The U.S. stock market entering a bear market does not necessarily mean that #BTC is also entering a bear market!

It can only be said that the liquidity of cryptocurrencies will become increasingly tight.

Historically, #BTC has had a stronger negative correlation with the U.S. dollar index, and this history is longer, meaning:

When the U.S. dollar index falls 📉 — the price of #BTC tends to rise 📈. Recently, the U.S. dollar index fell below 100, which has actually created significant benefits for #BTC, gold, and the yen (as shown in Figure 1).

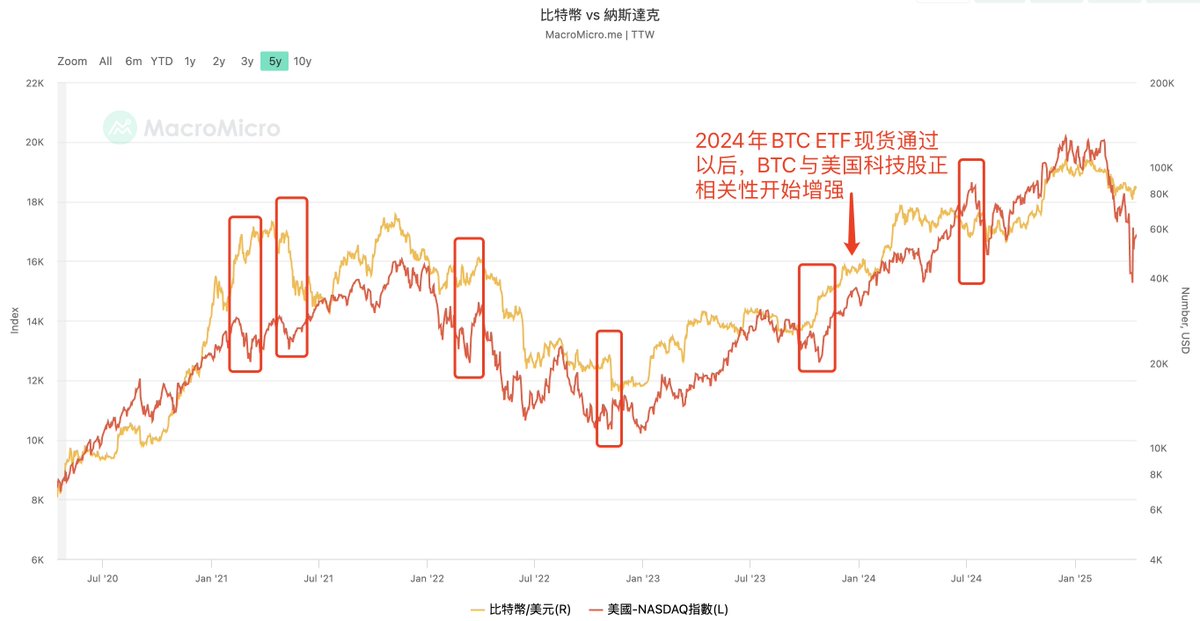

After the approval of the #BTC spot ETF in 2024, the price of #BTC will have a strong correlation with Nasdaq tech stocks, and this correlation is continuously strengthening. This is mainly due to companies like MicroStrategy holding a large amount of #BTC, creating a strong binding effect, and there is a significant arbitrage linkage between cryptocurrencies and stocks, leading to increased correlation (as shown in Figure 2).

But is there a day when #BTC completely decouples from the U.S. stock market? This situation is possible, especially when the credit of the U.S. dollar begins to show signs of crisis, such as special situations like short-term defaults on U.S. Treasury bonds. In such cases, the credit system may be reshaped, and funds will choose more safe-haven options to diversify risks, such as gold, the yen, and #BTC. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。