In an era of unstable credit, increased dollar volatility, and a reshaping of the global monetary landscape, gold is undergoing a process of "digital rediscovery."

I. Introduction: The Return of Safe-Haven Demand in a New Cycle

Since the beginning of 2025, frequent geopolitical conflicts, persistent inflationary pressures, and sluggish growth in major economies have led to a renewed demand for safe-haven assets. Gold, traditionally regarded as a "safe asset," has once again become the focus, with gold prices reaching new highs, surpassing the $3,000 per ounce mark, becoming a haven for global capital. Meanwhile, as the integration of blockchain technology with traditional assets accelerates, "Tokenized Gold" has emerged as a new trend in financial innovation. It not only retains gold's value-preserving properties but also possesses the liquidity, combinability, and smart contract interaction capabilities of on-chain assets. An increasing number of investors, institutions, and even sovereign funds are beginning to incorporate tokenized gold into their investment strategies.

II. Gold: An Irreplaceable "Hard Currency" in the Digital Age

Despite humanity entering a highly digitized financial era with a plethora of financial assets emerging—from fiat currencies, government bonds, and stocks to the rise of digital currencies in recent years—gold maintains its status as the "ultimate store of value" due to its unique historical depth, value stability, and cross-sovereign currency attributes. Gold is referred to as "hard currency" not only because of its natural scarcity and physical non-falsifiability but also because it embodies a long-standing consensus of human society over thousands of years, rather than being backed by the credit of a specific country or organization. In any macroeconomic cycle where sovereign currencies may depreciate, fiat currency systems may collapse, and global credit risks accumulate, gold is always seen as the last line of defense and the ultimate means of payment under systemic risk.

In the past few decades, especially after the collapse of the Bretton Woods system, gold was once marginalized, with its role as a direct settlement tool replaced by the dollar and other sovereign currencies. However, it has been proven that credit currencies cannot completely escape the fate of cyclical crises; gold's status has not been erased but rather reassigned as a value anchor in each round of monetary crisis. The 2008 global financial crisis, the wave of global monetary easing following the 2020 pandemic, and the high inflation and interest rate shocks since 2022 have all led to a significant rise in gold prices. Particularly after 2023, multiple factors such as geopolitical friction, risks of U.S. debt default, and persistent global inflation have pushed gold back to the critical threshold of $3,000 per ounce, triggering a new shift in global asset allocation logic.

The actions of central banks are the most direct reflection of this trend. According to data from the World Gold Council, global central banks have continuously increased their gold holdings over the past five years, with "non-Western countries" like China, Russia, India, and Turkey being particularly active. In 2023, the net purchase of gold by global central banks exceeded 1,100 tons, setting a historical record. This round of gold repatriation is essentially not a short-term tactical operation but a strategic consideration driven by asset security, the diversification of sovereign currencies, and the declining stability of the dollar system. In the context of ongoing restructuring of global trade patterns and geopolitical dynamics, gold is once again viewed as the most trusted reserve asset. From the perspective of monetary sovereignty, gold is replacing U.S. Treasury bonds as an important anchor for many countries' central banks in adjusting their foreign exchange reserve structures.

More structurally significant is the renewed recognition of gold's safe-haven value in global capital markets. Compared to credit assets like U.S. Treasury bonds, gold does not rely on the issuer's repayment ability and is free from default or restructuring risks. Therefore, in the context of high global debt and expanding fiscal deficits, gold's "no counterparty risk" attribute is particularly prominent. Currently, the debt-to-GDP ratio of major global economies generally exceeds 100%, with the U.S. exceeding 120%. The increasing skepticism about fiscal sustainability makes gold irreplaceably attractive in an era of weakened sovereign credit. In practice, large institutions such as sovereign wealth funds, pension funds, and commercial banks are raising their allocation to gold to hedge against systemic risks in the global economy. This behavior is changing gold's traditional "counter-cyclical + defensive" role, positioning it more as a "structurally neutral asset" in the long term.

Of course, gold is not a perfect financial asset; its relatively low trading efficiency, difficulties in physical transfer, and challenges in programmability present inherent drawbacks that seem "heavy" in the digital age. However, this does not mean it is being eliminated; rather, it prompts gold to undergo a new round of digital upgrades. We observe that gold's evolution in the digital world is not a static preservation of value but an active integration with financial technology logic towards "tokenized gold." This shift is no longer a competition between gold and digital currencies but a combination of "value-anchoring assets and programmable financial protocols." The on-chain nature of gold injects liquidity, combinability, and cross-border transfer capabilities, allowing gold to serve not only as a wealth carrier in the physical world but also to become an anchor for stable assets in the digital financial system.

It is particularly noteworthy that gold, as a store of value, has a complementary rather than absolute replacement relationship with Bitcoin, often referred to as "digital gold." Bitcoin's volatility is significantly higher than that of gold, lacking sufficient short-term price stability, and in an environment of high macro policy uncertainty, it is more likely to be viewed as a risk asset rather than a safe-haven asset. In contrast, gold, with its vast spot market, mature financial derivatives system, and broad acceptance at the central bank level, continues to maintain its threefold advantages of counter-cyclical behavior, low volatility, and high recognition. From the perspective of asset allocation, gold remains one of the most important risk-hedging factors in constructing global investment portfolios, holding an irreplaceable underlying "financial neutrality" position.

Overall, whether from the perspective of macro financial security, the restructuring of the monetary system, or the reconfiguration of global capital allocation, gold's status as hard currency has not weakened with the rise of digital assets; rather, it has been further enhanced by global trends such as "de-dollarization," geopolitical fragmentation, and sovereign credit crises. In the digital age, gold serves as both a stabilizing force in the traditional financial world and a potential value anchor for future on-chain financial infrastructure. The future of gold is not one of replacement but of continuing its historical mission as the "ultimate credit asset" through tokenization and programmability within both new and old financial systems.

III. Tokenized Gold: The Golden Expression of On-Chain Assets (Extended Version)

Tokenized Gold is essentially a technology and financial practice that maps gold assets onto a blockchain network in the form of encrypted assets. It represents the ownership or value of physical gold through smart contracts, allowing gold to no longer be confined to static records in vaults, storage receipts, and banking systems, but to circulate and combine freely on-chain in a standardized and programmable form. Tokenized Gold is not a creation of a new type of financial asset but a reconstruction method that injects traditional commodities into the new financial system in digital form. It embeds gold, a hard currency that transcends historical cycles, into the "decentralized financial operating system" represented by blockchain, giving rise to a new value-carrying structure.

This innovation can be understood as an important part of the global wave of asset digitization. The widespread adoption of smart contract platforms like Ethereum provides the underlying programmable foundation for gold's on-chain expression; meanwhile, the development of stablecoins in recent years has validated the market demand and technical feasibility for "on-chain value-anchoring assets." In a sense, tokenized gold is an extension and elevation of the stablecoin concept, as it not only seeks price anchoring but also has real, credit-default-risk-free hard asset support behind it. Unlike fiat-backed stablecoins, gold-backed tokens naturally escape the volatility and regulatory risks of a single sovereign currency, possessing cross-border neutrality and long-term anti-inflation capabilities. This is particularly important in the current context where the dollar-dominated stablecoin landscape increasingly raises regulatory and geopolitical sensitivities.

From a micro-mechanism perspective, the generation of tokenized gold typically relies on two paths: one is a custodial model of "100% physical collateral + on-chain issuance," and the other is a protocol model of "programmable mapping + verifiable asset certificates." The former, such as Tether Gold (XAUT) and PAX Gold (PAXG), is backed by physical gold custodians, ensuring that each token corresponds to a specific amount of physical gold and is regularly audited and reported off-chain. The latter, such as Cache Gold and Digital Gold Token, attempts to enhance the verifiability and liquidity of tokens by binding programmable asset certificates to gold batch numbers. Regardless of the path taken, the core goal is to construct a mechanism for the credible representation, liquidity, and settlement of gold on-chain, thereby achieving real-time transferability, divisibility, and combinability of gold assets, breaking the traditional gold market's issues of fragmentation, high barriers to entry, and low liquidity.

The greatest value of tokenized gold lies not just in the technological expression but in its fundamental transformation of the functionality of the gold market. In the traditional gold market, trading physical gold typically incurs high transportation, insurance, and storage costs, while paper gold and ETFs lack true ownership and on-chain combinability. Tokenized gold seeks to provide a new form of gold that is splittable, can be settled in real-time, and is cross-border transferable through on-chain native asset forms, transforming gold from a "static asset" into a "high liquidity + high transparency" dynamic financial tool. This characteristic greatly expands the available scenarios for gold in DeFi and global financial markets, allowing it to exist not only as a store of value but also to participate in multi-layered financial activities such as collateralized lending, leveraged trading, yield farming, and even cross-border clearing and settlement.

Furthermore, tokenized gold is driving the transition of the gold market from centralized infrastructure to decentralized infrastructure. In the past, the value transfer of gold heavily relied on traditional centralized nodes such as the London Bullion Market Association (LBMA), clearing banks, and vault custodians, leading to issues such as information asymmetry, cross-border delays, and high costs. Tokenized gold, using on-chain smart contracts as a carrier, constructs a system for the issuance and circulation of gold assets that does not require permission or trust in intermediaries, making the processes of title confirmation, settlement, and custody of traditional gold transparent and efficient, significantly lowering market entry barriers, allowing retail users and developers to equally access the global gold liquidity network.

Overall, tokenized gold represents a profound value reconstruction and system integration of traditional physical assets in the blockchain world. It not only inherits gold's safe-haven attributes and store of value functions but also expands the functional boundaries of gold as a digital asset in the new financial system. In the context of the global trend of financial digitization and the multipolarization of the monetary system, the on-chain reconstruction of gold is destined to be not a temporary attempt but a long-term process accompanying the evolution of financial sovereignty and technological paradigms. Whoever can build a tokenized gold standard that combines compliance, liquidity, combinability, and cross-border capabilities in this process may gain the discourse power of the future "on-chain hard currency."

IV. Analysis and Comparison of Mainstream Tokenized Gold Projects

In the current crypto-financial ecosystem, tokenized gold serves as a bridge connecting the traditional precious metals market with the emerging on-chain asset system, giving rise to a number of representative projects. These projects explore various dimensions such as technical architecture, custodial mechanisms, compliance paths, and user experience, gradually constructing a prototype market for "on-chain gold." Although they all adhere to the basic principle of "physical gold collateral + on-chain mapping" in core logic, the specific implementation paths and focuses differ, reflecting that the tokenized gold sector is still in a stage of competition and undefined standards.

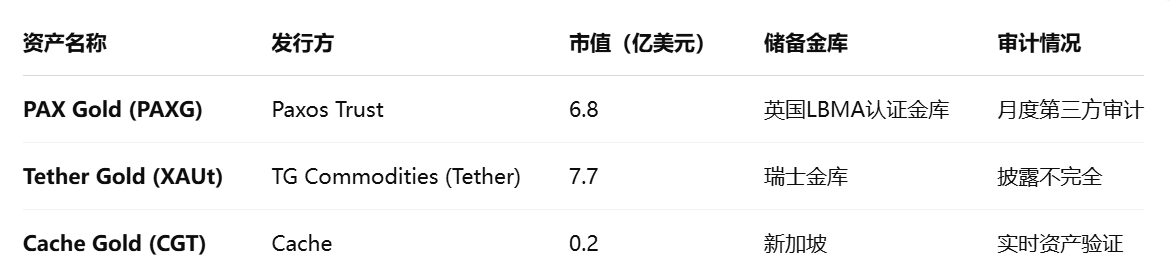

The most representative tokenized gold projects currently include: Tether Gold (XAUT), PAX Gold (PAXG), Cache Gold (CGT), Perth Mint Gold Token (PMGT), and Aurus Gold (AWG). Among them, Tether Gold and PAX Gold can be seen as the dual leaders of the current industry, not only leading in market capitalization and liquidity but also holding an advantageous position in user trust and exchange support due to their mature custodial systems, high transparency, and strong brand endorsement.

Tether Gold (XAUT) is launched by the leading stablecoin issuer Tether, with its main feature being that it is pegged to standard gold bars in the London gold market, with each XAUT corresponding to 1 ounce of physical gold held in Switzerland. This project benefits from the Bitfinex ecosystem behind Tether, giving it an advantage in liquidity, trading channels, and stability. However, Tether Gold is relatively conservative in terms of disclosure and transparency, as users cannot directly view the binding information of each token to specific gold bar numbers on-chain. This black-box asset custody method is controversial in the highly decentralized crypto community. Additionally, XAUT's compliance layout is still primarily aimed at international offshore users, making the entry threshold relatively high for investors wishing to invest in tokenized gold through formal financial channels.

In contrast, PAX Gold (PAXG) is launched by the U.S. licensed fintech company Paxos, which has gone further in terms of compliance and asset transparency. Each PAXG also represents 1 ounce of London standard gold and provides users with on-chain queryable asset correspondence information through verifiable gold bar serial numbers and custodial data. More importantly, Paxos, as a trust company regulated by the New York Department of Financial Services (NYDFS), has its gold asset custody and issuance mechanisms subject to regulatory scrutiny, which enhances PAXG's compliance endorsement to some extent. The project is also actively expanding its DeFi compatibility, having integrated with multiple DeFi protocols such as Aave and Uniswap, allowing PAXG to be used as collateral for lending and liquidity mining, thereby unlocking the compound value of gold assets on-chain.

Cache Gold (CGT) represents another attempt at tokenized gold that leans towards decentralization and verifiable asset certificates. This project employs a "Token Wrapper + Gold Bar Number Registration" system, with each CGT representing 1 gram of physical gold, bound to the batch number of gold stored in an independent custody warehouse. Its main feature is the strong binding mechanism between on-chain and off-chain, meaning that each gold collateral must generate a corresponding Proof of Reserve, with batch information and liquidity status recorded on the blockchain. This mechanism allows users to track the physical assets behind the tokens more transparently, but it also poses challenges in terms of custody efficiency and liquidity organization, and it has not yet been widely promoted in mainstream DeFi scenarios.

Perth Mint Gold Token (PMGT) is the official tokenized gold product launched by the Australian government-owned precious metals mint, Perth Mint. The gold assets behind this project are guaranteed by the Australian government and stored in a national-level vault, theoretically making it one of the most creditworthy projects in tokenized gold. However, due to its low participation in the cryptocurrency market, scarce trading pairs, and lack of DeFi compatibility, this project, while possessing high security and official endorsement, lags far behind Tether Gold and PAX Gold in terms of market liquidity and user adoption.

There are also some innovative projects like Aurus Gold (AWG) and Meld Gold, which attempt to build a new paradigm for tokenized gold through diversified custodians, NFT packaging, and cross-chain issuance. For example, Aurus Gold adopts a model of joint issuance by multiple mints and integration with various exchanges and wallets to enhance the anti-centralization dependency of gold tokens, introducing NFTs as wrapping certificates for gold to provide flexibility in asset management. These projects are conceptually closer to the Web3 native asset system but are still in the early stages and have not yet established widespread market consensus.

Overall, the current tokenized gold market presents a polarized pattern: on one hand, there are "centralized + high-trust" projects represented by Tether Gold and PAX Gold, which quickly occupy mainstream market share due to endorsements from large institutions, mature custodial structures, and exchange access advantages; on the other hand, there are "decentralized + verifiable" projects represented by Cache Gold and Aurus Gold, which emphasize asset transparency and on-chain autonomy but are still limited by market acceptance, custodial coordination efficiency, and the degree of DeFi integration. The competition between the two reflects the ongoing struggle within the entire crypto-financial ecosystem between "trust thresholds" and "technological ideals."

From the perspective of industry evolution trends, the future standards for tokenized gold are likely to evolve towards four directions: "compliance, verifiability, combinability, and cross-chain capabilities." On one hand, only by establishing transparent custodial systems in a strong regulatory environment and verifying assets through audits and on-chain validation can mainstream institutions and users gain long-term trust; on the other hand, projects must truly integrate into DeFi and Web3 infrastructures to achieve the "asset primitivization" of gold tokens; otherwise, they will merely be "gold certificates under financial packaging," failing to release sufficient utility value and network effects.

V. Tokenized Gold from the Investor's Perspective: Value, Opportunities, and Risks

Tokenized gold, as an emerging financial tool that combines traditional value anchoring with on-chain asset characteristics, is gradually becoming an alternative asset option in investors' portfolios. Unlike traditional gold ETFs or physical gold bars, its core value lies not only in the safe-haven properties represented by gold itself but also in the enhanced liquidity, improved trading convenience, and expanded combinability gained through the digitization of assets via blockchain infrastructure. From the investor's perspective, the appeal of tokenized gold lies in its ability to find a relatively balanced entry point between "financial stability anchor" and "technological innovation dividend," making it a practical path for allocating "on-chain hard currency" in the context of high volatility in the crypto market.

Firstly, tokenized gold naturally inherits the basic investment logic of gold as a global safe-haven asset. Historical experience shows that during periods of increased macroeconomic uncertainty, heightened inflationary pressures, or rising geopolitical risks, gold typically receives a risk premium in capital markets, becoming the preferred target for institutions and individual investors to hedge against the decline in fiat currency purchasing power and severe market fluctuations. Tokenized gold continues this attribute, especially during periods of extreme volatility in the crypto market, providing investors with low correlation or even negative correlation asset allocation opportunities. During the multiple downturns in the crypto market in 2022 and 2023, the price fluctuations of tokens like PAXG and XAUT were significantly lower than those of mainstream crypto assets, even becoming a "safe haven for on-chain funds" in the short term.

Secondly, tokenized gold provides unprecedented liquidity and accessibility to gold assets. Traditional gold investments face multiple pain points, including high trading thresholds, limited trading hours, inconvenient storage and withdrawal, and strong regional restrictions. As ERC-20 or cross-chain assets, tokenized gold can not only be transferred instantly in any wallet supporting public chains globally but also enables high-frequency trading, DeFi staking, cross-border settlement, and various advanced financial operations. This leap in liquidity greatly enhances the operational space of gold assets, transforming them from merely "asset storage" functions into dynamically managed "on-chain cash flow foundational assets."

More importantly, as DeFi and Web3 infrastructures gradually mature, tokenized gold is gaining combinability as a financial attribute, making it not just "gold in digital form" but gradually becoming a component module of on-chain native assets. Investors can obtain stablecoins by collateralizing PAXG, thereby releasing liquidity to participate in other investment opportunities; they can also add gold assets to liquidity pools to earn returns; or even transfer tokenized gold across chains in multi-chain interoperability protocols to meet global payment and settlement needs. This "asset as protocol" concept represents an innovative path that cannot be realized in the traditional gold financial system.

However, despite the many advantages of tokenized gold, it still carries certain structural risks and developmental bottlenecks that investors need to weigh carefully when participating. Firstly, there are custody and redemption risks, as the vast majority of tokenized gold projects still rely on centralized physical custody systems, requiring investors to trust that the issuers can properly safeguard the gold long-term and provide physical redemption when necessary. Currently, most projects have cumbersome redemption processes, high thresholds, and regional limitations, especially in extreme market conditions, where the uncertainty of whether users can smoothly complete the conversion from on-chain assets to physical gold remains a legal and operational concern. Additionally, some projects lack sufficient transparency in custody audits and asset proof, which can undermine user confidence and hinder their long-term function as "on-chain safe-haven anchors."

Secondly, there are external risks related to compliance and regulation. Since gold itself is a high-value sensitive asset, its tokenization process involves multiple regulatory requirements related to the precious metals market, securities laws, KYC/AML, etc. The legality and regulatory paths for tokenized gold are not uniform across different jurisdictions, meaning that the legal risks faced by projects carry a high degree of uncertainty. This is particularly crucial for institutional users wishing to use such assets for cross-border settlements or large transactions, as how to operate robustly within a compliance framework is a key factor determining their acceptance.

Finally, from the perspective of market dynamics, tokenized gold's position in actual investment portfolios remains as an "auxiliary allocation" role, making it difficult to become a dominant asset. Although its safe-haven and stability characteristics hold significant value during downturns, in a bull market environment, its performance often lags behind risk-oriented crypto assets like Bitcoin and Ethereum. This "value stability but limited upside" characteristic makes tokenized gold more suitable as a tool for hedging volatility and stabilizing portfolio returns rather than as a core investment target pursuing high growth.

In summary, tokenized gold represents both a "value storage tool" for a new type of asset and a "safety-first" allocation option in the digital economy world for investors. Its intrinsic logic is built on the stable value of gold over millennia, reshaping its trading, custody, and combinability through blockchain technology. With the further development of the DeFi ecosystem, the improvement of cross-chain infrastructure, and the gradual clarification of compliance paths, tokenized gold may play a more important role in the "full lifecycle management of digital assets." For individual users, it offers a practical path to enhance asset risk resistance and engage in counter-cyclical allocation; for institutions, it may become a foundational asset in building on-chain portfolios, thus ushering in a new era of "on-chain asset management."

VI. Conclusion: The On-Chain Upgrade of Gold is Not Replacement, but Continuation

In an era of unstable credit, increased dollar volatility, and a reshaping of the global monetary landscape, gold is undergoing a process of "digital rediscovery." It is not being replaced by digital assets like Bitcoin but is being tokenized, programmed, and smart contract-enabled, thus participating in the construction of the new financial system in a more flexible form. For users, this evolving gold remains "hard currency," just in a different on-chain form. It continues to provide a sense of security, value preservation, and risk resistance, becoming a true "stability anchor" in the digital world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。