This market really is like a cat one day and a dog the next. Just yesterday, due to the significant risk of a tariff rebound, the market returned to a downward trend today. This is why it has been emphasized that the recent rise is merely a rebound, not a reversal, as there is currently no demand for a reversal. Although the suspension of reciprocal tariffs for 90 days gives the market a breather, the 10% base tariff is still four times the average tariff in the U.S. for 2024, and the U.S. monetary policy remains tight, with the economy also heading towards a downturn.

The CPI data released today is actually quite good; overall inflation has shown a decline, indicating that inflation has been controlled even without the implementation of the 10% base tariff. Even with the 20% tariff on China included, the annual CPI rate is still below market expectations. Without considering the new tariffs, the U.S. has been effective in controlling inflation.

However, as inflation decreases, the monthly CPI rate has shown a negative value, which indicates that the U.S. economy is already in a state of contraction. This is not good data, which is why the Federal Reserve has always aimed to keep inflation at 2%. Too low inflation or deflation may lead to delayed consumption and investment, resulting in economic stagnation. Conversely, too high inflation can lead to rising living costs, wages not keeping up with prices, devaluation of savings, and even social unrest.

2% is a moderate inflation level that strikes a balance; it won't scare away consumers and can maintain moderate growth in prices and wages, encouraging consumption and investment while preserving monetary policy flexibility, without triggering inflation panic.

Thus, deflation often indicates expectations of economic downturn. Of course, one month’s data cannot definitively indicate that problems will arise, but when the market anticipates an economic recession, indicators of economic decline can cause investors to panic, not to mention that there is a significant GDP test at the end of this month.

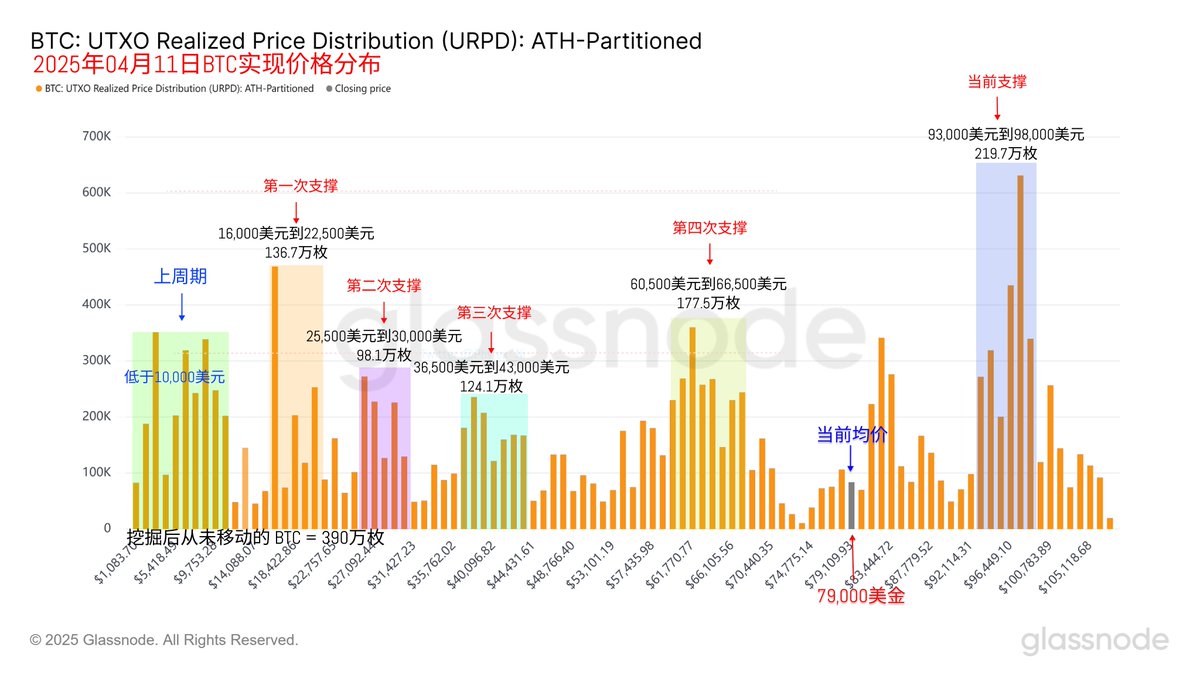

Looking back at Bitcoin's own data, although the price has shown a downward trend, investors have not panicked. Short-term investors are still providing the largest turnover, and even earlier investors, including those at a loss, have not shown signs of a mass exit. Therefore, the greatest pressure on the market currently does not come from so-called "dog traders," but rather from investors competing in the short-term market.

Additionally, it can be observed that investors in the $93,000 to $98,000 range are maintaining stable emotions and have not shown signs of panic. This group of investors still represents only a small portion of the market, which indicates that while Bitcoin investors may not have a clear bullish outlook in the short term, they have good expectations for future dips and bottom-fishing.

This future should be under conditions where monetary policy returns to being accommodative and the economy remains stable.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。