In 2025, asset tokenization (the digitization of various assets through blockchain technology and enabling on-chain transactions) emerged as one of the core trends of the Web3 ecosystem, achieving significant progress. From financial assets to physical assets and digital assets, the application of blockchain technology is reshaping traditional models of asset management, trading, and ownership. This article will review the latest developments in asset tokenization in 2025, focusing on the asset classes that first achieved on-chain transactions, and will explore the profound implications of this trend in conjunction with insights from authoritative media and key opinion leaders (KOLs) in the Web3 field.

Financial Assets: Rapid Tokenization Driven by Institutions

In 2025, financial assets became the pioneers of asset tokenization, particularly under the active promotion of traditional financial institutions. According to a report by the World Economic Forum in December 2024, major global financial institutions have shown increasing interest in asset tokenization due to its potential to reduce costs, improve efficiency, and mitigate settlement risks. As 2025 began, this trend accelerated further. For example, the Hong Kong Monetary Authority's (HKMA) Project Ensemble regulatory sandbox, launched in August 2024, successfully completed multiple on-chain transaction tests for financial assets at the beginning of 2025, including the trading of tokenized deposits and bonds. Participants included HSBC and Hong Kong's largest digital asset company, HashKey, marking a turning point for the practical application of financial asset tokenization.

The Monetary Authority of Singapore (MAS) also made breakthroughs in 2025. Since launching Project Guardian in 2022, MAS has facilitated over 20 pilot projects for financial asset tokenization by 2025, covering areas such as asset management, government bond management, and bond tokenization. In November 2024, MAS announced its support for the commercialization of asset tokenization, a commitment that was fulfilled in 2025. For instance, S&P Global collaborated with MAS to tokenize a portion of Singapore government bonds, enabling real-time trading on the Ethereum Layer 2 network, with transaction volumes reaching hundreds of millions of dollars monthly.

McKinsey's report in June 2024 predicted that by 2030, the market size for tokenized financial assets could reach $20 trillion (excluding cryptocurrencies and stablecoins), with cash, deposits, bonds, and ETFs being the first assets to achieve large-scale adoption. This prediction was preliminarily validated in 2025. BlackRock's BUIDL fund is a typical case, having tokenized U.S. Treasury bonds and repurchase agreements through the Securitize Markets platform, providing investors with daily dividends. By March 2025, its on-chain transaction volume had surpassed $1 billion.

Physical Assets: Breakthroughs in Real Estate Tokenization

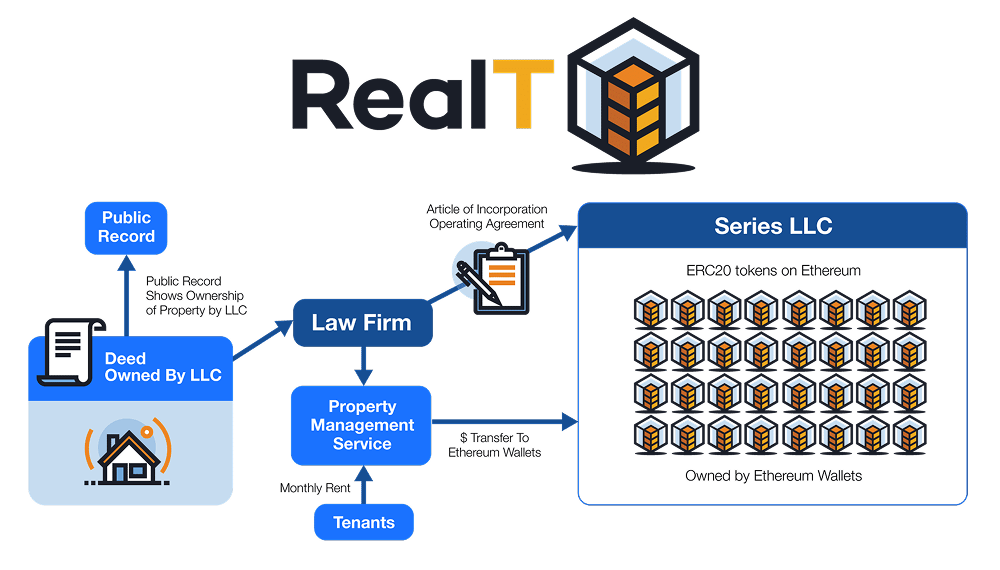

As a representative of physical assets, real estate became another highlight of asset tokenization in 2025. An article in Blockchain Magazine on March 21, 2025, pointed out that real estate tokenization significantly lowered investment barriers by addressing market liquidity issues. For example, the U.S. real estate tokenization platform RealT continued to expand its influence in 2025 by tokenizing residential and commercial properties into NFTs, allowing investors to purchase fractional ownership for as little as $50. By April 2025, over 500 properties had been tokenized on the RealT platform, with total on-chain transaction volumes exceeding $500 million.

In the Asia-Pacific region, the Thai project Sabai Ecoverse also achieved breakthroughs in 2025. This project tokenized resort properties into dynamic NFTs (dNFTs), not only enabling fractional ownership but also automating the management of rental income distribution through smart contracts. According to a Forbes report in March 2024, Sabai Ecoverse co-founder Vadym Bukhkalov stated, "The digitization of real estate lowers market barriers, enhances liquidity, and achieves unprecedented transparency through blockchain technology." In 2025, the project's on-chain transaction volume grew nearly threefold, attracting retail investors from around the world.

Additionally, a report from Chainlink in February 2025 noted that real estate tokenization typically adopts two forms: NFTs or fungible tokens. NFTs are suitable for trading entire properties, while fungible tokens are used for fractional ownership. A commercial property in Dubai was tokenized at the beginning of 2025 using Chainlink's oracle technology, allowing investors to purchase tokens representing 1% ownership through the Polygon network, with total transaction volumes reaching $30 million.

Digital Assets: Continued Momentum for NFTs and Game Assets

The tokenization of digital assets continued to maintain strong momentum in 2025, particularly for NFTs and game assets. An article by CoinDesk on January 9, 2025, noted that NFTs, as a typical form of digital asset tokenization, have expanded from artworks to the realms of gaming and the metaverse. The GameFi project Axie Infinity launched a series of on-chain game assets in 2025, including virtual land, equipment, and character skins, which were traded as NFTs, with on-chain transaction volumes reaching $200 million in the first quarter of 2025.

Furthermore, the metaverse platform Decentraland further promoted the tokenization of virtual real estate in 2025. Users can purchase virtual land using MANA tokens and utilize it for commercial development or leasing. According to Chainalysis data from March 2024, on-chain transactions for virtual real estate continued to grow in 2025, with some popular plots trading for over $100,000, reflecting the immense potential of on-chain metaverse assets.

Authoritative Perspectives: Opportunities and Challenges

Regarding the progress of asset tokenization, authoritative media and Web3 KOLs generally hold an optimistic view but also point out some challenges. An article by the World Economic Forum on March 24, 2025, emphasized that asset tokenization is unlocking significant liquidity potential; for instance, currently, only $25 trillion of securities are available as collateral, while tokenization could expand this pool to $230 trillion. Circle's CEO Jeremy Allaire stated at the 2025 Davos Forum, "The combination of the stablecoin USDC and the Canton network is breaking down barriers between traditional finance and crypto assets, and asset tokenization will become the core infrastructure of modern financial markets."

However, Web3 KOL Jason Barraza, COO of Security Token Market, warned in a CoinDesk column on January 9, 2025, that regulatory clarity remains the biggest obstacle to asset tokenization. Although the appointment of new SEC Chair Paul Atkins and crypto commissioner David Sacks in 2025 has brought hope for a legal framework for digital assets, global regulatory coordination still requires time. Additionally, McKinsey pointed out that technological standardization and implementation costs are also key issues hindering large-scale adoption, especially regarding cross-chain interoperability and off-chain asset authenticity verification.

Conclusion: The Future of Asset Tokenization

In 2025, asset tokenization made significant strides in the fields of financial assets, real estate, and digital assets. Financial assets, supported by institutional adoption and regulatory sandboxes, were the first to achieve large-scale on-chain transactions; real estate tokenization lowered investment barriers through fractional ownership, attracting global investors; and digital assets continued to gain momentum driven by NFTs and the metaverse. However, issues such as regulation, technology, and user acceptance still need to be addressed. Looking ahead, as blockchain technology matures and global regulatory frameworks improve, asset tokenization is expected to accelerate further, reshaping the global financial and asset management landscape.

This article represents the author's personal views and does not reflect the position or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

AiCoin official website: aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。