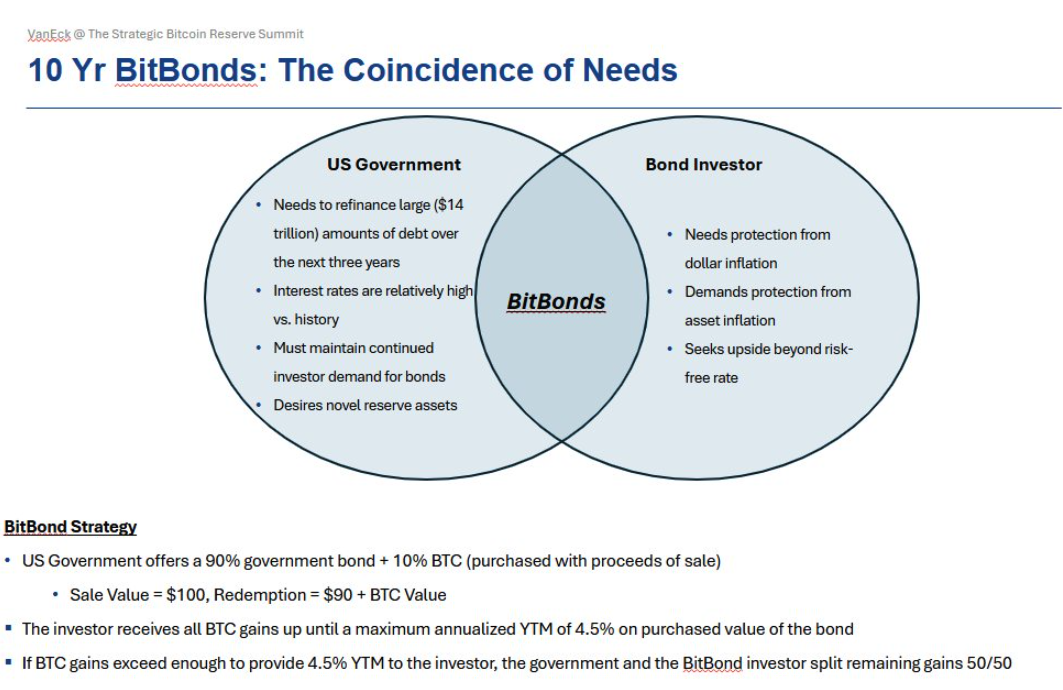

Sigel stated that this new 10-year bond would consist of 90% traditional debt and 10% BTC exposure, which would attract both the Treasury and global investors.

He mentioned that even in the case of Bitcoin "going to zero," Bitcoin Bonds could help the U.S. save money for refinancing the $14 trillion in debt expected to mature in the next three years.

"From a historical perspective, current interest rates are relatively high. The Treasury must maintain ongoing demand from investors for bonds, so they need to attract buyers," Sigel said during the online meeting.

At the same time, bond investors are looking for protection against dollar inflation and asset inflation, making Bitcoin an ideal component of the bond, as this cryptocurrency has become a tool for hedging against inflation.

Excerpt from Matthew Sigel's presentation on Bitcoin Bonds at the 2025 Strategic Bitcoin Reserve Summit. Source: Matthew Sigel

Sigel stated that under the proposed structure and 10-year term, Bitcoin Bonds would return "a $90 premium, plus any value contained in Bitcoin." He added that investors would receive all Bitcoin gains until the maximum annual yield reaches 4.5%.

"If Bitcoin gains are sufficient to provide an annual yield exceeding 4.5%, the government and bond purchasers will share the remaining gains 50-50," he said.

Sigel indicated that compared to standard bonds, the proposed 10-year Bitcoin Bonds would offer substantial returns to investors when Bitcoin gains exceed the breakeven rate.

However, he added that the downside is that Bitcoin must achieve a "relatively high compound annual growth rate" under lower coupon rates for investors to break even.

Source: Matthew Sigel

From the government's perspective, if bonds can be sold at a 1% coupon rate, Sigel estimates that even if "Bitcoin goes to zero," the government could still save money. He added:

"Similarly, if sold at a 2% coupon rate, even if Bitcoin goes to zero, the government would still save money compared to the current 4% market rate. And in the 3% to 4% coupon rate range, Bitcoin must perform for the government to save money."

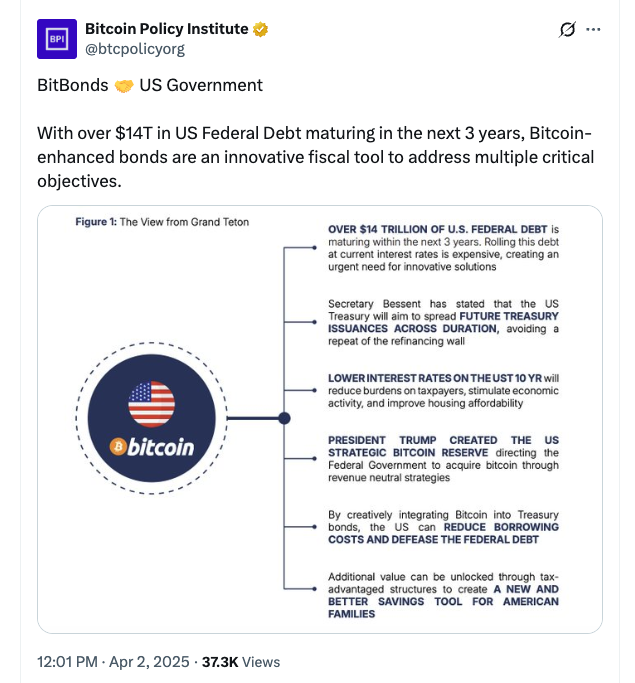

While cryptocurrency-backed government bonds are not a new concept, Sigel's Bitcoin Bond proposal is another exploration following a similar proposal made by the Bitcoin Policy Institute (BPI) in March.

BPI estimates that the plan could save $70 billion in interest expenses annually, totaling $700 billion over ten years.

Treasury bonds are debt securities issued by the government to investors, who provide loans to the government in exchange for future returns at a fixed interest rate.

Cryptocurrency-backed bonds would be linked to cryptocurrencies like Bitcoin, giving investors the opportunity for potentially more attractive returns.

Source: Bitcoin Policy Institute

Under the Trump administration, as the U.S. government's attitude towards cryptocurrencies turned optimistic, discussions about potential Bitcoin-enhanced Treasury bonds have continued to heat up.

Related: Analyst: If the U.S. Treasury continues to inject liquidity, Bitcoin prices could soar to $137,000 in the third quarter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。