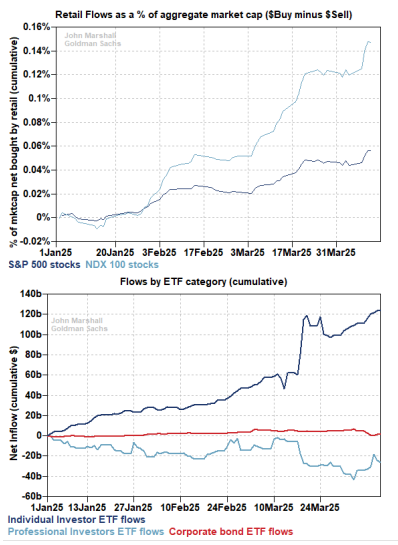

According to a report by Goldman Sachs, retail investors have started increasing their investments in the S&P 500, Nasdaq 100 index, and ETFs since last week.

This coincides with the suspension of reciprocal tariffs by Trump, indicating that investors' sensitivity to tariffs is no longer just talk; they are genuinely starting to buy the dip with their funds.

Although there were some twists regarding the tariffs on electronic products over the weekend, the opening of the U.S. stock market was quite good. I believe that if it weren't for the incident with Lutnick on Sunday, the situation on Monday would have been even better.

However, the upcoming GDP data at the end of the month and Trump's potential flip-flopping on tariffs may still not be enough to shift the risk market from a rebound to a reversal, so we must remain sensitive to information and events.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。