Source: Cointelegraph Original: "{title}"

As a key indicator from the world's largest cryptocurrency exchange, Binance, shows that buyers are starting to dominate the platform's trading volume, bullish sentiment for Bitcoin (BTC) may be returning.

CryptoQuant contributor DarkFost noted in a report on April 15 that the Binance Taker Buy Sell Ratio, which reflects the ratio of Bitcoin buyers to sellers on Binance, has "returned to neutral territory."

The current ratio is 1.008. When this ratio is above 1, it indicates that buyers dominate the trading volume, which is typically seen as a bullish signal; conversely, a ratio below 1 indicates that sellers dominate, reflecting bearish sentiment.

The trading price of Bitcoin at the time of publication was $83,000. Source: CoinMarketCap

According to CoinMarketCap data, the trading price of Bitcoin at the time of writing is $83,810, down 1.47% over the past week.

"In the past few days, the ratio has mostly been positive, indicating that bullish sentiment in the Binance derivatives market is strengthening again," DarkFost stated. On April 14, when Bitcoin was above $86,000, the ratio was above 1.1.

CoinGlass data shows that if Bitcoin returns to $85,000, nearly $637 million in short positions will face liquidation risk. Multiple key market indicators suggest that investors continue to prefer Bitcoin over other cryptocurrencies.

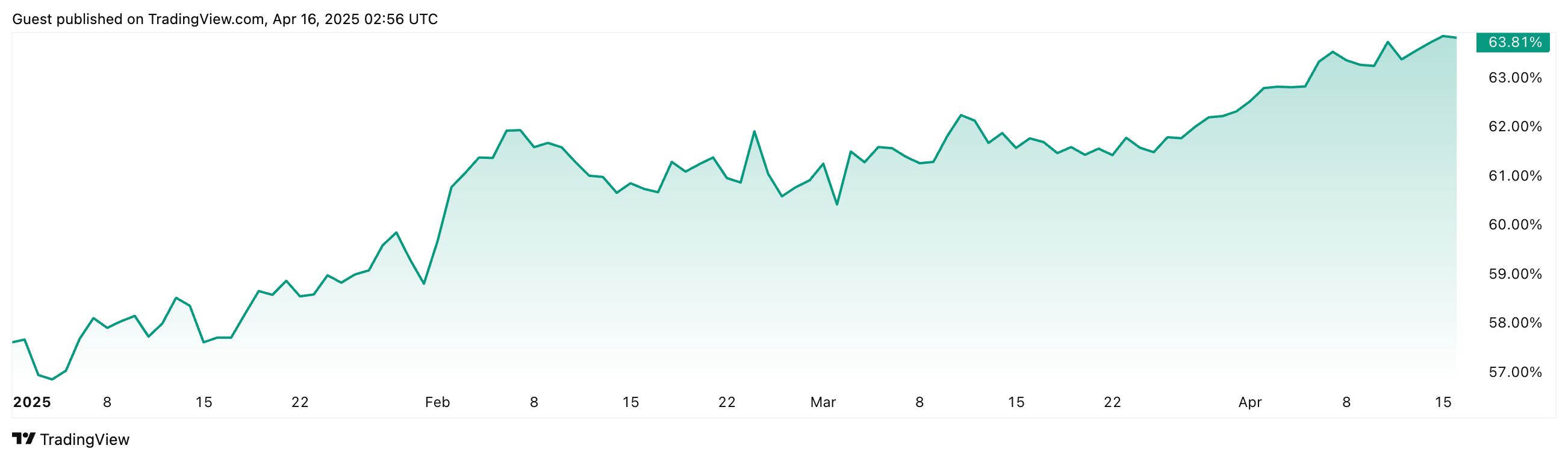

The altcoin season index from CoinMarketCap is currently at 15 (out of 100), indicating that it is still "Bitcoin season." TradingView's Bitcoin dominance chart shows that the asset's market share is 63.81%, up 9.82% year-to-date.

Bitcoin's dominance has increased by 9.88% since the beginning of the year. Source: TradingView

Overall, cryptocurrency market participants still seem to hold a cautious attitude. The cryptocurrency fear and greed index shows an overall market sentiment of "fear" on April 16, with a score of 29 (out of 100).

Some analysts, including DeFiDaniel, commented that Bitcoin's recent price movements are "very boring."

However, Cointelegraph previously reported that Bitcoin's apparent demand is recovering but has not yet reached net positive levels. Historically, when Bitcoin reaches a local bottom, the apparent demand may move sideways for an extended period, leading to horizontal price fluctuations.

Analysts have differing views on the future direction of Bitcoin.

Jamie Coutts, Chief Crypto Analyst at Real Vision, told Cointelegraph at the end of March, "The market may be underestimating the speed of Bitcoin's rise—potentially setting new highs before the end of the second quarter."

Rob Hamilton, CEO of AnchorWatch, stated on the X platform on April 15 that Bitcoin's price is "flat throughout the day as we are in an epic tug-of-war between those selling Bitcoin to pay taxes and those buying Bitcoin with their tax refunds." The tax deadline in the U.S. is April 15.

Related: Despite Bitcoin rising to $86,000, the death cross still exists—should Bitcoin traders be worried?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。