Why is gold shorting the dollar?

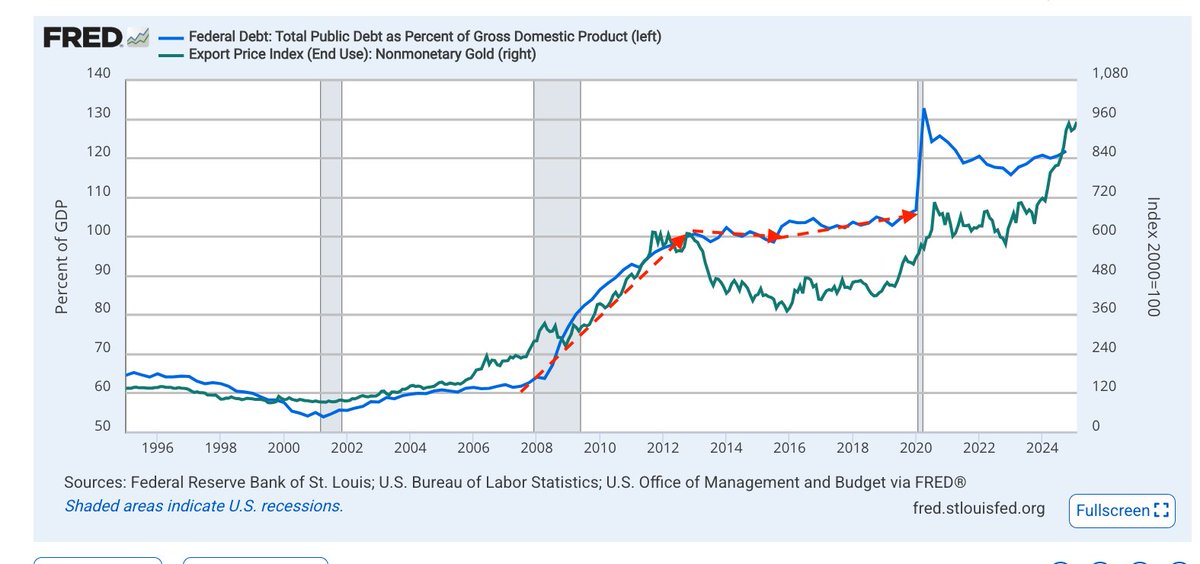

This chart may be the clearest. First, the overall trend of gold is highly correlated with the ratio of national debt to GDP.

Secondly, we can take a closer look at the performance from 2008 to 2020:

From 2008 to 2012, the ratio of U.S. national debt to GDP increased significantly, and gold rose.

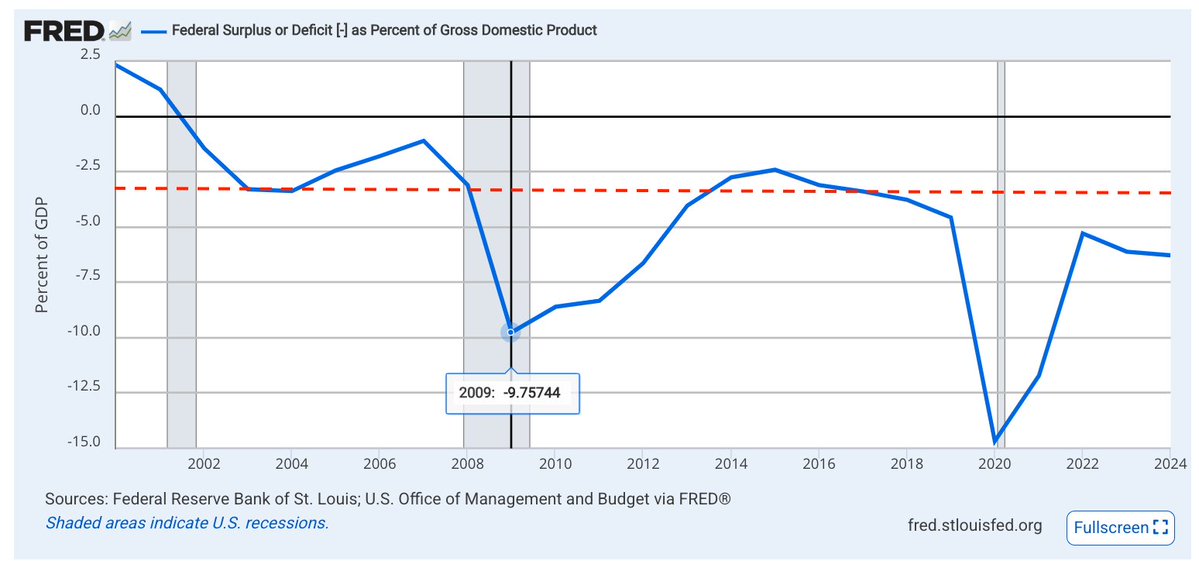

From 2012 to 2016, the ratio of national debt to GDP remained basically unchanged, and during this period, the U.S. deficit was kept within 3%, leading to a decline in gold.

Starting in 2016, the deficit rate exceeded 3% again, while the ratio of national debt to GDP began to rise, and gold warmed up.

Therefore, if the U.S. deficit rate continues to improve or the economy grows rapidly, reflected in a stable or even decreasing national debt to GDP ratio, gold will fall. Because at this time, it is definitely more appropriate to buy U.S. Treasury bonds or U.S. stocks.

Conversely, when the deficit rate is high or economic growth is slow, gold rises.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。