When failure strikes me once again, when I am battered and bruised, when a friendship I thought would last forever suddenly turns into betrayal, when everything comes crashing down on me, I wipe away the tears from the corners of my eyes, dust myself off, and tell myself I cannot give up.

Yesterday, it seemed I underestimated the strength of the bulls, which led to an overall operation that did not reach perfection. During yesterday's operations, when the market first surged, we took all our long positions and ultimately took profit near 82500, and then opened a short position near 82600. The first surge peaked around 83300, then retraced to around 81300, but we did not choose to take profit on the short position. As the market surged again, breaking through 83500, this short position was stopped out. I actually did not expect the bulls to strengthen again; we estimated that the bulls would gain momentum around Sunday night and early Monday morning, after the weekend's fluctuations. However, the final result was that the bulls broke through the short-term resistance at 83500. Overall, the bulls successfully took profit yesterday, while the shorts stopped out, giving back some profits, and I comforted myself by saying it was still okay.

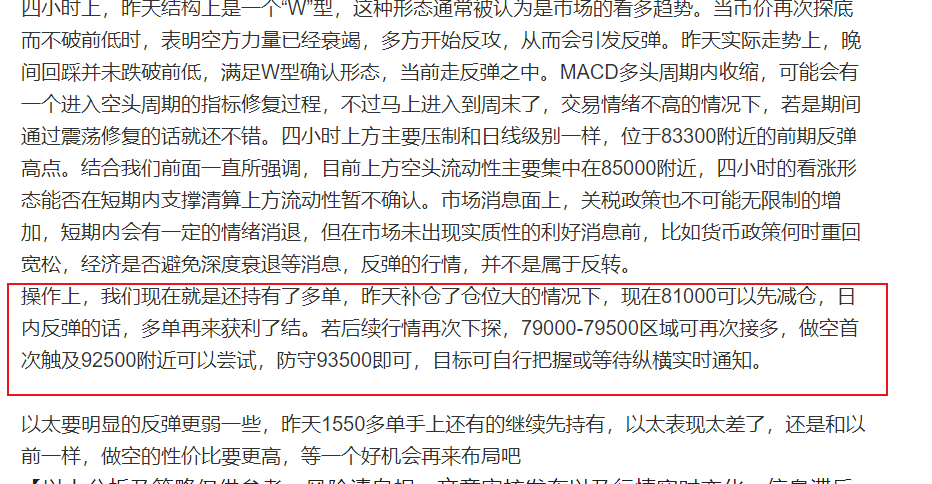

On the chart, with yesterday's bullish close, as long as there is no further dip today, the MACD is basically entering a preliminary bullish cycle, while all moving averages are turning upwards. In the short term, the market shows a strong state. On the four-hour level, after forming a W shape, the rebound was indeed strong. However, there is currently a structural pattern of a top divergence, indicating a technical correction is needed. But today is the weekend, so we need to see if there will be significant fluctuations in the market. For the upcoming market, if it continues to rise, the more obvious the divergence, the greater the probability of a correction. This is also why we hoped the market wouldn't rise immediately yesterday, but rather build up further momentum before rising again after this weekend. If the market fluctuates over the weekend, we will need to wait until Monday to see which direction it chooses. Additionally, from the perspective of liquidity clearing, yesterday's surge above 84000 only cleared a small portion of liquidity, and the short liquidity around 85000 was also just one step away from being cleared. If we follow the previous clearing patterns, after clearing, in most cases, there will be a reverse clearing, meaning if the short liquidity is cleared upwards, there will be subsequent actions to clear the long liquidity downwards.

In terms of operations, for today's weekend market, if we short, we will choose to enter around 85600 after liquidity clearing, add positions at 86600, defend at 87300, and set no target. If there is a pullback first, we will consider around 81500, and I will notify in real-time.

Ethereum has performed poorly, basically struggling to keep up with the rise, so we have always said that finding opportunities to short Ethereum will be more cost-effective. Let's wait for a short opportunity around 1620-1650.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market changes in real-time may lead to delayed information. Specific operations should follow real-time strategies. Feel free to contact us for market discussions.】

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。