Original Author: Jean-Paul Faraj

Original Compilation: BitpushNews

Despite holding the top spot in cryptocurrency market capitalization, Bitcoin's participation in the decentralized finance (DeFi) space is relatively low, prompting a profound discussion about its future role.

For over a decade, Bitcoin has been the cornerstone of the crypto ecosystem—lauded for its decentralization, censorship resistance, and provable scarcity. However, despite Bitcoin's dominant market cap and recent resurgence, it remains largely disconnected from one of the most vibrant areas of the crypto space—DeFi.

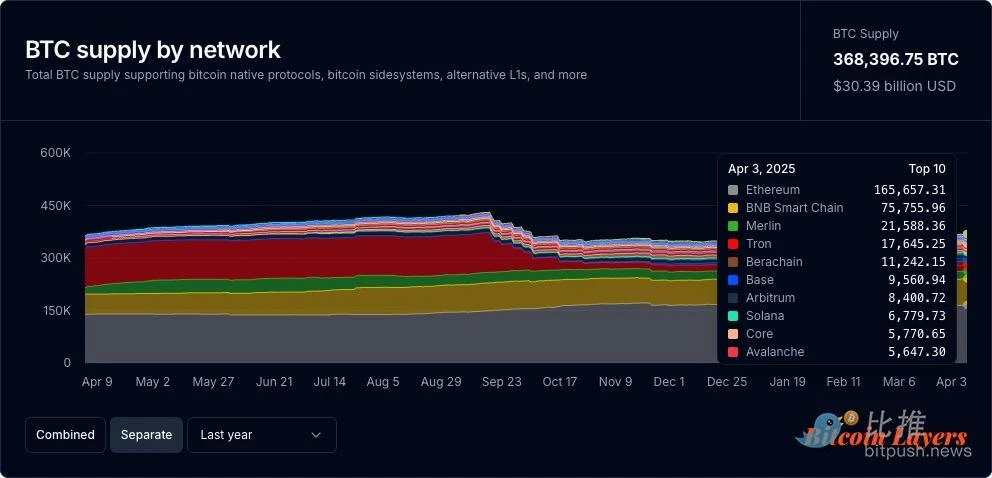

According to data from Bitcoin Layers, only about $30 billion worth of Bitcoin (just 1.875% of its total supply) is utilized in DeFi. In contrast, Ethereum has approximately $50 billion worth of ETH locked in DeFi, accounting for about 23% of its supply.

This gap highlights a core contradiction in today's Bitcoin narrative: while BTC holds immense value, relatively few BTC are actively utilized on-chain to provide yield opportunities. This disparity is driving a wave of innovation around wrapping, staking, and other methods to bring Bitcoin into the DeFi economy, unlocking ways to make BTC a productive capital asset.

Bitcoin Layers*: BTC supply segmented by network, showing all wrapped BTC

Ethereum's DeFi ecosystem has seen a surge of tools for lending, staking, and trading. In contrast, native Bitcoin remains difficult to use effectively, especially for new users. Slow transaction times, variable and often high fees, and Bitcoin's architecture lack the programmability that supports Ethereum-based applications.

As the broader cryptocurrency space matures, an important question arises: Can Bitcoin meaningfully participate in the on-chain economy? If so, how can we bring ordinary BTC holders into the fold without forcing them to navigate a maze of bridges, wrapped tokens, and unfamiliar applications?

The Question: Bitcoin's Design vs. DeFi's Usability

Bitcoin's underlying architecture is not optimized for the high programmability of today's smart contracts. Its proof-of-work (PoW) mechanism prioritizes security and decentralization over complex logical expressions—this design choice makes it a reliable store of value but also limits its adaptability in smart contracts and complex DeFi applications. As a result, native Bitcoin struggles to integrate into the thriving composable financial ecosystems on public chains like Ethereum and Solana.

In the past, we have seen some workarounds:

Wrapped Bitcoin: Users convert BTC into ERC-20 tokens to access Ethereum-based DeFi. This introduces custodial risks, as token liquidity may be opaque and not always backed 1:1 by a third-party custodian.

Bridging Protocols: Cross-chain platforms allow BTC to move into other ecosystems. However, manual bridging adds friction, complexity, and risk—especially for non-technical users.

Custodial Platforms: Centralized services like Coinbase offer BTC yield but require users to forfeit custody and often pay returns in points, stablecoins, or proprietary tokens instead of BTC.

Each option comes with challenges that compromise Bitcoin's core principles: security, simplicity, and user sovereignty.

Entry Barriers: Why User Experience Still Matters

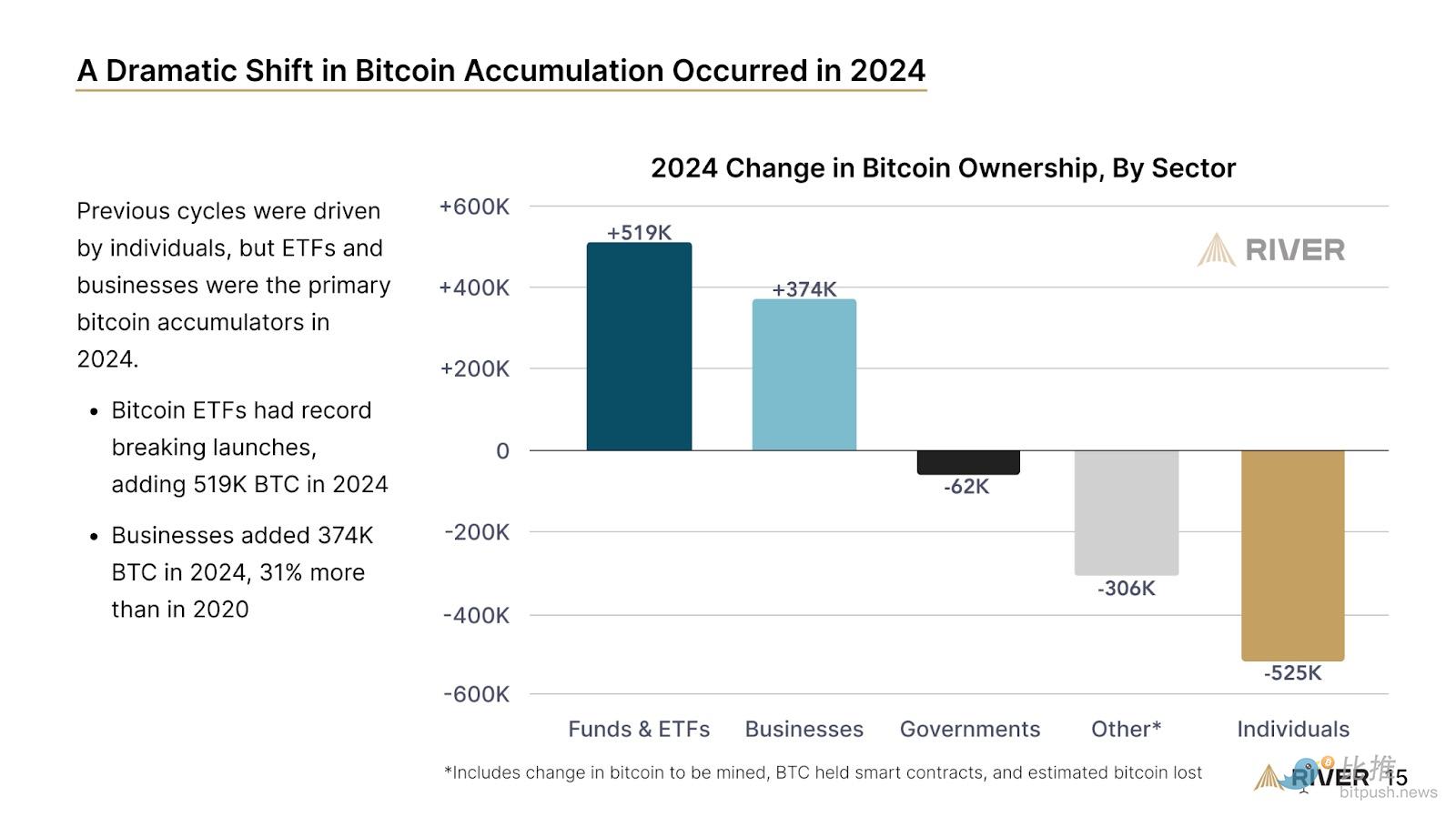

Accumulation of BTC in 2024, river.com

For Bitcoin holders curious about doing more with their assets (earning yield, participating in on-chain governance, or trying DeFi), the entry pathways remain fragmented, non-intuitive, and often daunting. While the infrastructure has matured, user experience still lags behind, and competitors are not just other blockchains but also TradFi.

This friction creates a significant entry barrier. Most users do not want to become advanced DeFi users—they want to simply and securely increase their net worth and BTC holdings without navigating a maze of applications, bridges, and protocols like recent Bitcoin buyers who have made substantial off-chain purchases through brokers, ETFs, and products like Michael Saylor's Strategy.

To transition the next wave of users from simple off-chain holders to on-chain users, tools need to eliminate this complexity while not sacrificing control, self-custody, or transparency. This is where emerging protocols and modern wallet experiences begin to play a crucial role—providing user-friendly access to DeFi's foundational functionalities while keeping Bitcoin's core principles intact.

A better user experience is not just a nice-to-have; it is a key infrastructure for the next phase of Bitcoin adoption.

New Methods for On-Chain BTC Yield and Productivity

Many emerging solutions aim to make Bitcoin more usable in DeFi—each with different trade-offs:

1. Staking, Re-staking, and Points-Based Yield Programs

Platforms like Babylon and Lombard now offer Bitcoin-related yield programs through points or reward tokens, often achieved via staking/re-staking, which can typically be redeemed for benefits or future airdrops. These systems appeal to early adopters and crypto-native users chasing airdrops and platform-specific token economics. These products often involve converting BTC into wrapped BTC standards and then locking assets in various programs/products to earn variable yields. For savvy on-chain traders, high yields can be obtained, but this requires a deeper understanding of how to use cryptocurrencies, as well as manual bridging, wrapping, and depositing funds.

Pros:

Wide range of yield opportunities

Often self-custodied

Cons:

Rewards are not paid in BTC

Often require lock-up periods

Long-term value of rewards is uncertain

2. Bitcoin Layer 2 and Meta-Protocols

Developments like the Lightning Network, Rootstock (RSK), Alkanes, and emerging Layer 2 solutions like Botanix and Starknet are bringing new functionalities, programmability, and speed to Bitcoin. These innovations enable use cases like fast payments, NFTs, and similar smart contract behaviors. As a result, users can now access a wide range of DeFi opportunities using their BTC—such as securing networks by locking funds, participating in market-making, lending, or converting assets to support various protocols' wrapped BTC standards. As more teams build these networks, the ecosystem of Bitcoin-based yield opportunities will continue to expand.

Pros:

Expands Bitcoin's use cases

Consistent with Bitcoin's architecture

Wide range of options for earning yield on-chain

Cons:

Still relatively early and fragmented

Requires intermediate to advanced understanding to leverage

Requires significant developer resources to build much of the utility already present on other smart contract chains

3. Smart Wallet Integrations and Native BTC Yield

Wallets like Braavos offer features that allow users to earn native BTC yield without manually wrapping their Bitcoin or forfeiting custody. Users can invest BTC directly through their wallets without dealing with the usual bridging or external application barriers. Complex steps—such as deposits, wrapping, and bridging—are seamlessly handled in the background, with BTC deployed into specific DeFi strategies. This user-friendly approach aims to make BTC yield accessible to everyone, regardless of their technical background or cryptocurrency experience.

Pros:

Yield is paid in BTC (rather than points or proxy tokens)

No need for manual bridging or third-party custody

Self-custodied by default

Beginner-friendly

Cons:

Relies on conversion to wrapped BTC

Requires a certain level of trust in bridging mechanisms and yield protocol infrastructure

The Bigger Picture: Bitcoin's Evolving Role On-Chain

The narrative around Bitcoin has long centered on "store of value"—a role it reliably fulfills. However, as the on-chain economy develops, the pressure is mounting for Bitcoin to integrate into this emerging financial stack and fulfill its promise as a reliable payment infrastructure.

To achieve this without sacrificing decentralization or user trust, new infrastructure must make these opportunities easily accessible without requiring technical expertise or compromising Bitcoin's core principles.

This means:

Yields should prioritize payment in BTC rather than derivative assets

Custody must remain with users

Complexity must be abstracted away rather than shifted to users

Products like Braavos, Lombard, Babylon, and others mentioned in this article exemplify how these ideas are being realized. Whether through staking to earn yield or embedding Bitcoin support into self-custody options while automating the complexities behind it, they make it easier for Bitcoin holders to access DeFi without requiring them to completely leave the Bitcoin ecosystem.

Bridging the Gap Cautiously

The transition of Bitcoin to the on-chain economy will not happen overnight—and it shouldn't. Caution, simplicity, and self-sovereignty are foundational to Bitcoin's core principles. However, as more tools that respect these values and offer new functionalities emerge, BTC's role in the broader cryptocurrency economy is continually evolving.

The current challenge is to build open, secure, and most importantly—accessible systems. If the next billion users are to join through Bitcoin, they will need experiences that meet their existing needs and are acceptable to a broader user base.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。