Source: Cointelegraph Original: "{title}"

A crypto venture capitalist has stated that the appeal of Ether (Ethereum, abbreviated as ETH) as an investment is declining due to second-layer networks siphoning value from the main network and a lack of opposition from the community against excessive token creation.

Nic Carter, a partner at Castle Island Ventures, pointed out in a post on X on March 28, "The primary reason for this situation is the greedy Ethereum second-layer networks extracting value from the first layer, while societal consensus accepts excessive token creation."

Ethereum "self-destructing"

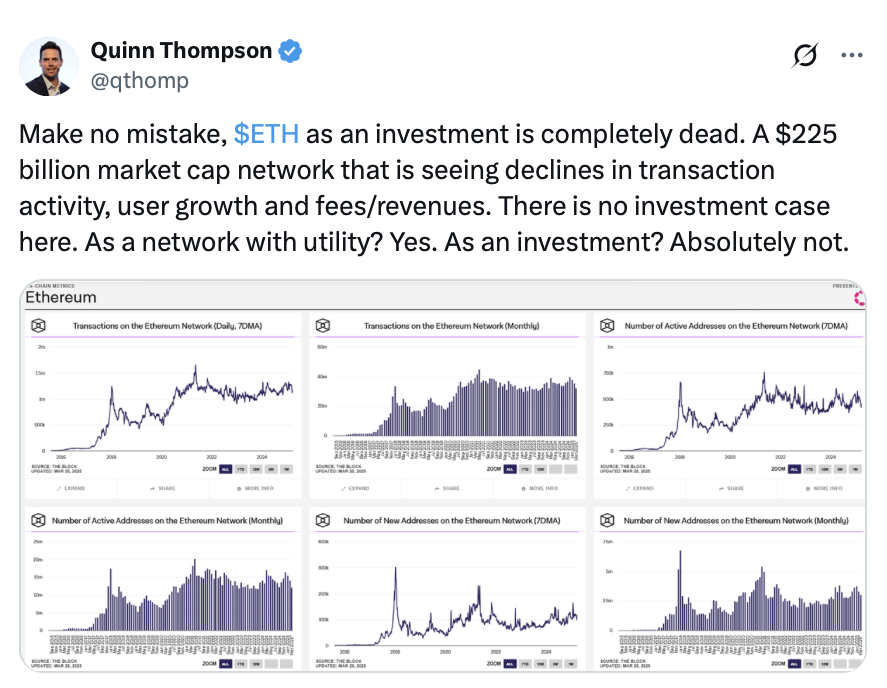

Carter commented, "ETH is buried by the avalanche effect of its own tokens; it is self-destructing." His remarks were in response to Quinn Thompson, founder of Lekker Capital, who concluded that Ether as an investment is "completely dead."

Source: Quinn Thompson

"A network with a market cap of $225 billion, declining trading activity, user growth, and fees/income. There is no reason to invest. As a practical network? Yes. As an investment? Absolutely not," Thompson noted in a post on X on March 28.

According to TradingView data, the ETH/BTC ratio—showing Ethereum's relative strength against Bitcoin (BTC)—is at 0.02260, the lowest level in nearly five years.

According to CoinMarketCap, at the time of publication, Ethereum's trading price was $1,894, down 5.34% over the past week.

Ethereum has dropped 17.94% in the past 30 days Source: CoinMarketCap

Meanwhile, Cointelegraph Magazine reported in September 2024 that Ethereum's fee revenue "collapsed" by 99% over the past six months, as "exploitative second-layer networks" absorbed all users, transactions, and fee revenue, contributing nothing to the base layer.

Around the same time, Adam Cochran, a partner at Cinneamhain Ventures, stated that Based Rollups could address the issue of Ethereum's second-layer networks extracting liquidity and revenue from the blockchain's base layer.

Cochran mentioned that Based Rollups could fundamentally change the incentive structure, directly impacting Ethereum's monetization.

Despite the optimism at the end of last year regarding Ethereum reaching $10,000 by 2025—especially after hitting $4,000 in December, while Bitcoin first touched $100,000—it has since sharply declined along with the broader crypto market.

Standard Chartered Bank in the UK added a pessimistic outlook in a client letter on March 17, lowering their estimate for Ethereum's price by the end of 2025 from $10,000 to $4,000, a reduction of 60%.

However, several cryptocurrency traders, including anonymous trader Doctor Profit and Merlijn The Trader, remain "extremely bullish," believing that Ethereum may be "the best opportunity in the market."

Source: Merlijn The Trader

Related articles: Since its launch, Ethereum's performance has only outperformed Bitcoin by 15%

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。