On February 15, we warned about liquidating U.S. stocks and advised caution regarding risks. Currently, we need to patiently wait for Buffett's move; he is often the most precise hunter, just like in 2008!

From various economic indicators, it seems that a recession in the U.S. is highly likely unavoidable, and the trade war will not stop in the short term. It's like playing Texas Hold'em; the sunk costs are too high, and both sides have already suffered trillions in economic damage, so we can only keep raising the stakes until one side wins it all. Today, Goldman Sachs' latest report predicts a very pessimistic outlook for the dollar, with a GDP growth expectation of 0 in 2025, and inflation is expected to rise significantly, with little chance of interest rate cuts.

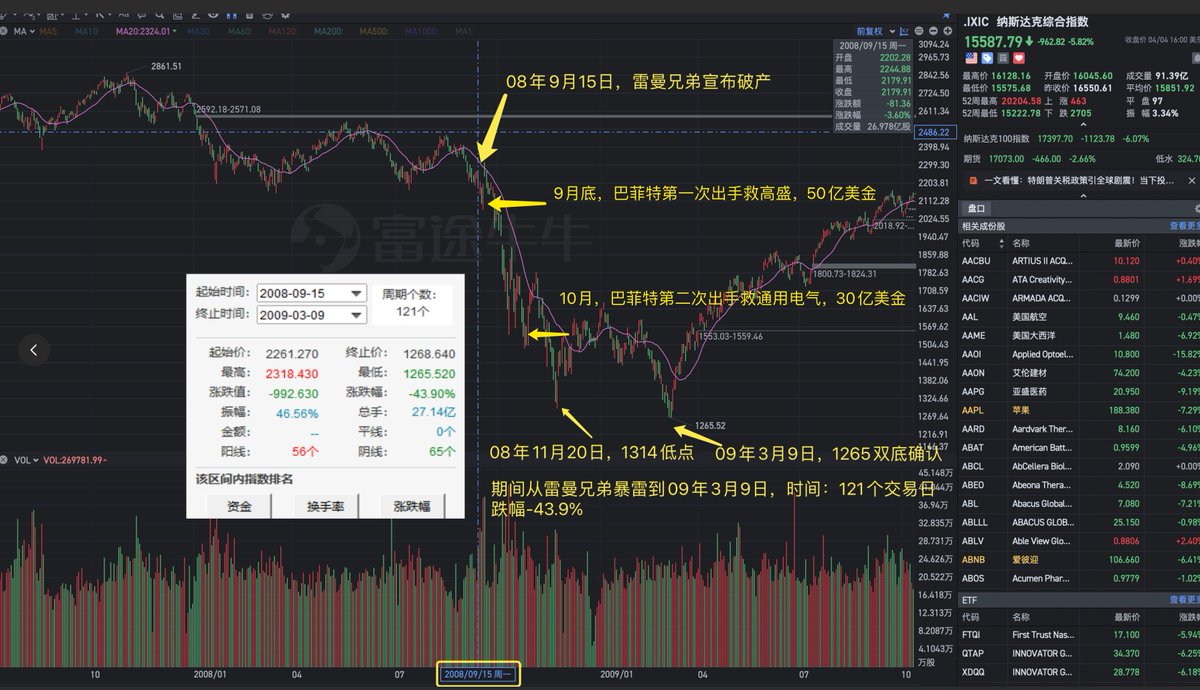

The team has created two charts for reference. One shows the situation during the 2008 financial crisis, where the bankruptcy of Lehman Brothers was just the beginning of a formal market decline, similar to our current situation. Buffett's two moves in 2008, especially saving GE, were remarkably precise in timing the bottom. We will soon receive Berkshire's Q1 financial report, which will reveal whether Buffett has made a move.

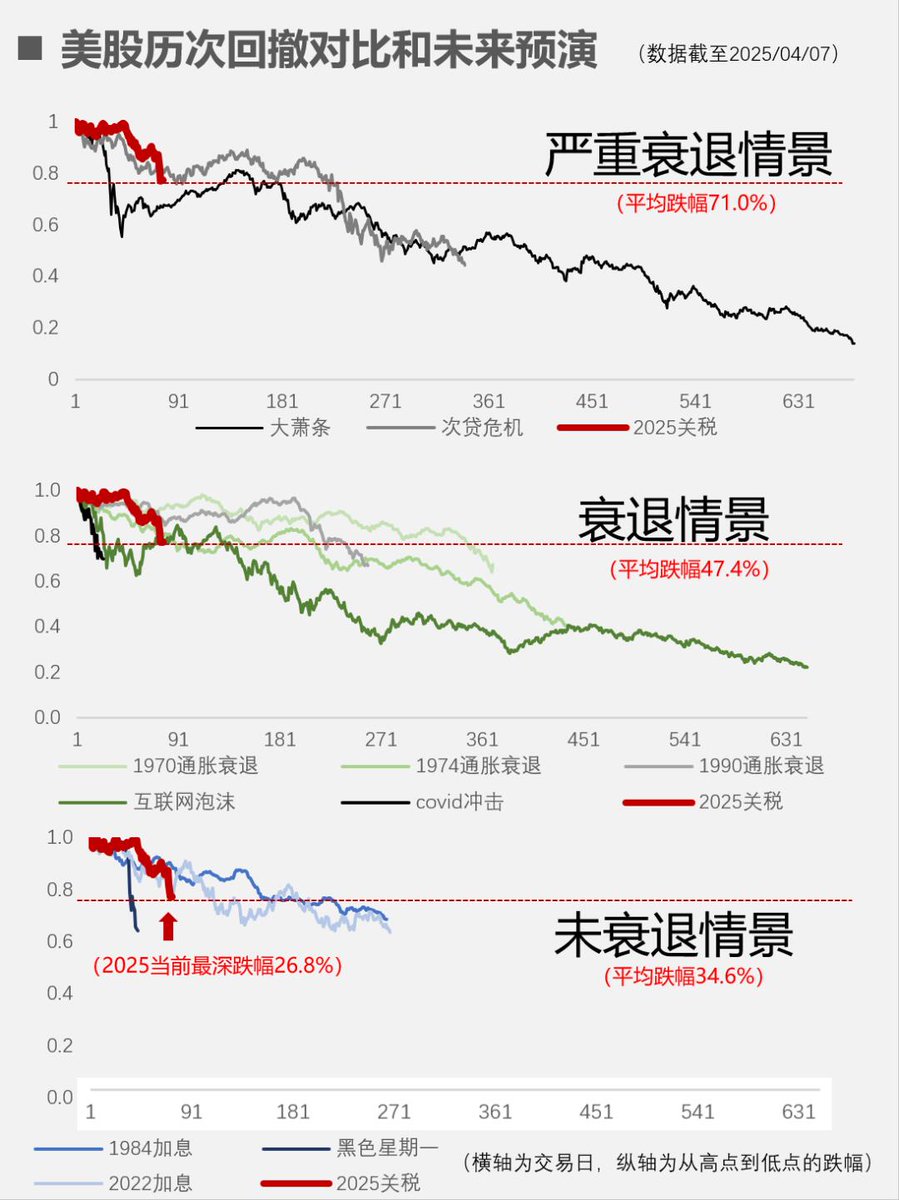

The other chart simulates predicted trends under various recession scenarios, overlapping with significant historical financial events. It is highly likely that we are still in the early stages of a decline; do not exhaust your resources too early. It is essential to maintain good cash flow and have enough ammunition. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。