Today's homework was manageable. Although the ideal increase was not achieved due to Lutnick's interference with electronic products, the overall rebound in the risk market was still quite good. This indicates that the pause on tariffs announced on Saturday has relieved the market somewhat. Moreover, early this morning, Trump announced again that he might adjust tariffs, specifically targeting the import tariffs on automobiles that have been in effect for half a month, as well as the tariffs on auto parts that are yet to be implemented (scheduled for May 3).

The adjustment might be similar to that of electronic products, potentially exempting all tariffs except for the 20% on China within a limited timeframe. Of course, Trump has not made a decision yet; he has only publicly stated that he is considering it. The aim is to provide a transition period for overseas car manufacturers to relocate their production to the U.S., just like with electronic products.

After the announcement, U.S. stocks rose again, although the increase was not significant since it has not been officially implemented yet. However, it is gradually becoming apparent that Trump's heavy-handed approach to tariffs may be easing, which has a significant impact on market sentiment. As of now, the yield on the 10-year U.S. Treasury has fallen below 4.4%, and the VIX is almost back to 30. Market sentiment is gradually improving, and Trump has also publicly stated that the stock market is up today.

Currently, both U.S. stocks and Bitcoin are maintaining a slight upward trend. Trump's frequent adjustments to tariffs may be signaling to the outside world that the actual tariffs may not be as strict as expected.

Additionally, the dovish representative of the Federal Reserve, Waller, has indicated that if the average tariff in the U.S. is around 25%, the impact on inflation may be temporary, but it could easily trigger an economic recession. If a recession is indeed anticipated in the U.S. economy, Waller supports a rapid and significant reduction in interest rates.

However, if tariffs are only around 10%, although inflation may be more stubborn, the impact on the economy would be very limited. In this case, the Federal Reserve would maintain a cautious approach to rate cuts, and if a path to returning inflation to 2% is visible, a rate cut in the second half of the year cannot be ruled out.

In simpler terms, Waller believes that if tariffs really reach an average of 25%, the probability of a recession in the U.S. economy would be quite high, and even rate cuts would merely serve to prevent or mitigate the recession.

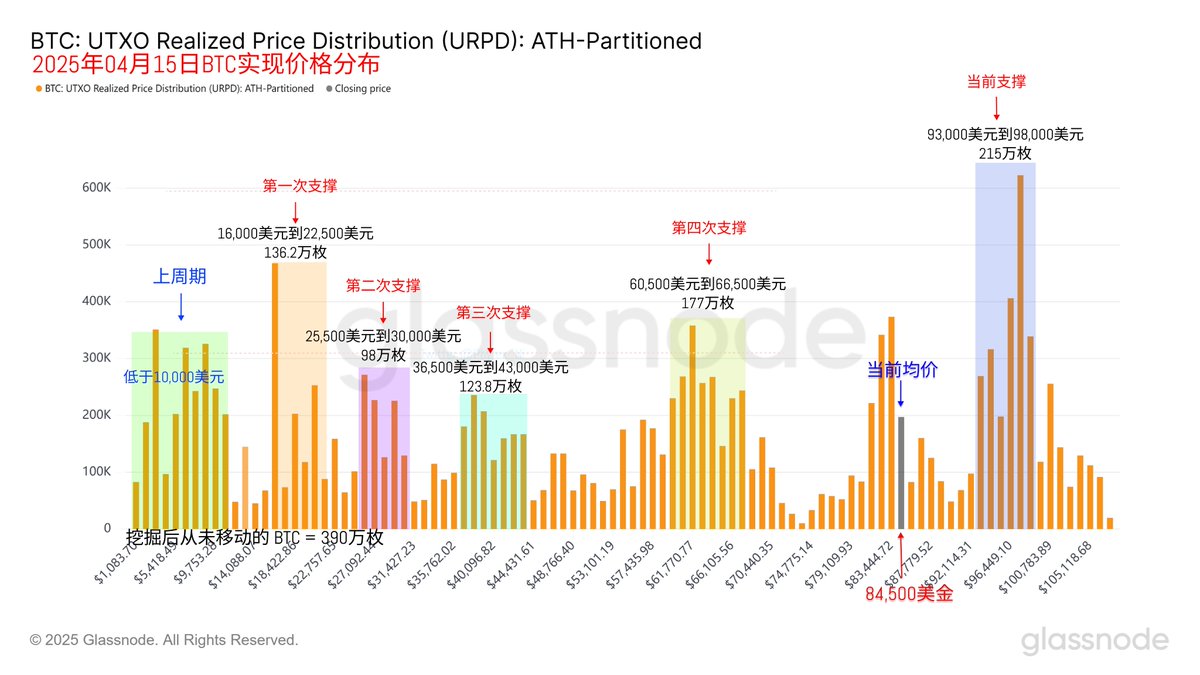

Returning to Bitcoin data, I may have selected the wrong data yesterday, and today it feels off. However, it's okay; I will correct it today, and there should be no issues tomorrow. Overall, the current turnover rate is still relatively low, and there hasn't been a situation where many investors are urgently exiting due to price increases. Currently, investor confidence seems to be quite good, possibly due to the tariff adjustments.

From a support perspective, the bottom around $83,000 is continuing to rise and may become a new bottom point. Interestingly, investors who are at a loss between $93,000 and $98,000 remain very calm, maintaining a low liquidity trend for a long time.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。