On April 15, Binance Wallet officially announced the launch of the Second Season Sei DeFi Event. Similar to the first season, this season will last for 6 weeks, with a total prize pool of $1.4 million, of which $1.3 million will be allocated to the leading project in the Sei ecosystem — Yei Finance.

Yei Finance: The Rapid Advancement of Sei Ecosystem Leader

Yei Finance is positioned as a decentralized money market (lending protocol) based on the high-performance Sei network, aiming to provide Sei ecosystem users with permissionless, secure, efficient, and user-friendly lending services.

On December 14, 2024, Yei Finance announced the completion of a $2 million seed round financing, led by Manifold, with participation from several well-known institutions including DWF Ventures, Kronos Research, Outlier Ventures, Side Door Ventures, and WOO.

As the mainstream lending market in the Sei ecosystem, Yei Finance has the following key features:

Increased Yield: Through collaboration with Binance Wallet, the incentivized yield on USDC deposits on Yei Finance can reach up to 12.8%, which is nearly the highest level among major lending markets in various ecosystems.

Flexible Borrowing: Yei Finance supports two borrowing models: one is traditional over-collateralized borrowing, and the other is under-collateralized flash loans, but both models adhere to strict risk parameters.

Dynamic Interest Rates: Yei Finance employs a more flexible dynamic interest rate model that can be adjusted based on asset supply and demand fluctuations. This responsive mechanism maintains liquidity balance, with interest rates rising as borrowing demand increases and falling as it decreases.

Efficient Mode (E-mode): Yei Finance allows users to use price-related assets as collateral, maximizing capital efficiency. This feature is particularly useful when trading stablecoins and other assets, as these assets tend to maintain stable value relative to specific reference currencies (e.g., USD).

Safe and Reliable: Yei Finance is essentially a fork of the original Aave protocol, thus benefiting from Aave V3's thoroughly tested and audited smart contract codebase. Additionally, the Yei Finance team has taken extra measures by hiring the well-known third-party auditing firm Zellic to enhance the protocol's audit.

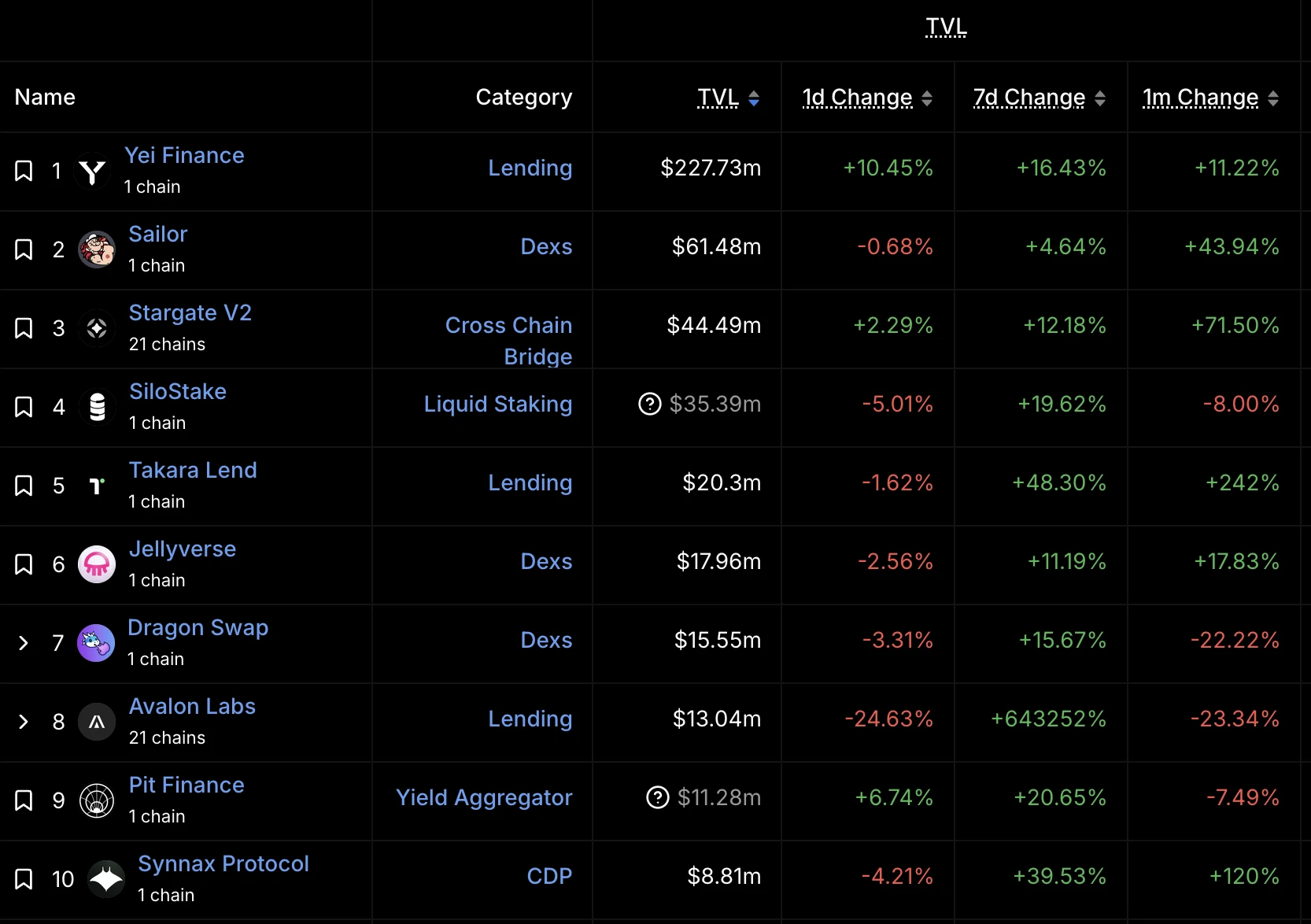

According to DeFillama data, Yei Finance currently ranks first in the Sei ecosystem with a real-time total locked value (TVL) of $227.7 million, significantly outpacing other protocols. Furthermore, Yei Finance's official website shows that the total scale of deposits and loans has reached $350 million (peaking at $600 million), with over 130,000 users and monthly revenue reaching $700,000.

Partnering with Binance Wallet for Rapid Growth

Looking back at Yei Finance's growth trajectory, high-quality and extensive ecosystem partnerships can be considered an effective "secret" for the protocol's rapid expansion.

According to Yei Finance's official disclosure, the protocol has currently established partnerships with several well-known institutions/projects including Circle, Binance Wallet, OKX Wallet, Frax, and Stargate, with the collaboration with Binance Wallet directly boosting Yei Finance's data surge.

On March 4, Binance Wallet launched the First Season Sei DeFi Event, which lasted for 6 weeks with a total prize pool of up to $1.5 million. During the event, users could bridge assets to Sei EVM through Binance Wallet and deposit into the Simple Yield Yei Finance pool (with $1.3 million allocated to the prize pool) or the Yield+ SEI Silo Pit strategy to share in the rewards.

Data from the Binance Wallet interface shows that under the incentive increase of this event, the APY for USDC deposits within the Yei Finance protocol consistently remained between 11% and 16%, attracting a large number of users to flow into the Sei ecosystem and deposit funds into Yei Finance.

According to a post-event review by Yei Finance, the collaboration with Binance Wallet attracted over 750,000 visits, with the number of deposit users reaching 7,543. The total deposit value during the event reached $759.8 million, with a final retained locked value of $166.7 million.

Event "Refill", How to Participate?

The first season of collaboration between Yei Finance and Binance Wallet officially ended today, but both parties have announced a seamless launch of the Second Season Sei DeFi Event, which will last until May 26, with Yei Finance's deposit activities accounting for $1.3 million of the total prize pool of $1.4 million.

Similar to the first season, users need to bridge assets to Sei EVM through Binance Wallet and deposit into the Simple Yield Yei Finance pool. However, in addition to USDC deposits, this season is expected to offer deposit incentive activities for solvBTC — the Binance Wallet page currently shows "coming soon," with details unknown, which is worth paying attention to.

Yei Finance Points Program: A Surprise for Double Benefits?

In addition to the clearly higher APY, Yei Finance has currently launched a points program.

According to Yei Finance's official introduction, currently depositing SEI, WSEI, USDT, or USDC within the protocol earns 1 point for every $1 borrowed; borrowing SEI, WSEI, USDT, or USDC within the protocol earns 4 points for every $1 borrowed.

Additionally, users can invite more users to join through a sharing system and earn a share of the points from the invited users. Furthermore, completing Galxe tasks during the Binance Wallet collaboration event can also earn double points bonuses.

Although Yei Finance has not explicitly defined the points for users, it is likely that, in line with current industry norms, points will serve as a reference for Yei Finance's future TGE airdrop.

Perhaps the Optimal Place for Stablecoins

In the current market, where fluctuations are frequent and the direction is unclear, investors are becoming increasingly cautious about their stablecoin holdings, and the demand for risk-free financial management is rising.

However, for most ordinary users, the yields from stablecoin interest-bearing financial management within exchanges are currently too low, and various DeFi protocols present certain operational difficulties and unknown risks, making it hard to find a trustworthy and profitable place for stablecoins. In this context, the collaboration between Yei Finance and Binance Wallet effectively addresses this issue; on one hand, Binance Wallet's endorsement strengthens Yei Finance's credibility, and on the other hand, the event provides users with clear and straightforward guidance.

In the current market environment, achieving a stable yield of 12%+ on stablecoins while also having potential airdrop expectations is hard to find a better place for stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。