The cryptocurrency world is ever-changing, and the "stability" of stablecoins often faces numerous tests. On April 10, the stablecoin sUSD within the Synthetix ecosystem experienced a significant de-pegging, with the lowest price dropping to $0.834, currently reported at $0.860, deviating approximately 14% from the $1 peg. This volatility quickly sparked heated discussions in the community, with many concerned that this is a signal of a new round of stablecoin crisis.

Mechanism Upgrade Leads to Short-term De-pegging

After the incident, Synthetix founder Kain Warwick explained the situation on the X platform and revealed that he had sold 90% of his ETH holdings and increased his position in SNX. Warwick stated that the de-pegging of sUSD is not a sign of a systemic crisis but rather a temporary "side effect" caused by Synthetix undergoing a critical mechanism upgrade.

This marks the second de-pegging event in sUSD's history. The last one occurred on May 17, 2024, but the reasons were different. According to analysis by blockchain security firm Chaos Labs, the primary reason for last year's de-pegging was likely due to a large liquidity provider for sBTC/wBTC suddenly withdrawing funds, redeeming sUSD through Synthetix's spot synthetic redemption mechanism, and then selling off a large amount in the related Curve liquidity pool.

For a long time, the peg of sUSD relied on a complex debt management mechanism: users mint sUSD by staking the native token SNX, while the system maintains its 1:1 peg to the dollar through high collateralization rates and debt adjustments. As Synthetix's strategic direction has shifted, this old mechanism has been gradually removed, replaced by a more efficient and decentralized new system—the "420 liquidity pool" under the SIP 420 proposal. The transition between the old and new mechanisms inevitably brought about transitional pains, and the short-term de-pegging of sUSD is a manifestation of this process.

Specifically, under the old mechanism, when the price of sUSD fell below $1, stakers could profit by repurchasing sUSD at a discount and destroying the debt, which would naturally push the price back up. However, with the abandonment of the old mechanism and the new mechanism not yet fully in place, the excess liquidity of sUSD in the market temporarily lost effective adjustment means, leading to price pressure. Warwick emphasized that this volatility is only temporary, and as the new debt management system is fully deployed, the long-term stability of sUSD will be significantly enhanced. Warwick repeatedly reiterated the collateralized nature of sUSD as a stablecoin, with its value supported by crypto assets like SNX, rather than relying on complex algorithms to adjust supply and demand, fundamentally differing from algorithmic stablecoins that have previously collapsed.

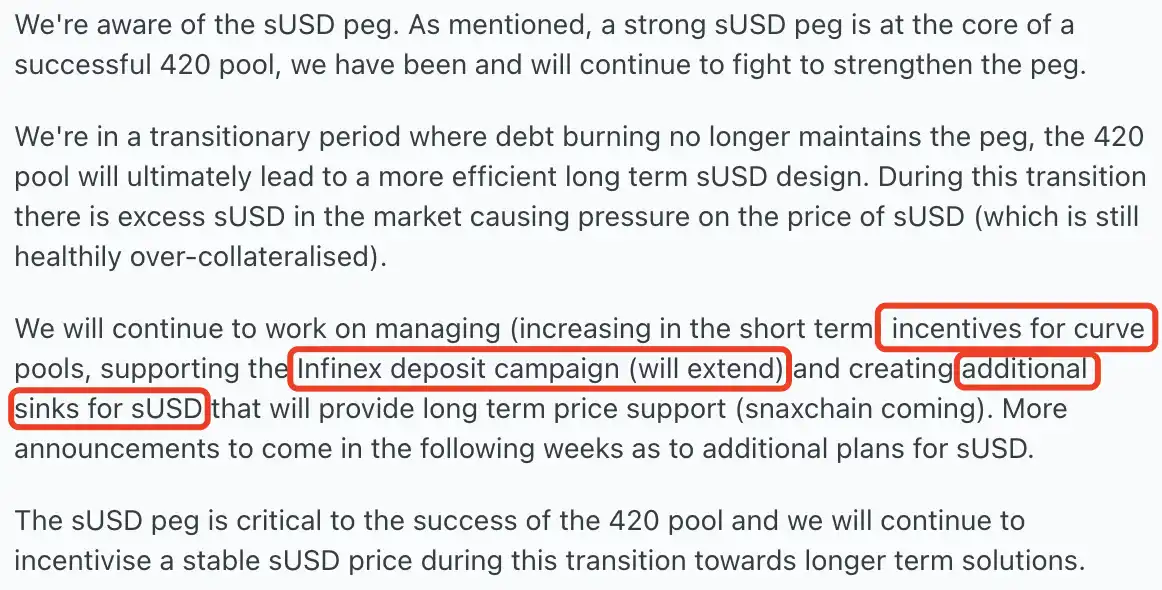

For SNX holders and sUSD users, the team has also developed a detailed plan for the transition period. Synthetix officials further supplemented the response measures through Discord, including strengthening incentives for Curve liquidity pools in the short term, extending the support period for Infinex deposit activities, and building a long-term price support system for sUSD.

"Antique Stablecoin" De-pegging Draws Attention, What Has Synthetix Been Up To in Recent Years?

To further understand the current situation of sUSD, we might as well review the development history of stablecoins. The origin of stablecoins can be traced back to 2014, the year that witnessed the birth of the first batch of stablecoins: Tether's USDT, BitShares' bitUSD, and Nubits. Although bitUSD and Nubits failed to withstand the test of time and gradually faded from the historical stage, USDT survived to this day due to its first-mover advantage and strong market adaptability, becoming the largest stablecoin by trading volume globally. The success of USDT was not without challenges, as its price experienced significant decoupling in 2017. However, to this day, USDT still firmly holds the top position among stablecoins.

2018 was another key milestone in the development of stablecoins. This year saw the rise of DeFi, leading to the emergence of several iconic stablecoins. MakerDAO's DAI, Synthetix's sUSD, and Terra's UST were introduced one after another. At the same time, the CeFi sector also welcomed a second wave of stablecoin enthusiasm, including Circle's USDC, TrueUSD (TUSD), Gemini's GUSD, and Paxos' PAX. Each of these projects has its own characteristics: DAI achieves decentralized pegging through over-collateralized ETH, sUSD relies on the high collateralization rate of SNX to support the synthetic asset ecosystem, while USDC promotes itself with redeemable fiat reserves. During this period, different types of stablecoins gradually diverged into two main paths: collateralized and algorithmic. Collateralized stablecoins use real assets as value support, offering relatively high stability but are susceptible to fluctuations in the value of the collateral. Algorithmic stablecoins, on the other hand, maintain their peg by adjusting supply and demand through smart contracts, theoretically offering higher capital efficiency, but can easily spiral out of control during market volatility.

In 2021, DeFi projects generally recognized the strategic value of having their own stablecoins, and many protocols began to vigorously develop stablecoin ecosystems. However, Synthetix chose to gradually marginalize sUSD, which, in hindsight, is undoubtedly a significant misstep. The SIP 420 proposal passed in early 2025 brought new opportunities for sUSD, as the new mechanism introduced a collective liquidity pool model, reducing the collateralization rate to 200% and planning to eliminate $62 million in historical debt within 12 months, significantly enhancing capital efficiency and system security. The old debt destruction mechanism became ineffective, while the new stability module was not yet fully in place, leading to this de-pegging as a result of the transition period.

Looking at the present, competition in the stablecoin space remains fierce. Although sUSD is still the third "longest-lived" stablecoin in the cryptocurrency field, its status has significantly diminished. However, its longevity (the Lindy effect) grants it unique resilience, and the current mechanism adjustment may just be another upgrade on its evolutionary path.

In the short term, the price of sUSD may continue to fluctuate in a discount range of 5-10%, but with ample reserves in the treasury, the likelihood of a complete collapse is low. In the long term, as the new mechanism is implemented, sUSD is expected to regain its footing within the Synthetix ecosystem. The history of stablecoins teaches us that true strong players are often survivors who continuously adjust amidst the storms.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。