In the spring of 2025, the global financial market fluctuated amid a series of "Trump-style dramas." From the ever-changing tariff policies to the frenzy of cryptocurrency trading, ordinary people seemed like lambs to the slaughter, repeatedly being ruthlessly harvested. The collusion of power and capital turned the market into a high-threshold playground, where ordinary investors without insider information or resource advantages could only watch helplessly as their wealth was devoured.

Tariff Turmoil: The Cost of Information Asymmetry

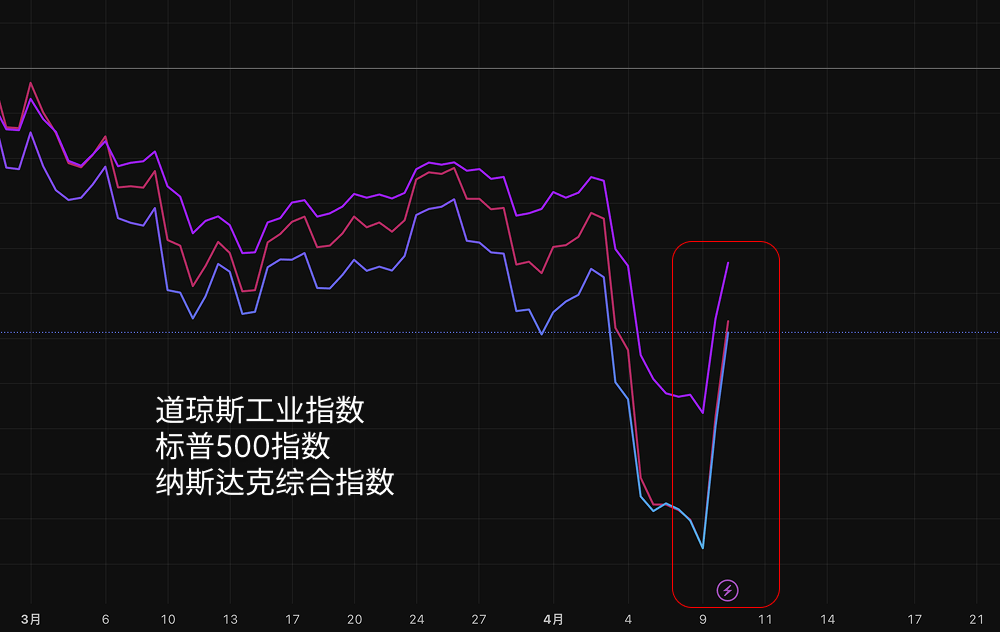

In April of this year, Trump once again stirred the market with his "policy magic." First, he wielded the tariff stick, causing panic among the three major U.S. stock indices, and then he threw out a statement on social media saying, "Now is a good time to buy," followed by announcing a 90-day suspension of tariffs and a reduction to 10%. As a result, the market instantly reversed, with the Dow Jones soaring by 2,900 points, the S&P 500 rising by 9.52%, the Nasdaq jumping by 12.16%, and Bitcoin surging by 8%, breaking through $83,000 at its peak. Tech giants saw their market value increase by $1.85 trillion in a single day, equivalent to about 13.4 trillion yuan. All of this happened within just a few hours.

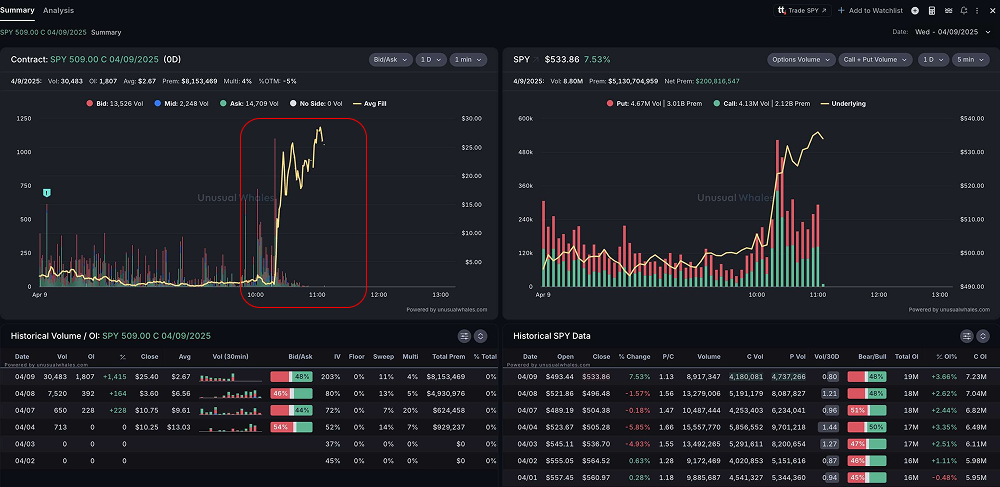

On the surface, this was a broad rebound brought about by favorable policies, but upon closer examination, the situation was not so simple. Data from the options trading platform Unusual Whales showed that before Trump issued the "buy" suggestion, someone had already accurately purchased call options. Even more astonishingly, before the announcement of the tariff suspension, someone had bet on $SPY 509 call options, which surged by 2,100% on the day of expiration. These traders seemed to have known the script in advance, boldly betting even when market volatility reached 82. What about ordinary investors? Most could only follow the trend after the news was made public or cut their losses in the panic beforehand.

Voices on X expressed the bitterness of many: "The market is like a casino for the connected, and we are just the fools at the gambling table." While this statement may be somewhat emotional, it points to a harsh reality: information asymmetry puts ordinary people at a natural disadvantage. When power can directly intervene in market direction, and a few can position themselves in advance, the majority can only passively accept the outcome.

Cryptocurrency Fog: The Frenzy and Disappointment of Retail Investors

If the stock market still shows some signs of regulation, the cryptocurrency market is practically synonymous with "laissez-faire." In early 2025, Trump launched his own meme coin, $TRUMP, and then introduced the concept of "cryptocurrency strategic reserves," driving tokens like XRP, SOL, and ADA to soar. When market sentiment was high, he added, "BTC and ETH are core," causing Ethereum's price to take off. His son Eric even touted on social media, "Retail investors finally won once." This sounded uplifting, but the reality was bittersweet.

Data platform Bubblemaps revealed that four hours before the release of $TRUMP, an address starting with 6QSc2 had already received funds and spent $1 million in the first minute to buy 5.9 million tokens, later selling them in batches to cash out tens of millions of dollars. Similar operations are not isolated cases in the Trump family's cryptocurrency business; they have publicly cashed out over $100 million through meme coins. In this nearly unregulated market, ordinary retail investors often buy high during the frenzy but leave quietly during the sell-off. The so-called "retail victory" is more like a sugar coating over the frenzy.

Trump's operations in the cryptocurrency space appear to inject vitality into the market, but in reality, they resemble using the presidential identity to pave the way for himself and his confidants. Ordinary people may make some small profits in short-term fluctuations, but the real big winners are always those at the top of the information chain.

The Shadow of Power: Fairness Drifting Further Away

Trump is not an isolated case. Looking back at his tariff statements in 2019, someone had accurately bet on S&P futures, earning $1.8 billion in a week. Now, he has simply upgraded this play to be more direct and flamboyant. Similar examples abound in American politics. For instance, former Speaker Nancy Pelosi's husband, Paul, always seems to "just right" buy stocks of Tesla, Microsoft, Google, and Nvidia before favorable policies, achieving a 70.9% return on investment in 2024, far exceeding the performance of Buffett and the S&P 500.

These phenomena point to a common issue: when power and capital are deeply intertwined, market rules are no longer a fair standard. Ordinary people work hard to study candlestick charts and analyze financial reports, trying to seize opportunities, but those holding policy information can simply give a gentle push to make the market follow their script. Fair competition has become an unattainable ideal, and the efforts of ordinary investors seem somewhat powerless in the face of this inequality.

The Dilemma of the Times: Is There a Way Out for Ordinary People?

Technological advancements should have made information more transparent and opportunities more equal, but the reality is that resource concentration makes it increasingly difficult for ordinary people to turn the tide. Trump's maneuvers are just the tip of the iceberg, with the entire system tilted behind them. Whether in the stock market or the cryptocurrency space, ordinary people face not only market risks but also the dual pressures of information barriers and power intervention.

Some may argue that as long as one is smart enough and diligent enough, ordinary people can also get a share. But the fact is that diligence and intelligence often yield diminishing returns in the face of absolute information asymmetry. When a president can create waves with policies at will, and a few can know "the next card" in advance, ordinary people, no matter how hard they try, find it difficult to escape a passive situation. The complaints on X may be exaggerated, but they also reflect a common helplessness: "Trump used the presidency to make millions for his family and friends, what about us? We can only watch."

Conclusion: The Fate of the Lambs or the Hope for Breakthrough?

In today's era dominated by power and capital, it seems difficult for ordinary people to avoid being "harvested." Whether it's Trump's businessman-style operations or politicians' precise investments, they all remind us that the market is no longer a simple trading venue but a battleground of information and resources. Ordinary people may not be completely without opportunities, but the threshold for success is becoming increasingly high, so high that it is daunting.

However, this does not mean complete despair. Perhaps realizing this unfairness itself is the first step toward change. Ordinary people may not be able to change the rules, but they can try to avoid those "known-to-be-hopeless" traps through more cautious choices and more rational judgments. The times may be cruel, but they also teach us one thing: rather than blindly chasing trends, it is better to learn to protect oneself. In this game, preserving capital may already be the greatest victory. As for fairness, that may be a longer story.

This article only represents the author's personal views and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

AiCoin official website: aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。