Source: Cointelegraph Original: "{title}"

Stablecoins have recently become the focus: several key bills have passed in the U.S. Congress, the stablecoin issued by First Digital briefly lost its peg due to reserve issues, and Binance's efforts to challenge the banking industry have faced opposition from lawmakers—this is just a part of the recent headlines.

As the market focuses on the status of the dollar and the future direction of the U.S. economic strength under Trump's controversial policies, cryptocurrencies pegged to the dollar are attracting attention.

In Europe, stablecoins face stricter regulatory frameworks. Many stablecoins have been delisted by exchanges for failing to meet the requirements of the EU's Markets in Crypto-Assets Regulation (MiCA) passed in 2023.

With rapid policy developments and new assets entering the market, many changes are occurring in the stablecoin sector. Here are the latest updates.

The Stablecoin Transparency and Better Ledger Accountability Act (STABLE Act) has passed a key vote in the U.S. House Financial Services Committee and is set for a full vote in the U.S. House of Representatives.

Source: U.S. Republican Financial Services Committee

The bill establishes basic rules for stablecoins in the payment sector, dollar-pegged stablecoins, and information disclosure by stablecoin issuers. The STABLE Act is being reviewed in parallel with the GENIUS Act, a major stablecoin regulatory framework that the crypto industry has been advocating.

Many industry insiders believe that stablecoin regulation is a key step in bringing cryptocurrencies into the mainstream, but the current bill also faces significant opposition. U.S. Democratic Representative Maxine Waters voted against the STABLE Act in the committee vote, criticizing her colleagues for creating "an unacceptable and dangerous precedent" with the bill.

Waters is primarily concerned that the bill would legitimize Trump's newly established stablecoin project, allowing him to profit personally at the expense of American taxpayers.

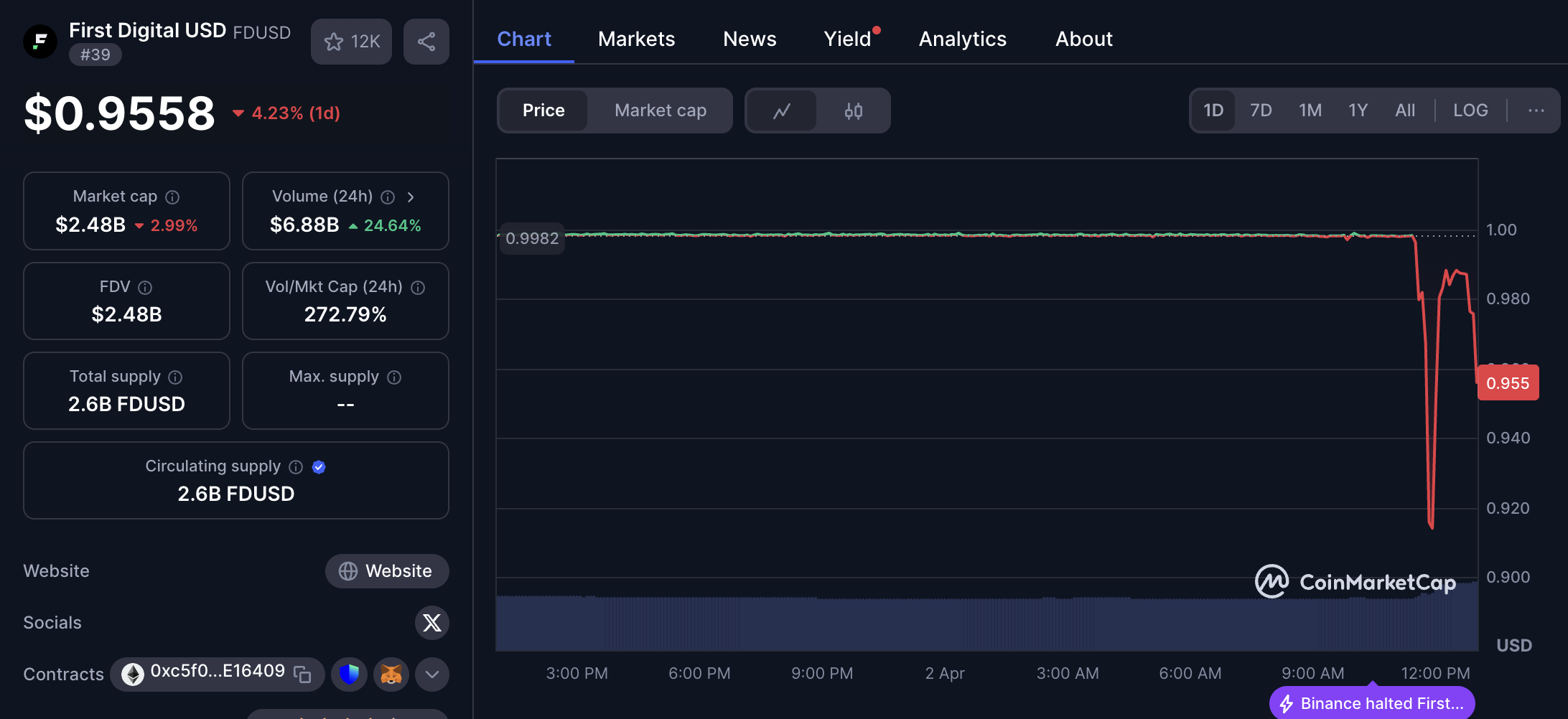

The First Digital (FDUSD) stablecoin lost its peg on April 2, after Tron network founder Justin Sun claimed that issuer First Digital was insolvent. First Digital refuted Sun's claims, stating that they are fully solvent and that FDUSD can still be exchanged 1:1 for dollars.

Price fluctuations of First Digital stablecoin. Source: CoinMarketCap

First Digital stated, "Every dollar supporting FDUSD is completely safe and secure, backed by U.S. Treasury bonds. The specific ISIN numbers of all FDUSD reserves are listed in our certification report and have clear records."

A representative from First Digital claimed that Sun's statements are "typical Justin Sun smear tactics aimed at attacking his business competitors."

The Trump family's decentralized finance project, World Liberty Financial, has launched a stablecoin pegged to the dollar, with a total supply exceeding $3.5 million.

According to data from Etherscan and BscScan, the project issued the World Liberty Financial USD (USD1) token on the Binance Smart Chain (BNB Chain) and Ethereum in early March.

Former Binance CEO Changpeng Zhao welcomed the new coin. Source: Changpeng Zhao

USD1 has faced strong criticism from Trump's political opponents, including Waters, who argue that Trump intends to replace the dollar with his own stablecoin for personal gain.

A group of U.S. senators recently issued a letter expressing their concerns, believing that Trump could benefit his project by changing regulatory and enforcement standards, which would harm other stablecoin projects and the overall economic health.

Coinbase CEO Brian Armstrong stated that he hopes to compete with banks by offering U.S. investors interest on stablecoin holdings that far exceeds traditional savings accounts.

In a lengthy post on March 31, Armstrong stated that U.S. stablecoin holders should be able to earn "on-chain interest," and that stablecoin issuers should be treated similarly to banks and "be allowed and incentivized to share interest with consumers."

His proposal has faced resistance in Congress. House Financial Services Committee Chairman French Hill stated that stablecoins should not be viewed as investments but merely as payment tools.

Source: Brian Armstrong

Reportedly, he said, "I don't think stablecoins should be viewed like I view bank accounts. I agree with Armstrong, but I don't think there is consensus on this in the House or Senate."

One of the world's largest cryptocurrency exchanges, Binance, has suspended trading of the dollar-backed USDT stablecoin issued by Tether. Users can still hold USDT in their accounts and trade it in perpetual contracts.

USDT can still be used for perpetual contract trading in the EU. Source: Binance

The decision to delist USDT is part of its compliance measures to adhere to the EU's large-scale cryptocurrency regulatory framework MiCA passed in 2023. Other major exchanges have taken similar actions. Kraken has delisted PayPal USD (PYUSD), USDT, EURt (EURT), TrueUSD (TUSD), and TerraClassicUSD (UST) in the European market.

Crypto.com has given its users until the end of the first quarter of 2025 to convert affected tokens into MiCA-compliant tokens. "Otherwise, they will be automatically converted into stablecoins or assets that comply with market value," the exchange stated.

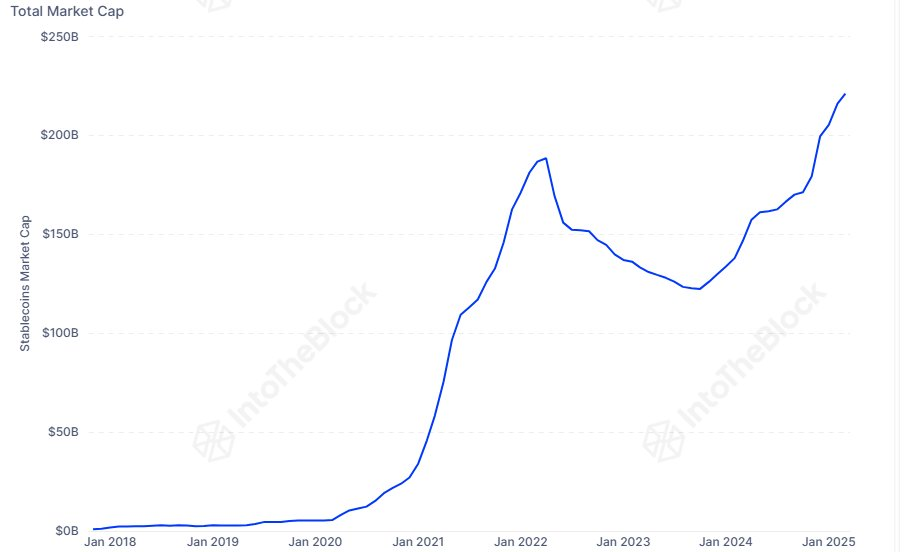

Crypto intelligence platform IntoTheBlock has found that the amount of funds entering tokenized real-world assets and stablecoins is increasing. According to the analysis firm, these assets are increasingly seen as "safe havens in the current uncertain market."

Total market capitalization of stablecoins. Source: IntoTheBlock

The institution noted that the unpredictable economic headwinds during Trump's presidency are a major reason for the influx of funds.

"Many investors initially expected economic tailwinds after Trump took office, but escalating geopolitical tensions, tariff issues, and overall political uncertainty have made investors more cautious," the institution stated.

As the Japanese government's stance softens, more companies are seeking to launch stablecoins in Japan. The cryptocurrency subsidiary of Japan's SBI Financial Group is set to support Circle's USDC. SBI VC Trade stated that it has completed the preliminary registration for stablecoin services and plans to offer cryptocurrency trading services for USDC.

On the same day this news was released, Hideki Ito, Commissioner of the Japanese Financial Services Agency, expressed support for stablecoin trading at the Fin/Sum 2025 event during Japan's FinTech Week.

Japan's Sumitomo Mitsui Financial Group (SMBC), TIS Inc., Avalanche network developer Ava Labs, and digital asset infrastructure company Fireblocks are looking to commercialize stablecoins in Japan.

These companies have signed a memorandum of understanding to develop strategies for issuing and circulating dollar and yen-backed stablecoins.

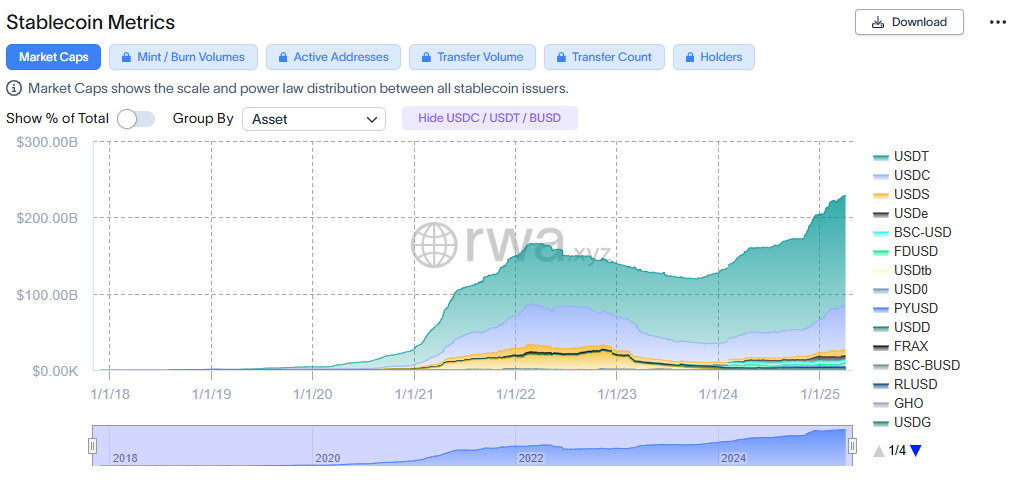

Overview of the stablecoin market. Source: RWA.xyz

Related: Ukraine imposes a 23% tax on certain cryptocurrency income, stablecoins are tax-exempt.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。