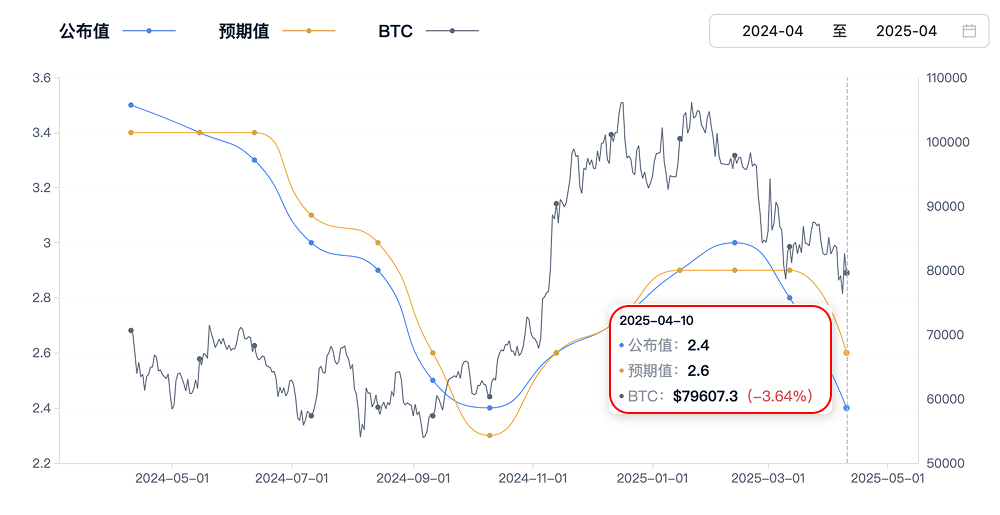

Market Background: U.S. Inflation Data Exceeds Expectations, Market Sentiment Fluctuates

In March 2025, the inflation rate in the U.S. dropped to 2.4%, a decline that exceeded expectations, prompting a strong market reaction. The latest CPI annual rate released by the U.S. Bureau of Labor Statistics was lower than February's 2.8%, not only falling short of economists' predictions of 2.5% but also raising investors' heightened attention to the Federal Reserve's policy direction. This data suggests that the U.S. economic growth may slow down, but inflationary pressures are relatively easing.

However, the Federal Reserve still faces a dilemma: on one hand, lowering interest rates may help avoid trade conflicts that could arise from Trump's continued expansion of tariff policies, but on the other hand, excessive rate cuts could exacerbate inflation. In such a complex environment, the market's short-term sentiment exhibits significant uncertainty.

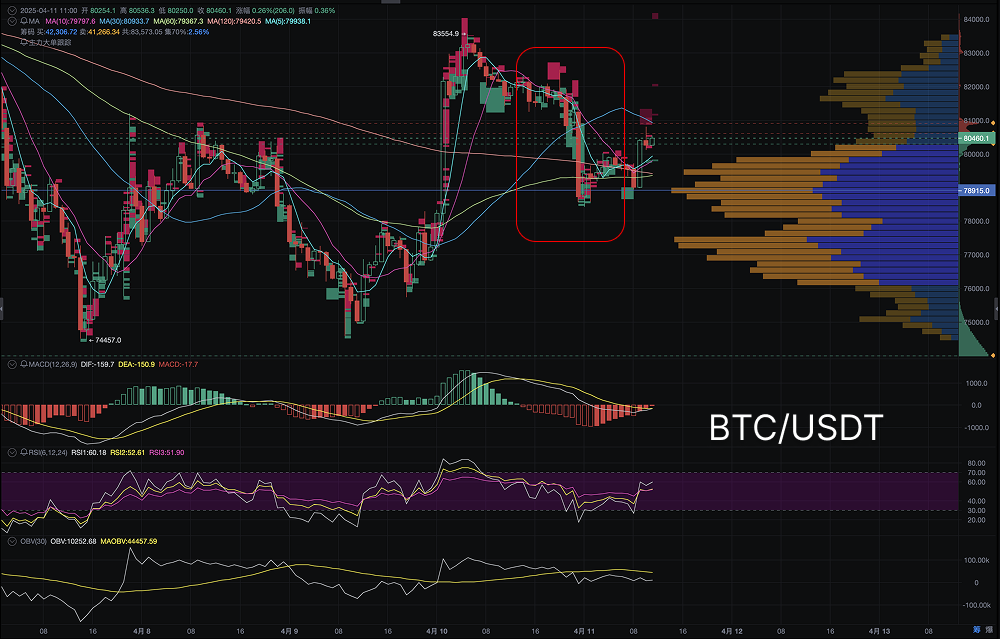

Bitcoin K-Line Analysis: Technical Aspects and Capital Flow of Last Night's Decline

Bitcoin's price experienced a notable decline between April 10 and 11.

1. K-Line Pattern:

In the red box area, Bitcoin's K-line formed a false breakout pattern, where the price failed to maintain its rise after breaking through $82,000 and instead fell back. This pattern typically indicates insufficient bullish strength in the market, with buying pressure not keeping pace, leading to increased selling pressure.

During the pullback, the K-line showed a bearish candle with a long upper shadow, indicating strong selling pressure in this price range.

2. Large Capital Movements:

According to on-chain data, significant capital movements of Bitcoin were evident in the red box area. A large amount of Bitcoin was transferred from cold wallets to exchanges, indicating that some institutional investors in the market might be avoiding risks and executing capital outflows. This outflow signal enhances the likelihood of a decline.

Recent on-chain data also shows a large number of sell orders around $83,000, preventing the price from sustaining its rise and leading to a pullback.

3. Technical Indicators:

- MACD: From the MACD indicator, the DIF line has crossed below the DEA line, forming a death cross, which typically signals that the price will continue to pull back in the short term. The current MACD histogram's green bars are gradually increasing, indicating that selling pressure is intensifying.

- RSI: The current RSI value is 61.57; although it has not reached the overbought zone, market sentiment remains relatively high, and the slight downward trend in RSI suggests that the price may further adjust.

- OBV (On-Balance Volume): The OBV indicator shows that during the decline in the red box area, trading volume did not significantly increase, indicating that this pullback is not accompanied by a large outflow of capital, which may suggest that the market has not completely lost confidence and there may be a rebound opportunity in the short term.

4. Volume Profile (VPVR):

The VPVR chart shows that the current support zone is located between $79,000 and $80,000, where trading volume is dense, indicating strong buying support in this range. If the price pulls back to this area, it may face strong support.

Market Sentiment Analysis: The Dual Impact of Trump's Tariffs and Inflation Data

The direction of Trump's tariff policy has had a significant impact on the Bitcoin market. Although inflation data has decreased, Trump's tariff policy against China still leaves the market filled with uncertainty. The decline in the red box area reflects investors' uncertainty about the future economy, especially regarding the direction of Federal Reserve policy. Despite the easing of inflationary pressures, the tariff issue remains unresolved, causing investors to worry about future economic growth and interest rate decisions, which has triggered a pullback in Bitcoin in the short term.

Today's Market Prediction: Expectation of Rebound After Short-Term Adjustment

Support Level: The short-term support level for Bitcoin is confirmed around $79,000. If the price successfully pulls back to this level and maintains support, the market is expected to see a rebound, with targets looking towards the resistance area of $82,000 to $83,000.

Resistance Level: If the price breaks through the resistance level of $82,000, it may further break through $85,000, initiating a new upward wave.

Short-Term Adjustment Risk: If the price falls below the $79,000 support level, it may retest $76,500, or even reach a low of $74,500.

Conclusion

The decline in Bitcoin last night can be attributed to the market's uncertain reaction to Trump's tariff policy and U.S. inflation data. Although inflation has decreased, changes in tariff policy continue to weigh on market sentiment.

Currently, Bitcoin's short-term trend is in a phase of oscillation and adjustment, but with the support level effectively confirmed in the $79,000 area, there remains a possibility of a rebound. Investors should pay attention to the support area at $79,000 and adjust their strategies flexibly.

This article only represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

AiCoin Official Website: aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。