Trump-Backed WLFI buys SEI Tokens of $775K during market difficulti

The Trump family-backed World Liberty Financial (WLFI), crypto project, has bought 4.89 million SEI tokens which is worth about $775,000, as per the new blockchain data. The purchase happened on April 12 and was made using USDC stablecoin. The data shows this was done by one of WLFI’s regular trading wallets, which has been used before to buy other altcoins.

A Growing Crypto Portfolio

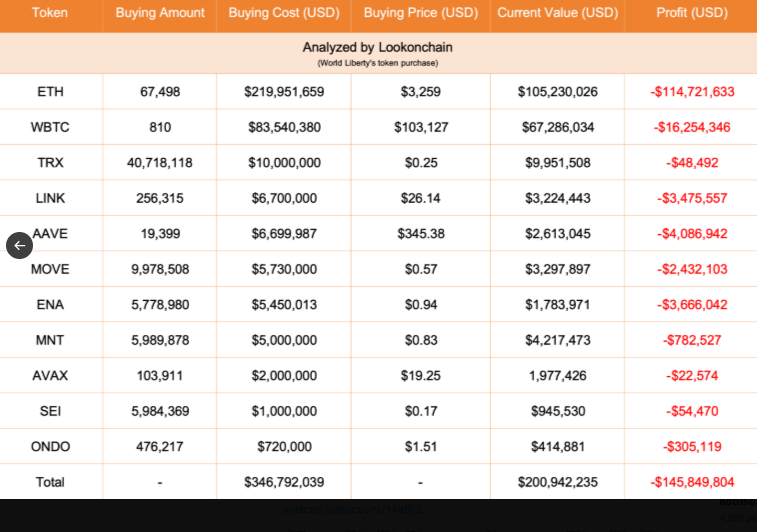

WLFI isn’t new to the altcoin space. It holds a wide mix of cryptocurrencies, including big names like Bitcoin and Ethereum, along with many smaller ones like Tron, Ondo Finance, Avalanche , and now Sei (SEI). So far, it has spent around $347 million buying 11 different tokens.

But there’s a problem — none of those investments are currently making a profit. According to blockchain tracker Lookonchain, it’s total crypto portfolio is down by about $145.8 million. The worst hit is Ethereum, with WLFI losing over $114 million on it alone.

Source: Lookonchain

The price of SEI increased after this event was reported and is up more than 27.67% over the last week which is now trading at $0.176 per token.

Eric Trump’s Ethereum Advice Backfires

Back in February, Eric Trump, son of Donald Trump, posted on social media encouraging people to buy Ethereum (ETH). He said, “In my opinion, it’s a great time to add $ETH.” He later edited the post to remove the words “you can thank me later.”

At the time, Ethereum was priced around $2,879. Now, just two months later, it's trading at $1,635, a 55% drop as per the reports of coinmarket cap, showing that Eric’s advice didn’t age well.

WLFI USD1 Stablecoin Appears on Major Platforms

In another twist, WLFI’s stablecoin USD1 has made a surprise appearance on big crypto platforms like Coinbase, Binance, and CoinMarketCap. The coin's logo showed up on these sites without any official announcement from the body.

This has caused even more controversy in Washington. Some U.S. lawmakers are worried about the President's growing role in the stablecoin space. At a House Financial Services Committee meeting on April 2, Democratic Rep. Maxine Waters warned that Trump could be planning to use USD1 to replace the U.S. dollar for government payments, including Social Security and tax payments.

Republican Rep. French Hill also raised concerns. He said he would not support any new stablecoin law if there’s no clear rule stopping the President from owning a stablecoin business.

Final Thoughts

WLFI’s growing list of Altcoin purchases shows the Trump family is serious about its crypto ambitions. However, the large losses, political drama, and unclear plans for USD1 are raising a lot of questions. Whether WLFI can turn things around or not, one thing is clear — Trump’s crypto moves are making big waves in both the market and the political world. The investment by WLFI in SEI token and the forthcoming launch of USD1 stablecoin have increased the talks about the potential conflicts of interest and regulatory negligence. These developments demonstrate the requirement of clear guidelines to inform the conflicts among the cryptocurrency markets and politics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。