Why is Crypto Going Up Today: Eyes on CPI Data and US-China Tariff War

The worldwide crypto market recently experienced a good turnaround. According to CoinMarketCap , the market cap is now at $2.6 trillion, an increase of 5.84% in only 24 hours. The overall market volume also rose to $156.47 billion, a high 20.07% climb. This quick turnaround has made the community sit up and take notice.

Why is Crypto Going Up Today?

A number of significant events have driven the latest increase in crypto prices. Here's an overview of the most important reasons:

Trump 90 Days Tariff Pause : US President Donald Trump, in a surprise decision, announced that he would raise tariffs on China from 104% to 125%. However, he also granted a 90-day halt to more than 75 other nations.

Source: Truth Social

This news created global buzz and temporarily reduced market panic. While this move could still spark a trade war, the short-term break gave some relief to the crypto community.

Paul Atkins as New SEC Head : Paul Atkins was confirmed as the new leader of the U.S. SEC on April 9. Well-known for his pro-crypto outlook, Atkins is set to usher in clearer guidelines and fewer restrictions for the digital assets. He takes over from Mark Uyeda and vows to defend innovation in the sector. This has boosted investor confidence.

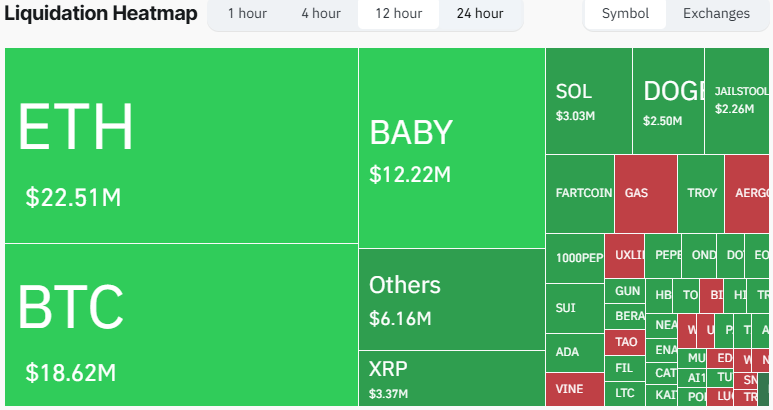

Liquidation Heatmap Turned Green : According to Coinglass , more than 130,000 traders were liquidated in the last 24 hours. The total liquidation value reached $483.49 million, showing strong price moves.

Source: Coinglass

The biggest single liquidation was a $3.33 million BTCUSDT order on Bybit. Green heatmaps tend to indicate higher market activity and bullish trader sentiment.

Fear and Greed Index on the Rise: Sentiment is gradually becoming positive. The index currently is 39 (Fear), increased from yesterday's Extreme Fear (18). It indicates that the sector is coming back down and more individuals are optimistic regarding price forecasts.

Will the Bull Market Sustain or Crypto Crash Again?

Although everything appears fine presently, there are still risks involved.

China response to US tariffs remains to be seen. If China wants to retaliate—perhaps by increasing China's own tariffs, selling U.S. bonds, or even selling Bitcoin—it may give a gigantic shock to the financial sectors. A drastic move may even lead to a market crash worldwide, including in crypto.

To make matters uncertain, the US CPI Inflation Data is to be released today at 6:00 PM IST (08:30 AM ET). The forecasted rate is 0.3%, which is a bit higher than the last 0.2%. If real data is equal to or exceeds the forecasted one, the industry may increase more. But if inflation declines, it can lead to a drastic fall.

In the meantime, Trump's behavior keeps investors in suspense. Prior to affirming the 90-day tariff suspension, he dismissed the news when it was still a rumor. His volatile remarks can easily destabilize markets, and any abrupt update could reverse the trend once again.

Final Thoughts

The crypto sector is right now basking in the glow of a strong rally fueled by a combination of political, economic, and market factors such as the SEC leadership shift, liquidation spikes, and improving investor sentiment. But with China's response, US CPI data, and Trump's next step still uncertain, investors need to stay on guard. Though the sector is currently on an upswing, it's wise to watch the global happenings that may rapidly alter the trend.

Also read: Dropee Daily Combo And Question of the Day 11 April 2025免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。