Source: Cointelegraph Original: "{title}"

Chip manufacturing giants Nvidia and Advanced Micro Devices (AMD) saw their stock prices decline in after-hours trading after Nvidia indicated that U.S. restrictions on artificial intelligence chips to China would lead to significant costs.

Nvidia stated in a regulatory filing on April 15 that it expects to incur approximately $5.5 billion in costs related to its AI chip inventory due to significant export restrictions imposed by the U.S. government on its business in China.

Nvidia reported that the U.S. government notified the company on April 9 that its popular H20 integrated circuit and any chips with similar bandwidth capacity now require an export license.

"The first quarter results are expected to include approximately $5.5 billion in costs related to inventory, purchase commitments, and associated reserves for H20 products."

The restrictions specifically mention China, Hong Kong, and Macau, with the government stating that the license requirements "address the risk that the relevant products may be used or re-exported for Chinese supercomputers."

Under previous export rules, the H20 was Nvidia's most advanced AI chip that could be exported to China. Government officials have been calling for stricter export controls on the chip, which has reportedly been used to train models for the Chinese AI startup DeepSeek.

According to NPR, the Trump administration initially shelved these restrictions after President Trump met with Nvidia CEO Jensen Huang earlier this month.

On April 14, Nvidia announced plans to manufacture some AI chips in the U.S. over the next four years, at a cost of hundreds of millions of dollars.

However, this did not prevent its stock price from falling after the latest filing and the impact of the upcoming earnings report. "No company is immune to tariffs," commented the Kobeissi Letter.

Nvidia's fiscal year 2026 first quarter ends on April 27.

Nvidia and AMD stocks decline in after-hours trading

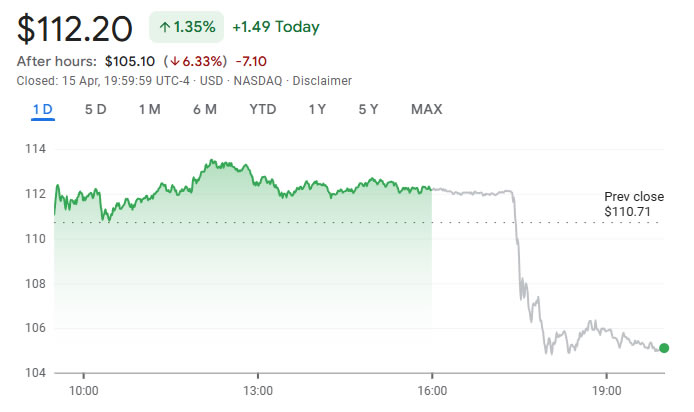

According to Google Finance, Nvidia (NVDA) shares fell 6% to $105 in after-hours trading on April 15.

So far this year, Nvidia's stock price has dropped 22%, amid a broad market decline caused by the escalating trade war and tariff threats from Trump.

NVDA price plummets in after-hours trading Source: Google Finance

Competitor chipmaker AMD also experienced a similar decline, falling over 7% to $88.55 in after-hours trading. Since January 1, AMD's stock price has dropped over 25%.

Related articles: Nvidia stock shows "death cross," will AI crypto tokens be affected?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。