I. Introduction: The First White House Cryptocurrency Summit and Its Aftermath

On March 7, 2025, the White House held the first-ever "Cryptocurrency Summit" in history. Prior to the summit, the market widely anticipated that the Trump administration would release significant positive signals, such as announcing additional purchases of Bitcoin, incorporating more mainstream cryptocurrencies into the "national crypto reserve," or implementing clearer regulatory policies to continuously boost market enthusiasm and further uplift the market.

Affected by these expectations, in the days leading up to the summit, Bitcoin surged from $80,000 to nearly $95,000, while other mainstream cryptocurrencies (including ETH, XRP, SOL, ADA) also generally rose by 5% to 25%.

However, after the summit officially convened, no large-scale purchasing plans or substantial new policies were announced, only reiterating the existing stance of "supporting the industry with moderate regulation." As market expectations fell short, a noticeable correction occurred after the summit, with Bitcoin dropping about 3% to 5% the day after the summit, and other mainstream coins also generally retreating by 5% to 10%.

Despite this, compared to the previous administration's comprehensive crackdown, the significant relaxation of current policies and regulatory environments still left the market relatively optimistic about the clarification of regulations and innovation space in the medium to long term. Some investors remain cautiously optimistic about the future evolution of U.S. policies in the crypto space.

To deeply understand this summit and its subsequent market fluctuations, we also need to review the regulatory path and policy evolution of the U.S. government in the crypto field in recent years. This article will provide a comprehensive analysis of the market trends before and after the summit, summarize key policy signals, and from an industry perspective, look forward to the far-reaching impacts of this summit on the future.

II. Historical Background: The Shift in U.S. Government Attitude Toward Cryptocurrency

- #### Early Years: A Cautious Attitude Focused on Regulation and Risk Prevention

- After the 2017 ICO bubble, U.S. regulatory agencies (such as the SEC, CFTC, etc.) primarily focused on combating fraud, money laundering, and preventing illegal capital flows, strengthening related law enforcement efforts, and requiring cryptocurrency exchanges to comply with "anti-money laundering/customer identity verification" (AML/KYC) regulations.

- At that time, the U.S. government mainly relied on existing legal frameworks (such as securities laws) to regulate cryptocurrencies and did not introduce specific federal legislation or regulatory sandboxes.

- #### Trump’s First Term and Biden Era: Fluctuating Attitudes and Gradually Stricter Enforcement

- Trump’s First Term (2017–2020): Overall, he held a skeptical attitude toward cryptocurrencies. In 2019, Trump publicly stated on social media that he "does not like Bitcoin" and other crypto assets, believing they would undermine the dollar's position. During this period, the U.S. government intensified law enforcement against ICO fraud cases and proposed to strengthen regulation of self-custody wallets at the end of 2020.

- Biden Administration (2021–2024): Although the Biden administration issued an executive order on digital assets in 2022, requiring federal agencies to coordinate research on cryptocurrency-related issues, subsequent enforcement efforts actually intensified. The SEC sued several large crypto companies, including Ripple and Coinbase, heightening market concerns about legal risks and somewhat suppressing institutional investor entry.

- #### Post-2024 Election: Trump’s Return and a Dramatic Shift to "Crypto-Friendly" Policies

- In January 2025, Trump returned to office and quickly signed Executive Order 14178, declaring that the U.S. would become the "global cryptocurrency capital." He revoked many of the regulatory policies from the Biden era, halted some lawsuits against cryptocurrency exchanges, and appointed former PayPal COO and investor David Sacks as the "Head of AI and Cryptocurrency Affairs."

- In late February 2025, Trump also signed an executive order to establish a "strategic Bitcoin reserve," but this measure was limited to retaining approximately 200,000 Bitcoins previously confiscated by the government, with no plans for additional purchases. While this action sent a strong signal to the market that "the U.S. government holds Bitcoin," it also dashed earlier market expectations that "the U.S. would purchase large amounts of BTC, ETH, and other cryptocurrencies."

III. Market Expectations and Enthusiasm Before the Summit

Before the summit officially convened (on March 7), the Trump administration hinted through social media in late February that it might include various cryptocurrencies such as BTC, ETH, XRP, SOL, and ADA in a "new U.S. cryptocurrency strategic reserve."

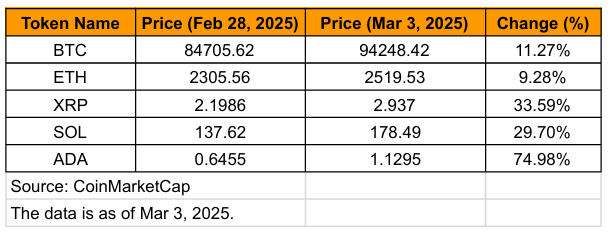

As a result, market expectations for "the Trump administration possibly announcing significant positive news" rapidly heated up. Bitcoin rose from $84,000 to nearly $95,000, and the cryptocurrencies mentioned by Trump (BTC, ETH, XRP, SOL, ADA) also saw significant price increases from late February to early March. The table below summarizes the price trends of these mainstream crypto assets from February 28 to just before the summit began (March 3):

From the data, the market originally expected the U.S. government to announce more substantial positive policies at the summit, such as formally purchasing Bitcoin or other mainstream coins using the federal budget, thereby further boosting market prices in the short term.

Driven by these expectations, market liquidity significantly increased, with trading volumes and the number of open interest (OI) in derivatives (such as futures and options) also rapidly growing during the same period. Overall market sentiment became optimistic, and investors' imaginations of "government endorsement" were quickly amplified.

However, the actual content of the executive order did not include any new purchasing plans, only stating that "the federal government will not sell the Bitcoin assets it currently holds," which meant limited new buying space in the short term and ultimately became one of the key reasons for the market correction after the summit.

IV. Summit Proceedings: Clear Policy Direction but Lacking Details

On March 7, the White House officially held the first "Cryptocurrency Summit," attracting over 20 key figures from the U.S. crypto industry. Although the meeting was promoted beforehand as "setting the tone for U.S. crypto regulatory policy for the next four years," no clear new policies or large-scale purchasing plans were ultimately announced:

- #### Trump’s Brief Attendance:

- Trump himself only attended the summit for about 30 minutes at the beginning, and during the live broadcast, he told participating crypto entrepreneurs that "the previous administration's war on cryptocurrency is over," emphasizing that the government would provide regulatory certainty for the crypto market at the legislative level.

- The subsequent closed-door discussions were led by David Sacks, the White House's head of crypto and AI affairs, and Treasury Secretary Scott Bessent. Several attendees (such as former CFTC Chairman Chris Giancarlo, MicroStrategy founder Michael Saylor, Paradigm partner Matt Huang, and Robinhood CEO Vlad Tenev) made suggestions, including large government purchases of Bitcoin, tokenizing traditional securities assets, and re-examining criminal charges against Tornado Cash developers, but these suggestions did not receive any immediate commitments or guarantees.

- #### "Friendly but Light-Touch" Regulatory Tone:

- Trump reiterated at the meeting that he would promote the development of the crypto industry through "friendly legislation and light-touch regulation."

- Although representatives from the Treasury and SEC did not explicitly commit to withdrawing more lawsuits, they stated that they would prioritize the industry's needs in the future.

- The summit did not issue any new executive orders or immediate bills, indicating that the government is still in the "gathering industry opinions and discussing regulatory details" phase.

- #### Mainstream Media Interpretation:

- Mainstream financial media (such as CNBC, Bloomberg, etc.) focused more on Trump's willingness to provide "regulatory certainty for the crypto market through congressional legislation," believing that there has been a clear improvement compared to the previous situation filled with gray areas and intensive lawsuits.

Overall, this summit "set the general direction but lacked specific details," and its short-term impact on the market was more about the disappointment brought by "expectations being falsified" rather than any disruptive positive news.

V. Market Trends and Technical Analysis After the Summit

After the summit concluded, the prices of Bitcoin and most mainstream coins experienced a wave of correction. The main reason was that the market quickly digested the "gap between expectations and reality," leading to short-term selling pressure, with many investors choosing to sell or temporarily wait and see.

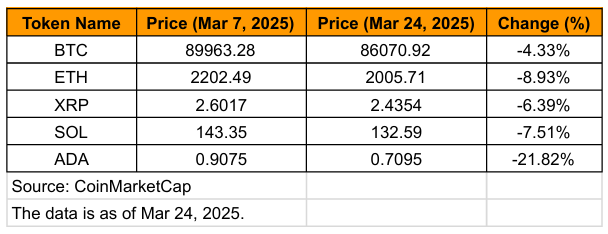

The table below summarizes the price trends of several major cryptocurrencies from the end of the summit (March 7) to late March (March 24):

Overall, the market atmosphere shifted from the optimistic expectation of "favorable policies" back to rationality, beginning a correction of "overly high expectations."

After losing the expectation of "government additional purchases," Bitcoin's price experienced a short-term pullback but did not show a breakdown; Ethereum and XRP also followed the overall market trend downward, while most other mainstream coins were in a state of "ending short-term upward trends and entering consolidation or correction." In the derivatives market, funding rates turned neutral or slightly negative, and open interest also decreased, reflecting a decline in the market's bullish leverage willingness and a weakening of short-term speculative sentiment. Meanwhile, Solana, due to the listing of CME futures and ETFs in mid-March, showed a slight upward trend against the trend, emerging with a certain independent market performance.

Although there has been an overall short-term pullback, many institutions and long-term investors remain optimistic about the potential for the U.S. to introduce more specific legislation or guidelines in the future, given the significant alleviation of regulatory risks in the medium to long term. Therefore, after experiencing a period of calm, the overall market still has the opportunity to regain buying momentum if the government announces specific favorable policies in the future.

VI. Conclusion: Short-Term Fluctuations in the Crypto Market, but Long-Term Potential Remains Promising

Regulatory and Legislative Trends

Although the first White House Cryptocurrency Summit did not introduce significant new policies or immediate legislative actions, the U.S. government clearly stated its support for "light-touch regulation to encourage industry development." From a policy perspective, the U.S. may become more proactive in formulating bills or regulatory mechanisms in the future, moving the market away from its previous "ambiguous or uncertain" state. If future legislation can be successfully implemented, it will encourage large financial institutions or technology companies to invest.

Market Sentiment and Institutional Participation

Compared to the previous administration's strong crackdown, the current regulatory risks are relatively lower. Many institutional investors (including investment banks, asset management companies, sovereign funds, etc.) have adopted a more accommodating attitude toward crypto assets, which may lead to an expansion of digital asset businesses.

In the long term, "national-level reserves" and a "government open attitude" are often significant driving forces behind bull market cycles. Even without large-scale cash purchases of cryptocurrencies this time, the market still anticipates more government collaboration projects or infrastructure investments in the future.

Long-Term Outlook

In the short term, the gap between market expectations and actual results has led to a price pullback from its highs. Technical and derivatives data indicate that trading sentiment has entered a wait-and-see phase, with investors awaiting clearer policy details or improvements in macroeconomic conditions.

From a medium to long-term perspective, as long as the direction of "U.S. officials recognizing the legal status of crypto assets and being willing to establish clear regulatory rules" remains unchanged, institutional funds and developer ecosystems are expected to continue flowing in. When macroeconomic and regulatory uncertainties gradually become clearer, the market may welcome a new wave of growth momentum. The current fluctuations are more about digesting "previous excessive expectations" rather than a reversal of trends. All parties are paying attention to whether the White House can formalize the opinions from this summit and implement them into a new regulatory framework, which will become one of the key driving forces for the subsequent market developments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。