A. Market Perspective

1. Macroeconomic Liquidity

Monetary liquidity is improving. The chaotic implementation of Trump's tariff policy, regardless of the final outcome, has quickly undermined market confidence in the U.S. economy and may continue to disrupt the market for the next three months. U.S. Treasury bonds and the dollar have also returned to a downward spiral, with historic surges in U.S. stocks often occurring in the mid-stages of a bear market. The cryptocurrency market is following the severe fluctuations of U.S. stocks.

2. Overall Market Trends

Top 300 by Market Cap Gainers:

This week, BTC rebounded from oversold conditions, while small coins faced significant declines after being delisted. The market lacks a mainline focus.

Top 5 Gainers

Gains

Top 5 Losers

Losses

XCN

110%

BERA

40%

FARTCOIN

100%

EOS

20%

GAS

60%

MEW

20%

LAYER

40%

W

20%

UXLINK

30%

NEAR

20%

- BERA: The DeFi public chain has dropped to a new low, breaking through long-term support levels. Over the past week, on-chain stablecoins have decreased by $300 million.

- FARTCOIN: A meme coin on the SOL chain, it surged several times against the market trend, becoming the leader of this rebound.

- BABY: A leading staking project in the BTC ecosystem, its market cap returned to $800 million after listing, the last round of institutional investment. The staking track has been discredited.

3. On-Chain Data

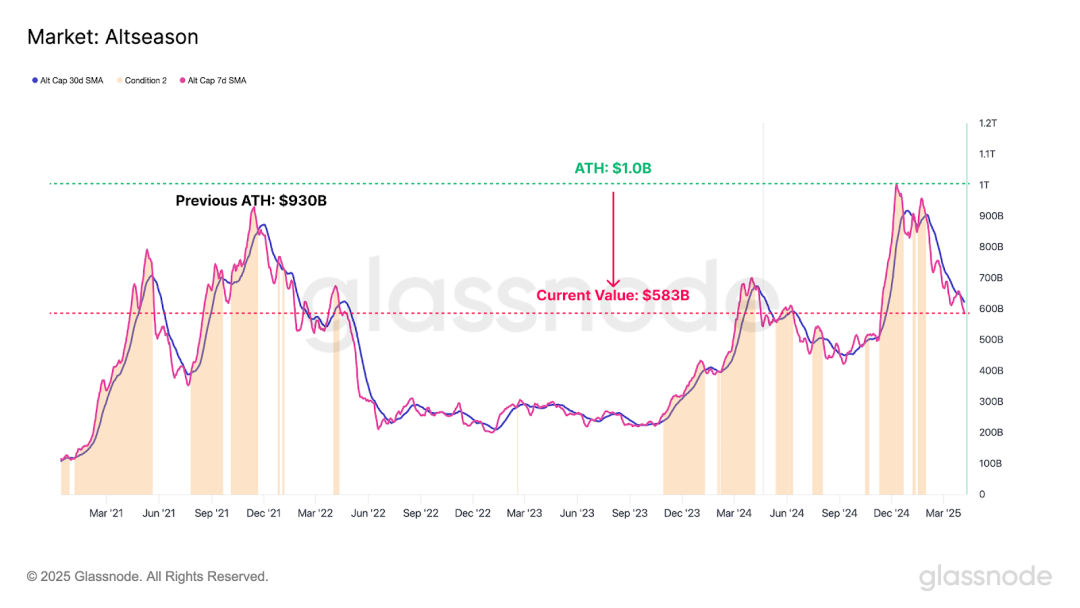

Capital inflow into the BTC market has stagnated. Liquidity is rapidly contracting, with the market cap of altcoins depreciating from $1 trillion at the end of 2024 to $600 billion. This decline appears to be widespread, with all sectors experiencing significant depreciation.

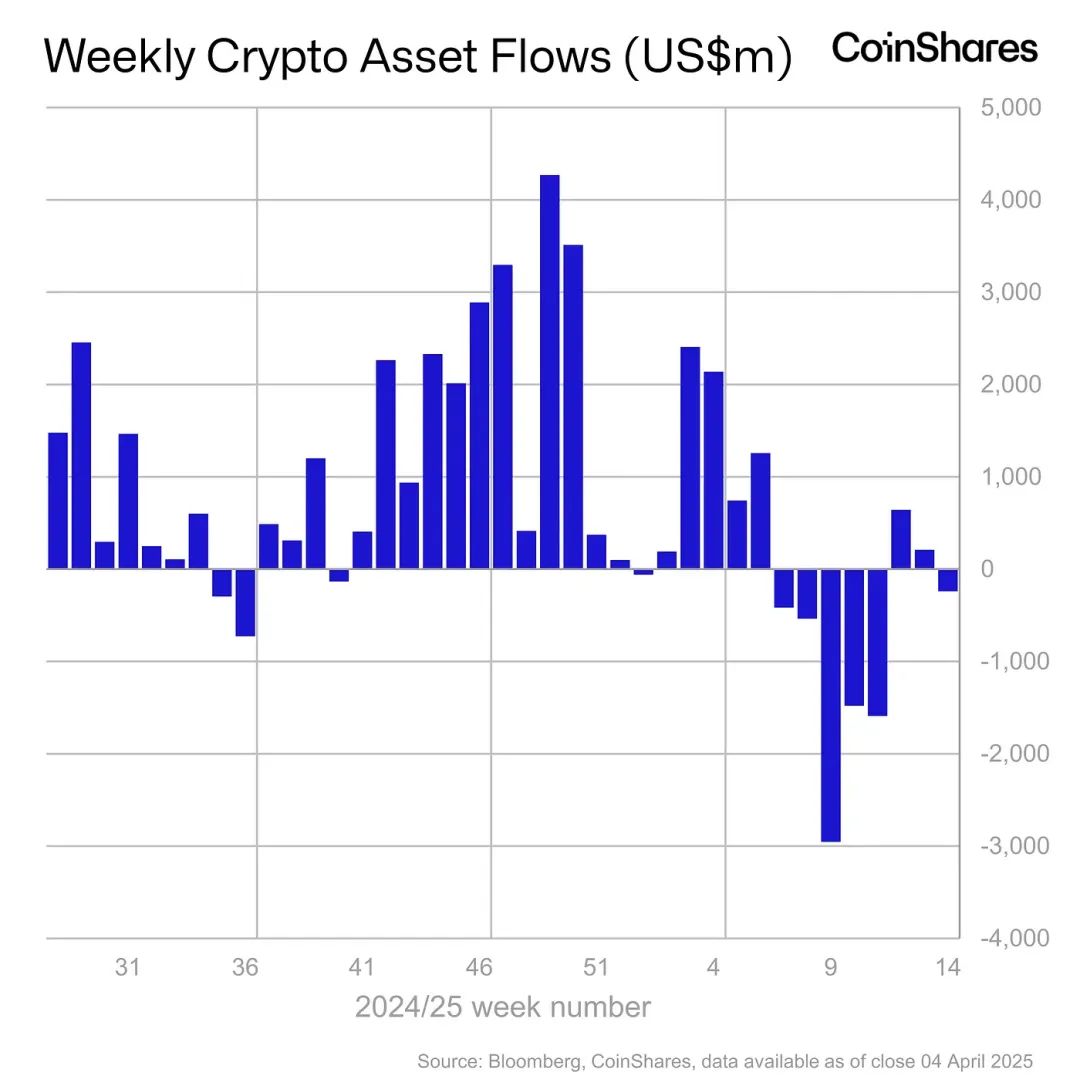

Institutional funds have slightly net flowed out again, causing panic in the global market.

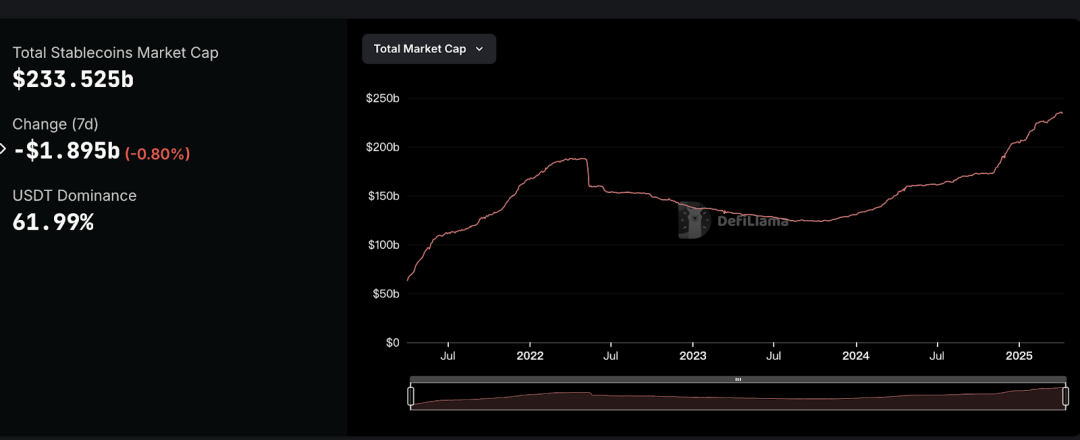

The market cap of stablecoins has slightly declined, with investors showing clear risk-averse sentiment.

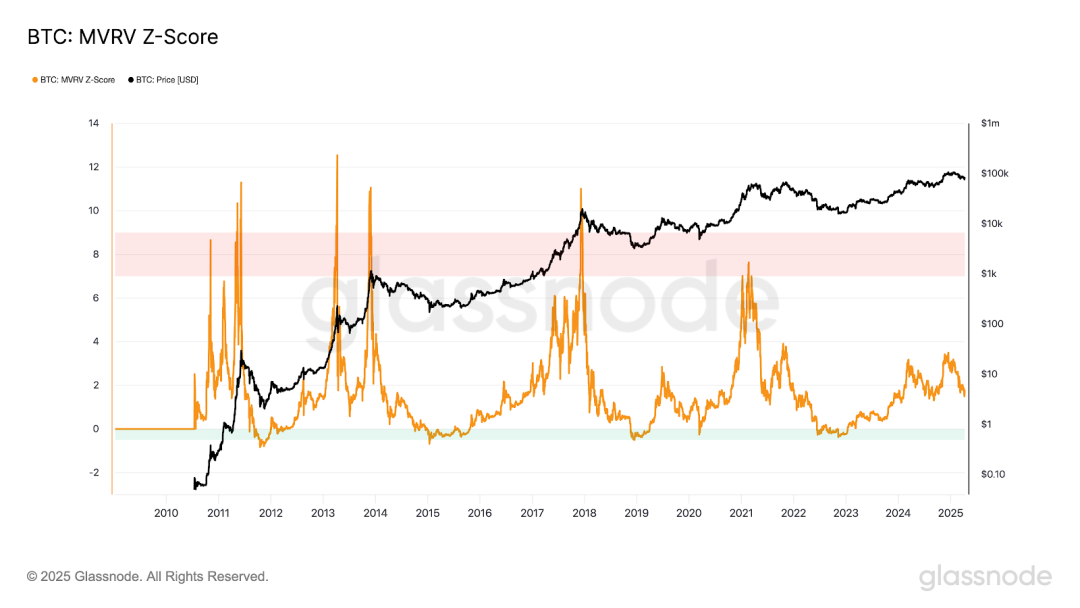

The long-term trend indicator MVRV-ZScore, based on the total market cost, reflects the overall profitability of the market. When the indicator is greater than 6, it indicates a top range; when it is less than 2, it indicates a bottom range. MVRV has fallen below the critical level of 1, indicating that holders are generally in a state of loss. The current indicator is 1.6, close to the bottom range.

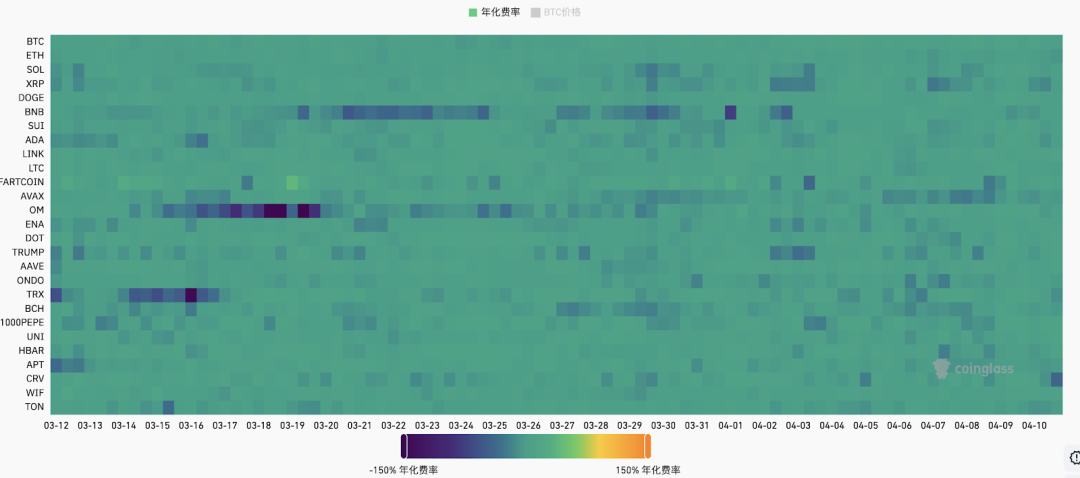

4. Futures Market

Futures funding rate: This week, the rate is low at 0.00%. A rate of 0.05-0.1% indicates a high level of long leverage, suggesting a short-term market top; a rate of -0.1-0% indicates a high level of short leverage, suggesting a short-term market bottom.

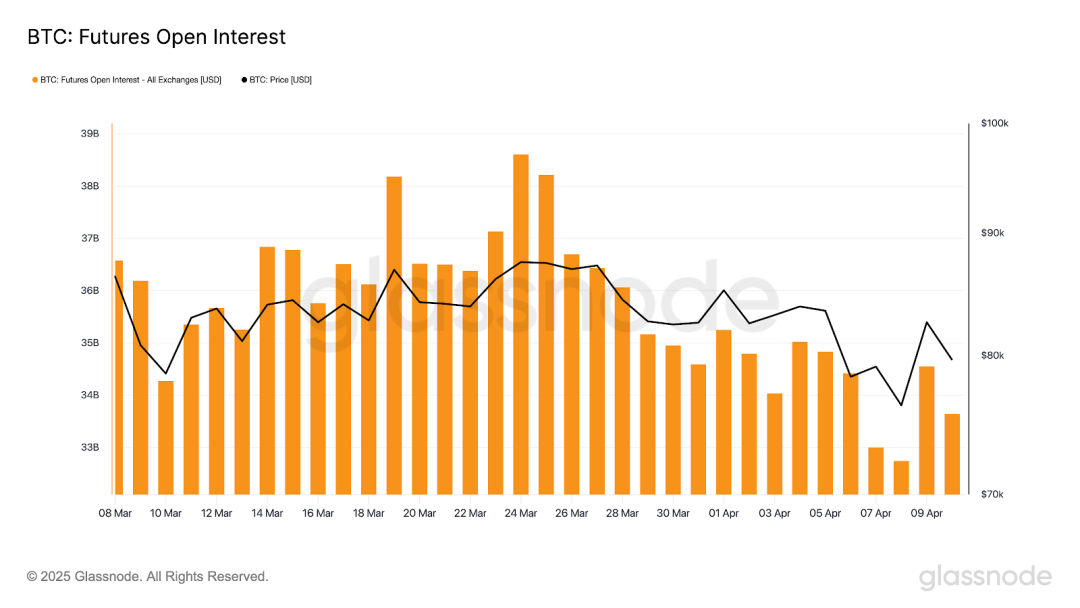

Futures open interest: This week, BTC open interest continues to decline, with market leaders exiting.

Futures long-short ratio: 1.9, indicating market sentiment is greedy. Retail sentiment often serves as a contrarian indicator; below 0.7 indicates fear, while above 2.0 indicates greed. The long-short ratio data is highly volatile, reducing its reference significance.

5. Spot Market

BTC experienced severe fluctuations this week, while altcoins lack new narratives. The ongoing uncertainty of the U.S. tariff system has intensified pressure on global financial markets. This weakness has spread to almost all asset classes, and the cryptocurrency market is also deeply mired in a bear market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。