Author: Zen, PANews

In recent years, with the rise of cryptocurrencies such as Bitcoin and Ethereum, the global digital asset market has rapidly expanded. As of early April 2025, the total market capitalization of the global cryptocurrency market has dropped to $2.63 trillion even after a significant decline, still making it an important pillar of the global financial market.

At the same time, traditional banks have a significant gap in meeting customer needs—according to a recent survey by Bitpanda, less than 20% of European banks offer digital asset services, while over 40% of commercial investors already hold crypto assets. Additionally, Michelle Neal, CEO of Fnality, pointed out that several major international banks are accelerating their embrace of blockchain technology to achieve real-time settlement and cost efficiency improvements.

In this context, Singapore Gulf Bank (SGB), the world's first licensed bank to offer fully remote account opening services in the MENA region, is attempting to break this situation. By combining crypto-friendly services with strict compliance regulations, it aims to provide new banking solutions for crypto users and digital nomads who have been overlooked by the traditional financial system.

Establishment and Background of Singapore Gulf Bank

Singapore Gulf Bank was established at the end of 2023. This digital bank, set up in Bahrain, was initiated by the Whampoa Group from Singapore. The Whampoa Group is an investment company active in the technology sector, founded by Li Runying, the niece of Singapore's founding Prime Minister Lee Kuan Yew, and Li Hanshi, the grandson of the founder of Oversea-Chinese Banking Corporation.

After officially establishing and obtaining a banking license from the Central Bank of Bahrain, the bank soon received investment from Bahrain Mumtalakat, the sovereign wealth fund of the Kingdom of Bahrain, elevating the banking project to a national strategic development project and becoming a new benchmark for financial technology service innovation in Bahrain and the Gulf region.

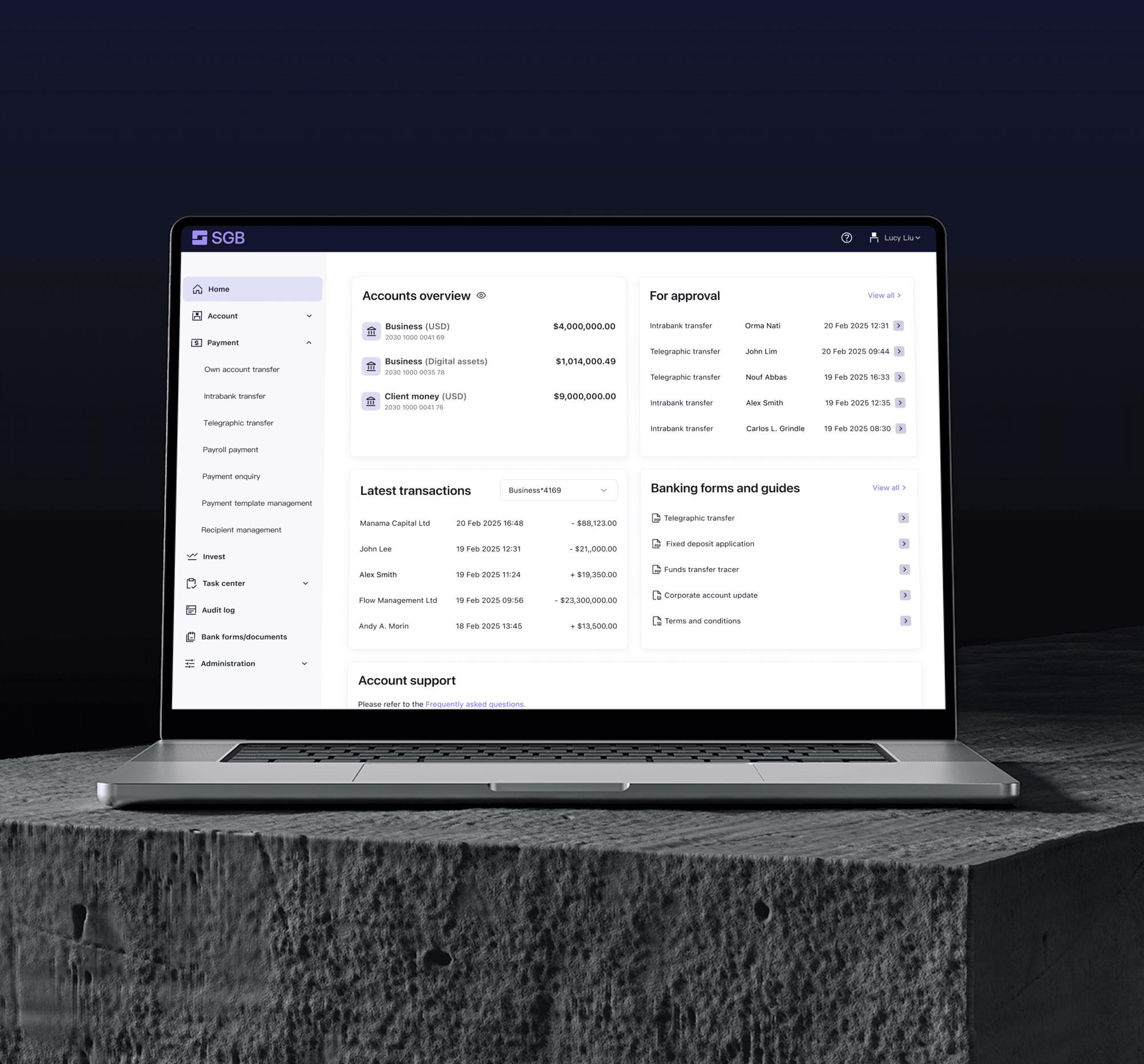

On November 4, 2024, Singapore Gulf Bank, in conjunction with the Central Bank of Bahrain and the Bahrain Economic Development Board, announced the launch of corporate banking services for the global digital economy, becoming the first licensed bank in Bahrain to offer comprehensive cryptocurrency-compatible banking services. In addition to conventional corporate banking services, the bank will also provide real-time settlement networks, digital asset custody, and intuitive and efficient trading solutions. As its Chief Development Officer and Executive Vice President Cai Yile stated, digital companies such as Web3 will constitute the main customer base for the bank's services.

SGB announced the launch of corporate banking services at the second Gulf Gateway Investment Forum.

After receiving a strong market response to its corporate banking services, in April of this year, Singapore Gulf Bank expanded its services to individual customers, officially launching personal banking services. As the first and only regulated bank in the MENA region to provide fully remote digital account opening services for global investors, innovators, and institutions, SGB aims to offer remote account opening and integrated banking solutions for traditional and digital assets to millions of individuals worldwide. Currently, personal banking services are offered through an invitation-only registration process.

Breaking the Limitations of Traditional Banks

Under the comprehensive regulation of the Central Bank of Bahrain, Singapore Gulf Bank provides global remote account opening services, allowing global investors, innovators, and small businesses to complete account opening without having to visit Bahrain, and utilize its settlement network for cross-border payments and settlements. This not only significantly lowers the barriers to account opening but also opens new opportunities for user groups that have been unable to enjoy quality financial services due to geographical limitations.

Facing global Web3 users, Singapore Gulf Bank is striving to break the limitations of traditional banks in the field of digital asset services by pioneering crypto-friendly bank accounts. These accounts not only support customers in depositing salaries in fiat or cryptocurrencies but also feature multiple functions such as payments, transfers, and investments. Through deep integration with top licensed trading platforms and exchanges, SGB can achieve instant and secure seamless conversion between fiat and cryptocurrencies, greatly enhancing the efficiency and convenience of fund circulation.

In addition, regarding cross-border payment and foreign exchange needs, Singapore Gulf Bank will combine the multiple advantages of wire transfers, its own bank cards, and cryptocurrency payment channels to provide global users with low-cost, high-efficiency international remittance solutions. Whether for studying abroad, business travel, or daily cross-border transactions, SGB can offer flexible and convenient financial services, effectively addressing the complexities faced by traditional banks in cross-border payments and settlements.

With comprehensive banking services, Singapore Gulf Bank also opens up diversified investment channels for customers. These channels not only include high-yield savings and fixed deposit accounts (with annual interest rates of up to 4%) but also products with unique investment opportunities in Asia and the MENA region, providing customers with more diversified asset allocation options.

Through its own settlement network, Singapore Gulf Bank has achieved 24/7 real-time payment services. This applies not only to quick transfers between individual users but also meets the needs for high-frequency fund flows between institutions. Its fee-free instant transfer service significantly enhances the overall efficiency of financial transactions and improves user experience.

Practical Exploration of Building a "New Banking" Model

"The company does not intend to compete with traditional banks, but in areas where it can compete, it hopes to be the first." Last year, Singapore Gulf Bank Chairman Li Youqiang stated in an interview with Lianhe Zaobao that he is firmly optimistic about the development prospects of digital assets and emphasized focusing on customer groups that have not been adequately served by traditional banks. SGB aims for differentiated competition and crypto-friendly banking services, with the goal of building an ecosystem that encompasses transactions, transfers, payments, and storage between digital assets and cash.

In building this new banking model, Singapore Gulf Bank fully relies on advanced digital technology and AI technology. By constructing an AI-driven risk control system, the bank can achieve real-time monitoring of customer behavior, reducing fraud risks. At the same time, through automated identity verification processes, Singapore Gulf Bank has greatly improved account opening efficiency while ensuring strict compliance management across its services. In this way, SGB not only achieves seamless integration of traditional banking business and digital asset services but also provides global users with a unified and convenient banking service entry point.

Bahrain's Minister of Finance and National Economy, Salman (left), and Singapore Gulf Bank Chairman Li Youqiang (right).

Li Youqiang emphasized in the interview with Lianhe Zaobao that Singapore Gulf Bank is not a cryptocurrency exchange, and he does not view cryptocurrencies as speculative assets but rather as a payment channel that can facilitate cross-border trade. Based on this concept, Singapore Gulf Bank clearly positions itself towards crypto-native users and customers interested in cryptocurrencies, while ensuring that traditional financial needs are met, focusing on building a comprehensive ecosystem for digital asset services.

As the global digital asset market continues to expand, countries are increasingly tightening regulations on cryptocurrency trading. Singapore Gulf Bank adheres to the principles of legal and compliant operations in its new banking model, especially concerning cryptocurrency business. Under the comprehensive regulation of the Central Bank of Bahrain, SGB strictly follows international financial and regional compliance standards in the processes of account opening, trading, and asset management, ensuring that all aspects involving fiat and cryptocurrency transactions meet anti-money laundering (AML) and know your customer (KYC) requirements.

Can the Innovative Model Lead a New Trend in Digital Banking?

"I come from a traditional banking background and see many disruptive changes happening. Technology allows us to do many things that were previously impossible." In his 40-year banking career, Li Youqiang has served as Chairman and CEO of DBS Vickers and Vice Chairman of JPMorgan Asia Pacific. Now, he views "developing Singapore Gulf Bank into a leading or largest digital bank in the industry" as the ultimate goal of his career, a challenging target for this newly established bank.

Bahrain's Crown Prince Salman (right) meets with Singapore Gulf Bank Chairman Li Youqiang (left).

Currently, with its core competencies in being crypto-friendly, cross-border payments, and strict compliance, Singapore Gulf Bank is gradually emerging as an important new force in the field of new banking. Facing challenges from technology, regulation, and the market, the bank provides global users with safe, convenient, and diversified financial solutions through differentiated strategies and refined management. Its innovative model offers a new financial choice for global individual users and will continue to be tested by the market and time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。