Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.53 trillion, with BTC accounting for 62.35%, which is $1.58 trillion. The market cap of stablecoins is $233.5 billion, with a 7-day increase of -0.67%, of which USDT accounts for 62.05%.

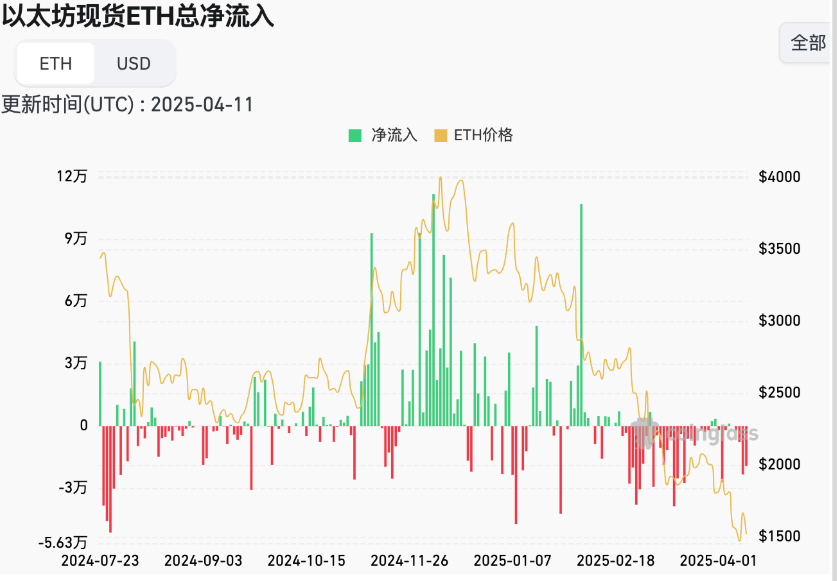

This week, BTC's price has shown range-bound fluctuations, currently priced at $83,668; ETH has also shown range-bound fluctuations, currently priced at $1,580.

Among the top 200 projects on CoinMarketCap, most have declined while a few have increased, including: XCN with a 7-day increase of 121.21%, FARTCOIN with a 7-day increase of 82.36%, ORCA with a 7-day increase of 62.25%, and BABY with a 7-day increase of 58.74%.

This week, there was a net outflow from the U.S. Bitcoin spot ETF of $708 million; the net outflow from the U.S. Ethereum spot ETF was $82.5 million.

On April 12, the "Fear & Greed Index" was at 43 (higher than last week), with the sentiment this week being: 1 day of extreme fear, 5 days of fear, and 1 day of neutrality.

Market Prediction: This week, the market experienced extreme fear for one day due to the U.S. imposing excessive tariffs globally, with a slight decrease in on-chain stablecoins, which is not an optimistic situation. There was a significant net outflow from the U.S. spot Bitcoin ETF, and the Ethereum ETF also saw a net outflow. This week, the U.S. CPI and PPI were far below expectations, and with a 90-day suspension of tariffs except for China, market sentiment improved in the latter half of the week, leading to a certain rebound in coin prices.

The probability of a 25 basis point rate cut by the Federal Reserve in May is 16%, lower than last week. It is expected that the market will maintain fluctuations during a period (April-May), with BTC oscillating between $75k and $90k. In terms of potential opportunities, projects with fundamentals like Babylon should be closely monitored, as well as the “Hotcoin New Coin List” to unlock more wealth opportunities.

Understanding Now

Review of Major Events of the Week

On April 8, Galaxy Digital announced that the registration statement submitted to the U.S. SEC has become effective, preparing for a listing on NASDAQ;

On April 9, according to FOX BUSINESS, the White House press secretary stated that the 104% additional tariffs on China took effect at noon Eastern Time. The 104% additional tariffs will start being imposed from April 9;

On April 9, according to Crowdfund Insider, Ripple announced the acquisition of Hidden Road Partners for $1.25 billion, entering the multi-asset institutional brokerage field. This acquisition is one of the largest transactions in the crypto industry to date, making Ripple the first crypto company to operate a multi-asset prime brokerage service. This deal was facilitated by FT Partners.

On April 9, Bloomberg reported that the U.S. announcement of so-called "reciprocal tariffs" severely impacted international capital markets, with global stock market value shrinking by $10 trillion since the 3rd of this month, slightly more than half of the EU's GDP;

On April 10, U.S. President Trump announced that he authorized a 90-day suspension of tariffs, applicable to reciprocal tariffs and 10% tariffs. The suspension took effect immediately;

On April 10, according to market information, after Trump announced the suspension of tariffs on most trading partners, the U.S. stock market surged within minutes, with the S&P 500 index rising over 9%, and the U.S. stock market value increasing by $4 trillion within 10 minutes;

On April 10, market news indicated that the U.S. Securities and Exchange Commission has now approved options trading for the spot Ethereum ETF;

On April 10, the U.S. Senate confirmed Paul Atkins, nominated by President Trump, as the chairman of the Securities and Exchange Commission (SEC) with a vote of 52 to 44;

On April 11, spot gold briefly surged to $3,218 per ounce, setting a new historical high, and has since retreated to $3,207 per ounce;

On April 11, according to market data, the yield on U.S. 30-year Treasury bonds rose to 4.907%, with a daily increase of 1.22%;

On April 11, President Trump signed a bill officially repealing the IRS DeFi crypto broker rules, marking the first cryptocurrency bill signed into law by a president.

Macroeconomics

On April 10, the U.S. March unadjusted CPI year-on-year was 2.4%, with an expectation of 2.6%;

On April 11, the U.S. March PPI year-on-year was 2.7%, with an expectation of 3.3%, and a previous value of 3.20%;

On April 10, according to CME "FedWatch" data, the probability of a 25 basis point rate cut by the Federal Reserve in May is 16%, while the probability of maintaining the current rate is 84%.

On April 9, the Eurozone money market is currently fully pricing in a 25 basis point rate cut by the European Central Bank in April, with a probability of 85% this Tuesday;

On April 9, the yield on Japan's 30-year government bonds rose to a 21-year high on Wednesday, as investors sold the most liquid bonds to raise cash amid a market collapse triggered by U.S. trade tariffs. With the stock market and oil prices plummeting, the yield on 30-year Japanese bonds peaked at 2.785%, the highest level since August 2004, rising 22 basis points during the day to 2.715%;

On April 9, Bank of Japan Governor Kazuo Ueda stated that if the economy improves as expected, he will continue to raise interest rates.

ETF

According to statistics, from April 7 to April 11, there was a net outflow of $708 million from the U.S. Bitcoin spot ETF; as of April 11, GBTC (Grayscale) had a total outflow of $22.736 billion, currently holding $16.523 billion, while IBIT (BlackRock) currently holds $47.899 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $93.702 billion.

There was a net outflow of $8.25 million from the U.S. Ethereum spot ETF.

Envisioning the Future

Event Preview

TOKEN2049 Dubai 2025 will be held in Dubai from April 30 to May 1, 2025;

Canada Crypto Week will take place in Toronto, Canada from May 11 to 17, 2025.

Project Progress

KerneIDAO will have its TGE on April 14, with the token being KERNAL;

The Genesis license sale for the decentralized, scalable AI chain Matchain will start on April 14, offering 100,000 utility-focused licenses linked to the platform's self-sovereign identity system MatchID;

25% of the airdrop from the Ethereum L2 network Mint community will be unlocked on April 15;

Ripple Labs has requested to set the deadline for its court brief in the SEC case to April 16.

Important Events

Trump has invited Salvadoran President Nayib Bukele to attend a White House meeting on April 14 to discuss bilateral cooperation and diplomatic relations;

A U.S. judge has postponed the trial of Tornado Cash developer Roman Storm, originally scheduled for December 2024, to April 14, with the trial expected to last two weeks.

Token Unlocking

Starknet (STRK) will unlock 127 million tokens on April 15, valued at approximately $15.66 million, accounting for 4.37% of the circulating supply;

Sei (SEI) will unlock 224 million tokens on April 15, valued at approximately $3.853 million, accounting for 2.25% of the circulating supply;

Zebec Network (ZBCN) will unlock 2.12 billion tokens on April 16, valued at approximately $2.05 million, accounting for 2.12% of the circulating supply;

ApeCoin (APE) will unlock 15.38 million tokens on April 17, valued at approximately $6.59 million, accounting for 1.54% of the circulating supply;

Immutable (IMX) will unlock 24.52 million tokens on April 18, valued at approximately $10.38 million, accounting for 1.23% of the circulating supply.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We have built a "trend analysis + value discovery + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and all-day market volatility monitoring. Combined with our weekly live strategy sessions of "Hotcoin Selected" and daily news briefings of "Blockchain Today," we provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。