Master's Discussion on Hot Topics:

Today, let's talk about some of my personal views on recent trends. So far, I still believe that the market will not reverse so quickly, so there is no need to rush; we can just wait patiently. Although there are some fluctuations now, many things have not yet reached their time.

First of all, in the current risk market, we cannot only focus on tariffs. Although tariffs are quite important, the biggest trouble for U.S. stocks or global risk assets this year is actually the chain reaction caused by the big reduction in spending.

Economics has its transmission and lag effects. When spending is reduced, economic growth must slow down, and employment will also decrease, leading to a host of subsequent problems. Therefore, we need to broaden our perspective and not just focus on one point.

Regarding the recent market situation, if you make money, you should quickly exit, regardless of what you bought, and do not hold too high a position. Don't always think about making a little more; taking profits when you can is the hard truth.

Before the Federal Reserve recognizes reality and shifts its policy, don't expect any liquidity-rich market this year. So, everyone should not think that the market can suddenly become bullish.

Speaking of Bitcoin, the strong resistance at the daily level has dropped from last month's 88.8k to around 87k, with specific resistance at around 86.8. If it breaks below 83k, it will try to reach 80k again, while 79k is the low point of the correction wave. Therefore, as long as it hasn't broken below, I won't look for lower positions.

If 86.8k is strongly broken, the highest it can reach will only be around 91.3 to 91.8k. This is the range of recent fluctuations. Yesterday, I also made it very clear in my public account article that Bitcoin could drop at any time; only a significant drop can properly adjust market sentiment.

In the medium term, there are definitely more opportunities to fall than to rise. Yesterday, it peaked around 86.5k, which was exactly the short position range I provided. This morning at 8 AM, it dropped below 83.2k. This short position almost perfectly reached the second target, yielding about 3000 points in profit—great!

Speaking of ultra-short-term trading, there is no need to care about macro control; as long as there are no major news impacts, it’s fine. Look at trend lines and technical indicators; making money is the key.

The logic of the trend hasn't changed. Don't think that just because it has risen a bit, it will reverse; that's overthinking. The daily line can still return to the trend line and move down. Considering the situation in the U.S. and industry patterns, a drop is still highly probable.

Master's Trend Analysis:

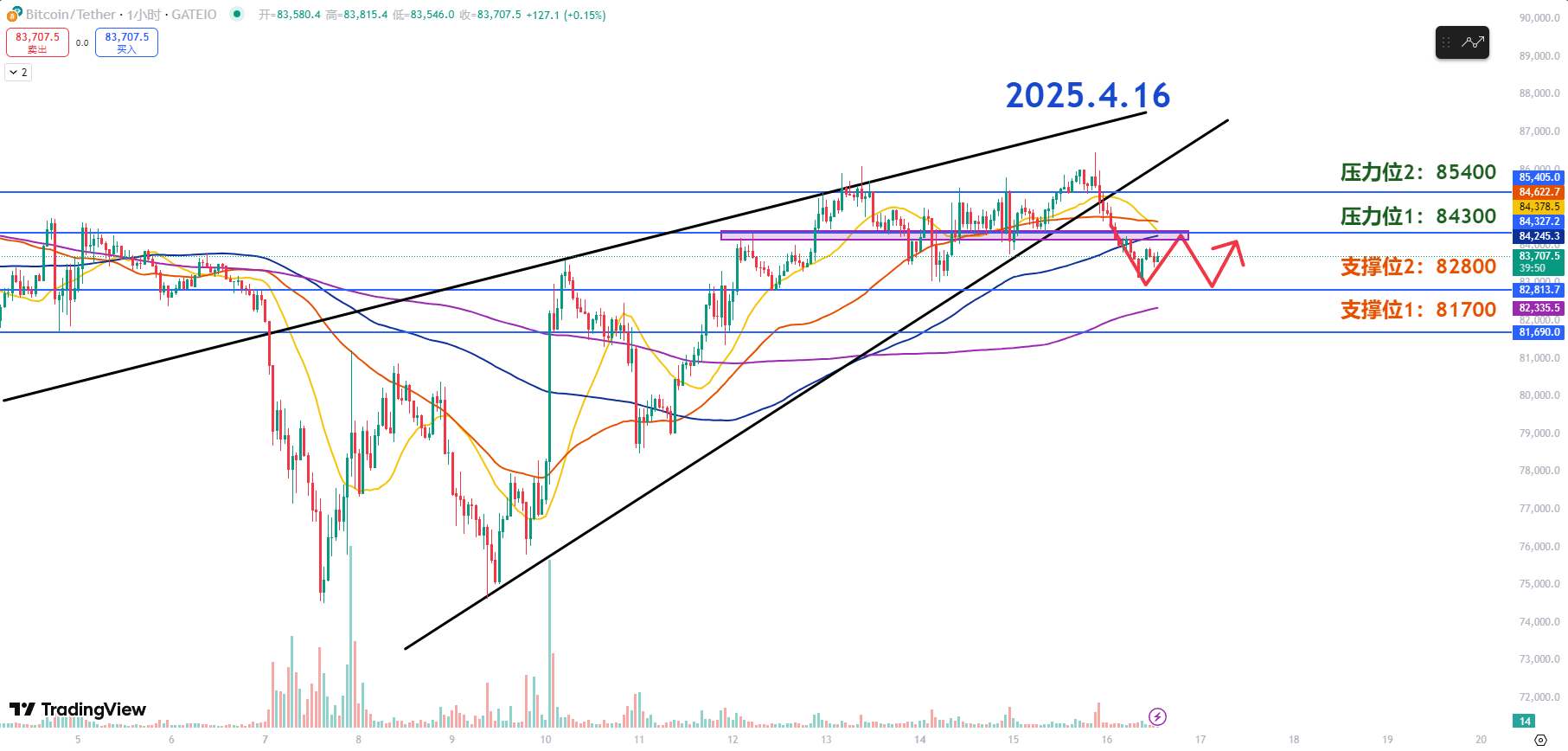

Resistance Levels Reference:

First Resistance Level: 85400

Second Resistance Level: 84300

Support Levels Reference:

First Support Level: 82800

Second Support Level: 81700

Today's Suggestions:

Bitcoin has fallen again after retesting 86K, currently staying at 83K. The price accelerated downwards after breaking the lower trend line of the rising wedge pattern, and temporarily stabilized at the 200-day moving average on the 4-hour level, which can be used as a baseline for today.

The recently stabilized support level of 84.3K has now turned into a resistance level. Since it was previously a strong support that has now become strong resistance, and overlaps with the moving average, if there is no significant trading volume to support a breakout, the price will continue to adjust here.

The range from 84.3K to 85.4K is a densely traded area above. If the price breaks through and consolidates within this range before retesting the high, it can turn bullish in the short term.

If the price holds above the first support level, the rebound expectation can be maintained. However, due to low trading volume and strong resistance, if the price breaks below the first support level again, it will accelerate downwards to the previous low.

Before reaching the second support level, attention can be paid to the 200-day moving average on the 1-hour level. Although it has broken below the rising trend line, the densely traded area of the previous low can be set as a phase support, seeking short-term rebound opportunities.

4.16 Master's Short Position Setup:

Long Entry Reference: Not currently applicable

Short Entry Reference: Light short in the 84700-85400 range, Target: 82800-81700

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Friendly Reminder: This article is only written by Master Chen on the official account (as shown above). Other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。