The market is surging with the banner of Trump.

Written by: Pzai, Foresight News

The market is surging with the banner of Trump.

On April 9, following Trump's announcement to suspend tariffs on other countries for 90 days and reduce reciprocal tariffs to 10%, the cryptocurrency market reacted swiftly, with mainstream assets showing widespread gains. At the same time, with the U.S. Senate approving Paul Atkins as the new SEC chairman, and the acting chair of the Commodity Futures Trading Commission (CFTC), Caroline D. Pham, indicating that there will be no future lawsuits against registration violations for digital assets, the future of the U.S. cryptocurrency market is becoming clearer.

Market Sentiment Overview

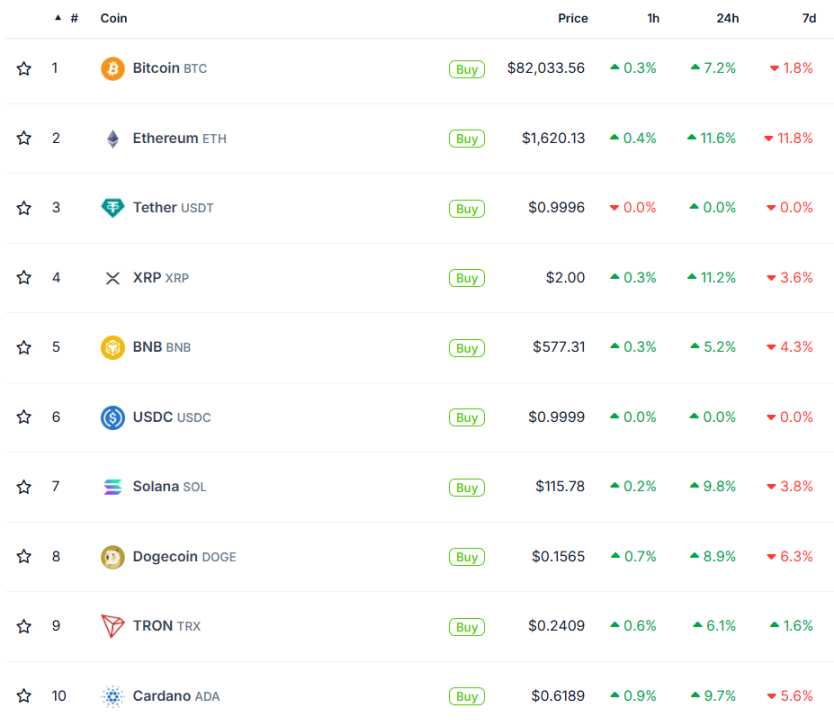

In terms of mainstream assets, the top ten assets all saw daily gains exceeding 5%, partially recovering from the week's losses. Bitcoin returned to the $82,000 level, while Ethereum climbed back above $1,600. Despite the uncertainty regarding which countries are specifically exempt from tariffs and whether Trump is still prepared to escalate the trade war significantly, cryptocurrency assets benefited from expectations of a "de-escalation of the trade war," combined with regulatory easing, leading to a burst of short-term positive sentiment and an effective recovery from previous market emotions.

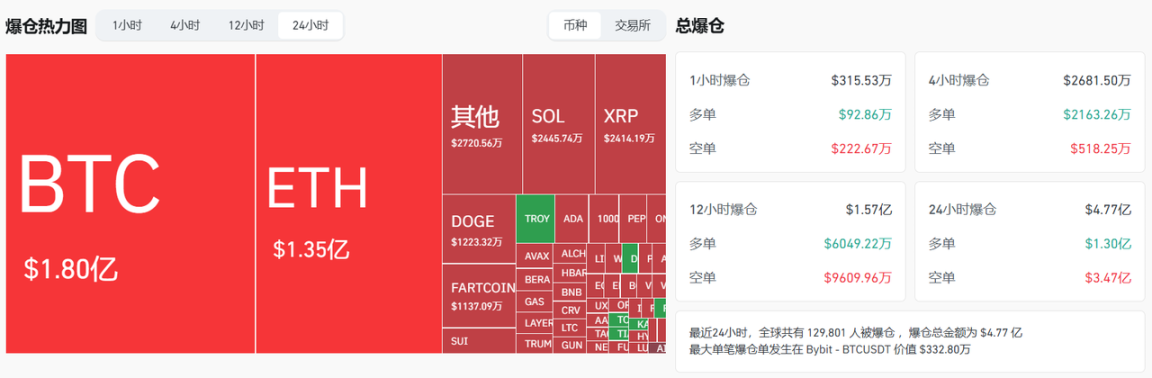

In such a volatile market, according to Coinglass data, $477 million was liquidated across the network in the past 24 hours, with long positions liquidating $130 million and short positions liquidating $347 million. Among them, Bitcoin saw $180 million in liquidations, and Ethereum saw $135 million. In this market environment, Bitwise Chief Investment Officer Matt Hougan stated, "Bitcoin bulls should be inspired by its performance… Once market volatility stabilizes, we will see it return to historical highs or even higher."

How is the market responding to the tariff suspension expectations?

After the delay in tariff implementation, many possibilities are emerging. In the macro environment, the market originally expected the Federal Reserve to potentially start cutting interest rates in the second half of 2025, while Federal Reserve analysts predict that if the tariff suspension continues, the inflation impact is expected to weaken, and the threshold for rate cuts remains high. If Trump extends the tariff suspension within 90 days or announces tariff exemptions for more countries (such as Europe, Japan, and South Korea), it will further alleviate global trade friction pressures, combined with regulatory easing and expectations of capital inflow, which will help the cryptocurrency market maintain strength. However, after China's reciprocal tariffs, Trump clearly stated that he would impose tariffs on Chinese goods up to 125%, and the potential impact of a new round of U.S.-China trade friction has led to a rise in global risk aversion sentiment. The increase in global risk aversion sentiment is likely to put pressure on risk assets, including cryptocurrencies, for a certain period.

Most analysts believe that if the tariff suspension can significantly alleviate imported inflationary pressures, the Federal Reserve may relatively delay the pace of interest rate cuts in the medium to long term. On the other hand, if global trade frictions continue or escalate, risk assets will face more downward pressure in the short term, and the Federal Reserve may find itself in a more complex balancing act regarding monetary policy. Considering the internal divisions in the U.S. regarding tariff policy, the probability of future policy reversals is high, which may cause fluctuations in market sentiment. The market will need to pay more attention to the direction of Federal Reserve monetary policy (especially the FOMC meetings in June and September). If market expectations gradually adjust to "easing to neutral," the cryptocurrency market may continue its recent warming trend; conversely, if the situation worsens and the Federal Reserve becomes more hawkish, the pressure on risk assets may accumulate rapidly.

Multiple institutions are working together to promote compliance, and cryptocurrency stocks are rebounding strongly.

While the market is volatile, compliance progress in the U.S. cryptocurrency market continues to advance steadily.

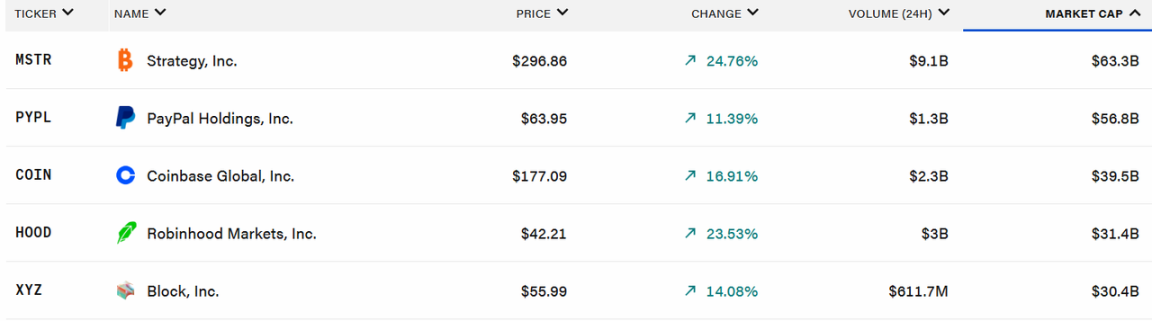

On April 8, according to Fortune magazine, U.S. Deputy Attorney General Todd Blanche instructed the immediate closure of the Department of Justice's cryptocurrency litigation department (NCET), which was established in 2021 and handled several landmark cases, including the cryptocurrency mixer Tornado Cash and the Mango Markets vulnerability incident. Blanche stated that the previous administration used the Department of Justice with a "reckless strategy" to over-regulate the cryptocurrency industry through enforcement actions. On the same day, CFTC acting chair Caroline D. Pham also supported the Department of Justice's policy, stating that there would be no future lawsuits against registration violations for digital assets and initiated a plan aimed at quickly resolving the backlog of non-compliance issues. These compliance advancements, combined with the favorable tariff policies from Trump, drove cryptocurrency stocks to rebound on April 9. Among them, MSTR rose to nearly $300, closing at $296.86, with a daily increase of 24.76%.

During the Senate Banking Committee hearing in March 2025, newly appointed SEC Chairman Paul Atkins stated in his testimony that he would prioritize creating a regulatory framework for digital assets, emphasizing the urgency of establishing clear rules for digital assets, with momentum building for bills like FIT 21. Although progress has been made across party lines, some Democrats criticized the Department of Justice for abandoning cryptocurrency enforcement due to the complexity of the former, expressing concerns about who will regulate the field and whether outdated legal frameworks still apply. When regulatory policies become clear and coherent, uncertainty in the market will significantly decrease. Recent compliance dynamics send a signal that U.S. regulators are actively working to build a long-term management mechanism for cryptocurrency assets. This will help investors who have long focused on compliance and regulation to reduce the volatility risk of funds in a "regulatory vacuum," while companies facing high compliance costs and legal risks in the industry are expected to gain more room for development in the future.

In the era of Trump’s continued deepening involvement in cryptocurrency, this series of regulatory easing actions is by no means isolated but is a key piece of the American "cryptocurrency national strategy"—the Department of Justice's exit reduces the burden on the industry, CFTC's flexible enforcement expands the market base, and SEC's rule-making attracts mainstream capital. The integration and cooperation of these departments reflect that the U.S. is attempting to build a "regulatory friendliness - market scale - strategic reserve" trinity in the cryptocurrency market system. As this system deepens further, we have reason to believe that the cryptocurrency market is gradually entering more investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。