4 Alpha Core Views

I. Market Performance Review

US Stock Market Plummets: The S&P fell 10% over two days, VIX surged past 40, entering a technical bear market, with extreme market panic.

Divergence in Safe-Haven Assets: US Treasury yields plummeted, gold rose sharply before retreating, and the dollar index weakened.

Commodity Market Crash: Major commodities like crude oil and copper saw significant declines, reflecting a pessimistic outlook for global demand.

Bitcoin Exhibits "Dual Attributes": Initially boosted by the US dollar credit crisis, it later fell due to global risk asset panic, showcasing its complexity as both a "safe haven + liquidity-sensitive" asset.

II. Analysis of Trump's Tariffs

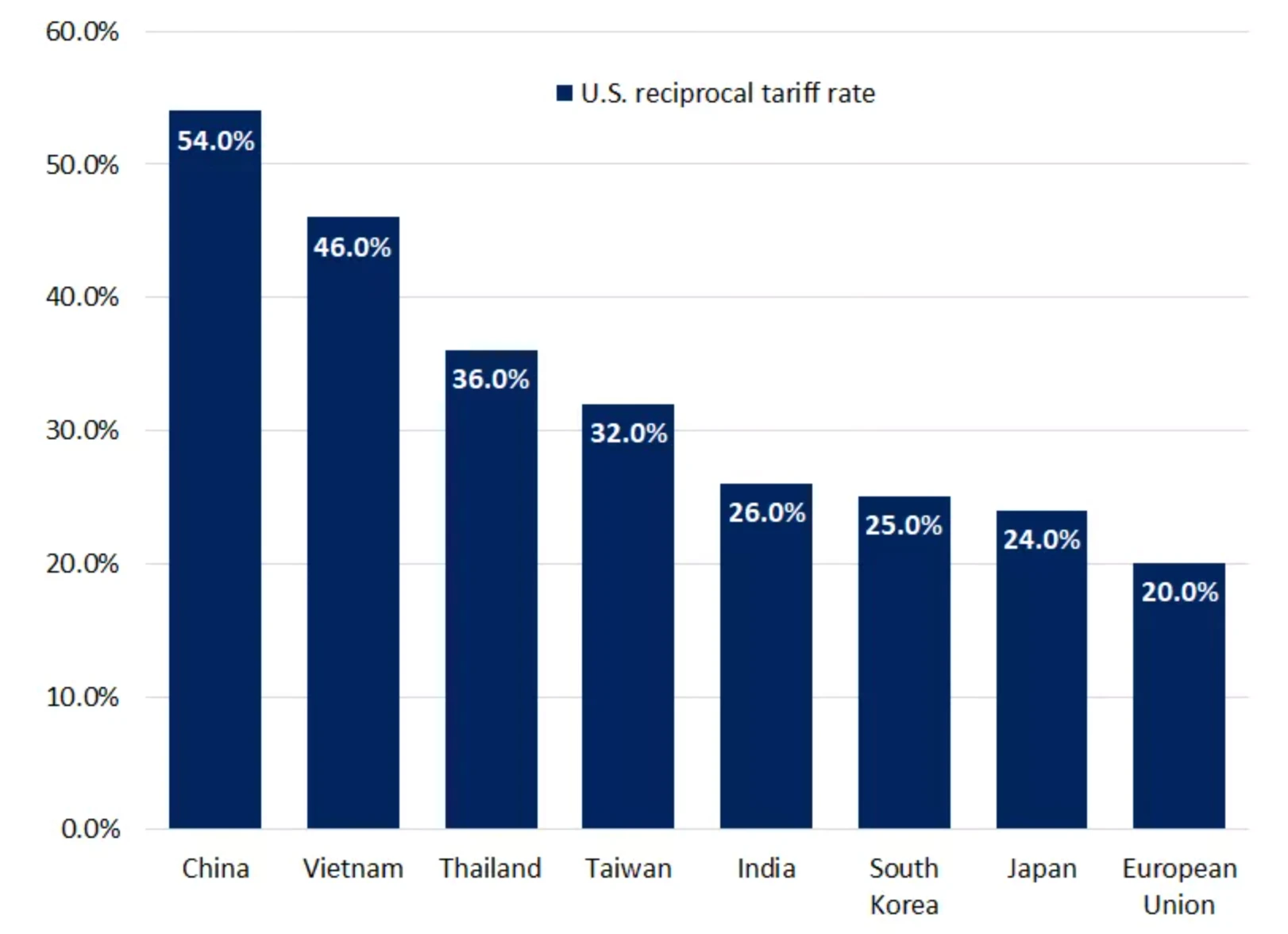

Stricter than Expected: Traditional allies set a "minimum threshold" of around 10%, while Asian countries faced tariffs as high as 25–54%, and the EU was also hit with a 20% tariff.

Political Logic Over Economic Logic: Building legitimacy, increasing fiscal revenue, paving the way for tax cuts; enhancing negotiation leverage, and increasing pressure for manufacturing to return.

Tariff Strategy is Blunt but Leaves Room for Negotiation, as countries like South Korea and Japan actively negotiate for lower tariffs.

Countermeasures from China and the EU are the Biggest Risk Variables, especially since China has already implemented countermeasures, potentially dragging into a long-term game.

III. Analysis of Non-Farm Employment Data

Surface stability, structural weakness: The official unemployment rate is 2%, but U6 is as high as 7.9%, and has risen for two consecutive months.

Employment growth has been revised down, with a decrease in part-time positions. Average hourly wage growth has slowed, and labor participation remains low.

Data collection methods show human distortion, leading to a decline in job quality.

IV. Analysis of Liquidity and Interest Rates

SOFR forward rates have clearly declined, indicating market expectations for the Fed to cut rates sooner.

The 2Y and 10Y US Treasury yields have both plummeted, indicating a market shift towards "pricing in recession."

Powell's remarks are cautious, acknowledging stagflation risks but not yet signaling easing, leaving policy in a wait-and-see mode.

V. Outlook and Recommendations for Next Week

Risk Factors:

High Uncertainty Over Tariff Retaliation Escalation, especially regarding whether China and the EU will retaliate further;

Economic Data "Lagging Response + Data Gaps" exacerbating policy and market games;

Market Lacks "Priced Policy Pathways", with extremely high structural vulnerabilities.

Market Pricing Logic Has Changed:

Shifting from "inflation pressure" to "high inflation + high tariffs → suppressed demand → early recession";

US Treasury rates and risk asset volatility jointly confirm "pessimistic expectations + seeking policy bottom."

Recommendations:

Maintain a Neutral Stance, cautiously responding to market volatility;

Bitcoin has Long-Term Potential as a "Dollar Liquidity Proxy", which will benefit again if the Fed initiates easing;

Short-Term Control of Leverage, waiting for policy easing and confirmation of market bottom signals.

Impact of Reciprocal Tariffs: What Are the Consequences?

I. Macroeconomic Review This Week

1. Market Overview

This week, Trump's reciprocal tariffs were implemented, but far exceeded market expectations, leading to a global risk asset crash.

US Stocks: The S&P 500 index fell 10% over two days, marking the largest drop since March 2020; the Dow dropped 7.6% for the week, and the Nasdaq entered a bear market (down 22% from December highs). The semiconductor ETF (SOXX) plummeted 16% in a week, the worst performance since 2001. The VIX index soared above 40, reflecting extreme short-term market panic.

Safe-Haven Assets: The 10-year Treasury yield fell 32 basis points to 3.93%, a new low since September 2022; spot gold peaked at $3,023/oz before retreating, down 1.7% for the week; the dollar index fell 1.1% for the week.

Commodities: Brent crude oil plummeted 10.4% to $61.8/barrel, with OPEC+ increasing production amid demand concerns. Copper prices fell 13.9%, marking the largest weekly drop since July 2022; iron ore fell 3.1%.

Cryptocurrency: Bitcoin briefly diverged from US stocks this week; after the reciprocal tariffs, while US stocks plummeted, Bitcoin rose, but fell again after China announced countermeasures, though it performed better overall than the US market. This reflects the dual nature of Bitcoin as both a safe haven and a risk asset.

Under the impact of tariffs, Bitcoin vividly demonstrated its intertwined safe-haven and risk attributes. When the reciprocal tariffs were implemented, Trump's tariffs raised concerns about the credibility of the global fiat currency system, activating Bitcoin's alternative currency attributes as "digital gold." However, after China's 34% counter-tariff was announced, fears of global supply chain disruptions surged, with the VIX index breaking 45, leading to indiscriminate selling of all risk assets. Bitcoin's performance in this crisis reveals its essence as a complex entity in the digital age: constrained by the liquidity shackles of traditional risk assets while embodying a revolutionary vision to disrupt the fiat currency system.

2. Economic Data Analysis

This week's data analysis focused primarily on Trump's tariffs and non-farm data.

2.1 Analysis of Trump's Tariffs

Although the market had anticipated Trump's reciprocal tariffs, the extent and scope of the tariffs announced on April 2 far exceeded expectations.

In terms of content, Trump's reciprocal tariffs can be divided into two parts:

The US set a minimum benchmark tariff of around 10% for its traditional trade partners, such as the Five Eyes Alliance (UK, Australia, New Zealand). Notably, the tariff rates for these countries are also around 10%. This portion of the tariffs generally aligns with market expectations.

Higher tariffs were imposed on specific countries and regions, mainly in Asia. China faced an additional 34% (on top of the already imposed 20%, totaling 54%), Indonesia 32%, Vietnam 46%, Thailand 36%, South Korea 25%, and Japan 24%. Additionally, the EU faced a 20% increase.

Chart 1: US Reciprocal Tariff Situation Source: The White House

In fact, "reciprocal tariffs" is not a precise economic concept; in Trump's political narrative, it is a core means to balance trade deficits and an important negotiation tool. Further analysis of its political objectives reveals two main effects of Trump's tariffs:

Building Legitimacy and Gaining Congressional Support: On one hand, Trump cloaks high tariffs in a "fairness" narrative to win public support in Midwestern manufacturing states; on the other hand, the revenue from tariffs will indeed increase US fiscal revenue, which will be very beneficial for his subsequent tax cuts and deregulation measures, especially in gaining Congressional support.

Negotiation Leverage and Accelerating Manufacturing Return: Creating uncertainty in advance, lowering optimistic export expectations for 2025 from China and Europe; applying extreme pressure to force global manufacturing leaders to accelerate localization in North America.

At a deeper level, the essence is that Trump is reconstructing the distribution of interests domestically and internationally by creating a "controllable crisis," converting short-term economic costs into long-term political capital.

From the specifics of Trump's tariff actions, another characteristic of these tariffs is that they are blunt yet leave room for negotiation. The tariff rates imposed on specific countries/regions are primarily calculated based on trade deficits; additionally, the implementation timeline allows other countries some time, as South Korea, Japan, and Vietnam have actively accelerated negotiations with the US to lower tariffs in pursuit of equal tariff reductions.

The only aspect that requires special attention is the countermeasures from China and the EU. Given that China took reciprocal measures last Friday and has a firm stance, it is expected that the US-China game cycle will significantly lengthen.

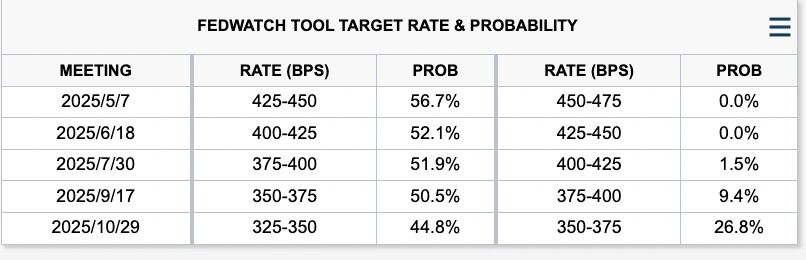

After the tariffs were announced, risk assets plummeted, and the risk market began to price in future recession risks, with the number of expected rate cuts for the year now at four.

Chart 2: Interest Rate Market's Expectations for Rate Cuts This Year Source: The White House

2.2 Non-Farm Data

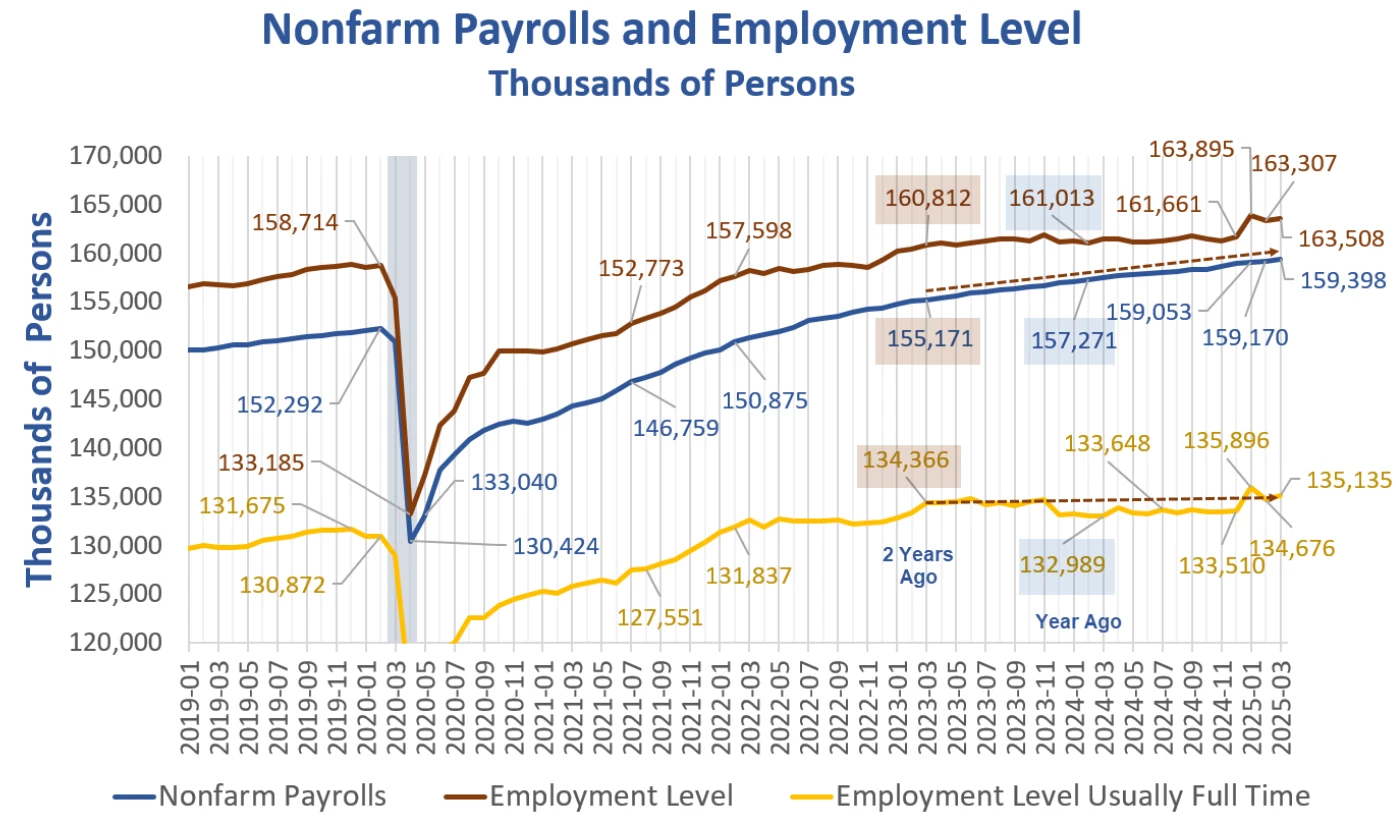

As we previously assessed, although the total non-farm employment data appears relatively robust, further analysis reveals otherwise. Most current macro research is trapped in an illusion: believing that the job market remains strong, thus inflation decline will naturally continue. However, we note that the quality of employment is diverging from the superficial strength of the data.

Chart 3: US March Non-Farm Employment Data Source: MishTalk

Key structural data includes:

1) The official unemployment rate is 4.2%; U6 is higher at 7.9%.

2) The change in total non-farm employment for January was revised down by 14,000; February's change was revised down by 34,000; after these revisions, the total employment numbers for January and February are 48,000 lower than previously reported.

3) The unemployment rate has risen for the second consecutive month. With an increase in government layoffs, the unemployment rate is expected to rise further.

4) The average hourly wage increase for all non-farm workers is 8%. The average hourly wage increase for production and non-management workers is 3.9%, with overall growth continuing to slow.

5) The labor participation rate remains low at 5%; part-time employment decreased by 44,000, while full-time employment rebounded by 459,000 (partially correcting last month's 1.22 million drop).

It is important to note that in the US Department of Labor's statistics, as long as you work for one hour, you are considered employed. If you are not working and not looking for work, you are not counted as unemployed but rather as having exited the labor market; searching for job vacancies in recruitment ads does not count as "looking for work"; you need to participate in actual interviews or send resumes to be included in the employment population. In reality, these distortions artificially lower the unemployment rate, artificially inflate full-time employment, and artificially increase the monthly wage employment report.

Although the data cannot deny the basic robustness of the US labor market, the structural outlook is not optimistic. The market's expectation of a "comprehensive cooling" has not yet arrived, but signs of deterioration are accumulating.

3. Liquidity and Interest Rates

From the perspective of the Fed's balance sheet, this week, the Fed's broad liquidity continued to maintain around $6.1 trillion. From the perspective of interest rates and the Treasury market, we find that since March, market expectations have undergone dramatic adjustments.

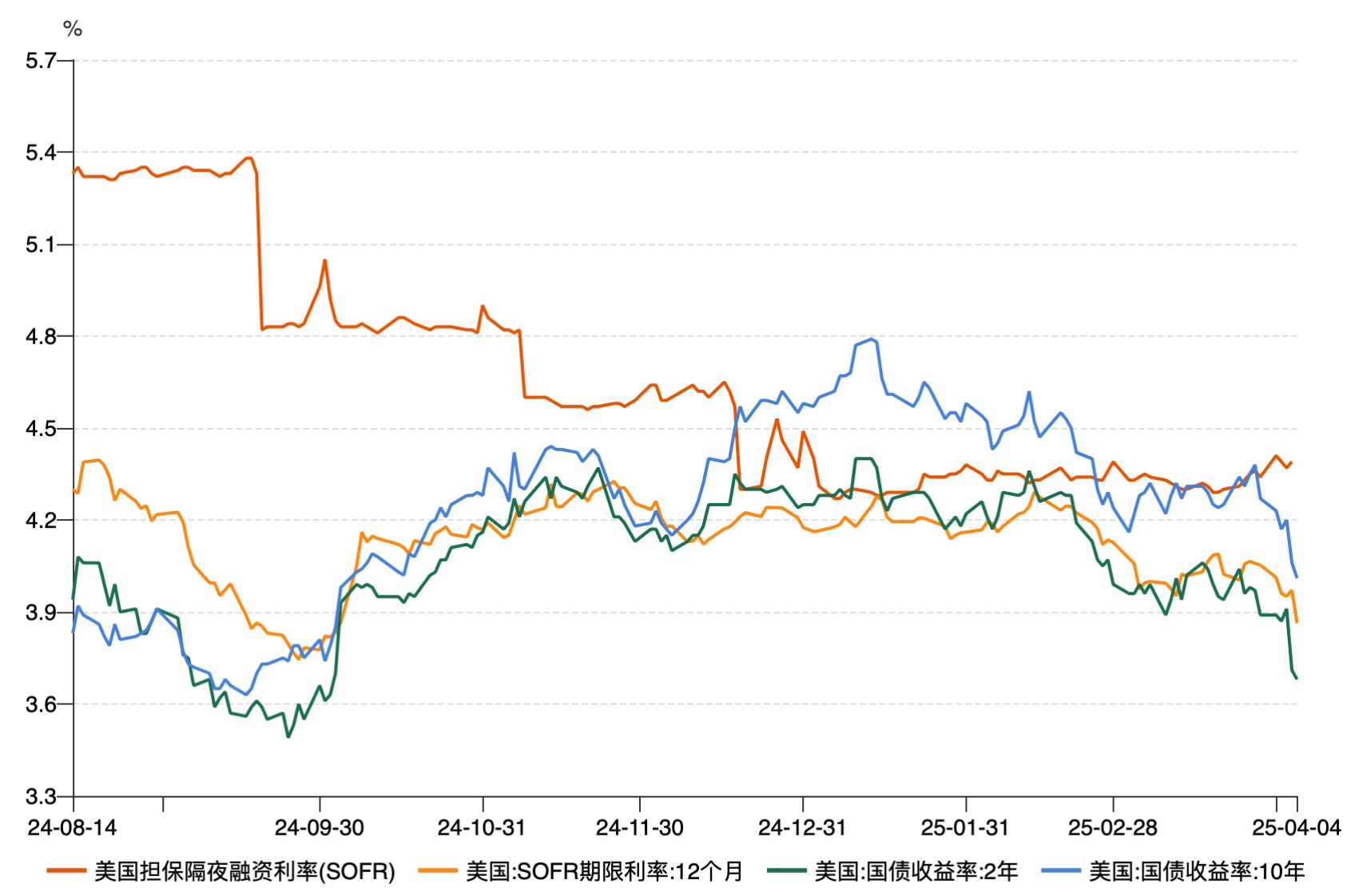

Chart 4: Changes in US Overnight Financing Rates and Treasury Yields Source: Wind

As shown in the above chart:

1) SOFR 12-month forward rate (light orange line): This reflects the market's expectations for the Federal Reserve's interest rate level over the next year. The data shows a significant decline, diverging more from the current SOFR rate, dropping from about 4.3% to below 4.0%, indicating that the market is re-pricing: the Fed is more likely to cut rates earlier or maintain a looser stance for a longer period.

2) The 2-year Treasury yield (green) and the 10-year Treasury yield (blue) have both rapidly declined, currently falling below 4.0%, with the 10-year yield approaching 3.8%. This indicates that the market has reached a consensus on a shift towards looser short-term policy (reflected in the 2Y) and has significantly lowered expectations for long-term economic growth and inflation (reflected in the 10Y). The market has overall entered a "pricing in recession" phase, believing that interest rates are no longer the core risk, but rather that the economy itself is facing issues.

Overall, Trump's "reciprocal tariffs" speech has intensified the market's pricing of stagflation risks, and the main logic of the market has shifted to: high inflation + increased tariffs → suppressed demand → early recession → the Fed may be forced to cut rates sooner.

Additionally, Powell's remarks this week have drawn significant market attention; however, from his statements, the Fed is deeply mired in a policy dilemma under stagflation. Powell's overall tone is cautious, acknowledging the "stagflation dilemma of rising unemployment and inflation risks," emphasizing the need to wait for clearer data and not adjusting the policy stance for now. Although the market is pricing in a 115 basis point rate cut by the Fed in 2024, with a 35.1% probability of a cut in May, Powell hinted that "wait-and-see" remains the main tone.

II. Macroeconomic Outlook for Next Week

For global assets, the current situation is a typical period of rising structural uncertainty: it is not that the market lacks liquidity, but rather that there is a lack of "priced policy pathways." The risks facing the market mainly revolve around the following three points:

1) Tariff Retaliation: With China's countermeasures, it is unclear how the US will respond; additionally, it remains uncertain whether the EU and other Asian economies will have retaliatory measures.

2) Economic Data: Current market concerns about recession are increasing; if tariff retaliation escalates, soft economic data may further suppress market risk appetite, but at the same time, the lagging nature of hard economic data complicates the Fed's decision-making, potentially prolonging market volatility.

Considering the conclusions from the interest rate market, risk market, and economic data, we believe the market remains in an extremely fragile state. In a vacuum where data cannot falsify, the market lacks strong upward momentum. However, it is important to note that according to members of Trump's cabinet, the current tariffs are already at the highest limit, and upcoming negotiations may gradually establish a policy bottom for the market.

Based on the aforementioned analysis, our overall view is:

The current trading benchmark is: High inflation combined with tariff shocks leads to a re-pricing of global recession expectations.

The synchronized decline in US Treasury yields (especially the sharp drop in SOFR forward rates) clearly reflects "opening policy space + increasing macro pessimism"; the significant volatility in risk assets (US stocks, raw materials) reveals a severe lack of confidence in "priced futures"; alternative assets like gold and Bitcoin, while having safe-haven logic, still cannot strengthen independently due to liquidity constraints, reflecting that structural risks have not been cleared.

For cryptocurrencies, Bitcoin's dual characteristics of "safe haven vs. liquidity sensitivity" have been fully exposed in this tariff crisis; if the Fed is forced to ease quickly, BTC may again be viewed by funds as a "dollar liquidity proxy asset"; we recommend maintaining a neutral stance, controlling leverage, and being cautious of sharp market fluctuations.

Key macroeconomic data for next week is as follows:

Disclaimer

This document is for internal reference only by 4Alpha Group, based on 4Alpha Group's independent research, analysis, and interpretation of existing data. The information contained in this document is not investment advice and does not constitute an offer or invitation to residents of the Hong Kong Special Administrative Region, the United States, Singapore, or any other countries or regions where such offers are prohibited to purchase, sell, or subscribe to any financial instruments, securities, or investment products. Readers should conduct their own due diligence and seek professional advice before contacting us or making any investment decisions.

This content is protected by copyright, and may not be copied, distributed, or transmitted in any form or by any means without the prior written consent of 4Alpha Group. While we strive to ensure the accuracy and reliability of the information provided, we do not guarantee its completeness or timeliness, and we accept no liability for any loss or damage arising from reliance on this document.

By accessing this document, you acknowledge and agree to the terms of this disclaimer.

All information provided on this website is for reference only. This website does not guarantee the accuracy, validity, timeliness, and completeness of the information. Any actions taken based on the information provided on this website are at the user's own risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。