Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

"This is even worse than LUNA."

In the early hours of today Beijing time, a sudden crash kept many crypto investors awake all night. The MANTRA token OM dropped about 10% in just one hour, then plummeted from $5.21 to $0.50, a staggering decline of 90%.

The community was in an uproar, with sharp comments: "There are still many people holding OM for interest, and they didn't even have time to escape. This is even more deadly than the LUNA flash crash back in the day."

This sudden crash is not just a technical issue; it seems like a long-buried landmine has finally exploded.

A Heavy "Dark History"? Unveiling MANTRA's Controversial Past

In the Web3 world, it is not uncommon for project valuations to deviate from fundamentals. However, when a DeFi protocol has a TVL of only $4 million but boasts a fully diluted valuation (FDV) of up to $9.5 billion, it is hard not to raise questions about its legitimacy.

The collapse of MANTRA may not be without signs, as it has been filled with various controversies and unsavory pasts in recent years:

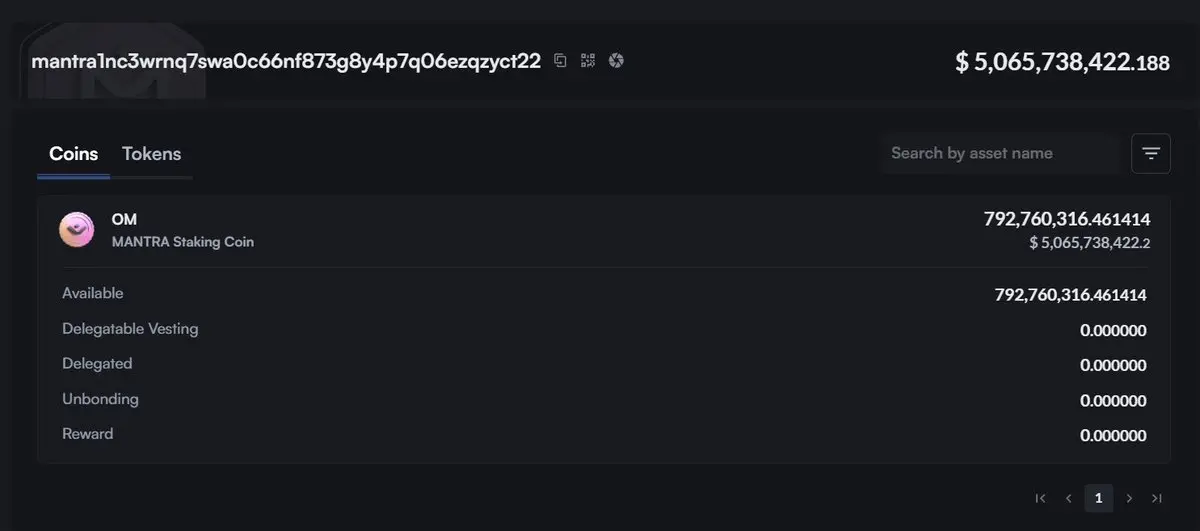

The project team has a high degree of control. Crypto analyst Mosi stated that MANTRA controls most of the circulating supply of $OM. The project team has concentrated as much as 90% of the $OM (792 million tokens) in a single wallet address.

An endless cycle of token relay games. Crypto KOL Rui pointed out that the underlying logic of OM resembles a carefully packaged OTC funding game. It is said that over the past two years, OM has raised more than $500 million through OTC sales via ground-pushing models. The operation involves continuously issuing new OTC tokens to absorb the selling pressure from previous investors, creating a cycle of "new taking old, old exiting new." Once liquidity dries up or unlocked tokens can no longer be absorbed by the market, the entire system may collapse.

The project team itself also "withdraws in line with the trend" during each round of price increases, obtaining additional profits by opening contracts and coordinating with market surges.

Middle Eastern capital acquired the project shell. According to Ye Su, in 2023, OM's FDV had dropped to less than $20 million, and the project was nearly abandoned. Subsequently, through intermediaries, a Middle Eastern capital firm acquired the OM project, retaining only the original CEO while replacing the rest of the team. This Middle Eastern capital has an extremely rich portfolio of luxury homes, resorts, and various RWA assets, packaging OM as an RWAfi concept project. Leveraging the popularity of the RWA theme and high control methods, OM achieved over 200 times growth in 2024.

Involved in legal disputes, accused of asset misappropriation. According to the South China Morning Post, the Hong Kong High Court had previously ordered six members of MANTRA DAO to disclose relevant financial information due to accusations of misappropriating DAO assets.

Defaulting on numerous promised fees and tokens. Crypto KOL Phyrex stated that he participated in the project investment in its early days but never received the promised tokens. Even after winning a lawsuit in 2023, the MANTRA team did not execute the court's ruling, claiming they had "moved from Hong Kong to the United States." He accused, "They haven't given a single cent or token."

Airdrop operations have been heavily criticized. According to Ice Frog, the MANTRA project team frequently modified rules from the early stages of airdrop activities, gradually delaying the token unlocking schedule, ultimately leading to users' expectations of airdrops being repeatedly dashed. During the airdrop distribution phase, the project team lacked transparency and consistently adopted a cold response to community doubts, even implementing a "witch trial" style of withdrawal mechanism, stripping users of airdrop eligibility under the pretext of "Sybil attacks," without ever disclosing specific criteria or data for judgment.

Unraveling the Truth Behind the Collapse: Forced Liquidation and Big Holder Exodus

As the price of OM experienced a cliff-like drop, quickly triggering panic and doubts within the community, the MANTRA team urgently spoke out within hours, attempting to clarify that the project team had no direct relation to the severe market fluctuations. Various analyses and speculations circulated in the market regarding this crash. The triggers can be roughly summarized into two points:

Forced Liquidation Triggering Market Volatility

According to MANTRA co-founder JP Mullin, the severe volatility in the OM market was caused by reckless forced liquidations of OM account holders by centralized exchanges. He pointed out that the liquidation of these account positions occurred very suddenly, without sufficient prior warning or notification.

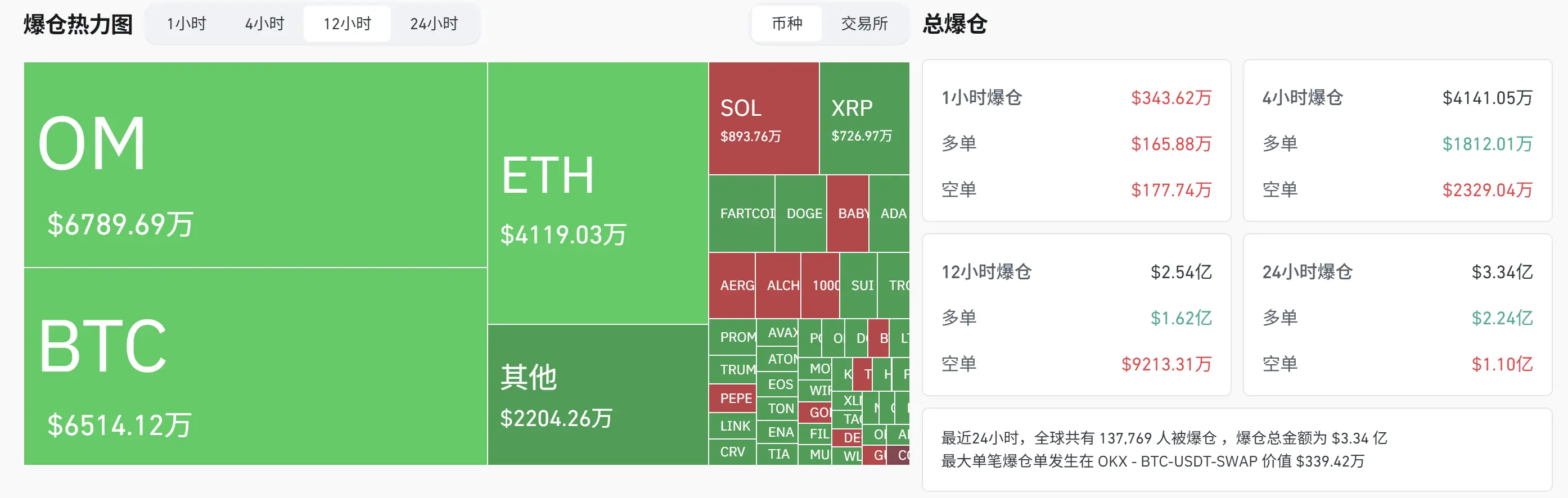

Data shows that in the past 12 hours, the OM crash led to over $66.97 million in forced liquidations, with 10 positions having liquidation amounts exceeding $1 million.

Strategic Investors' Large Exodus

According to Lookonchain monitoring, before the OM crash, at least 17 wallets transferred 43.6 million OM (worth about $227 million at the time) to exchanges, accounting for 4.5% of the circulating supply. Among them, two wallet addresses were associated with MANTRA's strategic investor Laser Digital.

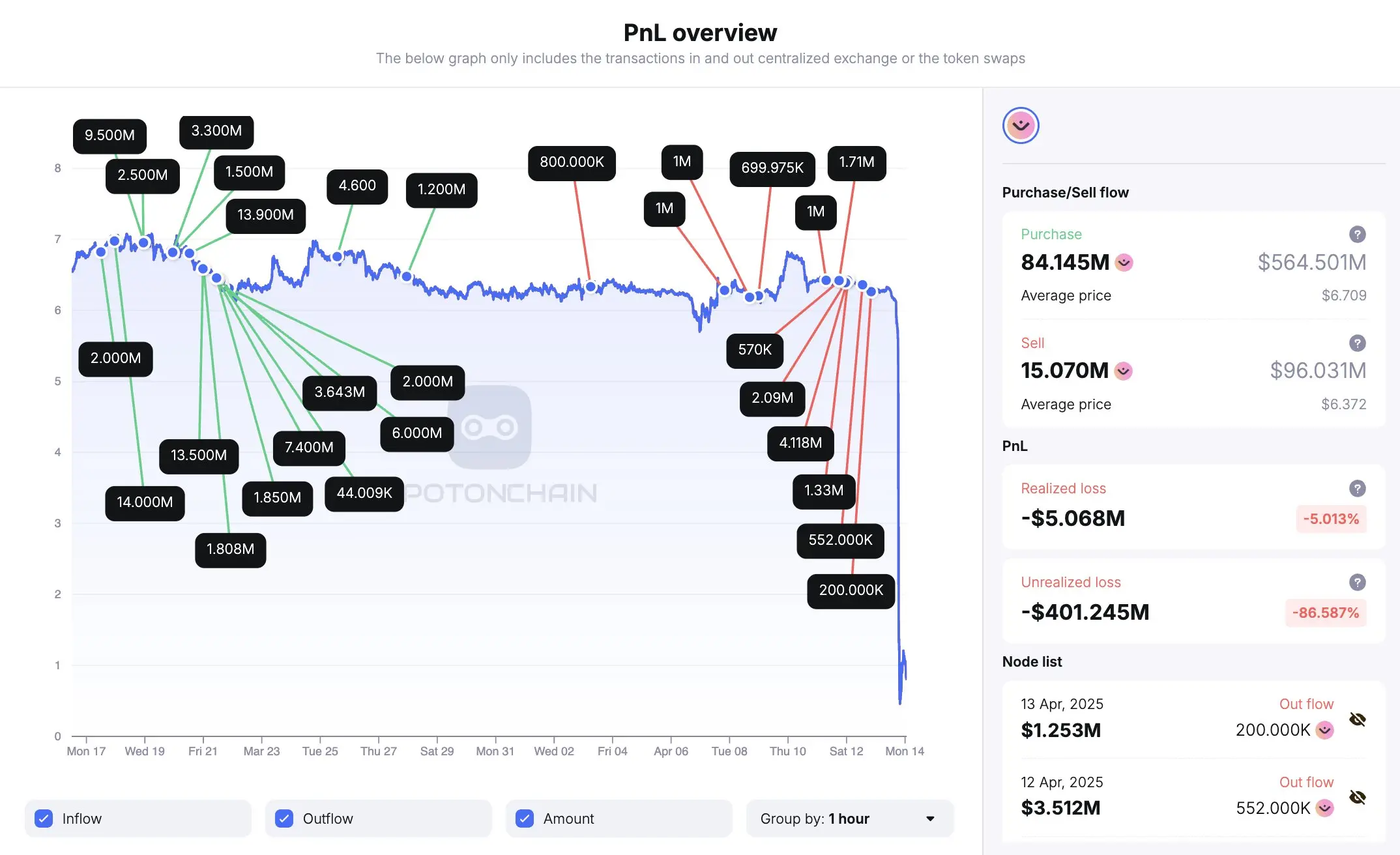

Additionally, according to Spot On Chain monitoring, 19 wallets suspected to belong to the same entity transferred 14.27 million OM (about $91 million) to OKX at an average price of $6.375 in the three days leading up to the OM crash. As early as late March, these wallets had purchased 84.15 million OM from Binance for about $564.7 million, at an average price of $6.711. These wallets may have hedged some positions on other platforms, exacerbating the situation of this crash.

The 90% drop of OM once again verifies the harsh reality of the "harvesting logic" in the crypto market. OM is not the first project to encounter this fate, nor will it be the last. In the crypto industry, where booms and bubbles coexist, staying vigilant and investing rationally is the only way to navigate the complex and ever-changing market environment steadily.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。