Original | Odaily Planet Daily (@OdailyChina)

At 2 AM on April 14, the native token OM of the star project Mantra in the Real World Assets (RWA) sector suffered a severe blow, plummeting from $6.15 to $0.37, a staggering drop of 90%, with a market cap evaporating by $5.5 billion in an instant. This drastic fluctuation triggered over $65 million in liquidations across the network, with the liquidation volume in the last 12 hours only second to BTC, causing an uproar in the crypto community, which quickly pointed fingers at the possibilities of insider trading and market manipulation.

On-chain data reveals: Who is driving the crash?

On-chain data provides crucial clues to this crisis. According to Lookonchain monitoring, at least 17 wallets deposited 43.6 million OM (worth $227 million at the time) into exchanges before the crash, accounting for 4.5% of the circulating supply. Among them, two addresses marked by Arkham are related to Mantra's strategic investor Laser Digital, indicating that institutional behavior may have played a role behind the scenes.

Additionally, Spot On Chain disclosed that three days before the crash, a new OM whale transferred 14.27 million OM (about $91 million) to OKX at an average price of $6.375. These addresses had previously purchased 84.15 million OM from Binance at the end of March this year, costing about $565 million (average price of $6.711). After the crash, their remaining holdings were worth only $62.2 million, with an unrealized loss of $406 million.

Spot On Chain suspects that these addresses may have hedged or even been the driving force behind this crash.

The mutual blame between the project team and exchanges, fierce confrontations filled with tension

After the incident, Mantra's official account quickly spoke out at 4:50 AM, attempting to stabilize market sentiment. They insisted: "MANTRA is fundamentally sound, and today’s chaos was entirely triggered by reckless liquidations from certain parties, which has nothing to do with our project. We want to clarify: this was absolutely not done by our team. We are investigating thoroughly and promise to release more details as soon as possible." In their words, the project team was eager to distance themselves from the situation, shifting the blame to the "free market."

Subsequently, Mantra co-founder JP Mullin's response was even more direct and aggressive. He publicly accused: "The severe volatility in the OM market was entirely caused by centralized exchanges (CEX) recklessly forcing liquidations on OM account holders." He emphasized that the crash occurred during a period of extremely low liquidity in the early hours of Asia, with account positions being abruptly closed without warning, which at least exposed serious negligence on the part of CEX, and could even hide a conspiracy of intentional market manipulation. JP further pointed out that CEX plays a key role in providing liquidity for projects, but if their discretion lacks effective oversight, it could lead to disaster, as seen in the current market dislocation, which not only harms the project but also causes significant losses for investors. He repeatedly stressed that this crisis was not caused by the Mantra team, the chain association, or core advisors or investors selling tokens; the tokens remain strictly locked, the tokenomics has not been affected, and the relevant wallet addresses are transparent, placing all blame squarely on the exchanges.

The exchanges did not back down either. Former Binance CEO CZ was the first to respond on X, suggesting investors "not chase narratives," but instead choose "projects with users, revenue, and profits" to avoid similar turmoil, implicitly indicating that the Mantra project itself lacks fundamentals. In response to the community's sharp questions about whether the OM flash crash was due to Binance's failure to conduct due diligence, CZ retorted: "CEX should no longer take the blame for the listing process; investors should decide for themselves which trading pairs to engage with." The implication was that the project team and investors had lost their footing, and the exchanges were merely scapegoats.

Afterward, Binance also released a statement, noting that they had observed the severe volatility in OM's price, and preliminary investigations indicated that the fluctuations were mainly triggered by cross-exchange liquidations. Since October last year, Binance has implemented multiple risk control measures for OM, including reducing leverage levels, and has enabled pop-up reminders on the spot trading page since January this year, alerting users that the tokenomics of OM has undergone significant changes, with an increase in supply. Binance emphasized that they will continue to monitor and take action to protect user interests, which serves both as a defense and a clear indication that Mantra's fundamentals have undergone significant changes.

OKX CEO Star also strongly countered on X: "The OM flash crash is a major scandal for the entire crypto industry. All on-chain unlocking and deposit data are public, and the collateral and liquidation data of major exchanges can also be verified. OKX will prepare all relevant reports and welcomes scrutiny." Star's response was both defensive and an indirect strike against Mantra, subtly suggesting that the project team may have concealed key information.

The two sides are at odds, with a palpable tension. Mantra insists on its "innocence," blaming all faults on the CEX's "recklessness"; leading CEXs retort, emphasizing transparency, hinting that Mantra may have significant "dark secrets." This conflict has yet to subside, with both sides seemingly waiting for the other's next move. Where is the truth that investors seek?

The undercurrents of interest games: Economic adjustment or power struggle?

Although the mutual blame between the project team and exchanges has yet to reach a conclusion, it reveals a key clue: the adjustment of Mantra's economic model may be the true trigger of this crisis.

According to KOL danny@agintender, this crisis "is everyone's responsibility," rooted in the conflict of interest and communication failures between the project team and market makers, and there may even be internal strife, with the trigger being the announcement released by Mantra on April 8, “Understanding $OM”.

Danny analyzed that the market makers (active/passive) did not reach an agreement with the project team on the allocation plan for the "new token portion," leading to dissatisfaction on one side, which then transferred hundreds of millions of OM to OKX and Binance "as a demonstration" a few days ago, attempting to exert pressure. As a result, a non-Binance exchange adjusted its position limits and liquidation lines, causing a chain reaction that ultimately led to the crash in the early hours. The implication is that the crash of OM is an unintended result of multiple interest games.

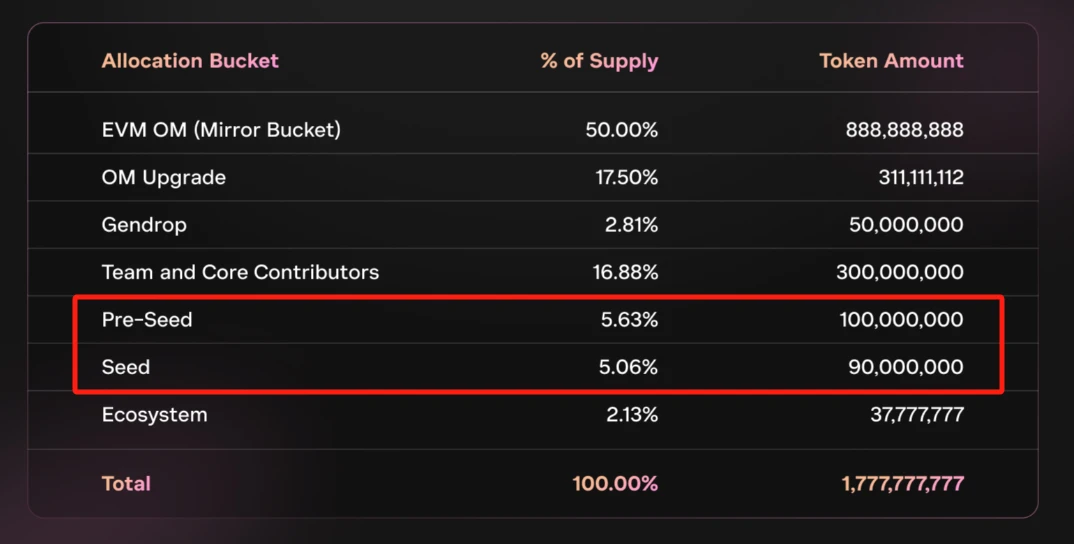

In fact, the adjustment of the economic model was not a sudden event. It was determined through a governance proposal from the Sherpa community back in January 2024, deciding to abandon the "two tokens, one ecosystem" model and instead use a single OM as the native asset of MANTRA Chain (for staking and gas fees), which received nearly unanimous support in February 2024. To achieve this goal, Mantra destroyed the ERC-20 OM on Ethereum through a "mirror bucket" mechanism and released an equivalent amount of tokens on the mainnet, doubling the total supply from 888,888,888 to 1,777,777,776.

In fact, the adjustment of the economic model was not a sudden event. It was determined through a governance proposal from the Sherpa community back in January 2024, deciding to abandon the "two tokens, one ecosystem" model and instead use a single OM as the native asset of MANTRA Chain (for staking and gas fees), which received nearly unanimous support in February 2024. To achieve this goal, Mantra destroyed the ERC-20 OM on Ethereum through a "mirror bucket" mechanism and released an equivalent amount of tokens on the mainnet, doubling the total supply from 888,888,888 to 1,777,777,776.

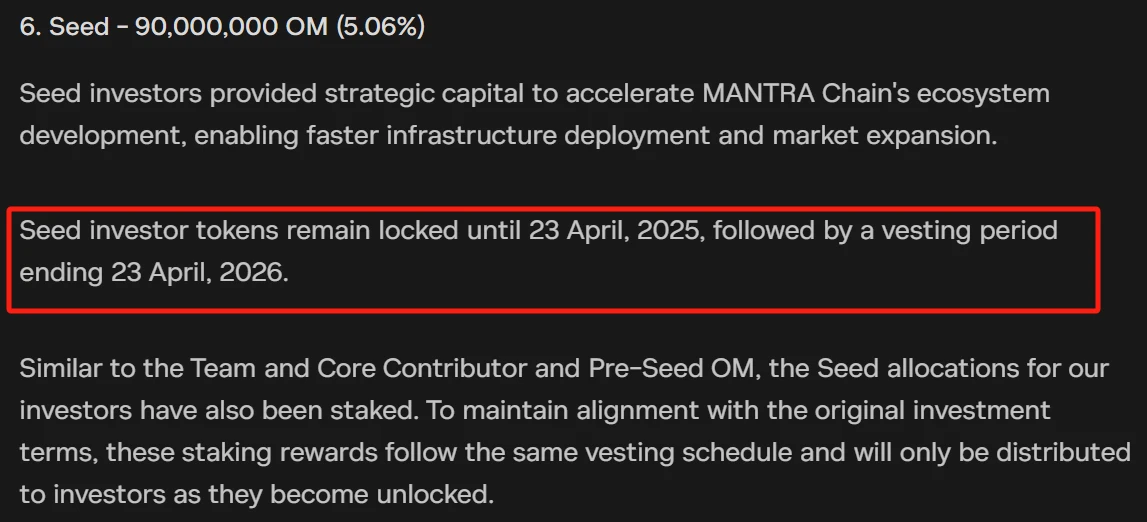

The community had no objections to upgrading OM from a fixed supply model to an inflationary model, doubling the supply, but the issue may lie in the announcement on April 8. This announcement detailed the token distribution and unlocking schedule for all relevant stakeholders, with early investors (including Pre-Seed and Seed) allocated 5.63% and 5.06% to be released this year, especially since the tokens of seed round investors will be unlocked on the 23rd of this month.

The timing of this announcement is suspiciously sensitive, leading to doubts that the divergence in interest distribution ignited the crisis.

Meanwhile, data management platform Tokenise analyst Daniel@_founderdan provided another layer of insight. He pointed out that an initial transaction from a wallet associated with Mantra to OKX seemed to have triggered panic selling. This transaction raised market concerns about possible internal involvement or mismanagement.

Further investigation revealed that most $OM tokens, especially those allocated to early investors and Mantra itself, have already been unlocked and are tradable, while additional token distribution plans will begin unlocking on April 21, 2025, which will undoubtedly exacerbate future selling pressure. Thus, the timing is particularly suspicious: just before this significant unlocking plan was about to commence, the market experienced a sudden large-scale sell-off, raising suspicions of possible internal manipulation, although there is currently no conclusive evidence.

Daniel proposed two possible scenarios: one is that a centralized exchange or market maker recklessly sold due to holding too much liquidity, triggering market panic; the other is that insiders or early investors deliberately sold off before the broader token unlocking to mitigate risks or seek profits. Regardless of which scenario holds, the severity and unnatural nature of the crash strongly suggest that it was not a natural market fluctuation, but rather the result of some form of manipulation. He called on the project team to strengthen token management and transparency to prevent similar incidents from recurring.

Mantra's trust blemish: History and community doubts

In fact, Mantra has long been jokingly referred to by the community as a "single-player coin" or "strong manipulation coin," and its trust crisis is not a result of a single incident but rather a long-term accumulation of issues. Behind this label are multiple controversies regarding the project team's market operations, token management, and community commitments.

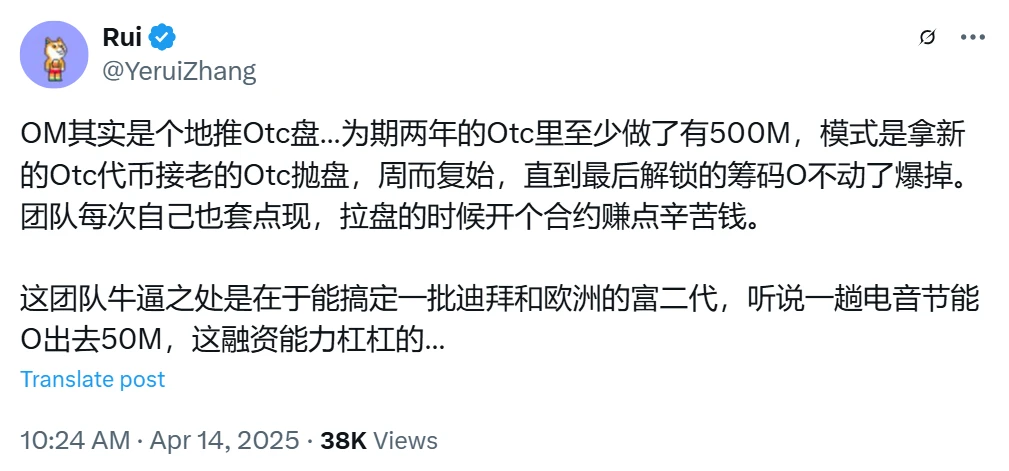

According to Rui from HashKey Capital and Ye Su, Founding Partner of ArkStream Capital, who revealed on X, OM is an "offline OTC platform," with an OTC scale of $500 million, operating in a cycle of "new OTC tokens taking over old OTC sell-offs" until the final unlocked chips "remain inactive in OTC," leading to the crash. In 2023, when OM's FDV dropped to $20 million, a Middle Eastern capital intervened, retaining only the CEO position and rebranding OM as an RWAfi project.

Under this high level of control, OM achieved an astonishing 200-fold growth in 2024, but recently it has still been promoting its "OTC platform" business, raising widespread market suspicions of manipulation.

The repeated modifications of the airdrop rules by Mantra have further deepened community doubts. In November last year, the project team promised that the airdrop rules would include a 3-month cliff period followed by initial liquidity distribution and a 9-month linear unlocking to attract user participation. However, shortly after, they changed the rules to a 1-month cliff period and an 11-month linear unlocking, initially claiming to distribute 50 million OM, with 20% unlocked upon listing, and the airdrop to be completed within a month. In practice, however, Mantra repeatedly delayed fulfilling its promises, changing "unlocked upon listing" to "linear release starting one month later," and further extending it to "10% initial release, with the remainder having a vesting period of up to three years." This erratic behavior effectively locked community traffic as long-term chips, provoking strong dissatisfaction.

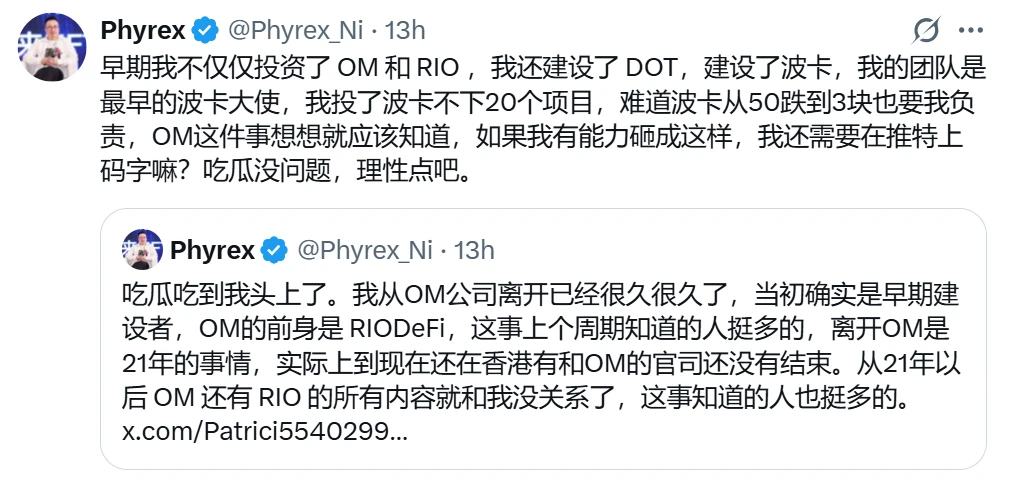

The trust crisis is also reflected in the experiences of early investors. @Phyrex_Ni, who invested in OM's predecessor RIODeFi years ago, clarified on X after being affected by this flash crash: "I left OM years ago; I was an early builder, but since 2021, I have had nothing to do with OM or RIO. I am currently in a lawsuit with OM in Hong Kong; they owe me my investment tokens and fees, not a cent has been repaid, and even winning the lawsuit is useless because the team has moved to the U.S." His revelations not only expose historical debt issues within Mantra but also resonate with the current OTC model and high control strategy, indicating that the project team's lack of transparency and trustworthiness has long been entrenched.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。