Source: Cointelegraph Original: "{title}"

According to reports, local governments in China are actively exploring ways to sell seized cryptocurrencies; however, this process faces numerous challenges due to the national ban on cryptocurrency trading and exchanges.

There is currently a lack of clear rules regarding how authorities should properly handle seized cryptocurrencies, raising concerns about potential "inconsistent and opaque methods," lawyers noted in a Reuters report on Wednesday (April 16).

Reuters cited trading and court documents showing that local governments in China are selling seized cryptocurrencies through private companies in offshore markets to exchange for cash to supplement public funds.

According to reports, by the end of 2023, local governments held approximately 150,000 bitcoins (BTC), with a total value of $1.4 billion, making these sales an important source of revenue.

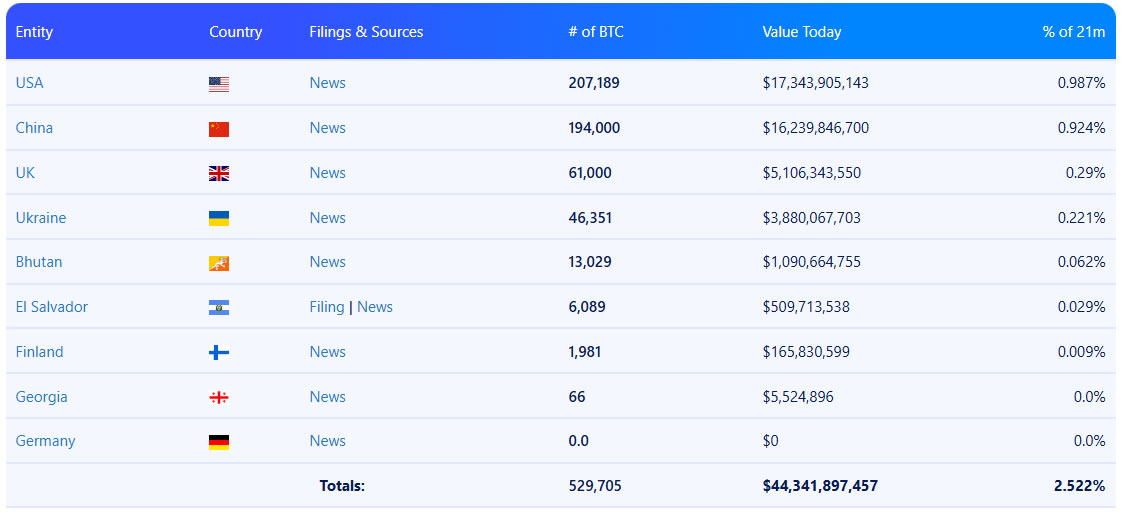

Data from Bitbo estimates that China holds 1,940,000 bitcoins, with a total value of about $16 billion, making it the second-largest holder of bitcoin globally, after the United States.

Chen Shi, a professor at Zhongnan University of Economics and Law, told Reuters that these sales are a "temporary solution that does not fully comply with China's current ban on cryptocurrency trading."

Countries and governments holding bitcoin Source: Bitbo

This issue has become increasingly severe with the rise of cryptocurrency-related crimes in China, including online fraud, money laundering, and illegal gambling. Additionally, the state has prosecuted over 3,000 individuals involved in cryptocurrency-related money laundering activities in 2024.

Chinese crypto reserves proposed as a solution

Shenzhen lawyer Guo Zhihao believes that the People's Bank of China is better equipped to handle seized digital assets and suggests selling them overseas or establishing a crypto reserve.

Ru Haiyang, co-CEO of Hong Kong cryptocurrency exchange HashKey, also made a similar suggestion, arguing that China might want to build a strategic reserve using confiscated bitcoins, similar to the approach taken by former U.S. President Donald Trump.

He also proposed the idea of creating a crypto sovereign fund in Hong Kong, where cryptocurrency trading is legal.

As tensions between the U.S. and China escalate, and Trump plans to strengthen regulations on stablecoins while promoting growth and innovation in the crypto industry, this issue has garnered widespread attention.

Some industry observers believe that China's tariff responses could lead to a depreciation of the yuan, thereby prompting capital to flow into the cryptocurrency market.

Related articles: The Rise of DeepSeek and Its Security Risks: Lower Prices, Faster Speeds, Greater Risks

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。