Uniswap restarts liquidity mining, involving multiple USDT0 related pools.

Written by: 0xTodd

Isn't Uni restarting liquidity mining on April 15? This time it involves 12 pools, many of which are related to $USDT0. So, taking this opportunity, I want to talk about USDT0.

First of all, what is USDT0?

In simple terms, it is the cross-chain version of USDT. The parent asset USDT exists on ETH, and by using Layer0 to cross-chain to other chains, it becomes USDT0.

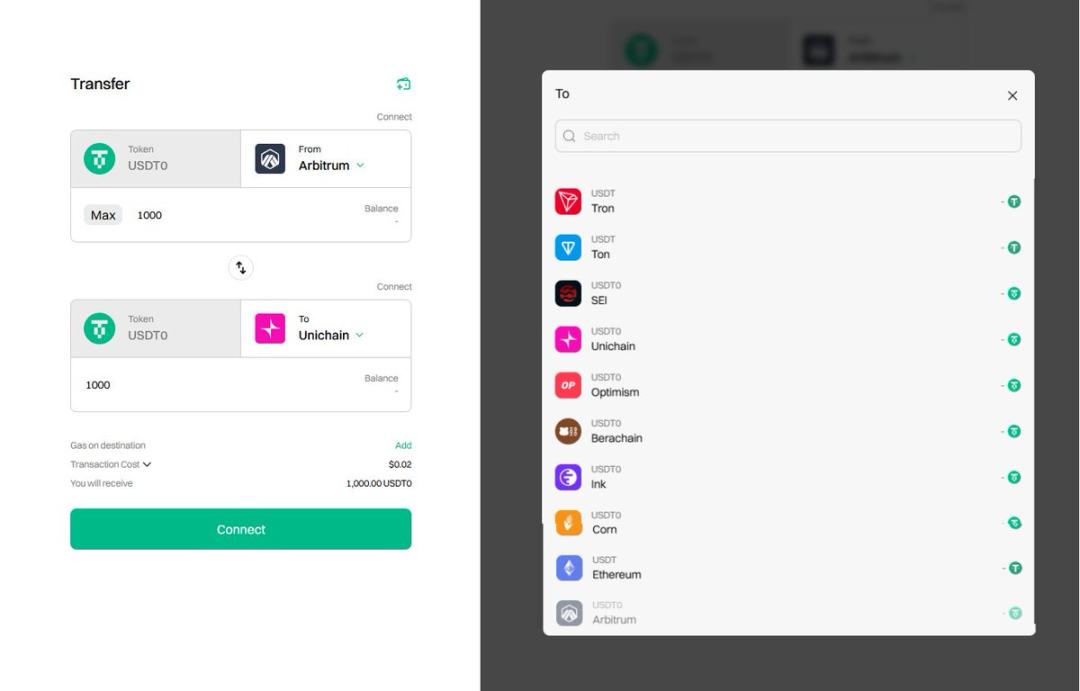

USDT0 can also cross between supported chains, such as ETH-Arb-Unichain-Bear Chain-megaETH, etc.

Who is behind USDT0?

This is the trickiest part; it took me a while to figure it out.

The USDT0 project is backed by a collaboration of 1+3 entities:

- Led by Everdawn Labs;

2.1 The underlying technology used is Layer0;

2.2 Backed by Tether;

2.3 Backed by the INK public chain (which is issued by Kraken).

However, who exactly is Everdawn Labs? There is no information online.

I reasonably suspect that it is just a front for Tether.

This aligns well with their tone:

If nothing goes wrong—then everyone can enjoy the multi-chain convenience of USDT;

If something goes wrong—then it’s Everdawn Labs' fault, unrelated to Tether.

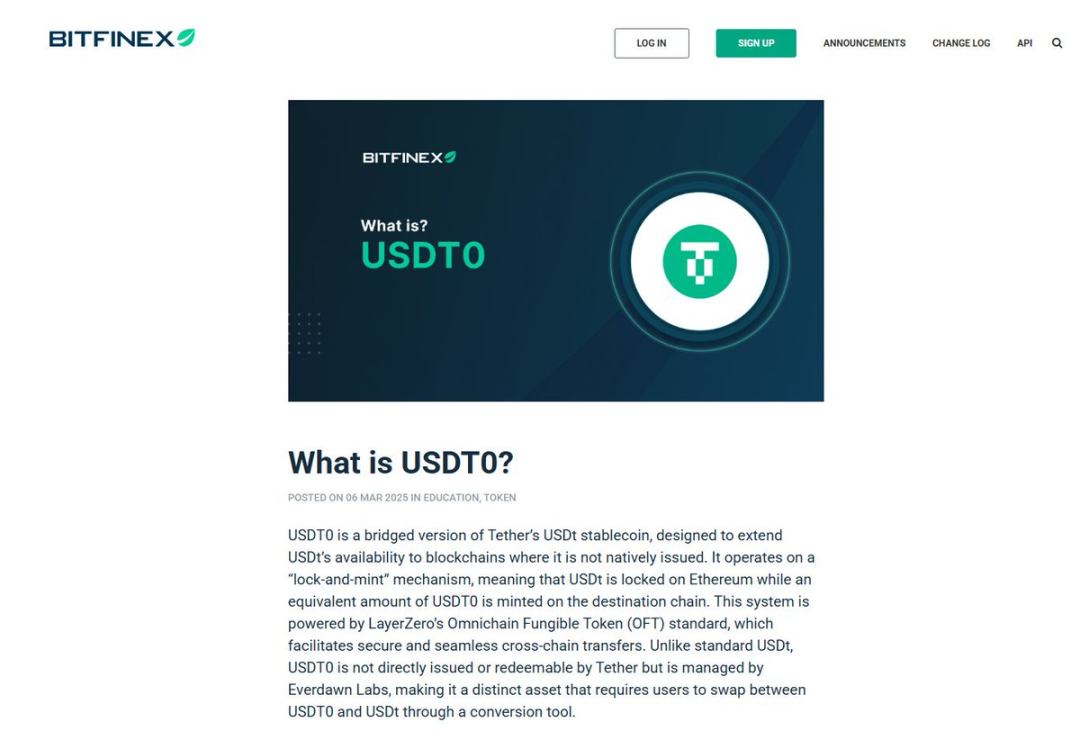

One reason for this speculation is that after USDT0 was launched this year, Tether officially expressed support immediately, and then Bitfinex also published an article interpreting it. If there wasn't a strong relationship, they (BF and Tether) wouldn't provide such support.

How to evaluate it?

I believe if Tether personally created this bridge, it would be a significant achievement, allowing USDT to cross chains without loss, avoiding the various ridiculous third-party cross-chain bridges.

However, my trust in Layer0 is limited.

There have been numerous cases of top cross-chain bridges failing, from multichain to thorchain; the technology of cross-chain has no real threshold, it's just multi-signature.

In the past, USDT has always used official bridges, not third-party bridges like L0.

Official bridges are generally safer, but the downside is that liquidity is dispersed.

For example, if you want to transfer a large amount of funds from Arb to OP without loss, you must go back to ETH from Arb and then to OP, and using a third-party bridge quickly incurs costs.

PS: Not to mention there are also troublesome public chains like Sei, where entering and exiting the official bridge incurs fees.

With the USDT0 solution, Arb can go directly to OP, without loss, and instantly.

PS: Of course, there is a historical issue with OP, as all USDT on OP are the old ETH cross-chain version, and the new USDT0 ETH cross-chain version has not yet been unified, so while it is nominally feasible to cross from Arb to OP, it is practically useless; this is just an example.

However, new public chains that support USDT0 from the start have no historical issues, so their usability is much higher.

But!

Tether itself is reluctant to personally create this bridge and insists on sending out Everdawn Labs to cover it up, which is a bit…

In the past, when I mined $UNI on ETH, I only had to bear the small risks of Tether and Uniswap as third parties. Now I have to bear an additional four risks, namely:

- Everdawn not messing up

- L0 not messing up

- Unichain not messing up

- USDT0 supporting other N public chains, each one not messing up

(If other public chains are hacked, and USDT0 is infinitely minted, then the USDT0 on those chains will also be contaminated)

Sounds a bit overwhelming.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。