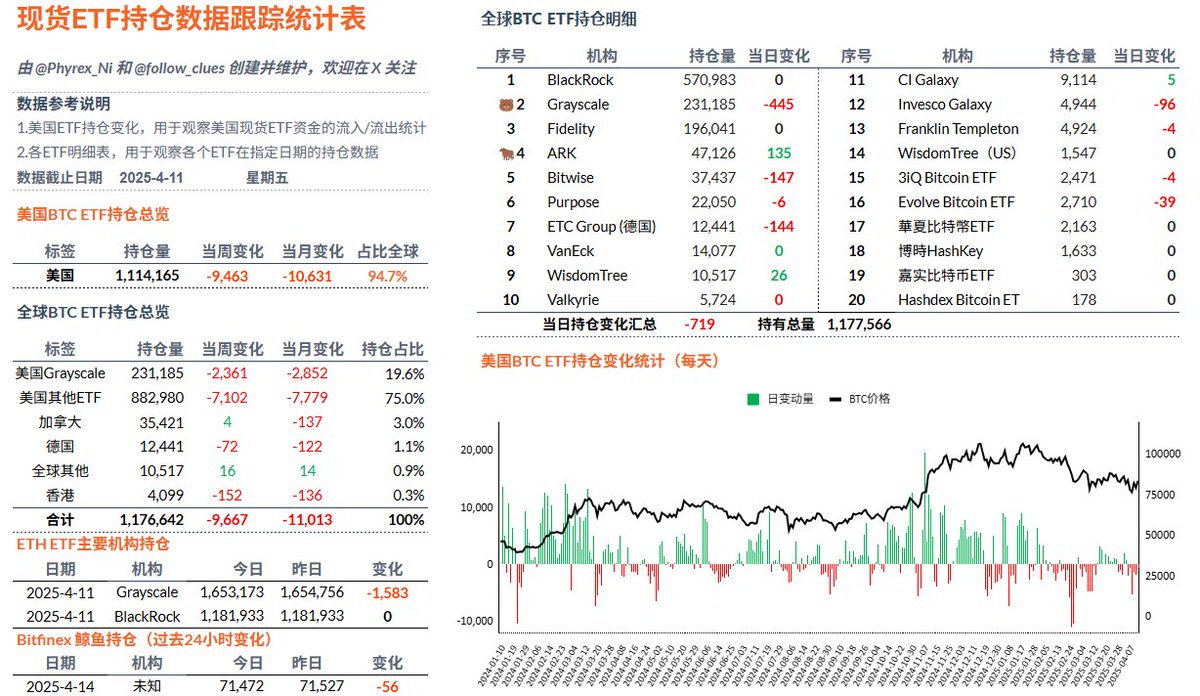

Last Friday, the data for Bitcoin spot ETFs remained lukewarm, with U.S. investors slightly withdrawing 556 BTC. This data is unlikely to impact prices significantly, but from the perspective of investor sentiment, it is not very optimistic. Although most investors do not have the intention to sell, purchasing power remains low, indicating a cautious attitude towards the short-term cryptocurrency market.

From a weekly data perspective, the net selling by investors in week 65 was more than four times that of week 64. Simply based on this data, it appears that investor sentiment worsened after entering week 65. Coupled with the macro sentiment of week 65, it is indeed true that the tariff escalation between China and the U.S. occurred during this week, making it normal for investors to take some hedging actions.

Next, we will look at this week's data. If investors still have no intention to buy, while it cannot be said that Bitcoin's price will not rise, it can indicate that ETF investors are less interested in the short-term price fluctuations of BTC, possibly due to expectations of potential economic issues in the U.S. at any time.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。